New York Self-Employed Independent Contractor Payment Schedule

Description

How to fill out Self-Employed Independent Contractor Payment Schedule?

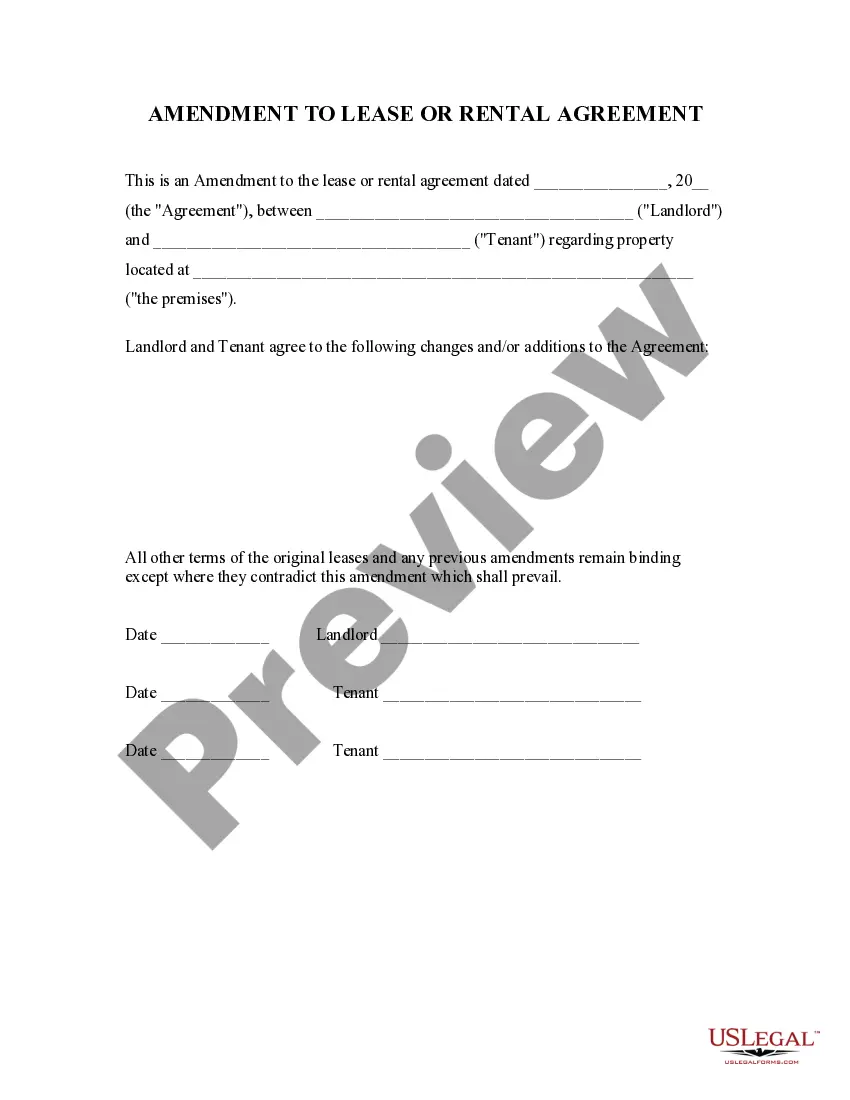

US Legal Forms - one of the several largest collections of legal documents in the United States - offers a broad selection of legal form templates that you can download or print.

While using the website, you can access thousands of forms for business and personal purposes, organized by categories, states, or keywords. You can obtain the latest versions of forms like the New York Self-Employed Independent Contractor Payment Schedule in just moments.

If you already have a subscription, Log In and download the New York Self-Employed Independent Contractor Payment Schedule from the US Legal Forms library. The Download button will appear on every form you view. You have access to all previously obtained forms in the My documents section of your account.

Process the payment. Use your credit card or PayPal account to complete the transaction.

Select the format and download the form to your device. Make modifications. Complete, edit, print, and sign the downloaded New York Self-Employed Independent Contractor Payment Schedule. Every template you added to your account does not expire and is yours indefinitely. So, if you wish to download or print another copy, just visit the My documents section and click on the form you need. Access the New York Self-Employed Independent Contractor Payment Schedule with US Legal Forms, one of the most extensive libraries of legal document templates. Utilize a vast array of professional and state-specific templates that meet your business or personal needs and requirements.

- If you wish to use US Legal Forms for the first time, here are simple instructions to help you get started.

- Ensure you have selected the correct form for your area/region. Click on the Review option to examine the form's content.

- Read the form details to be certain you have chosen the right form.

- If the form does not meet your requirements, utilize the Search field at the top of the screen to find one that does.

- If you are satisfied with the form, confirm your choice by clicking the Buy now button.

- Then, select your preferred pricing plan and provide your details to create an account.

Form popularity

FAQ

Independent contractors in New York are responsible for paying self-employment taxes, which include both Social Security and Medicare taxes, in addition to federal and state income taxes. It is crucial to estimate and make quarterly tax payments throughout the year to avoid penalties. Utilizing a comprehensive platform like US Legal Forms can help streamline your understanding and adherence to the New York Self-Employed Independent Contractor Payment Schedule.

Self-employed individuals typically report income using Schedule C, Profit or Loss from Business, as part of their tax return. This schedule documents both income and expenses related to your freelance work or independent contracting. By using Schedule C, you can effectively manage your taxes according to the guidelines of the New York Self-Employed Independent Contractor Payment Schedule.

Receiving payments as an independent contractor generally involves invoicing your clients for services rendered. You can set your payment terms and methods, such as bank transfers, checks, or online payment platforms. Ensure that you provide clear instructions and details in your invoices to facilitate timely payments. This practice aligns with the New York Self-Employed Independent Contractor Payment Schedule.

Independent contractors often negotiate payment terms directly with their clients, which can include a variety of options such as milestone payments, progress payments, or regular monthly payments. Clarity in these terms not only protects both parties but also ensures smooth transaction flows. For independent contractors in New York, using US Legal Forms can simplify the setup of your New York Self-Employed Independent Contractor Payment Schedule.

Payment terms for 1099 contractors usually reflect what is agreed upon in the contract. Many 1099 contractors expect payment within a specific timeframe, commonly within 30 days of submitting an invoice. Understanding your obligations is essential, and for assistance with ensuring accurate agreements, US Legal Forms offers resources specifically focused on the New York Self-Employed Independent Contractor Payment Schedule.

In general, the typical payment term for contractors often ranges from 30 to 60 days after invoicing. However, the specific terms can vary based on the agreements made between the contractor and the client. For those seeking clarity on their payment schedules, resources like US Legal Forms can provide templates and guidelines tailored to the New York Self-Employed Independent Contractor Payment Schedule.

You should plan to set aside 25% to 30% of your taxable freelance income to pay both quarterly taxes and any additional tax that you owe when you file your taxes in April. Freelancers must budget for both income tax and FICA taxes. You can use IRS Form 1040-ES to calculate your estimated tax payments.

Who aren't eligible to receive their 13th month pay? Employees of government agencies and any political subdivisions are not eligible under PD 851. Employees who work for multiple employers or government employees doing part-time work with a private company aren't also covered by the law.

Reporting self-employment income Remember that an independent contractor is considered to be self-employed, so in effect, you are running your own one-person business. Any income that you earn as an independent contractor must be reported on Schedule C. You'll then pay income taxes on the total profit.

Benefits. Certain benefits under the law are provided to employees that independent contractors are not entitled to, such as overtime pay, premium pay, holiday pay, and 13th month pay, among others. Some employers also provide non-monetary benefits such as maternity/paternity leave and parental leave.