New York Clauses Relating to Venture IPO

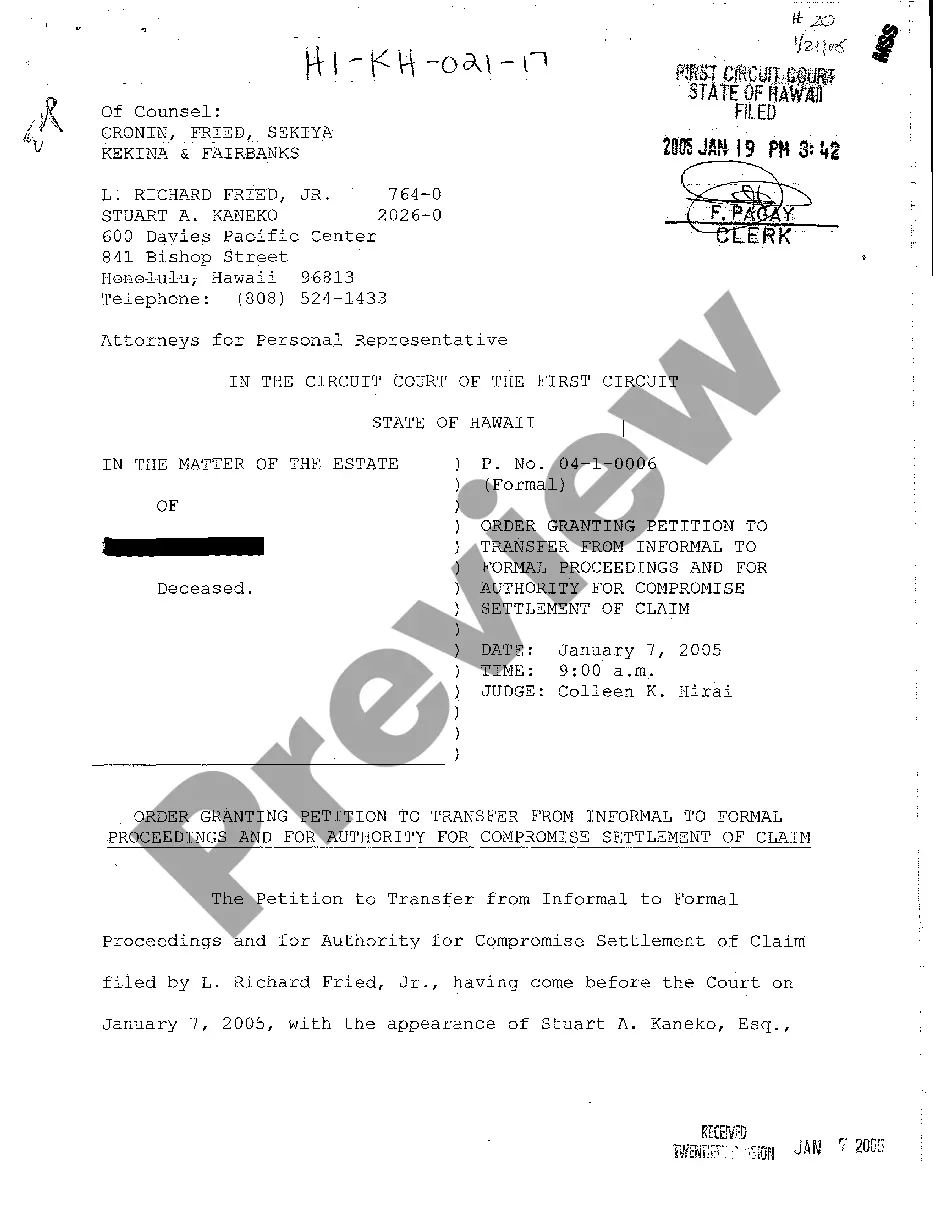

Description

How to fill out Clauses Relating To Venture IPO?

Choosing the right legal file template can be a struggle. Naturally, there are a lot of themes accessible on the Internet, but how can you obtain the legal form you want? Make use of the US Legal Forms web site. The assistance gives 1000s of themes, like the New York Clauses Relating to Venture IPO, that can be used for enterprise and personal requires. Every one of the varieties are examined by pros and meet up with state and federal specifications.

In case you are presently registered, log in for your profile and then click the Acquire key to find the New York Clauses Relating to Venture IPO. Use your profile to look through the legal varieties you might have acquired earlier. Go to the My Forms tab of your profile and obtain yet another backup of the file you want.

In case you are a fresh customer of US Legal Forms, allow me to share straightforward guidelines that you can adhere to:

- Initially, make certain you have chosen the proper form for the area/county. You may examine the shape using the Review key and study the shape information to guarantee this is the best for you.

- In the event the form will not meet up with your needs, take advantage of the Seach discipline to get the correct form.

- Once you are positive that the shape is suitable, click the Purchase now key to find the form.

- Opt for the prices program you would like and enter in the essential information and facts. Make your profile and buy your order making use of your PayPal profile or charge card.

- Choose the submit structure and download the legal file template for your device.

- Total, modify and print and signal the obtained New York Clauses Relating to Venture IPO.

US Legal Forms will be the most significant collection of legal varieties in which you can see a variety of file themes. Make use of the company to download skillfully-created papers that adhere to condition specifications.

Form popularity

FAQ

To purchase IPO shares, you must open an account with TD Ameritrade, then complete a personal and financial profile, and read and agree to the rules and regulations affecting new issue investing. Each account being registered must have a value of at least $250,000, or have completed 30 trades in the last 3 months.

IPO Application Rules Only one application per PAN is allowed. Payment for an IPO should be made from the investor's own bank account to avoid rejection. In some cases, individuals receive allotment for third-party IPO applications also.

The Payor agrees that the Payee shall have the right to subscribe for a minimum of such number of shares as may be purchased at the initial public offering price using the proceeds of the principal and interest due on the Maturity Date under this Note.

up agreement is a contractual provision preventing insiders of a company from selling their shares for a specified period of time. They are commonly used as part of the initial public offering (IPO) process.

Buying an IPO first starts with having a brokerage account. From there, you must ensure you meet the eligibility requirements of the IPO. You will then need to request the shares from your broker. A request does not ensure that you will have access to the shares as brokers typically get a set amount.