New York Clauses Relating to Initial Capital contributions

Description

How to fill out Clauses Relating To Initial Capital Contributions?

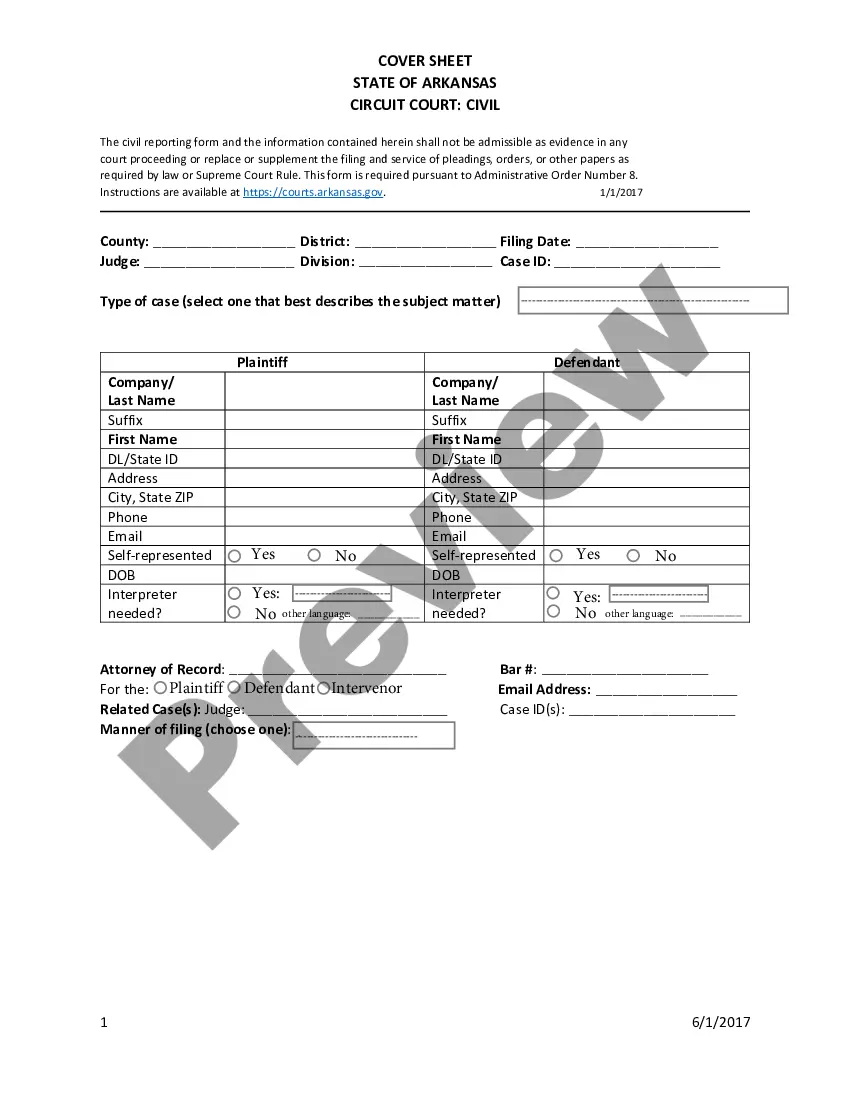

Finding the right legitimate papers design can be a have difficulties. Obviously, there are a lot of layouts available online, but how would you discover the legitimate kind you will need? Use the US Legal Forms website. The assistance delivers thousands of layouts, for example the New York Clauses Relating to Initial Capital contributions, that you can use for organization and personal requirements. Each of the forms are checked out by professionals and meet up with state and federal specifications.

If you are presently signed up, log in to your account and click the Down load button to have the New York Clauses Relating to Initial Capital contributions. Utilize your account to appear throughout the legitimate forms you might have purchased earlier. Go to the My Forms tab of your own account and have yet another backup of the papers you will need.

If you are a fresh customer of US Legal Forms, listed below are easy guidelines that you should comply with:

- Initial, ensure you have selected the appropriate kind for your area/state. It is possible to examine the form utilizing the Preview button and study the form explanation to make sure this is the best for you.

- In case the kind fails to meet up with your requirements, utilize the Seach area to find the right kind.

- When you are certain that the form is proper, click the Acquire now button to have the kind.

- Opt for the rates prepare you need and type in the needed details. Create your account and pay money for an order utilizing your PayPal account or Visa or Mastercard.

- Opt for the document formatting and down load the legitimate papers design to your product.

- Full, revise and print out and sign the received New York Clauses Relating to Initial Capital contributions.

US Legal Forms is the largest library of legitimate forms for which you can discover different papers layouts. Use the service to down load expertly-produced documents that comply with status specifications.

Form popularity

FAQ

This clause should be used when one member contributed real property to the joint venture in exchange for membership interests and another member has contributed capital. The capitalized terms and section references used in this clause should be conformed to the relevant joint venture operating agreement.

Your initial contributions upon forming an LLC can be any amount. The typical amount that members will contribute is enough to pay the startup expenses and assets.

Contributed capital, also known as paid-in capital, is the cash and other assets that shareholders have given a company in exchange for stock. Investors make capital contributions when a company issues equity shares based on a price that shareholders are willing to pay for them.

What is a Capital Contribution? A capital contribution refers to the cash or property that owners provide to their business. LLC members typically make initial capital contributions when opening the business and may contribute more throughout the company's lifetime.

An Initial Capital Stock Contribution is a specific amount of money you noted on your Operating Agreement that you as a shareholder in your LLC with S Corp tax formation would 'contribute' to get the business up and running.

One of the most important sections in the operating agreement is the capital contribution section. A capital contribution section usually addresses what happens if members fail to contribute their portion of the initial start-up capital.

The capital contribution is the initial amount that the owners/members give to the company from their personal funds. It can be in the form of cash, property, or even services (sometimes called sweat equity). These contributions are put into the company's bank account to fund the initial operations of the company.