Indiana Identification Form- Corporate/Business is an official document issued by the Indiana Department of Revenue to business entities. It is used to obtain an employer identification number (EIN) which is needed to open a business bank account, file taxes, and hire employees. The types of Indiana Identification Form- Corporate/Business include the Indiana Business Tax Application, the Indiana Business Registration Application, the Indiana Subchapter S Election Form, and the Indiana Combined Employer's Registration Form. Each of these forms must be completed and submitted to the Indiana Department of Revenue in order to obtain an EIN.

Indiana Identification Form- Corporate/Business

Description

How to fill out Indiana Identification Form- Corporate/Business?

What amount of time and resources do you generally allocate for creating formal documentation.

There is a more efficient method to obtain such forms rather than employing legal professionals or dedicating hours to find an appropriate template online. US Legal Forms stands as the premier online repository offering expertly crafted and verified state-specific legal documents for any purpose, including the Indiana Identification Document- Corporate/Business.

Another benefit of our library is that you can revisit previously downloaded documents securely stored in your profile under the My documents tab. Retrieve them at any time and re-fill your paperwork as often as you require.

Conserve time and energy when handling legal documents with US Legal Forms, one of the most reliable online solutions. Join us today!

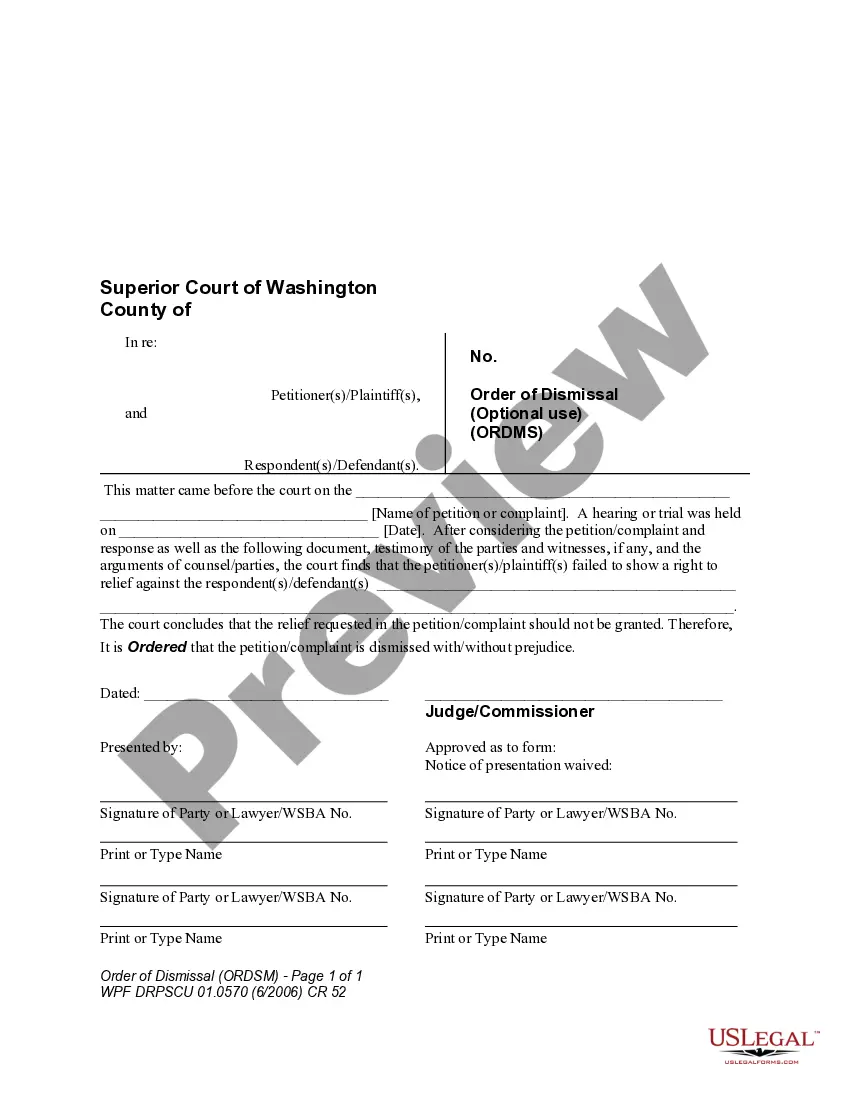

- Review the form's content to ensure it meets your state laws. To accomplish this, read the form's description or use the Preview option.

- If your legal template does not satisfy your needs, search for another one using the search bar at the top of the page.

- If you already possess an account with us, Log In and download the Indiana Identification Document- Corporate/Business. If you do not, move to the following steps.

- Click Buy now after locating the appropriate document. Choose the subscription plan that best fits your needs to gain access to our library’s complete service.

- Sign up for an account and complete the payment for your subscription. Payments may be made via credit card or PayPal - our service is entirely trustworthy for that.

- Download your Indiana Identification Document- Corporate/Business onto your device and complete it either on a printed hard copy or digitally.

Form popularity

FAQ

The Secretary of State must maintain a public record of businesses operating in Indiana. It is essential that the information is current. Indiana Statute requires businesses to submit a Business Entity Report.

Indiana Naming Requirements Your name must include the phrase ?Limited Liability Company? or one of its abbreviations (LLC or L.L.C.). Your name must be distinguishable from any existing business in the state. This includes Indiana reserved names.

Selecting a business name is one of the first steps of starting a business. Indiana law requires that the name of a Corporation, L.L.C., L.P., and an L.L.P. is distinguishable from the name of any other business of the same type on record with the Secretary of State's office.

An LLC must file biennial business entity reports with the Secretary of State in order to remain in existence. A corporation is formed by the filing of articles of incorporation with the Indiana Secretary of State. It is owned by its shareholders, who are issued shares of corporate stock in the corporation.

Some states have a general license requirement, which means all businesses operating in those states must have the license, regardless of what they do. But good news: Indiana doesn't require a general license to do business in the state. Meaning, your Indiana LLC doesn't need a general state business license.

Indiana Corporation Naming Rules Your name must contain the word "corporation," "incorporated," "company," or "limited;" the abbreviation "Corp.," "Inc.," "Co.," or "Ltd.;" or words or abbreviations of similar meaning in another language.

Naming your Indiana LLC The name you select for your LLC must include the words "Limited Liability Company," or an abbreviation thereof. Plus, your LLC's name must be distinguishable on the records of the Secretary of State's office from the names of other domestic or foreign filing entities, reserved or assumed names.

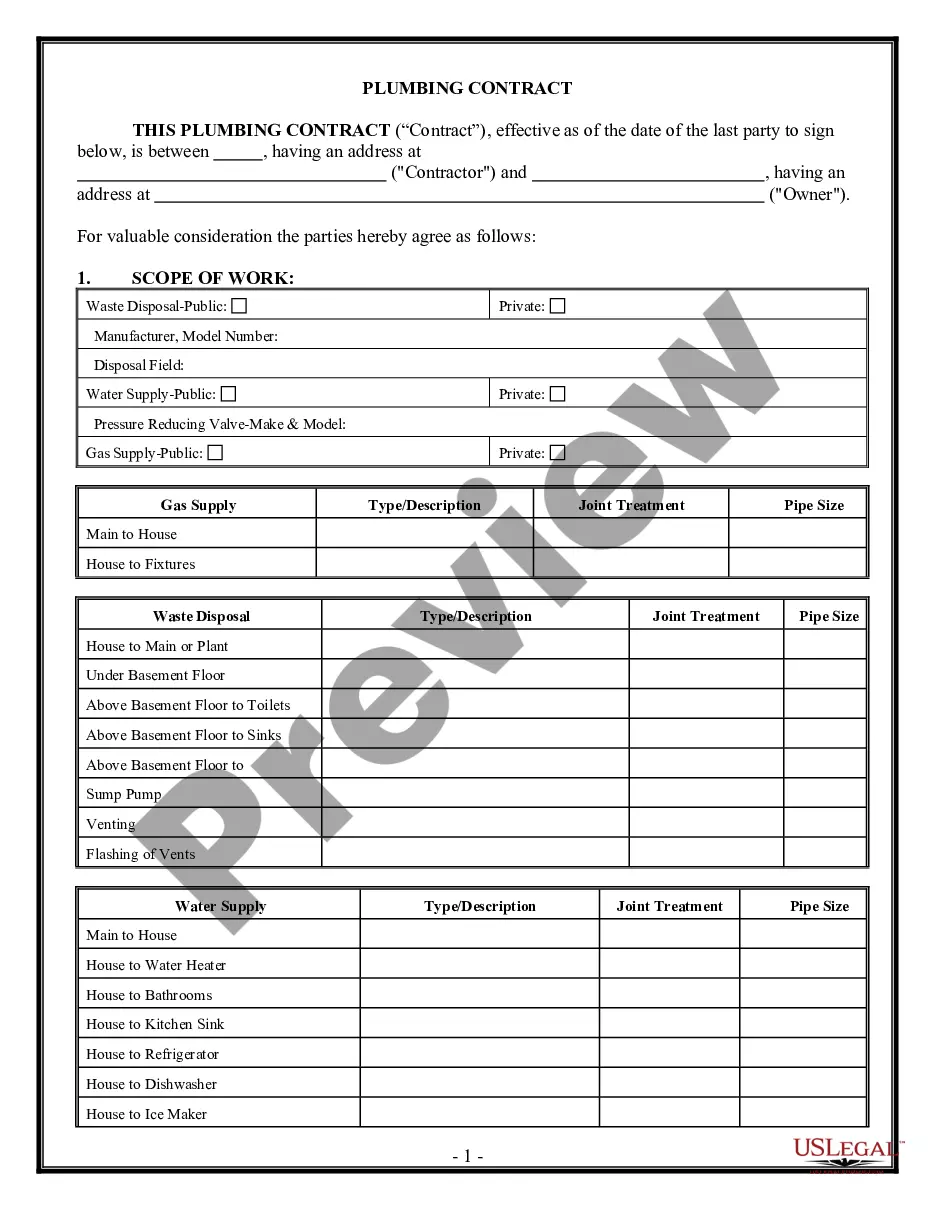

Purpose: Form BT-1 is an application used when registering with the Indiana Department of Revenue for Sales Tax, Withholding Tax, Out-of-State Use Tax, Food & Beverage Tax, County Innkeepers Tax, Motor Vehicle Rental Excise Tax, and Prepaid Sales Tax on Gasoline, or a combination of these taxes.