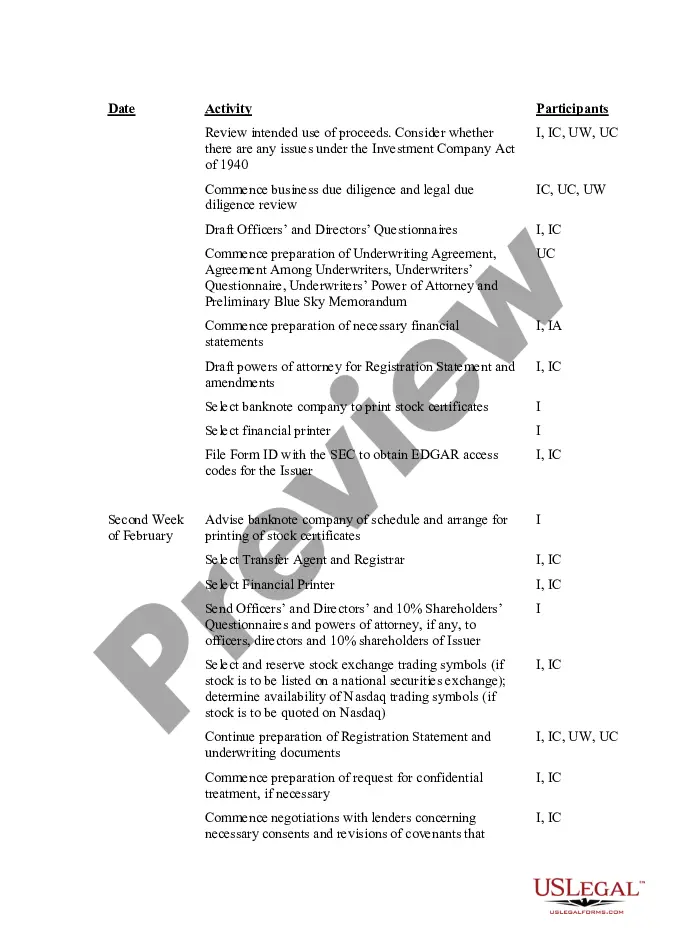

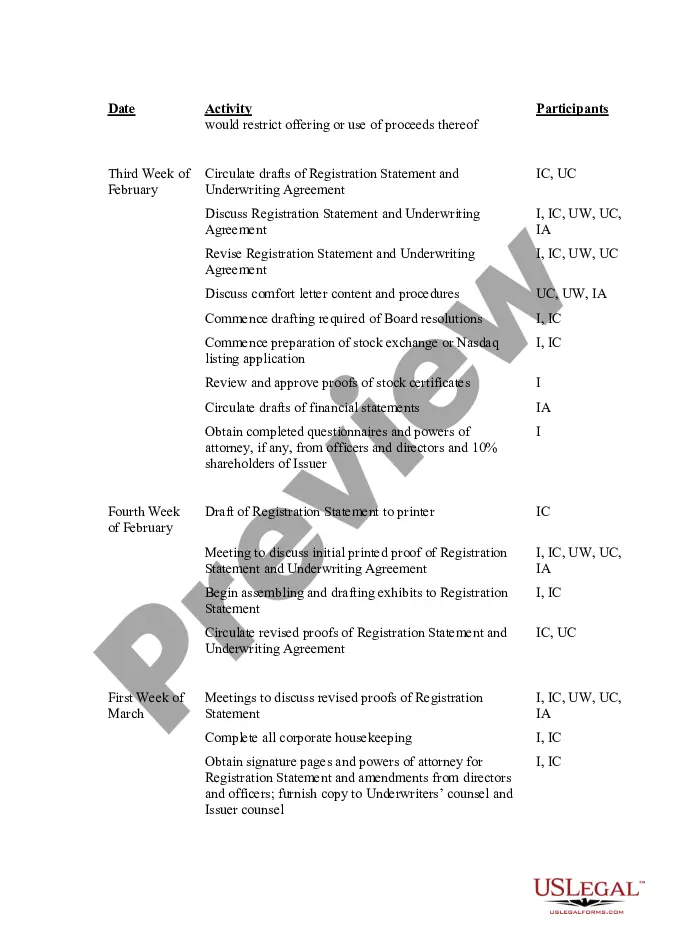

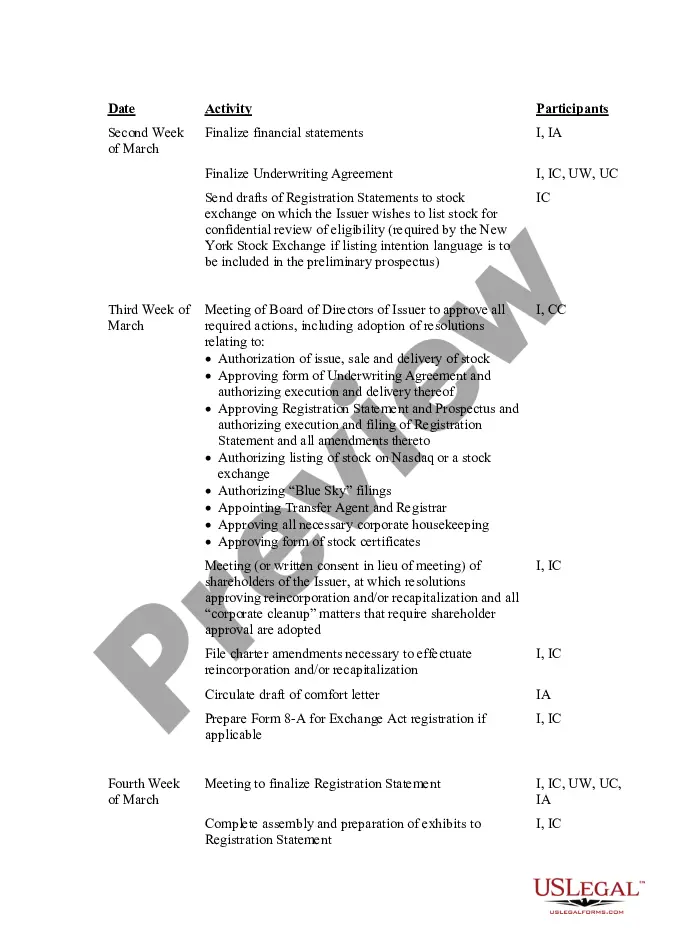

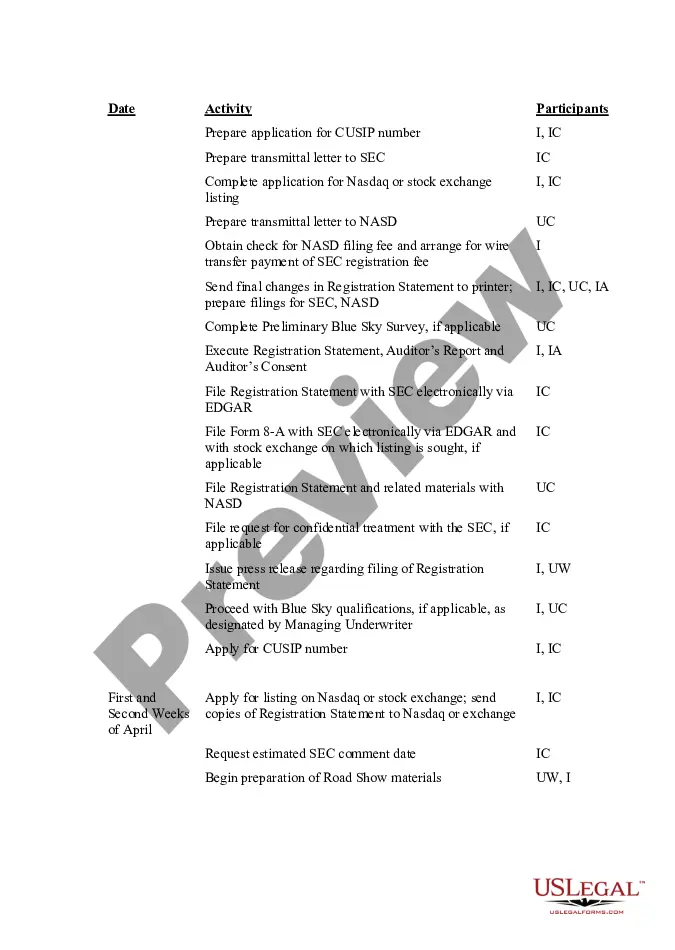

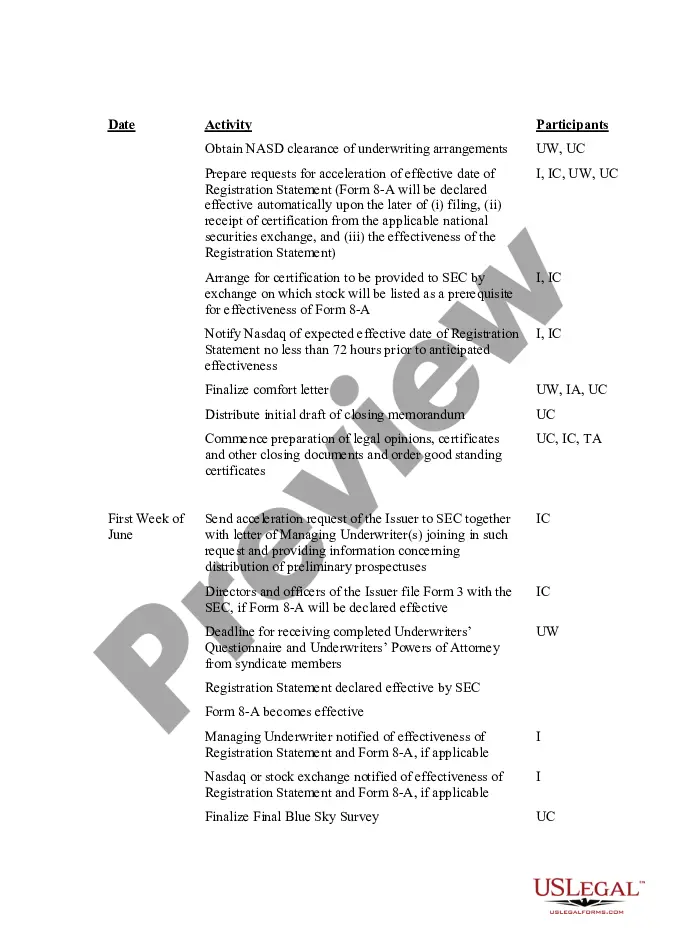

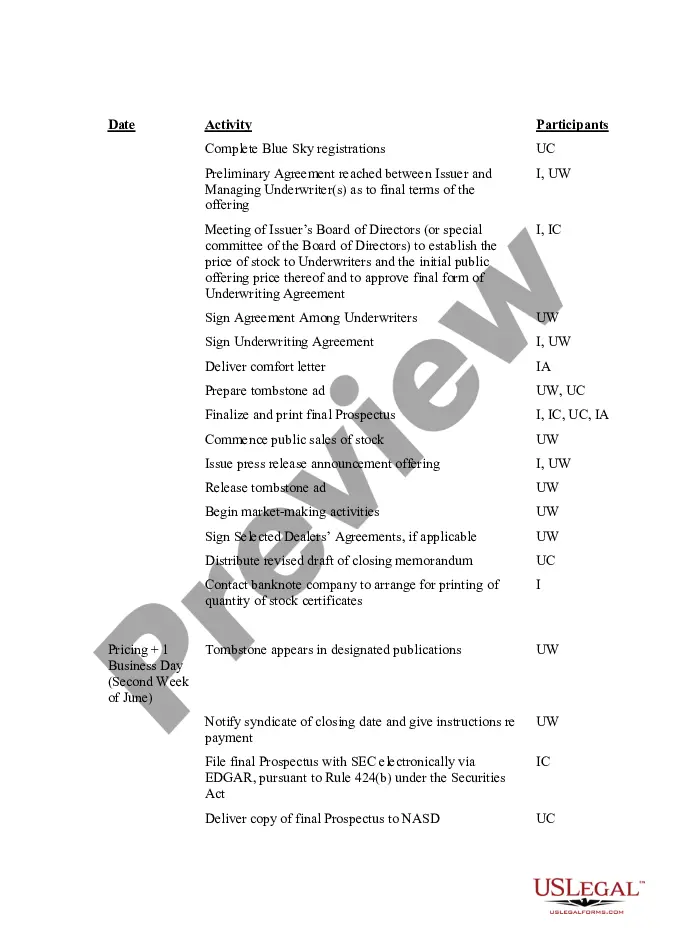

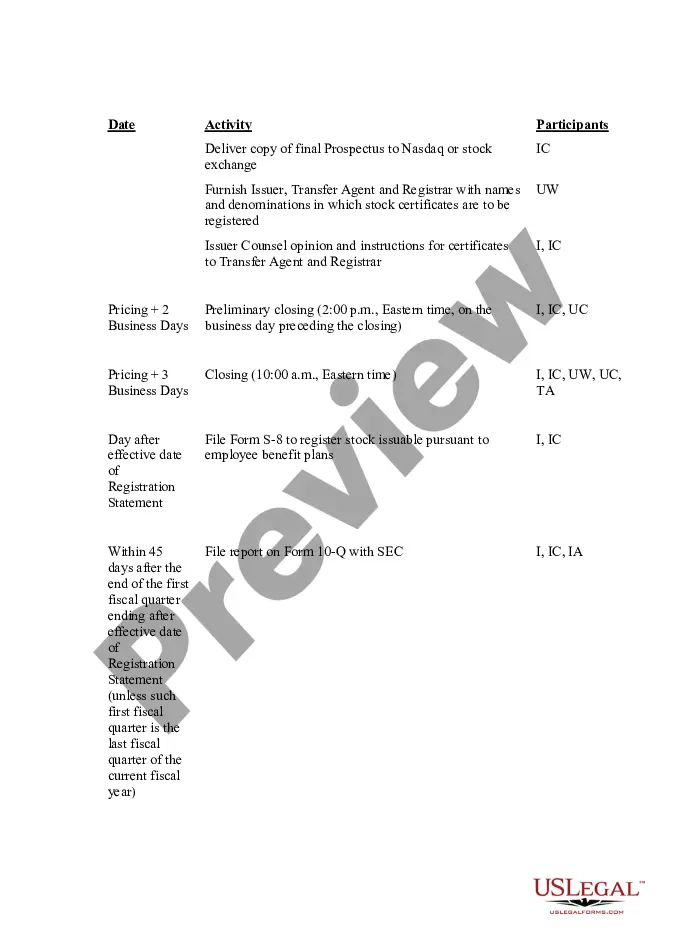

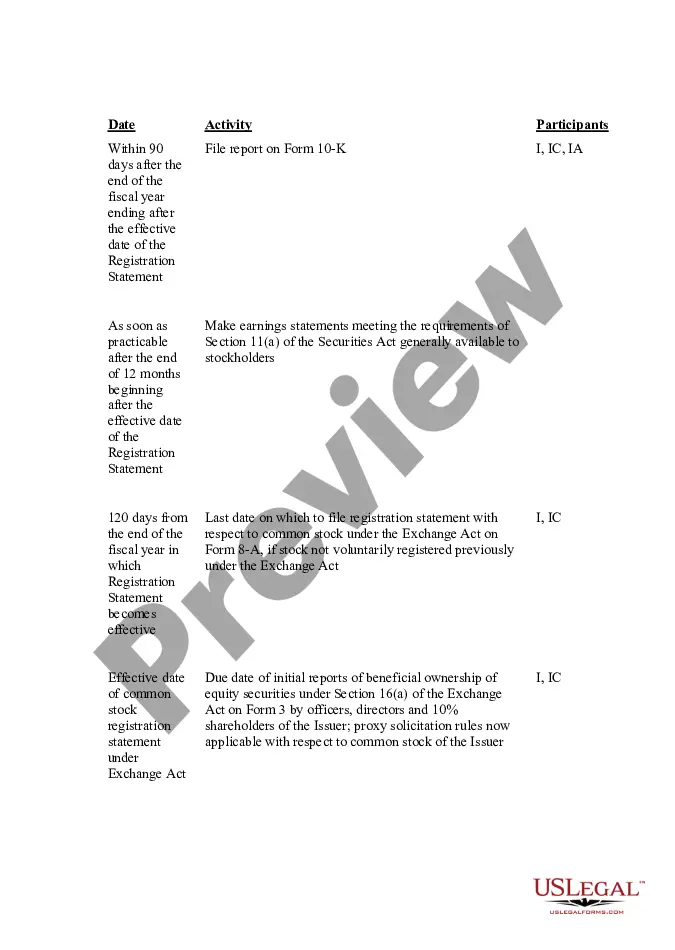

This IPO Time and Responsibility Schedule details, week by week, the tasks to be performed in the months leading up to the IPO. It lists the activities to be undertaken and the participants assigned to each task.

New York IPO Time and Responsibility Schedule

Description

How to fill out IPO Time And Responsibility Schedule?

Are you currently within a placement that you require documents for both company or specific purposes virtually every day? There are plenty of legal file templates available online, but finding kinds you can rely is not effortless. US Legal Forms provides 1000s of develop templates, such as the New York IPO Time and Responsibility Schedule, that happen to be composed in order to meet state and federal specifications.

If you are presently familiar with US Legal Forms internet site and also have a free account, basically log in. Afterward, you can download the New York IPO Time and Responsibility Schedule template.

Unless you have an accounts and need to begin using US Legal Forms, abide by these steps:

- Obtain the develop you will need and ensure it is to the proper metropolis/state.

- Take advantage of the Review key to review the form.

- Look at the outline to ensure that you have chosen the proper develop.

- In case the develop is not what you`re trying to find, make use of the Look for field to find the develop that meets your requirements and specifications.

- Once you find the proper develop, simply click Purchase now.

- Select the prices prepare you want, fill in the specified information to generate your money, and pay for the order making use of your PayPal or Visa or Mastercard.

- Select a practical file structure and download your duplicate.

Locate all the file templates you may have bought in the My Forms food selection. You may get a more duplicate of New York IPO Time and Responsibility Schedule any time, if required. Just click on the necessary develop to download or print out the file template.

Use US Legal Forms, one of the most substantial collection of legal kinds, in order to save time and stay away from errors. The support provides professionally produced legal file templates which can be used for a range of purposes. Produce a free account on US Legal Forms and begin creating your life easier.

Form popularity

FAQ

IPOs or initial public offerings usually start trading a little after the stock market opens, around 10 am.

What is the typical IPO timeline? While an IPO timeline can stretch across years, many professionals recommend you operate as a public company for one to two years before actually going public. There are about six key months during the IPO process.

The IPO listing takes place at a.m. on the listing day with a listing ceremony. The exchanges conduct a special one-hour trading session, called the pre-open session between 9 a.m. to 10 a.m. for newly listed IPO shares. The regular trading in IPO shares starts at 10 a.m.

Quiet Period Process The quiet period begins when the registration statement is made effective and lasts for 40 days after the stock starts trading and is for analysts employed by the offering's managing underwriters and 25 days for analysts employed by other underwriters participating in the IPO.

What is IPO listing time? The IPO listing takes place at a.m. on the listing day with a listing ceremony. The exchanges conduct a special one-hour trading session, called the pre-open session between 9 a.m. to 10 a.m. for newly listed IPO shares. The regular trading in IPO shares starts at 10 a.m.

Key Takeaways. An IPO lock-up is period of days, typically 90 to 180 days, after an IPO during which time shares cannot be sold by company insiders. Lock-up periods typically apply to insiders such as a company's founders, owners, managers, and employees but may also include early investors such as venture capitalists.