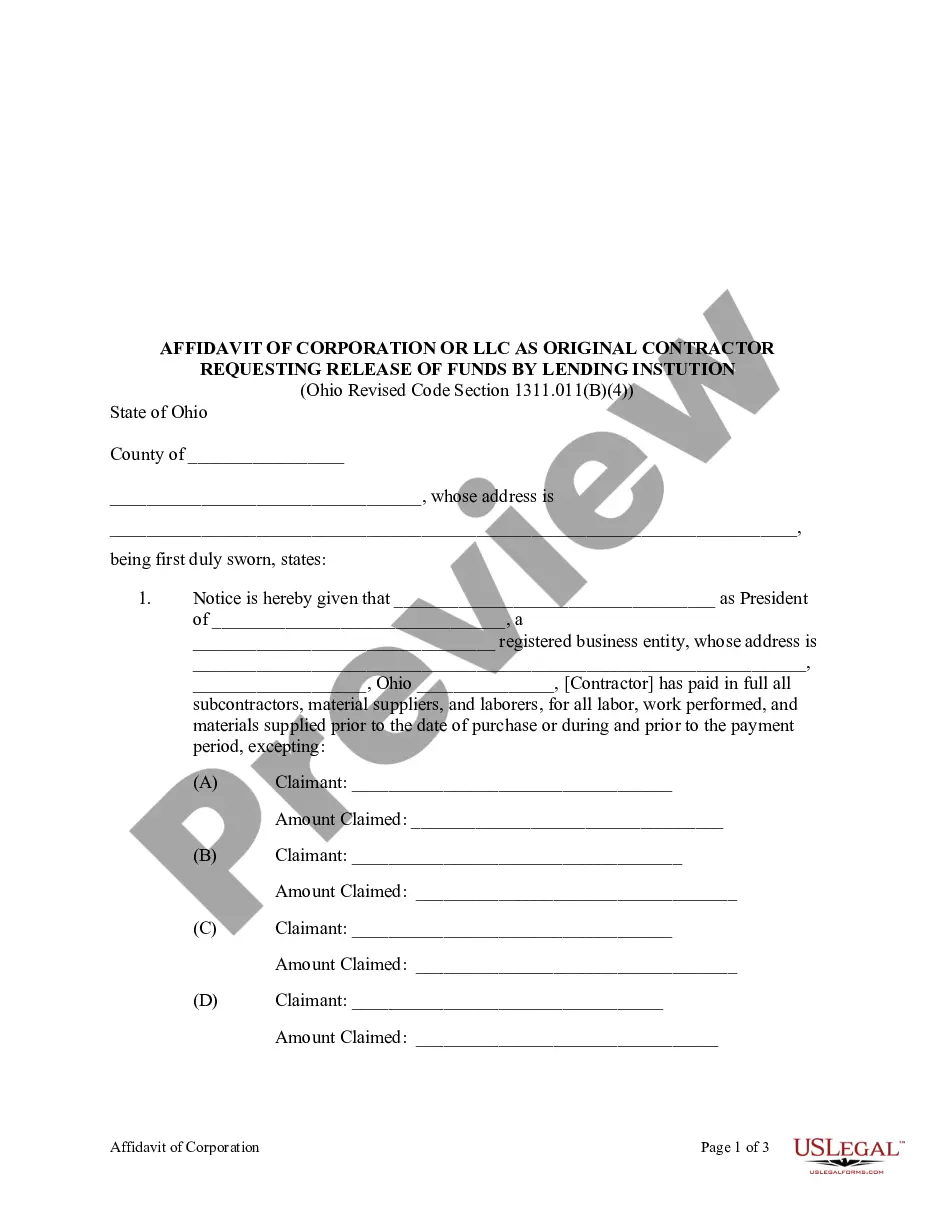

This sworn affidavit is filed with the county recorder by the corporate original contractor and attests to the fact that the corporate original contractor has paid in full for all labor and work performed and for all materials furnished by the original contractor and all subcontractors, materialmen, and laborers prior to the date of the closing of the purchase or during and prior to the payment period, except such unpaid claims as set forth specifically by claimant and amount claimed. Further, it attests that there are no other claims than those listed in the affidavit. Successful filing of this affidavit by the original contractor allows the lending institution to make payment to the original contractor pursuant to Ohio Revised Code Section 1311.011(B)(4).

Ohio Request for Release of Funds - Corporation

Description

How to fill out Ohio Request For Release Of Funds - Corporation?

In terms of filling out Ohio Request for Release of Funds - Corporation or LLC, you most likely think about a long process that consists of getting a perfect sample among countless very similar ones after which needing to pay an attorney to fill it out to suit your needs. Generally, that’s a slow and expensive option. Use US Legal Forms and select the state-specific document in a matter of clicks.

For those who have a subscription, just log in and click Download to get the Ohio Request for Release of Funds - Corporation or LLC template.

If you don’t have an account yet but need one, stick to the step-by-step manual listed below:

- Be sure the document you’re saving is valid in your state (or the state it’s needed in).

- Do it by reading the form’s description and through visiting the Preview option (if accessible) to view the form’s content.

- Simply click Buy Now.

- Select the proper plan for your budget.

- Join an account and choose how you would like to pay: by PayPal or by credit card.

- Download the file in .pdf or .docx format.

- Find the record on your device or in your My Forms folder.

Professional legal professionals work on creating our templates so that after downloading, you don't have to worry about enhancing content outside of your individual information or your business’s information. Sign up for US Legal Forms and get your Ohio Request for Release of Funds - Corporation or LLC document now.

Form popularity

FAQ

Corporation Franchise Tax: In order to dissolve a corporation all business tax accounts must be current on all filings and payments and closed. Notification of Dissolution or Surrender with the Ohio Department of Taxation once a final return and payment are made.

Failing to dissolve the corporation allows third parties to continue to sue the corporation as if it is still in operation. A judgment might mean that shareholders use the money received from distributed assets when the corporation closed down to satisfy judgments against the corporation.

You must file Form 966, Corporate Dissolution or Liquidation, if you adopt a resolution or plan to dissolve the corporation or liquidate any of its stock. You must also file your corporation's final income tax return.

Choose a Name for Your LLC. Appoint a Registered Agent. File Articles of Organization. Prepare an Operating Agreement. Comply With Other Tax and Regulatory Requirements.

Corporation Franchise Tax: In order to dissolve a corporation all business tax accounts must be current on all filings and payments and closed. Notification of Dissolution or Surrender with the Ohio Department of Taxation once a final return and payment are made.

Definition. The ending of a corporation, either voluntarily by filing a notice of dissolution with the Secretary of State or as ordered by a court after a vote of the shareholders, or involuntarily through government action as a result of failure to pay taxes.

Ohio does not require an operating agreement in order to form an LLC, but executing one is highly advisable.The operating agreement does not need to be filed with the state.

An LLC Operating Agreement is Not Compulsory, but it is Highly Recommended. An LLC operating agreement is not necessarily compulsory, although this depends on the state where your business is based. You could get into a lot of unnecessary strife if situations change in your LLC.

Create a new operating agreement for the LLC which includes the new ownership information. This voids the existing document that is on file with the Ohio Secretary of State. File the "Domestic Limited Liability Company Certificate of Amendment or Restatement" as required by the Ohio Secretary of State.