Ohio Shareholder and Corporation agreement to issue additional stock to a third party to raise capital

Description

How to fill out Shareholder And Corporation Agreement To Issue Additional Stock To A Third Party To Raise Capital?

You might spend hours online searching for the legal document format that meets the federal and state requirements you desire. US Legal Forms provides a vast selection of legal forms that are vetted by experts.

It is easy to download or print the Ohio Shareholder and Corporation agreement to issue additional stock to a third party for the purpose of raising capital from the assistance.

If you already have a US Legal Forms account, you can Log In and then click on the Acquire option. Afterwards, you can complete, modify, print, or sign the Ohio Shareholder and Corporation agreement to issue additional stock to a third party to raise capital.

Choose the pricing plan you want, enter your credentials, and create your account on US Legal Forms. Complete the purchase. You can use your credit card or PayPal account to pay for the legal document. Select the format of the document and download it to your device. Make modifications to your document if necessary. You can complete, modify, sign, and print the Ohio Shareholder and Corporation agreement to issue additional stock to a third party to raise capital. Obtain and print numerous document templates using the US Legal Forms website, which offers the largest selection of legal forms. Utilize professional and state-specific templates to address your business or personal requirements.

- Each legal document format you obtain is yours indefinitely.

- To acquire an additional copy of a purchased document, visit the My documents tab and click the corresponding option.

- If you are using the US Legal Forms site for the first time, follow the simple instructions listed below.

- First, ensure that you have selected the correct document format for the region/city of your choice.

- Review the document description to confirm you have chosen the appropriate document.

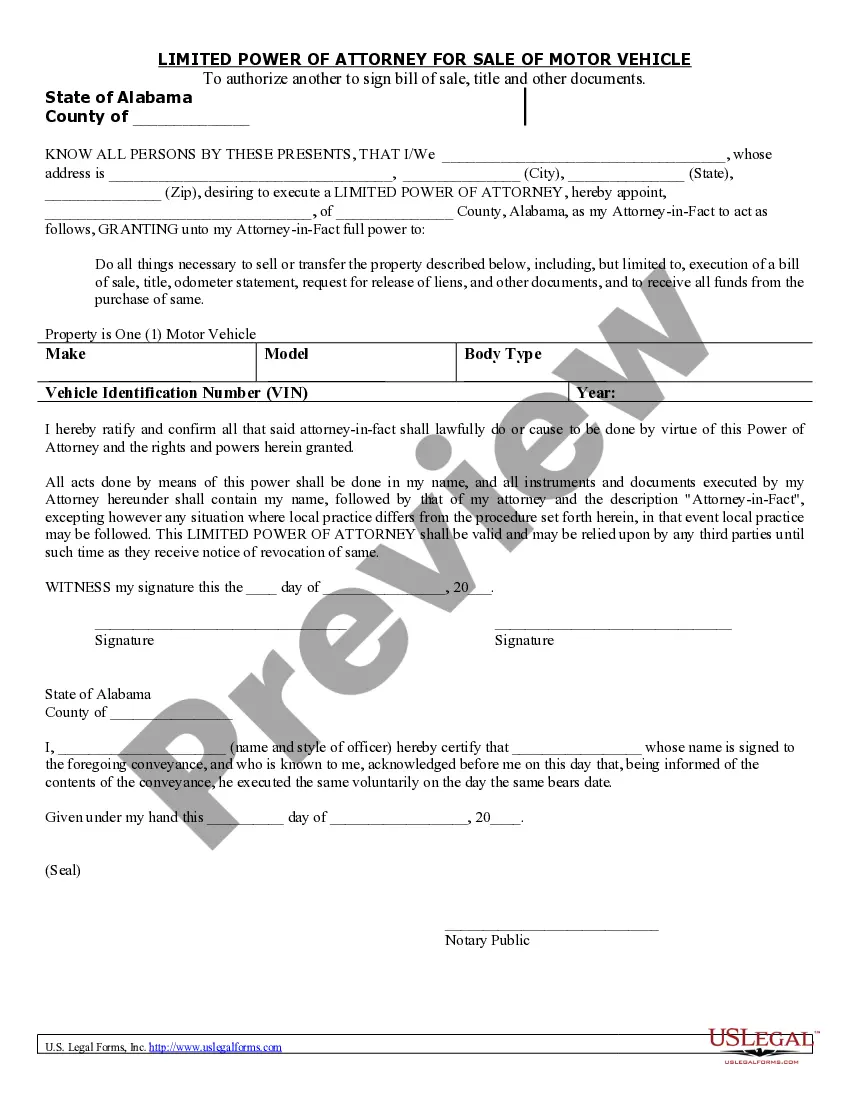

- If available, use the Preview option to view the document format as well.

- If you would like to find another version of the document, use the Search section to locate the format that fits your needs and requirements.

- Once you have found the format you want, click on Get now to proceed.

Form popularity

FAQ

A better name for an operating agreement might be a membership agreement. This agreement is similar in form to a partnership agreement for a business partnership.

A shareholders' agreement (SHA) is a contract between a company's shareholders and often the company itself. A SHA specifies shareholders' rights and obligations, regulates the management of the company, ownership of shares, privileges, voting and various protective provisions for shareholders.

An operating agreement is similar to a shareholder agreement, but it is tailored for a limited liability company. Instead of shareholders, the company has members.

What to Think about When You Begin Writing a Shareholder Agreement.Name Your Shareholders.Specify the Responsibilities of Shareholders.The Voting Rights of Your Shareholders.Decisions Your Corporation Might Face.Changing the Original Shareholder Agreement.Determine How Stock can be Sold or Transferred.More items...

Does a shareholders' agreement override articles? No, a shareholders' agreement will not override the Articles if there is a conflict, then the articles will prevail.

In most circumstances, the shareholders' agreement should take priority, because the agreement is specifically designed to control the shareholders' relationship. Once a conflict is disclosed between the bylaws and shareholders' agreement, the bylaws should be amended to remove the conflict.

From the decision, we can gauge that the law gives the articles of association priority over shareholders agreement and the shareholders agreement cannot go beyond the articles of association.

Shareholder Support Agreements means the support agreements between the Company and the Support Shareholders, pursuant to which such Shareholders have agreed to support and vote in favour of the resolutions required to give effect to the Recapitalization, including the Shareholders' Arrangement Resolution.

Even though the law does not require shareholder agreements, every privately held corporation with more than one shareholder and every privately held limited liability company (LLC) with more than one member is well advised to have a formal partnership agreement, preferably implemented at the onset of the business

In case of public company if the terms and conditions in the shareholders agreement is not in contravention to the provisions of the company act and the articles of association then it would be enforceable against the members. Albeit, no obligations can be imposed on the statutory powers of the company.