This form is a Quitclaim Deed where the Grantor is a inter-vivor trust and the Grantee is an Inter-Vivos Trust. Grantor conveys and quitclaims the described property to Grantee. This deed complies with all state statutory laws.

Ohio Quitclaim Deed - Inter-Vivos Trust to Inter-Vivos Trust

Description

How to fill out Ohio Quitclaim Deed - Inter-Vivos Trust To Inter-Vivos Trust?

In terms of filling out Ohio Quitclaim Deed - Inter-Vivos Trust to Inter-Vivos Trust, you almost certainly imagine a long procedure that involves getting a ideal form among hundreds of very similar ones then having to pay out legal counsel to fill it out to suit your needs. On the whole, that’s a slow-moving and expensive option. Use US Legal Forms and select the state-specific document in just clicks.

In case you have a subscription, just log in and click Download to get the Ohio Quitclaim Deed - Inter-Vivos Trust to Inter-Vivos Trust form.

If you don’t have an account yet but want one, follow the point-by-point manual below:

- Make sure the file you’re downloading is valid in your state (or the state it’s needed in).

- Do this by reading through the form’s description and by clicking on the Preview option (if readily available) to view the form’s content.

- Simply click Buy Now.

- Select the appropriate plan for your budget.

- Sign up for an account and choose how you would like to pay: by PayPal or by credit card.

- Download the document in .pdf or .docx format.

- Get the record on the device or in your My Forms folder.

Professional attorneys draw up our templates to ensure after saving, you don't have to bother about enhancing content outside of your individual info or your business’s information. Join US Legal Forms and receive your Ohio Quitclaim Deed - Inter-Vivos Trust to Inter-Vivos Trust document now.

Form popularity

FAQ

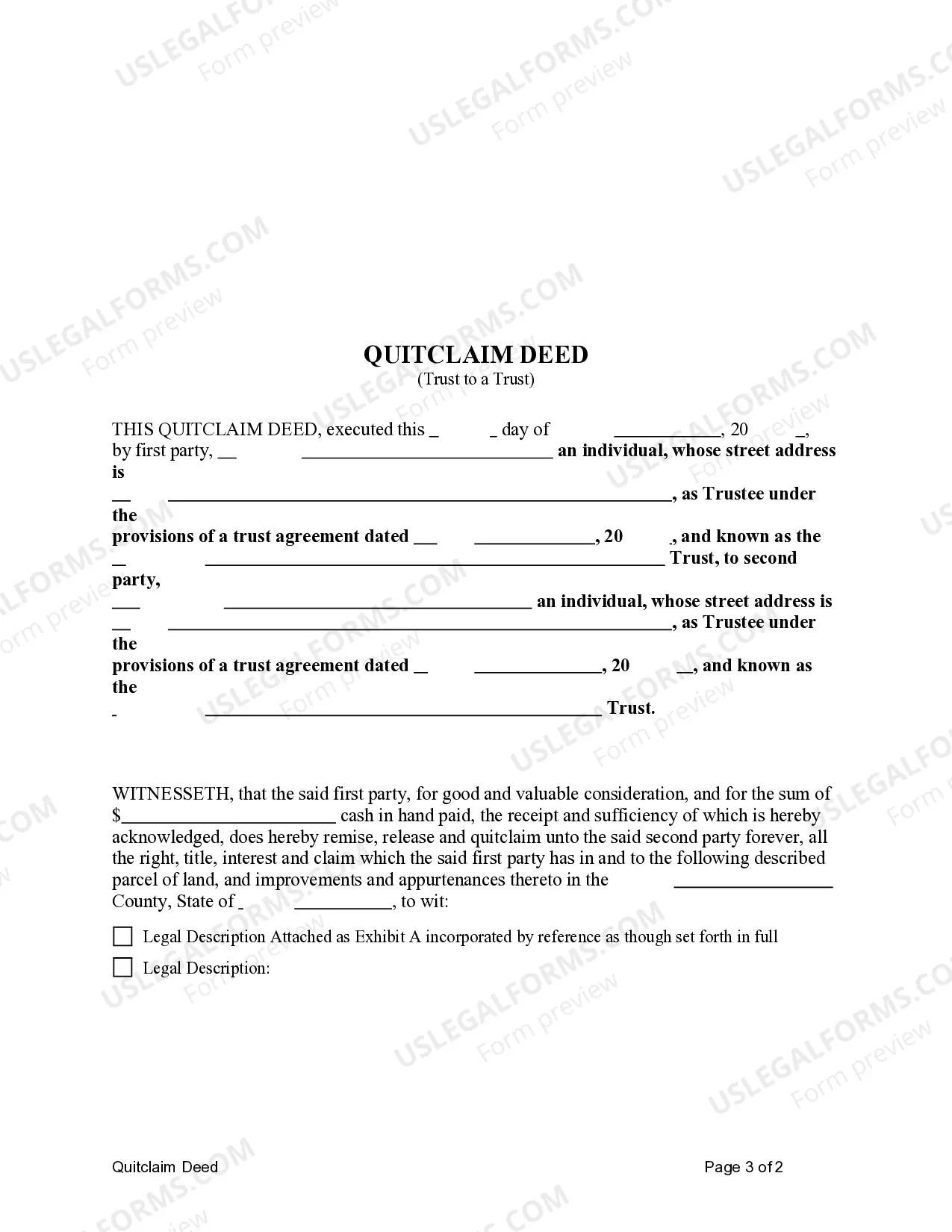

Party information: names and addresses of the trustor(s), trustee(s), beneficiary(ies), and guarantor(s) (if applicable) Property details: full address of the property and its legal description (which can be obtained from the County Recorder's Office)

A quitclaim deed can be used to transfer property from a trust, but a Special Warranty Deed seems to be a more common way to do this.

Yes, a quit claim deed supercedes the trust. The only thing that can be done is to file a suit in court challenging the deed as the product of fraud and undue influence. A court action like that will cost thousands of dollars, but might be worth it if the house was owned free and clear.

Contact the county auditor's office to find out about the county's property transfer tax and exemptions. Contact the county recorder's office to find out the volume and page numbers for the prior deed on the property. Fill in the deed form. Print it out.

In the context of a California mortgage transaction, a trust deed also transfer ownership. Only this time, the title is being placed in the hands of a third-party trustee, who holds the property on behalf of the lender and the homeowner-borrower until the mortgage is paid.

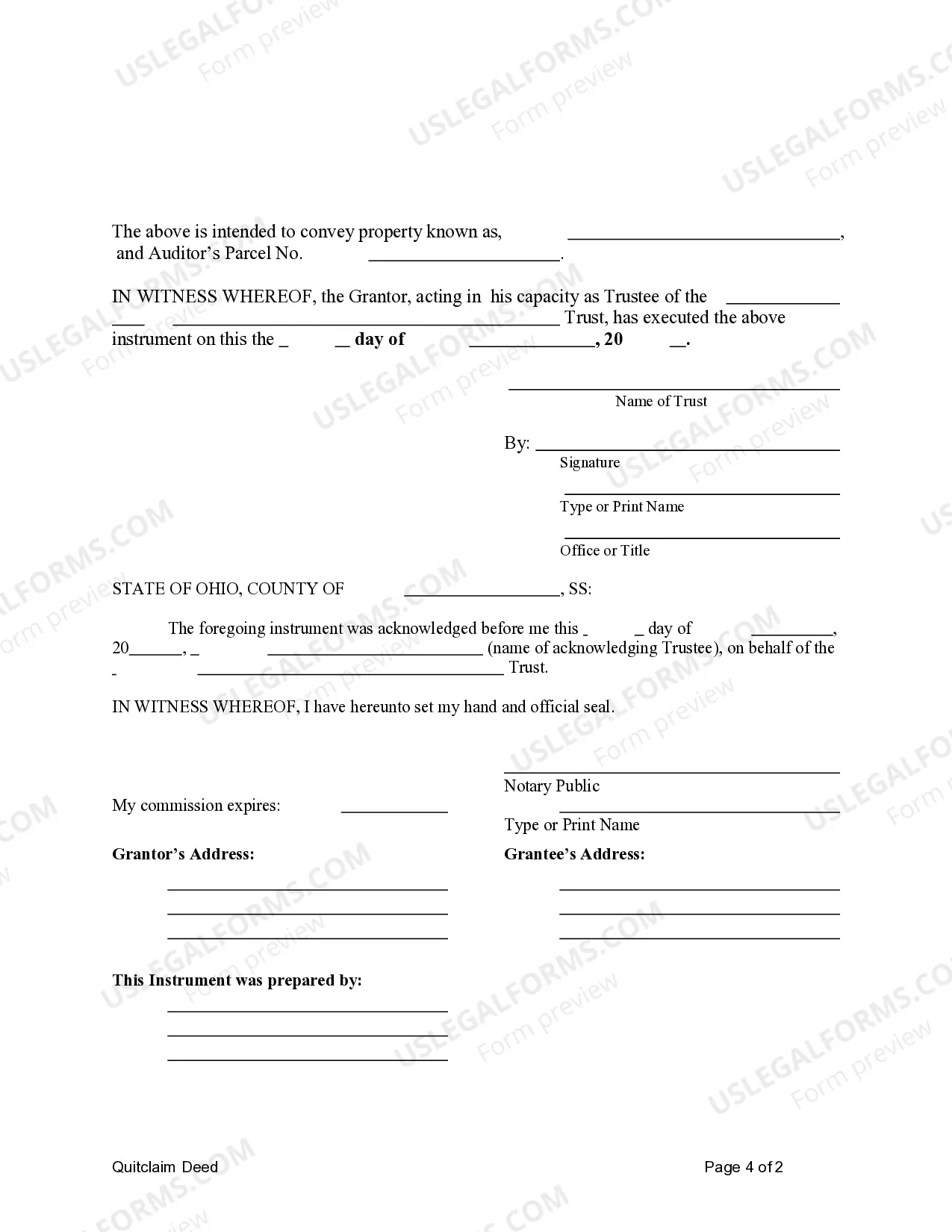

When you're ready to transfer trust real estate to the beneficiary who is named in the trust document to receive it, you'll need to prepare, sign, and record a deed. That's the document that transfers title to the property from you, the trustee, to the new owner.

California Property TaxesTransferring real property to yourself as trustee of your own revocable living trust -- or back to yourself -- does not trigger a reassessment for property tax purposes. (Cal. Rev. & Tax Code § 62(d).)

Locate the deed that's in trust. Use the proper deed. Check with your title insurance company and lender. Prepare a new deed. Sign in the presence of a notary. Record the deed in the county clerk's office.

In Ohio, you need to have the quitclaim deed signed by both parties and notarized by a notary public. Step 6: File the deed at the Recorder's Office. The deed must be filed at the Recorder's Office in the county where the property is located to finalize the transfer.