Ohio Lien Notice

Description

How to fill out Lien Notice?

If you need to obtain comprehensive, acquire, or print out official document templates, utilize US Legal Forms, the most significant collection of official forms available online.

Take advantage of the site’s straightforward and user-friendly search feature to locate the documents you require.

Numerous templates for business and personal use are organized by categories and states, or keywords.

Step 4. After locating the form you need, click on the Buy now button. Choose the pricing plan you prefer and enter your details to register for an account.

Step 5. Complete the transaction. You can use your credit card or PayPal account to finalize the purchase.

- Utilize US Legal Forms to find the Ohio Lien Notice with just a few clicks.

- If you are already a US Legal Forms user, Log In to your account and click the Obtain button to get the Ohio Lien Notice.

- You can also access forms you have previously downloaded from the My documents tab in your account.

- If this is your first time using US Legal Forms, follow these instructions.

- Step 1. Ensure that you have selected the form for the correct city/state.

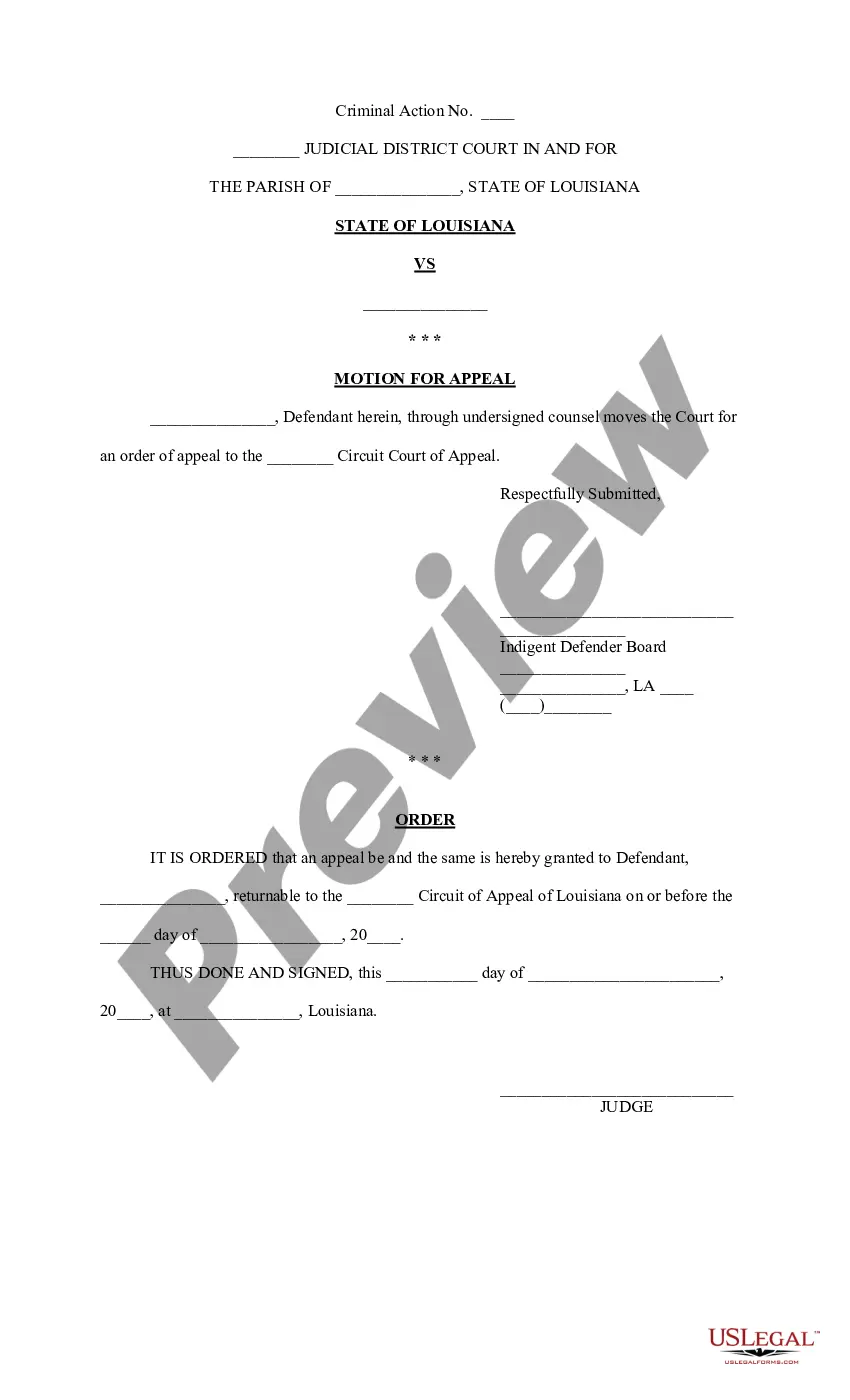

- Step 2. Utilize the Preview option to review the form’s details. Don’t forget to read the description.

- Step 3. If you are not satisfied with the form, use the Search field at the top of the screen to find other versions of the official form template.

Form popularity

FAQ

Yes, Ohio is a title holding state, which means that the state issues titles for vehicles and property that serve as proof of ownership. In this system, the title may be held by a lender if there is a lien. An Ohio Lien Notice is often relevant here, as it ensures that all parties are aware of any claims against the title, thus protecting the interests of the lien holder.

To file a lien in Ohio, you will need specific documentation that shows the debt owed to you. This typically includes a completed lien form, proof of the underlying obligation, and an Ohio Lien Notice. You may also need to submit the paperwork to the secretary of state or the local court, depending on the type of lien you're filing.

A notice of intent to lien in Ohio serves as a formal notification to a property owner that you plan to file a lien against their property. This document provides the owner with the opportunity to resolve the debt before a lien is officially placed. It is advisable to issue an Ohio Lien Notice, ensuring clarity regarding your intentions and the amount owed, which can potentially facilitate a resolution.

If you need to obtain a title for a car without an existing title in Ohio, you should start by applying for a title through the Ohio Bureau of Motor Vehicles. You may need to provide proof of ownership, such as a bill of sale or an Ohio Lien Notice if applicable. Completing an affidavit and possibly having an inspection done may also be necessary during this process.

To place a lien on an Ohio vehicle title, you need to complete the lien section of the title application. You will fill out the necessary forms and submit them to the Ohio Bureau of Motor Vehicles. Including an Ohio Lien Notice will help notify all parties involved about your claim on the vehicle. This ensures that your legal rights are secured concerning the lien.

In Ohio, both parties do not have to be physically present to transfer a car title. However, the seller must sign the title over to the buyer and provide a signed Ohio Lien Notice if there is a lien against the vehicle. It's essential for the buyer to receive all necessary documentation to ensure a smooth transfer of ownership.

To place a lien on your property in Ohio, you typically need to file a formal complaint with the court. This process may involve gathering necessary documentation that proves the debt or obligation owed to you. After filing, you may also need to provide a notice to the property owner, often referred to as an Ohio Lien Notice. This step ensures that the property owner is aware of your claim.

In Ohio, a creditor typically has 21 years to collect a judgment, but this duration can vary based on specific circumstances. Creditors must act within this time frame to enforce the judgment through lien actions or other means. You may receive an Ohio Lien Notice as part of this collection process, so staying informed is key. Be proactive in managing debts and understanding your rights regarding judgments.

Yes, liens can expire in Ohio, but specific conditions apply. Generally, if creditors do not take action to enforce the lien within a certain timeframe, it may become unenforceable. An Ohio Lien Notice serves as a reminder of any active liens that might affect your property. Checking on liens frequently can help you avoid unexpected issues.

An Ohio tax lien is a claim the government places on a property for unpaid property taxes. This lien ensures that the government can collect owed taxes, and it can hinder the sale of the property until settled. Receiving an Ohio Lien Notice related to tax issues prompts property owners to address their tax obligations promptly. Staying informed can prevent complications in property ownership.