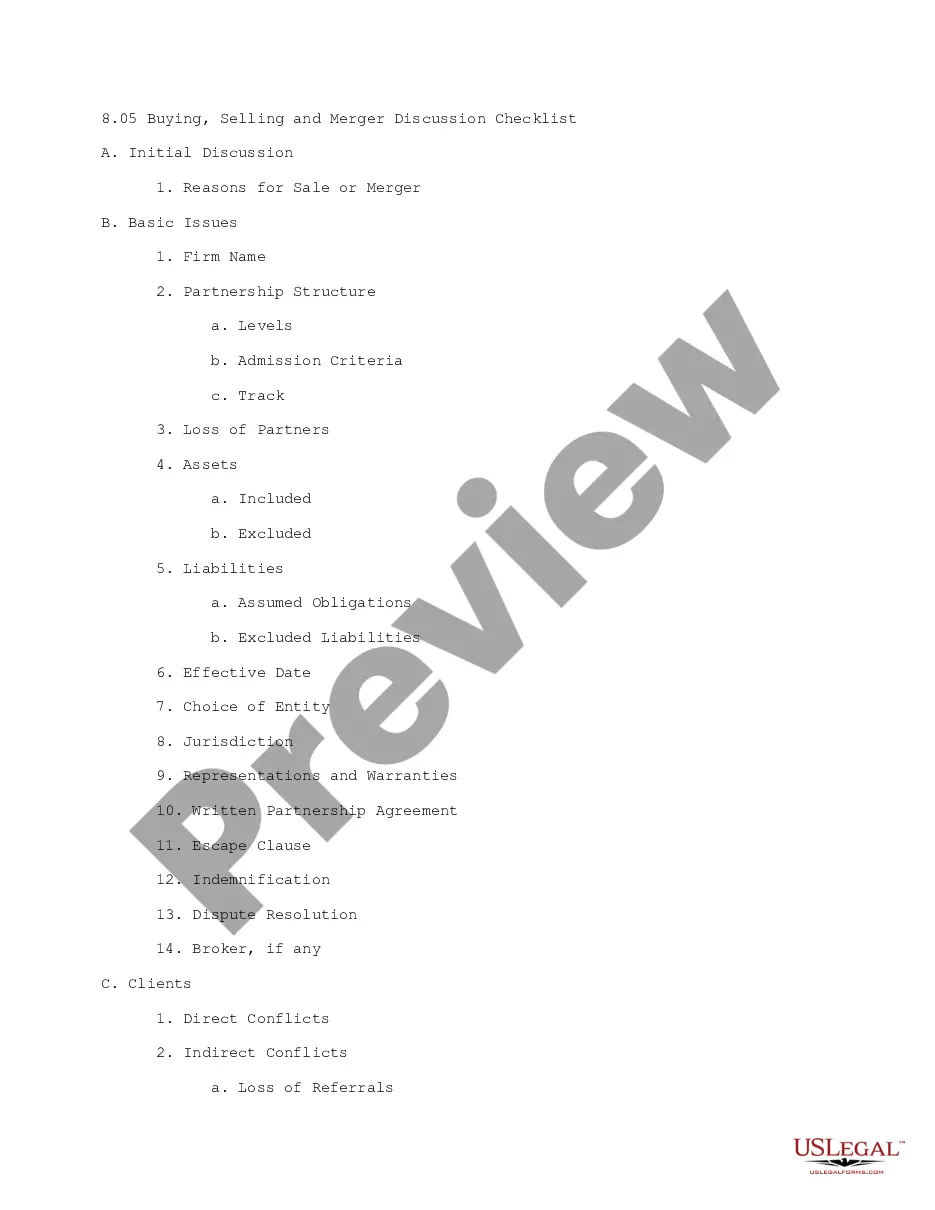

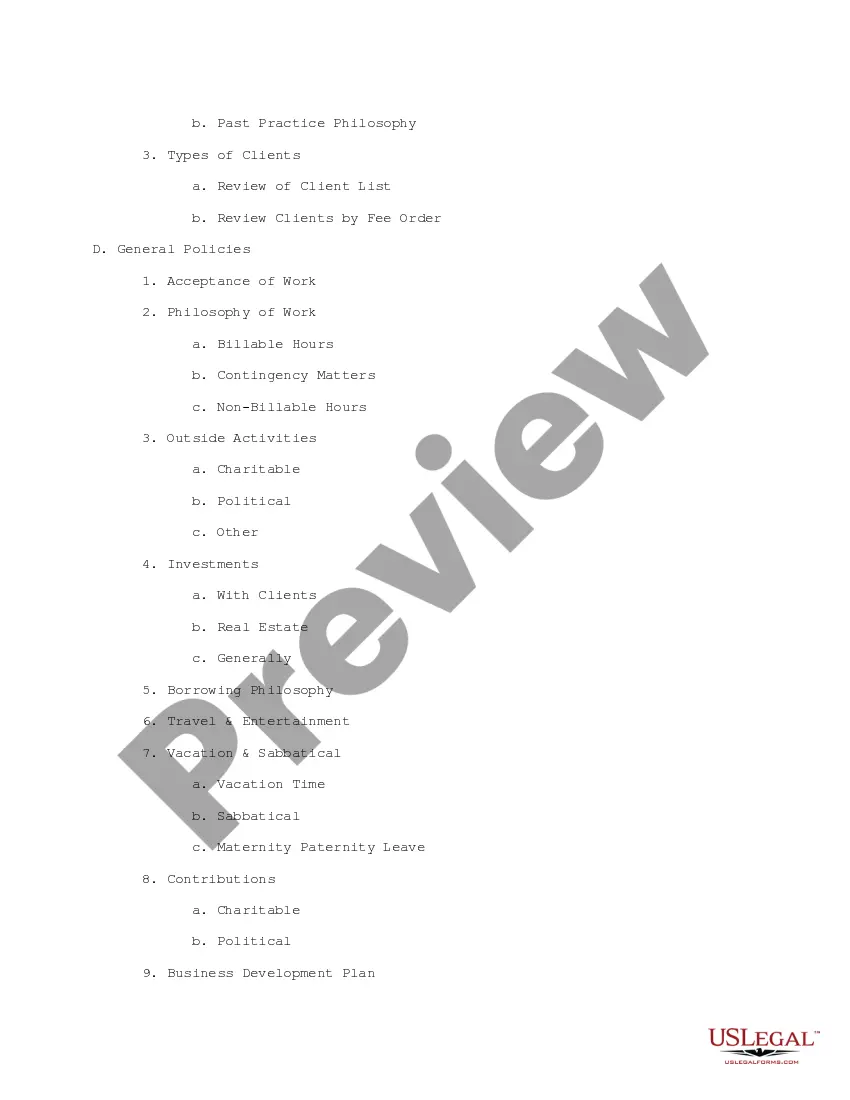

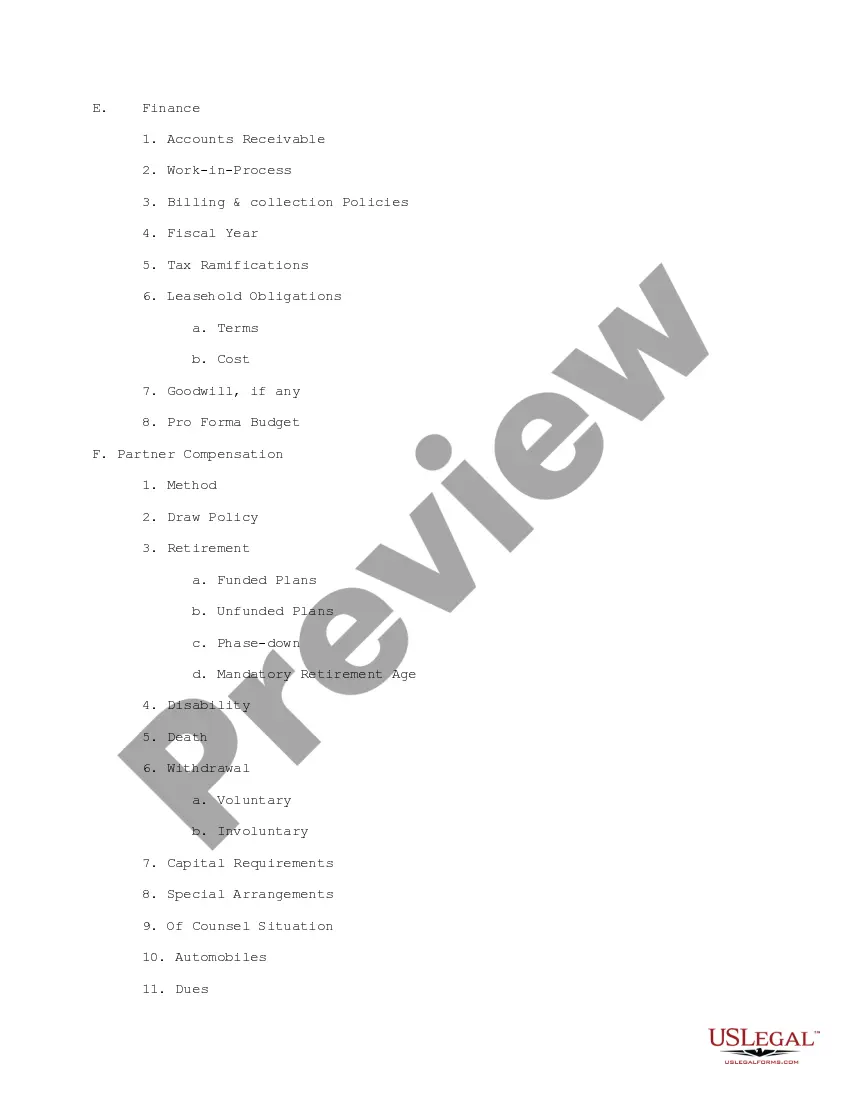

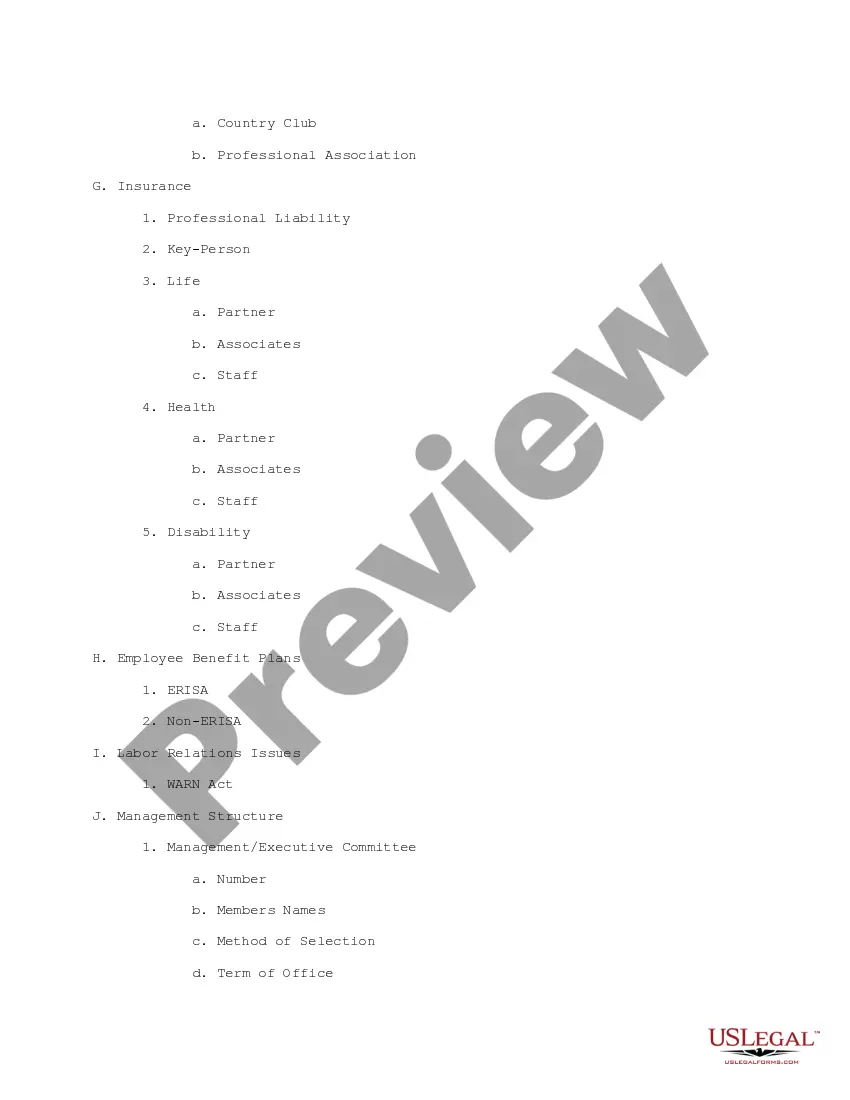

This is a checklist for the discussion of buying, selling, or merger of a law firm. Each category (clients, finance, partner compensation, etc.) is broken into sub-categories as a way of bringing to mind all issues to be discussed.

New York Buying, Selling and Merger Discussion Checklist

Description

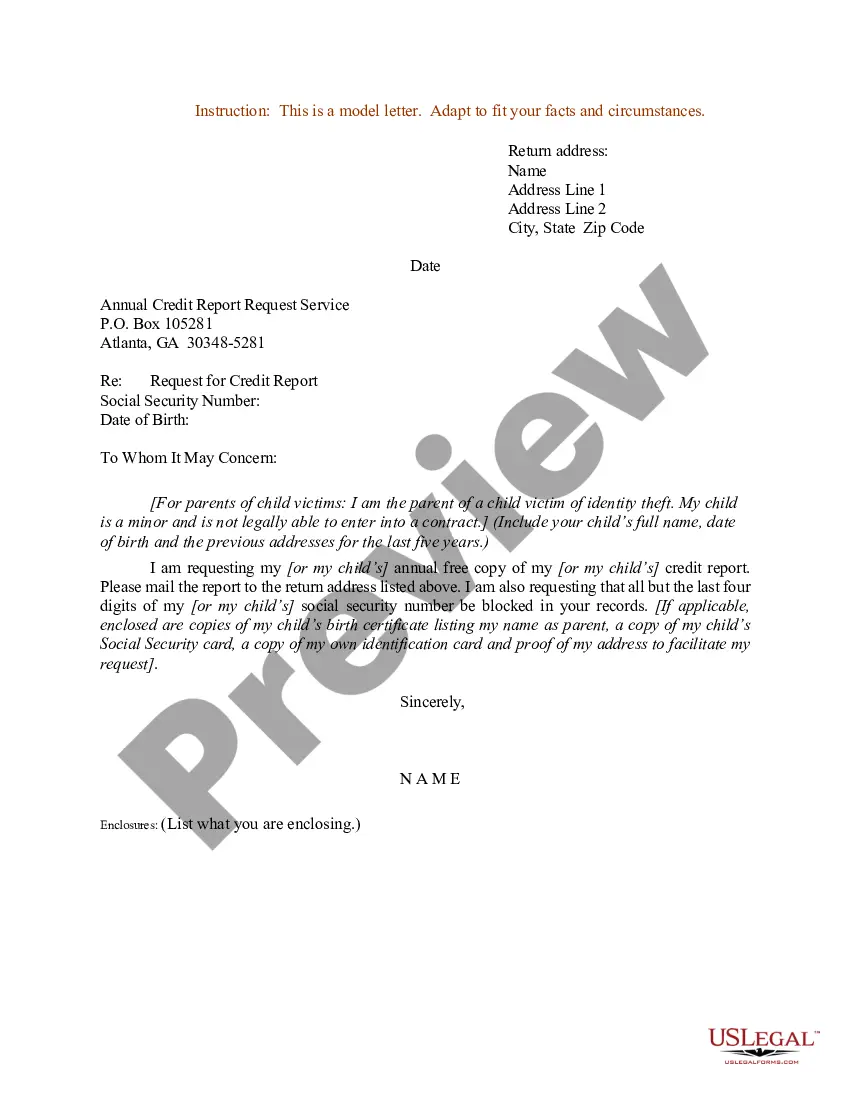

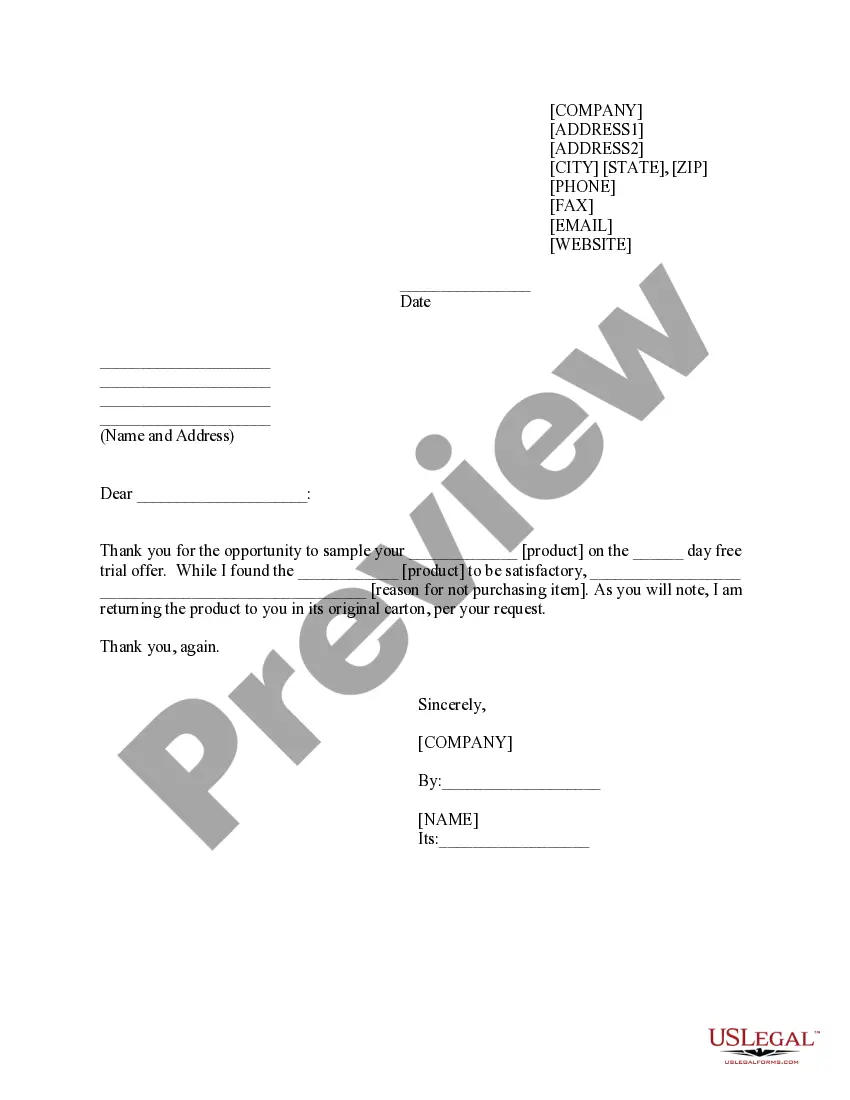

How to fill out Buying, Selling And Merger Discussion Checklist?

Have you been inside a position where you will need papers for sometimes organization or specific reasons just about every day? There are tons of authorized file templates available online, but discovering versions you can depend on isn`t effortless. US Legal Forms gives 1000s of kind templates, much like the New York Buying, Selling and Merger Discussion Checklist, that are composed to satisfy state and federal demands.

Should you be previously familiar with US Legal Forms website and possess a free account, simply log in. Next, you can acquire the New York Buying, Selling and Merger Discussion Checklist template.

Should you not provide an profile and want to begin to use US Legal Forms, abide by these steps:

- Find the kind you want and ensure it is for your correct metropolis/region.

- Utilize the Preview key to analyze the form.

- Look at the outline to actually have chosen the correct kind.

- When the kind isn`t what you are seeking, use the Search industry to discover the kind that suits you and demands.

- If you find the correct kind, just click Get now.

- Opt for the rates prepare you need, fill out the necessary details to produce your bank account, and pay money for an order with your PayPal or credit card.

- Decide on a practical document file format and acquire your copy.

Get all of the file templates you may have purchased in the My Forms food selection. You can get a more copy of New York Buying, Selling and Merger Discussion Checklist at any time, if needed. Just click the necessary kind to acquire or print out the file template.

Use US Legal Forms, probably the most substantial selection of authorized kinds, in order to save efforts and stay away from mistakes. The service gives appropriately manufactured authorized file templates which can be used for a variety of reasons. Generate a free account on US Legal Forms and initiate producing your daily life a little easier.

Form popularity

FAQ

Certifications & Education Formal education is non-negotiable. A bachelor's degree in business, accounting, finance, economics, or other related fields is essential to perform the job at the highest level. Other companies even require candidates with master's degrees in business management or finance.

During the first engagement, strive to understand the business opportunity, its values and employee structures. You should also have a list of your deal breakers. If they get through that first stage, the move into detailed diligence would and should be aided by finance and legal experts.

Merger and Acquisition Strategy is a process in which one corporate buys, sells, or combines with the other corporate to achieve certain goals and attain rapid growth in the competitive market.

What Are the Steps in the Merger and Acquisition Process? Develop an acquisition strategy. The first thing a buyer needs to do is strategize about how they will pursue an acquisition. ... Set M&A search criteria. ... Search for potential target companies. ... Start acquisition planning. ... Perform valuation.

The Seven-Step Process: Mergers & Acquisition Determine Growth Markets/Services: ... Identify Merger and Acquisition Candidates: ... Assess Strategic Financial Position and Fit: ... Make a Go/No-Go Decision: ... Conduct Valuation. ... Perform Due Diligence, Negotiate a Definitive Agreement, and Execute Transaction:

The key legal documentation of the Transaction (i.e. the share purchase agreement or business/asset purchase agreement, the disclosure letter and the guarantee); C. signing and completion of the Transaction; and D. other considerations such as finance, antitrust, employment and tax.

Best Practices for Communication during Mergers, Acquisitions and Corporate Transitions Communication needs to start well in advance. ... Be honest. ... Identify ALL your audiences. ... Be able to answer the 4 Ws: who, what, when and why. ... Be prepared for leaks. ... Over communicate with your internal audiences.