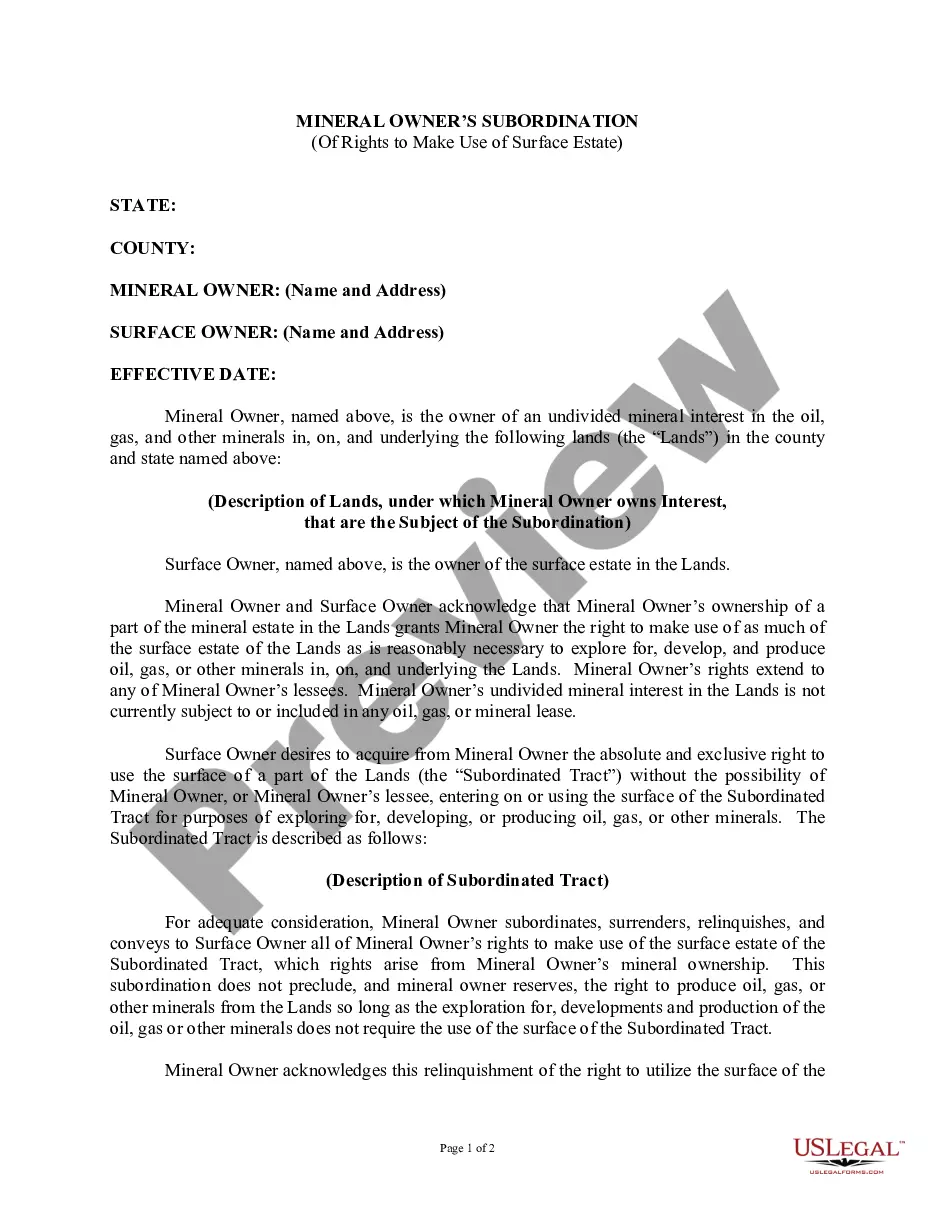

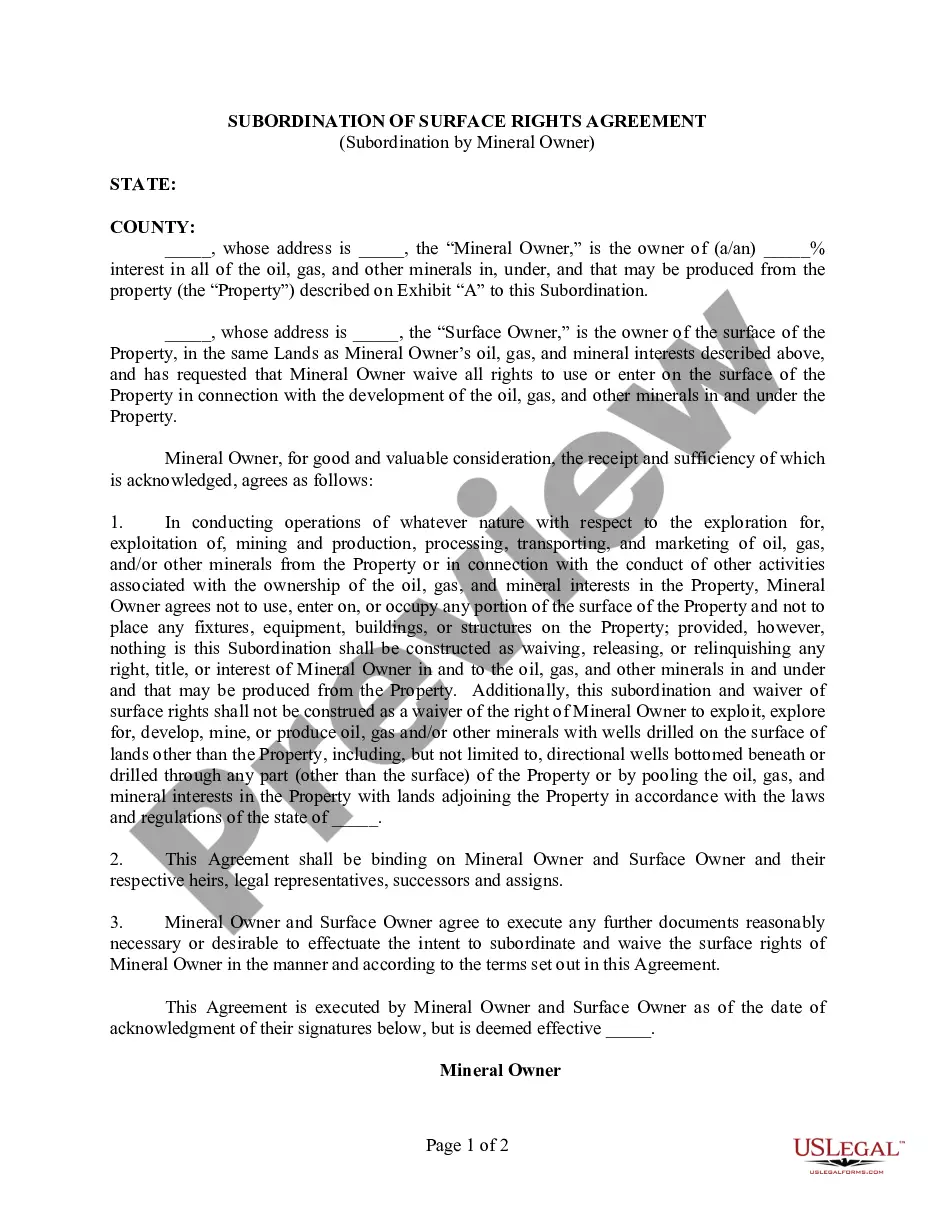

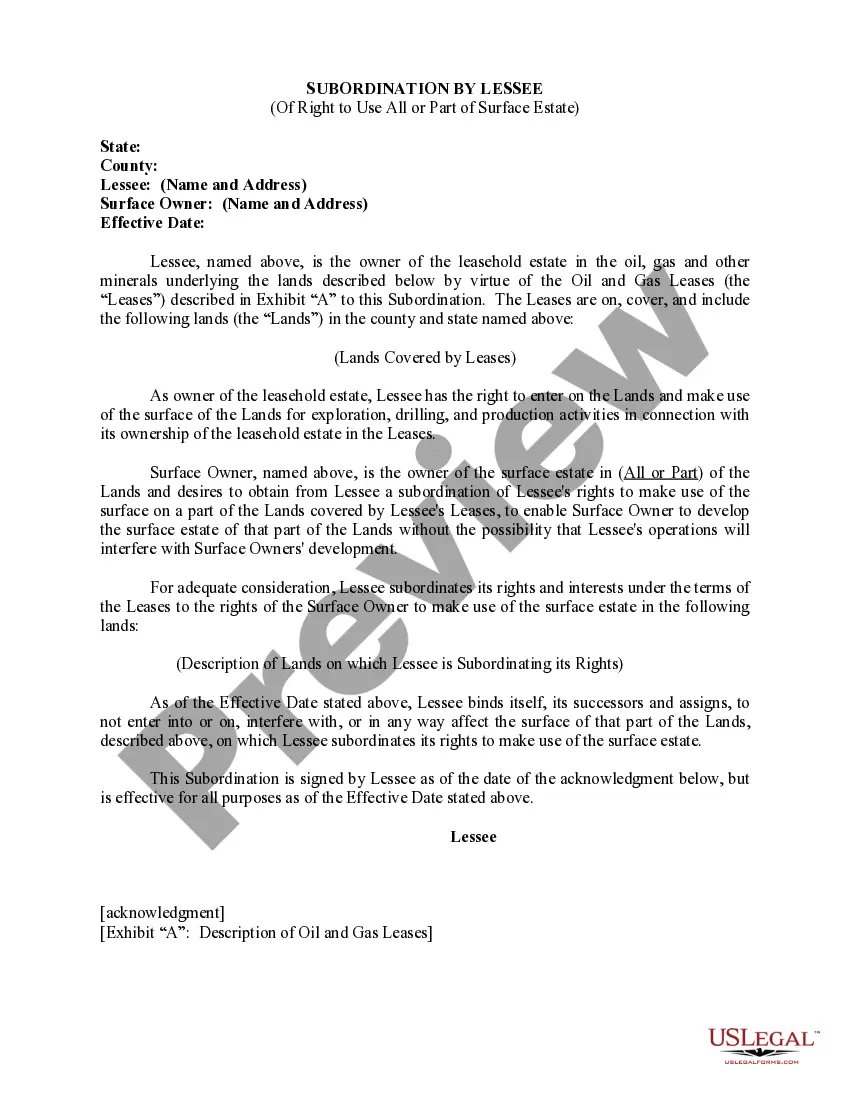

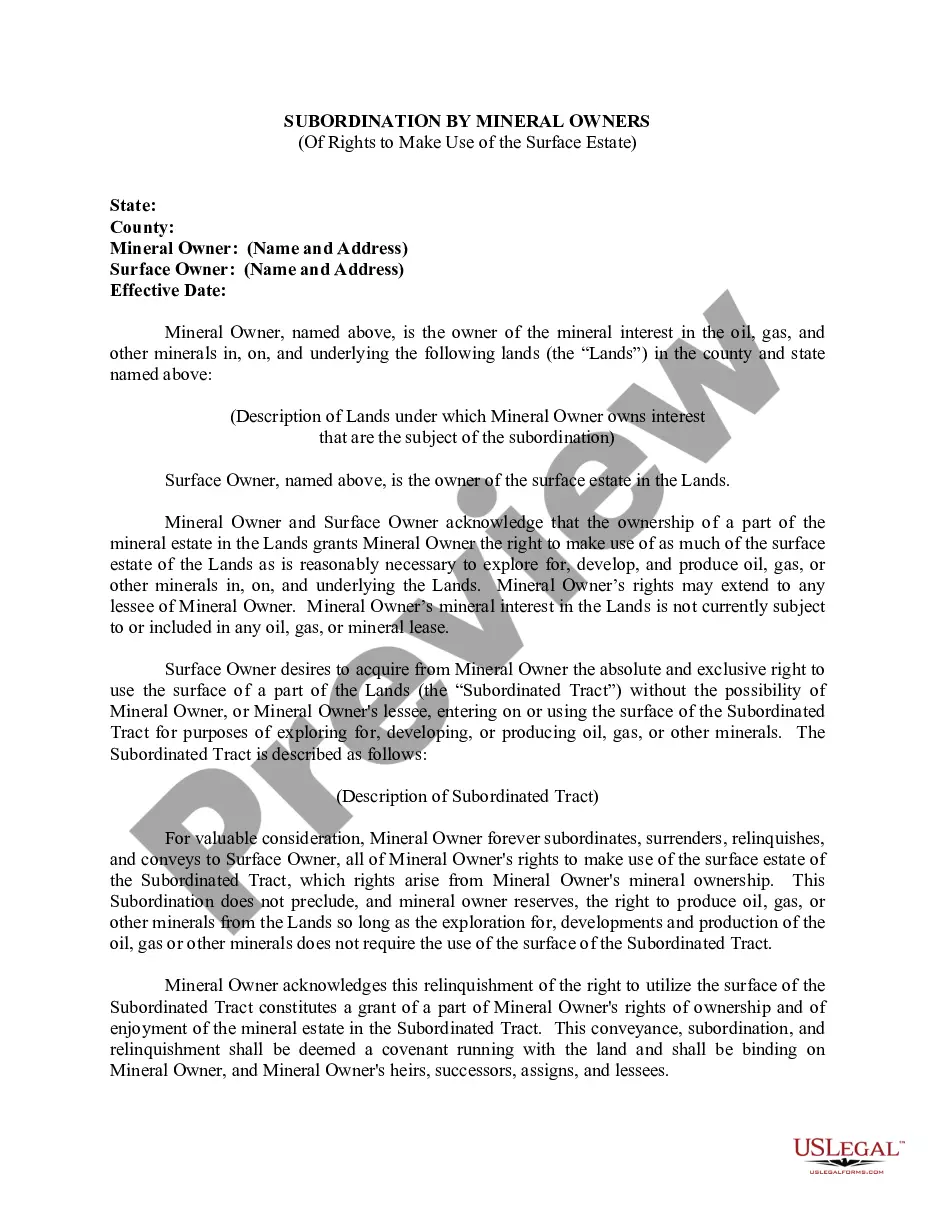

New York Mineral Owner's Subordination (of Rights to Make Use of Surface Estate)

Description

How to fill out Mineral Owner's Subordination (of Rights To Make Use Of Surface Estate)?

US Legal Forms - one of several greatest libraries of authorized kinds in America - provides a wide range of authorized record layouts it is possible to download or print out. Making use of the internet site, you will get thousands of kinds for company and specific purposes, sorted by groups, claims, or keywords.You can get the latest types of kinds such as the New York Mineral Owner's Subordination (of Rights to Make Use of Surface Estate) within minutes.

If you currently have a monthly subscription, log in and download New York Mineral Owner's Subordination (of Rights to Make Use of Surface Estate) from your US Legal Forms local library. The Obtain option will appear on every kind you view. You gain access to all earlier acquired kinds from the My Forms tab of the account.

If you would like use US Legal Forms initially, listed here are easy recommendations to help you started off:

- Make sure you have chosen the correct kind to your city/area. Select the Review option to review the form`s content material. Read the kind explanation to actually have chosen the correct kind.

- When the kind does not fit your specifications, make use of the Research field on top of the display to find the one which does.

- When you are content with the form, confirm your selection by clicking the Purchase now option. Then, select the pricing strategy you want and supply your qualifications to register on an account.

- Method the transaction. Use your bank card or PayPal account to accomplish the transaction.

- Select the file format and download the form on your own gadget.

- Make changes. Load, edit and print out and sign the acquired New York Mineral Owner's Subordination (of Rights to Make Use of Surface Estate).

Each design you put into your account lacks an expiry time and is your own property eternally. So, if you would like download or print out yet another copy, just check out the My Forms portion and click on around the kind you need.

Get access to the New York Mineral Owner's Subordination (of Rights to Make Use of Surface Estate) with US Legal Forms, one of the most extensive local library of authorized record layouts. Use thousands of professional and status-particular layouts that fulfill your company or specific demands and specifications.

Form popularity

FAQ

Unsolicited purchase offers are happening in greater numbers and for greater ? sometimes much greater ? amounts than in the past. The upshot? Sometimes selling makes good sense. Indeed, depending on your situation, the sale of your mineral rights can represent a prudent ? and even compelling ? opportunity.

The value of mineral rights per acre differs from state to state. Typically, the price ranges from $100 to $5,000 per acre in several states. In Texas, the average price per acre for non-producing mineral rights is usually between $0 and $250 per acre, as a general guideline.

Yes, it can be beneficial to sell your mineral rights for a fair price, even producing rights. First, sellers must be aware of the different stages of the production process. They must also know the value their minerals and royalties command in every development stage.

A landowner may own the rights to everything on the surface, but not the rights to underground resources such as oil, gas, and minerals. In the United States, landowners possess both surface and mineral rights unless they choose to sell the mineral rights to someone else.

Taxes: The #1 reason for selling mineral rights is taxes. If you inherited mineral rights and then sold them for $100,000, you could pay only $5,250 in taxes and keep $94,750. If you collect royalty income of $100,000, you could pay $30,000+ in taxes and only keep $70,000 and it would takes years to collect.

Cons of Selling Your Mineral Rights Loss of Potential Future Income: When you sell your mineral rights, you also give up any potential future income from those rights. This can be a significant loss if the mineral rights end up producing more than expected or if there are new discoveries in the future.

In the United States, mineral rights can be sold or conveyed separately from property rights. As a result, owning a piece of land does not necessarily mean you also own the rights to the minerals beneath it. If you didn't know this, you're not alone. Many property owners do not understand mineral rights.

Surface rights are what you own on the surface of the property. These include the space, the buildings and the landscaping. Mineral rights, on the other hand, cover the specific resources beneath the surface. In areas designated for mining, it's common for surface rights and mineral rights to be separate.