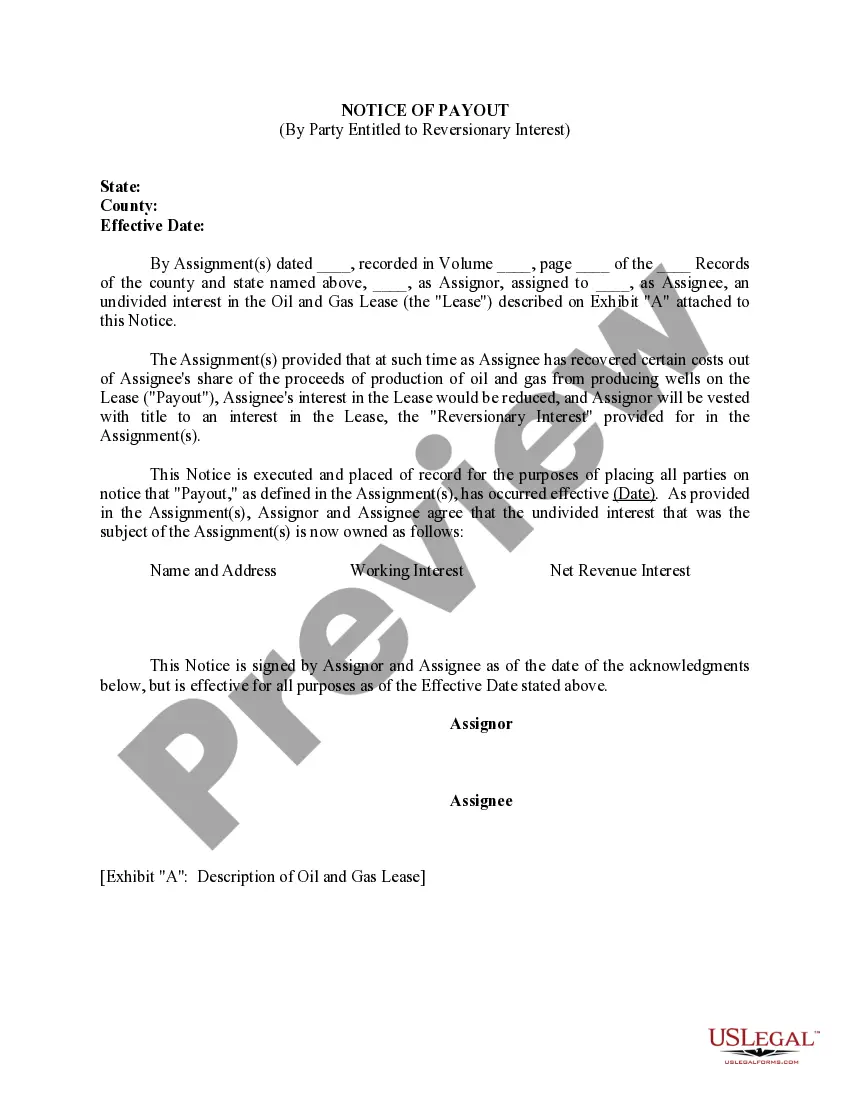

New York Notice of Payout, Election to Convert Interest to Party With Right to Convert An Overriding Royalty Interest to A Working Interest

Description

How to fill out Notice Of Payout, Election To Convert Interest To Party With Right To Convert An Overriding Royalty Interest To A Working Interest?

If you have to complete, obtain, or printing legal record web templates, use US Legal Forms, the biggest assortment of legal varieties, which can be found on-line. Make use of the site`s simple and handy search to obtain the documents you require. A variety of web templates for company and individual uses are sorted by categories and says, or keywords and phrases. Use US Legal Forms to obtain the New York Notice of Payout, Election to Convert Interest to Party With Right to Convert An Overriding Royalty Interest to A Working Interest in just a few click throughs.

Should you be previously a US Legal Forms customer, log in to the account and then click the Down load switch to find the New York Notice of Payout, Election to Convert Interest to Party With Right to Convert An Overriding Royalty Interest to A Working Interest. Also you can gain access to varieties you previously downloaded from the My Forms tab of your account.

If you are using US Legal Forms the very first time, follow the instructions listed below:

- Step 1. Be sure you have selected the shape to the correct town/region.

- Step 2. Use the Review solution to look over the form`s articles. Do not overlook to learn the information.

- Step 3. Should you be unhappy using the develop, make use of the Search industry at the top of the monitor to discover other variations of your legal develop design.

- Step 4. Once you have located the shape you require, click on the Purchase now switch. Pick the pricing prepare you choose and add your references to register for the account.

- Step 5. Procedure the purchase. You can utilize your charge card or PayPal account to accomplish the purchase.

- Step 6. Choose the file format of your legal develop and obtain it on the gadget.

- Step 7. Total, edit and printing or indication the New York Notice of Payout, Election to Convert Interest to Party With Right to Convert An Overriding Royalty Interest to A Working Interest.

Each legal record design you buy is your own property permanently. You might have acces to each develop you downloaded in your acccount. Click the My Forms segment and decide on a develop to printing or obtain yet again.

Remain competitive and obtain, and printing the New York Notice of Payout, Election to Convert Interest to Party With Right to Convert An Overriding Royalty Interest to A Working Interest with US Legal Forms. There are many specialist and status-distinct varieties you may use for your personal company or individual needs.

Form popularity

FAQ

Overriding Royalty Interest Conveyance means an assignment, in form and substance acceptable to Lender, pursuant to which Borrower grants in favor of Lender an overriding royalty interest equal to six and one-fourth percent (6.25%) of Hydrocarbons produced, saved and sold or used off the premises of the relevant Lease, ...

Participating Royalty Interest (NPRI) is an interest in oil and gas production which is created from the mineral estate. Like the plain ?royalty interest? it is expensefree, bearing no operational costs of production.

An overriding royalty interest (ORRI) is an interest carved out of a working interest. It is: A percentage of gross production that is not charged with any expenses of exploring, developing, producing, and operating a well.

Non-operating working interests include overriding royalty interests, production payments, and net profit interests. Unlike royalty interests, non-operating working interest must include a portion of the costs associated with the day-to-day operation of the well.

To calculate the number of net royalty acres I'm selling, I use this formula: [acres in tract] X [% of minerals owned] X 8 X [royalty interest reserved in lease] X [fraction of royalty interest being sold]. 640 acres X 25% X 8 X 1/4 X 1/2 = 160 net royalty acres.

You may convey overriding royalty interest on either an Assignment of Record Title Interest (Form 3000-3), a Transfer of Operating Rights (Form 3000-3a), or on a private assignment. We only require filing of one signed copy per assignment plus a nonrefundable filing fee found at 43 CFR 3000.12.

An overriding royalty interest (ORRI) is an interest carved out of a working interest. It is: A percentage of gross production that is not charged with any expenses of exploring, developing, producing, and operating a well.

How Do Overriding Royalty Interest Payments Work? The value of an overriding royalty interest is simple to calculate since it is a percent of the working interest lease. The ORRI value is based on production on the acreage leased by the working interest.