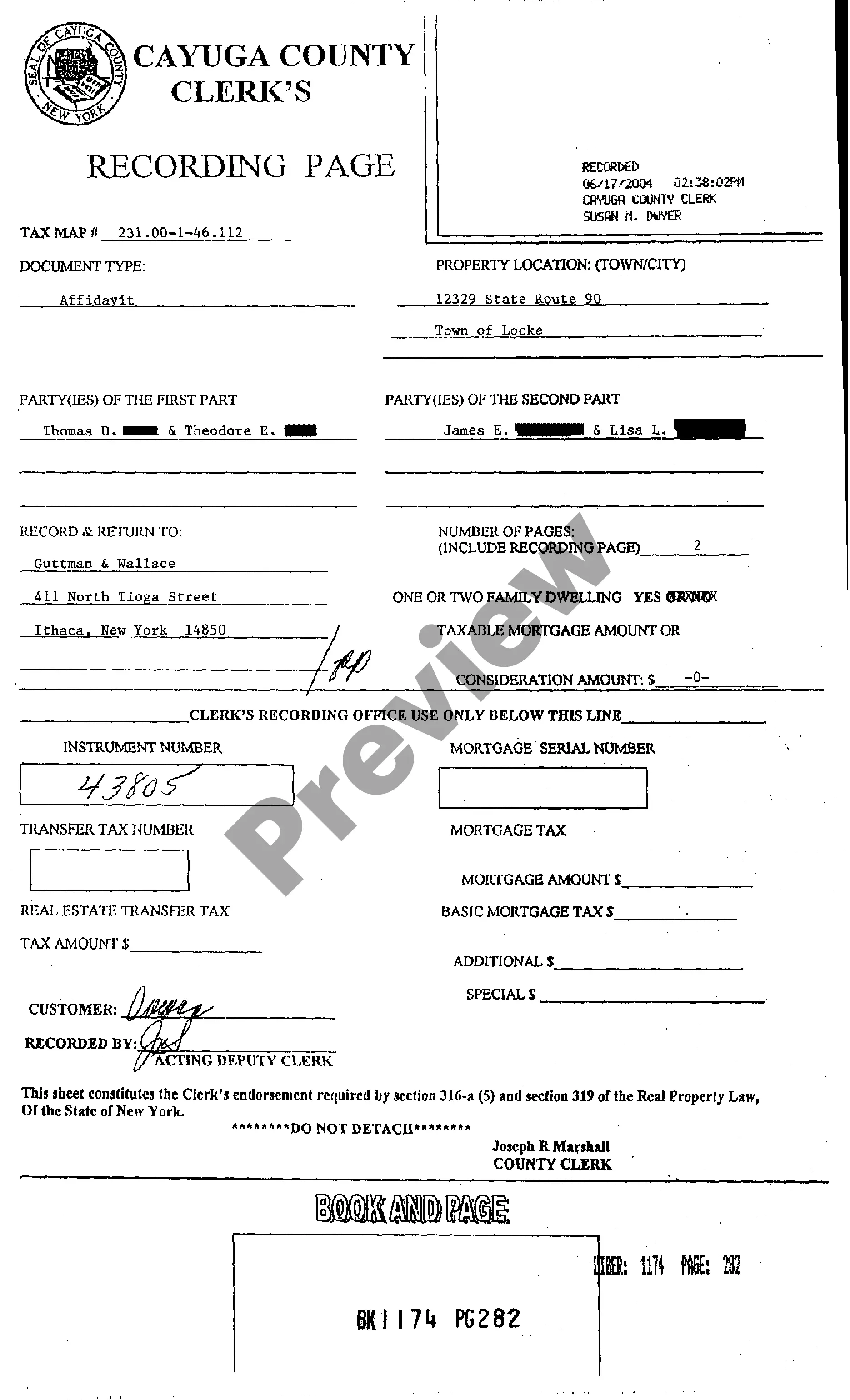

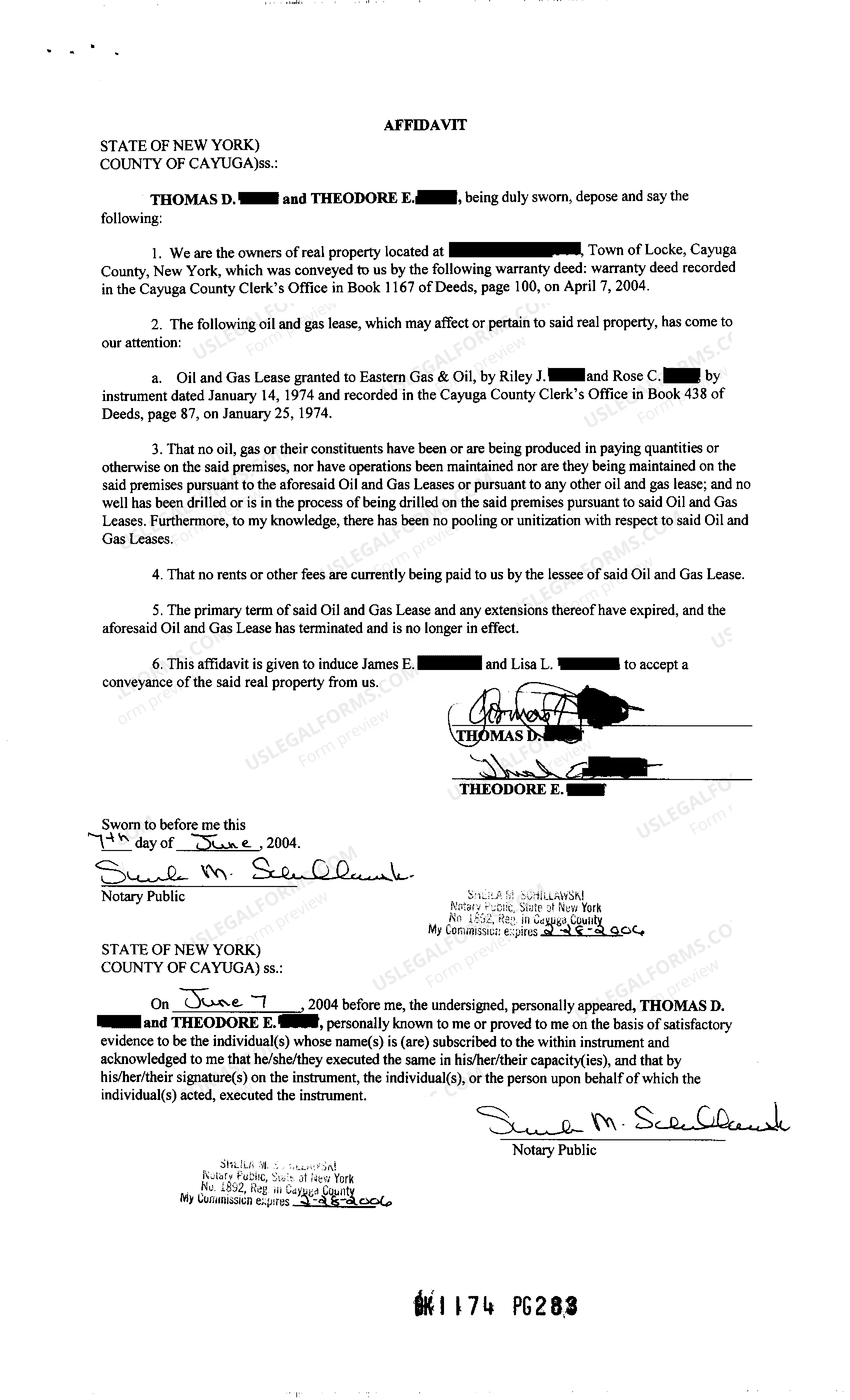

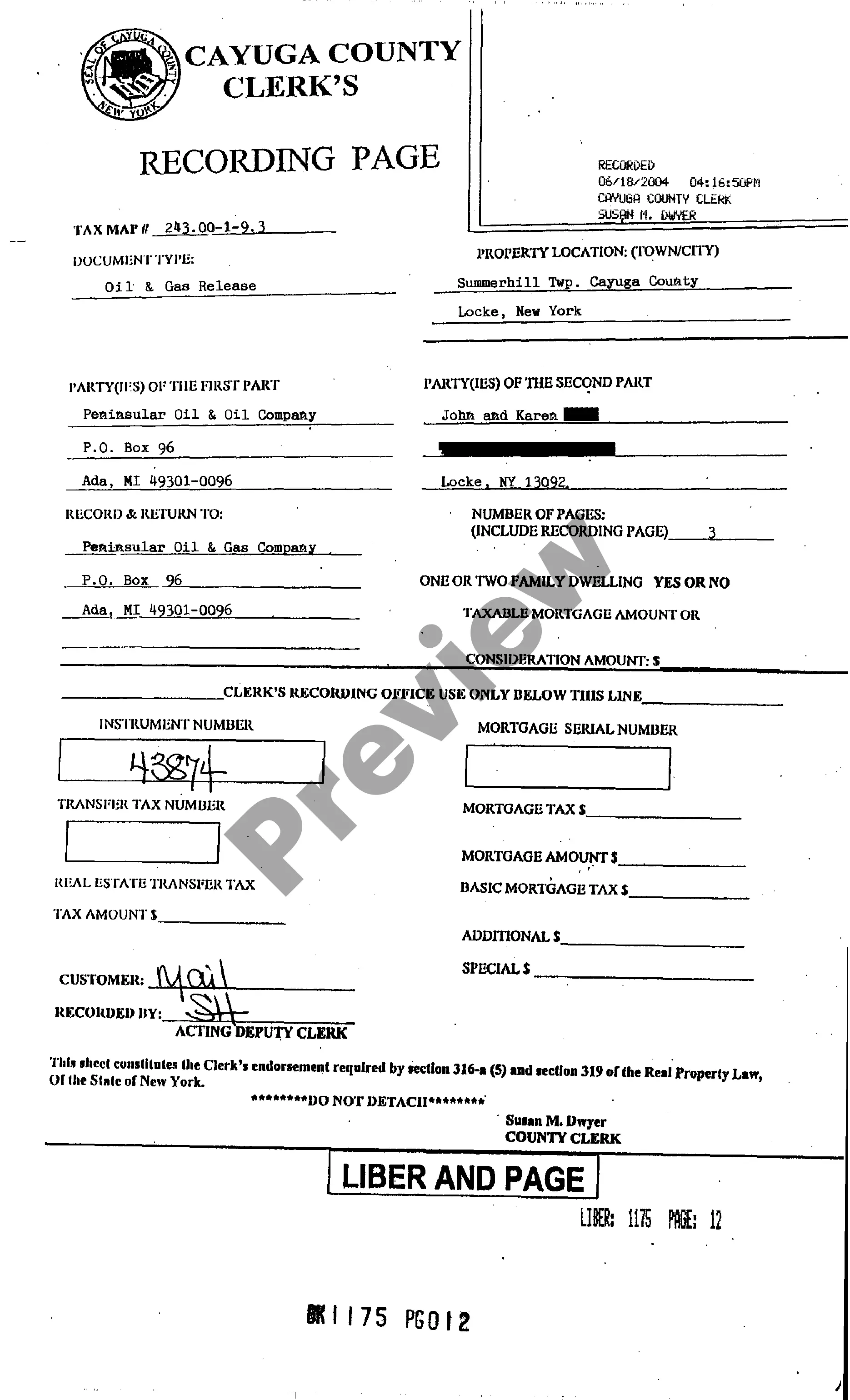

New York Affidavit of Oil and Gas Lease

Description

How to fill out New York Affidavit Of Oil And Gas Lease?

Among lots of free and paid samples that you get online, you can't be sure about their accuracy. For example, who made them or if they’re qualified enough to deal with what you need those to. Always keep calm and utilize US Legal Forms! Find New York Affidavit of Oil and Gas Lease templates made by professional legal representatives and avoid the high-priced and time-consuming procedure of looking for an lawyer and then having to pay them to draft a papers for you that you can find on your own.

If you already have a subscription, log in to your account and find the Download button near the form you’re searching for. You'll also be able to access your earlier saved examples in the My Forms menu.

If you are making use of our platform the very first time, follow the tips listed below to get your New York Affidavit of Oil and Gas Lease quick:

- Make certain that the document you find is valid where you live.

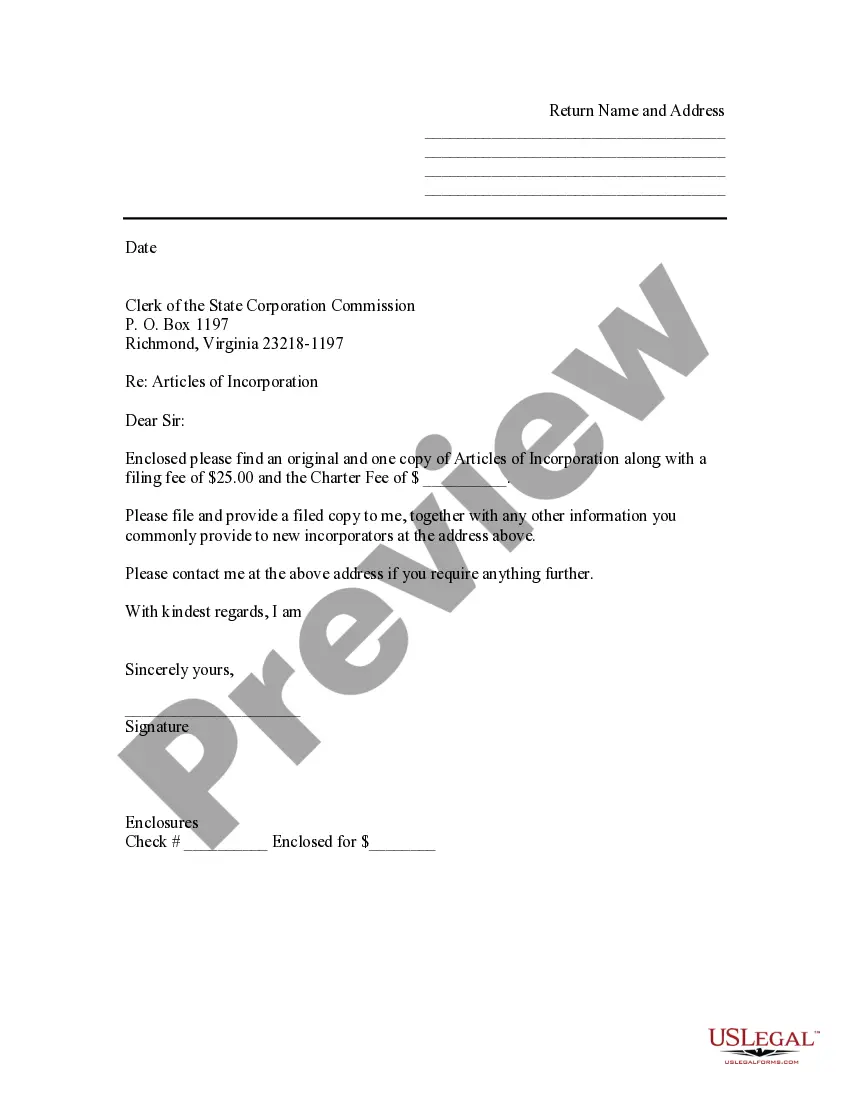

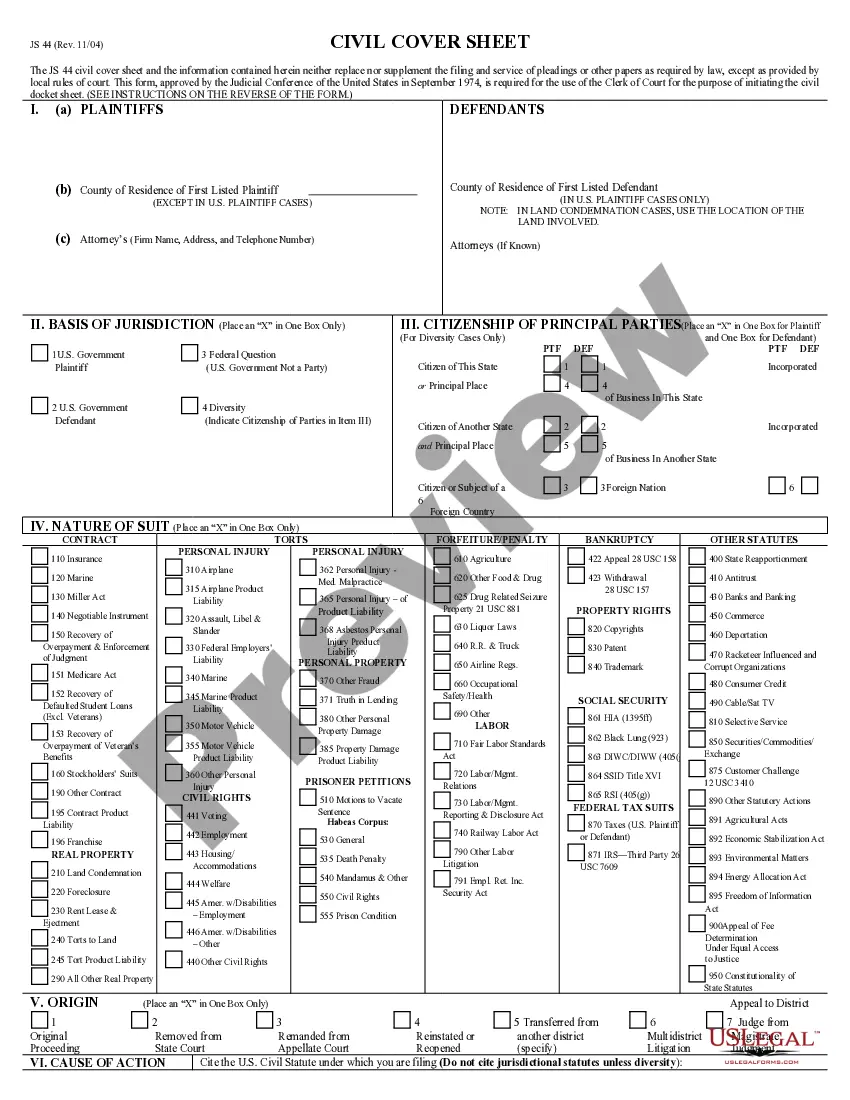

- Review the template by reading the description for using the Preview function.

- Click Buy Now to start the purchasing procedure or find another template using the Search field located in the header.

- Select a pricing plan sign up for an account.

- Pay for the subscription with your credit/debit/debit/credit card or Paypal.

- Download the form in the preferred format.

As soon as you’ve signed up and bought your subscription, you can use your New York Affidavit of Oil and Gas Lease as often as you need or for as long as it continues to be valid where you live. Revise it in your favorite offline or online editor, fill it out, sign it, and print it. Do a lot more for less with US Legal Forms!

Form popularity

FAQ

To calculate your oil and gas royalties, you would first divide 50 by 1,000, and then multiply this number by . 20, then by $5,004,000 for a gross royalty of $50,040. Once you calculate your gross royalty amount, compare it to the number you see on your royalty check stubs.

Wellbore. An assignment can be limited to the wellbore of a well. A wellbore limitation means that the assignor is assigning only those rights to production from the wellbore of a certain well, arguably at the total depth it existed at the time of the assignment.

Oil and gas lease is an agreement between a mineral owner (lessor) and a company (lessee) in which the owner grants the company the right to explore, drill and produce oil, gas, and other minerals below the surface of the earth.

Calculating net revenue interest formula To determine net revenue interest, multiply the royalty interest by the owner's shared interest. For example, if you have a 5/16 royalty, your net royalty interest would be 25% multiplied by 5/16, which equals 7.8125% calculated to four decimal places.

An Assignment of an Oil, Gas and Mineral Lease is a document in which the original Lessee, and or their successors, assign either all or part of their working interest and/or net revenue interest that they own in that lease. This is leasehold interest. You can also assign or reserve interest in wellbores.

Assignment is a legal term whereby an individual, the assignor, transfers rights, property, or other benefits to another known as the assignee. This concept is used in both contract and property law. The term can refer to either the act of transfer or the rights/property/benefits being transferred.

To ratify a lease means that the landowner and oil & gas producer, as current lessor and lessee of the land, agree (or re-agree) to the terms of the existing lease.In all likelihood, the lessee (usually the current producer) believes that you have legitimate grounds to break the existing lease.

Further, annual rental fees for onshore oil and gas leases $1.50 per acre during the first five years and $2 per acre each year thereafter allow drilling companies to hold and explore mineral leases for the price of a cup of coffee.