Transfer on Death Designation Affidavit from Individual to Individual: This affidavit is used to transfer the title of a parcel of land, attaching any existing covenants, upon the death of the Affiant/Owner to the Beneficiary. It should be signed in front of a Notary Public. The form does NOT include provision for an contingent beneficiary in the event the designated beneficiary predeceases the affiant/owner. The designation of the beneficiary in an affidavit of transfer on death may be revoked or changed at any time, without the consent of that designated transfer on death beneficiary, by the owner of the interest by executing in accordance with Chapter 5301. of the Ohio Revised Code and recording a transfer on death designation affidavit conveying the owner's entire, separate interest in the real property to one or more persons, including the owner, with or without the designation of another transfer on death beneficiary.

Ohio Transfer on Death Designation Affidavit - TOD from Individual to Individual without Contingent Beneficiary

Description

How to fill out Ohio Transfer On Death Designation Affidavit - TOD From Individual To Individual Without Contingent Beneficiary?

When it comes to filling out Ohio Transfer on Death Designation Affidavit - TOD from Individual to Individual without Contingent Beneficiary, you most likely think about a long procedure that requires finding a perfect sample among numerous similar ones after which needing to pay out legal counsel to fill it out for you. On the whole, that’s a slow and expensive option. Use US Legal Forms and select the state-specific document within just clicks.

If you have a subscription, just log in and then click Download to find the Ohio Transfer on Death Designation Affidavit - TOD from Individual to Individual without Contingent Beneficiary form.

If you don’t have an account yet but need one, follow the point-by-point guideline below:

- Make sure the document you’re downloading is valid in your state (or the state it’s required in).

- Do so by looking at the form’s description and also by clicking the Preview option (if offered) to find out the form’s information.

- Click Buy Now.

- Find the proper plan for your financial budget.

- Subscribe to an account and select how you would like to pay: by PayPal or by card.

- Download the document in .pdf or .docx format.

- Find the record on your device or in your My Forms folder.

Skilled legal professionals work on creating our templates so that after downloading, you don't have to bother about modifying content material outside of your individual details or your business’s details. Sign up for US Legal Forms and get your Ohio Transfer on Death Designation Affidavit - TOD from Individual to Individual without Contingent Beneficiary sample now.

Form popularity

FAQ

When someone dies and their property transfers to their beneficiaries, the federal government impose an estate tax on the value of all that property. Since the transfer on death account is not a trust, it does not help you avoid or minimize estate taxes.

Inheritances are not considered income for federal tax purposes, whether you inherit cash, investments or property. However, any subsequent earnings on the inherited assets are taxable, unless it comes from a tax-free source.

If the deeds to the property are unregistered, it is possible to place a death certificate with the deeds, but it's advisable to register the title with the Land Registry at this point. Once this has been done, the property will then be registered in the name of the surviving joint owner.

The amount that's in a TOD account at the time of your death is not taxable under federal law to the person who receives the account, although it may be taxable to your estate. If your beneficiary or the account are in a state with an inheritance tax, he may have to pay that.

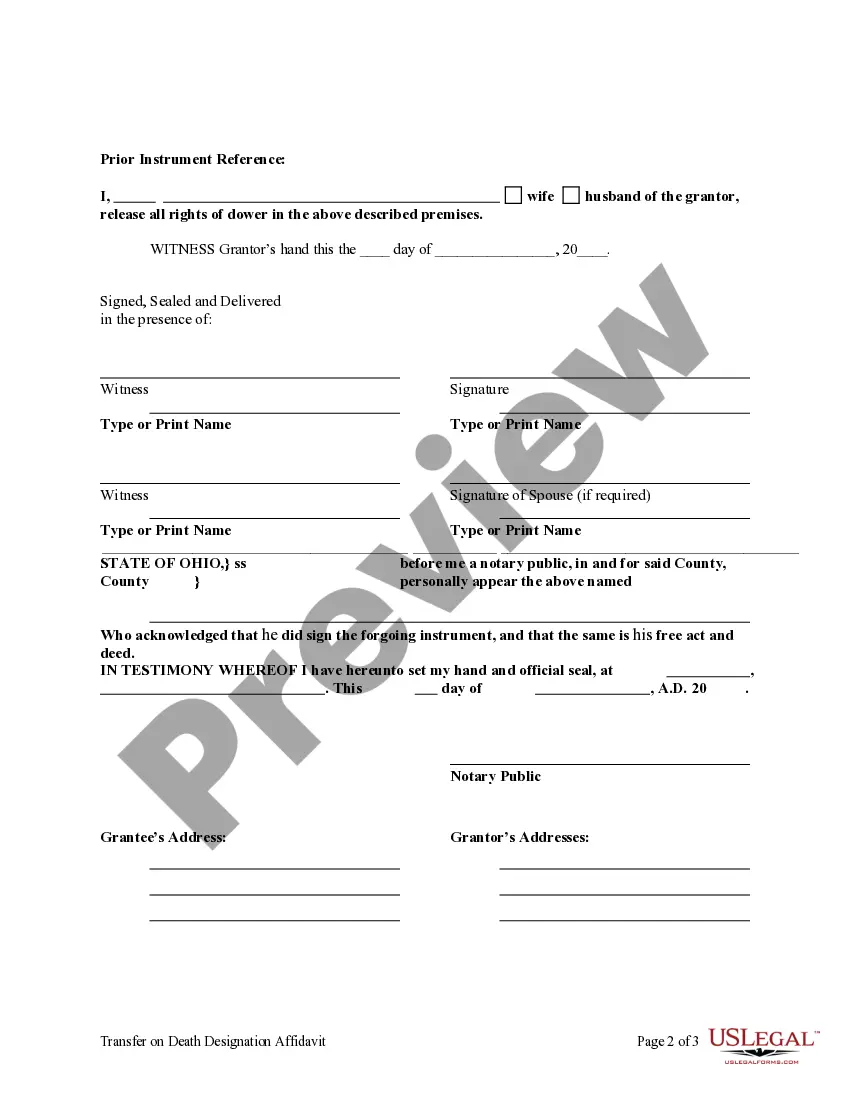

Fill in information about you and the TOD beneficiary. provide a description of the property. check over the completed deed. sign the deed in front of a notary public, and.

Survivorship Deeds contain special language that enables the property to transfer to the surviving owner(s) upon the deceased owner's death.A Transfer-On-Death Designation Affidavit allows the owner of Ohio real estate to designate one or more beneficiaries of the property.

Yes. Ohio law allows individuals who do not need the estate administration benefits of a trust agreement to avoid Probate on the transfer of real property by executing a legal document called a Transfer-On-Death (TOD) Designation Affidavit.