New York General Home Repair Services Contract - Long Form - Self-Employed

Description

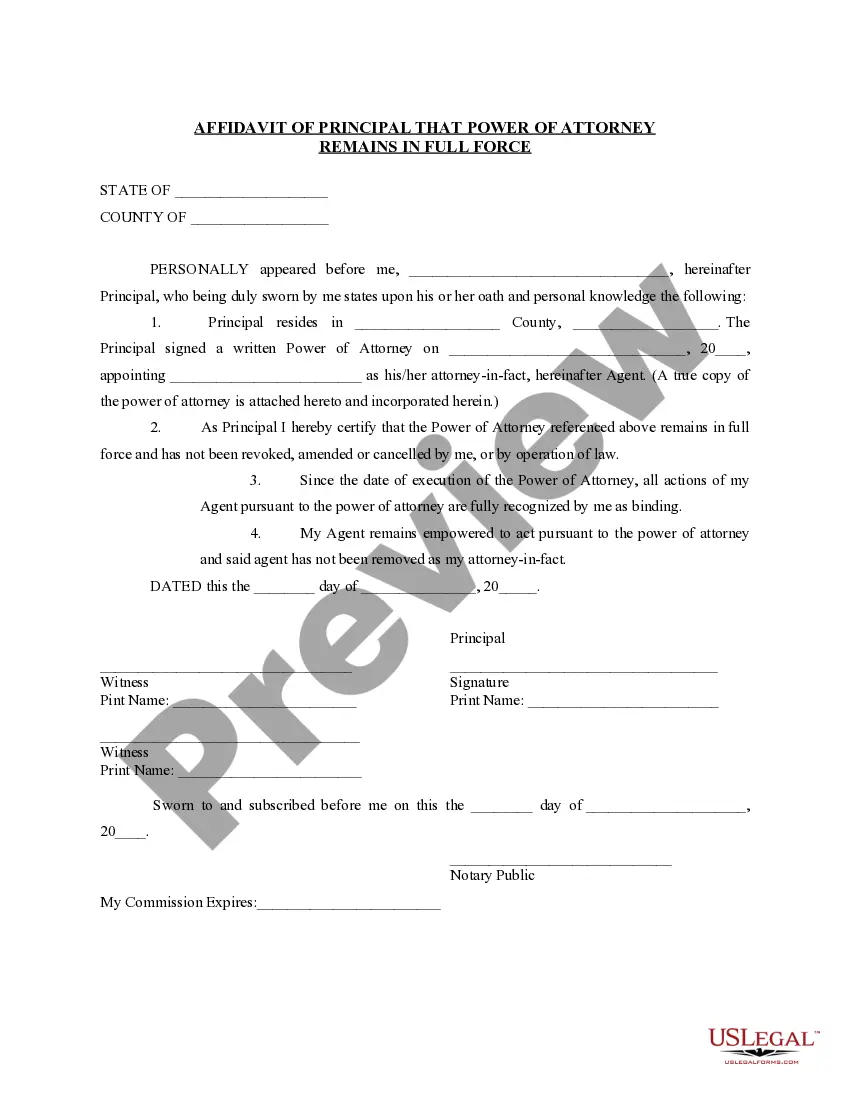

How to fill out General Home Repair Services Contract - Long Form - Self-Employed?

If you need to finalize, download, or print legal document templates, use US Legal Forms, the largest collection of legal documents available online.

Utilize the site's straightforward and convenient search feature to find the files you require.

Numerous templates for business and personal purposes are organized by categories and states, or keywords.

Step 4. After finding the form you need, click the Buy now button. Choose your preferred pricing plan and provide your information to sign up for an account.

Step 5. Complete the transaction. You can use your credit card or PayPal account to finalize the purchase.

- Use US Legal Forms to obtain the New York General Home Repair Services Contract - Long Form - Self-Employed with just a few clicks.

- If you are already a US Legal Forms customer, Log Into your account and click the Download button to retrieve the New York General Home Repair Services Contract - Long Form - Self-Employed.

- You can also access forms you previously acquired from the My documents section of your account.

- If you are using US Legal Forms for the first time, follow the instructions below.

- Step 1. Ensure you have selected the form for the appropriate city/state.

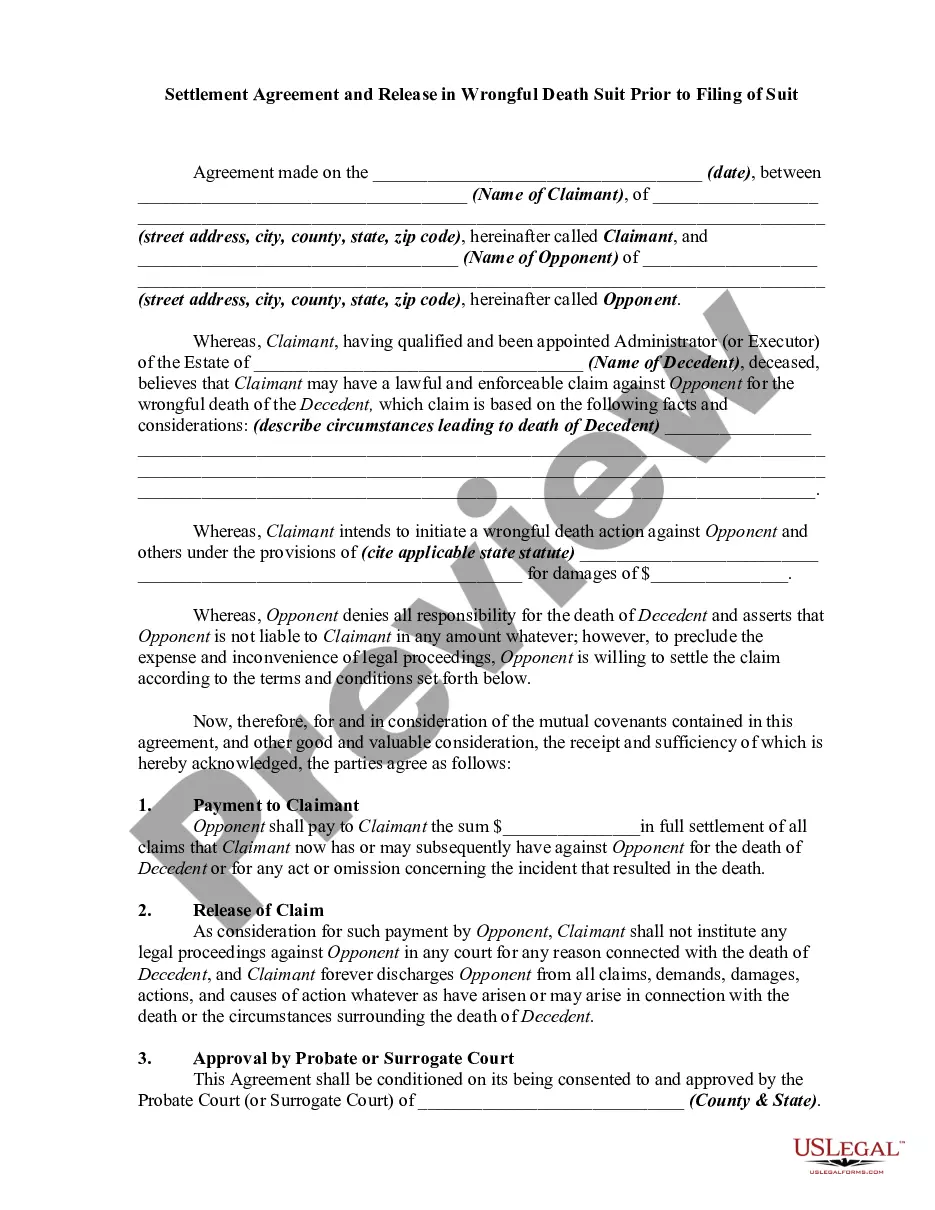

- Step 2. Use the Review feature to examine the content of the form. Do not forget to read through the outline.

- Step 3. If you are not satisfied with the form, use the Search field at the top of the screen to locate different versions of the legal document template.

Form popularity

FAQ

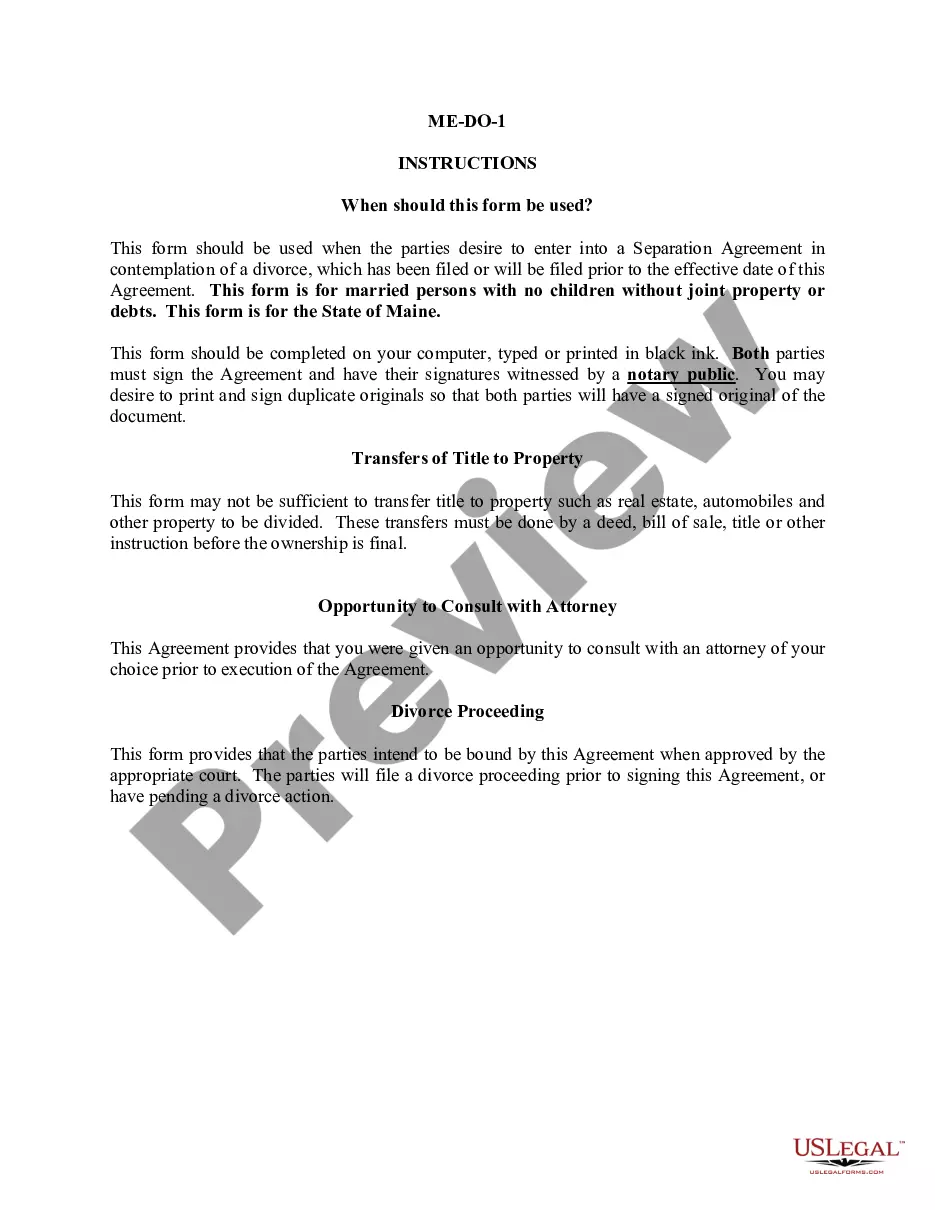

Filling out a contract agreement involves a few key steps. Start by clearly stating the names of the parties involved, the purpose of the contract, and the obligations of each party. Additionally, it’s crucial to include payment details and timelines. Using a structured template like the New York General Home Repair Services Contract - Long Form - Self-Employed can simplify this process, ensuring all critical components are addressed.

A valid contract in New York should have five essential elements: mutual agreement, consideration, capacity, legality, and intent. First, both parties must agree on the terms and conditions of the contract. Additionally, clear exchange of value must be present, and both parties should have legal capacity to enter a contract. To strengthen your agreement, consider using the New York General Home Repair Services Contract - Long Form - Self-Employed as a reliable resource.

Filling out an independent contractor agreement in New York requires clarity and detail. Begin with identifying the parties, stating the services provided, and outlining the payment terms. It’s advisable to reference the New York General Home Repair Services Contract - Long Form - Self-Employed, as it helps to establish a solid foundation for your agreement, protecting both parties involved.

To fill out a home improvement contract in New York, start by providing the date and parties involved, including contractor and homeowner details. Next, describe the scope of work and specify materials involved, then outline the payment schedule. For a thorough process, utilizing the New York General Home Repair Services Contract - Long Form - Self-Employed can guide you step by step, ensuring you cover all necessary aspects.

Repair services in New York are generally taxable, but it can depend on several specific factors. For example, if materials are included in the service, taxes may apply. Self-employed individuals should rely on a New York General Home Repair Services Contract - Long Form - Self-Employed to clarify tax responsibilities and ensure compliance with local regulations.

Certain services, including some repair and maintenance services, can be exempt from sales tax in New York. For instance, services that are deemed necessary for keeping a property in good working condition may qualify. However, self-employed contractors should reference a New York General Home Repair Services Contract - Long Form - Self-Employed to help identify services that may be taxable versus exempt.

In New York, many repair services are subject to sales tax. However, certain circumstances may lead to an exemption. To navigate the complexities of tax laws, it's beneficial for self-employed individuals using a New York General Home Repair Services Contract - Long Form - Self-Employed to consult with a tax professional.

Yes, in New York, you can serve as your own general contractor if you hold the necessary licenses and permits. This setup allows you to oversee home repair projects directly. Using a New York General Home Repair Services Contract - Long Form - Self-Employed can facilitate your responsibilities and provide a clear framework for managing subcontractors and clients alike.

employed individual typically uses a general home repair services contract, particularly under New York General Home Repair Services Contract Long Form SelfEmployed. This contract outlines the scope of work, payment terms, and responsibilities. It helps protect the rights of both the contractor and the client while ensuring clarity in business transactions.

Yes, handyman work is often taxable under New York law. However, whether a specific job is taxable can depend on various factors, like the materials used and the nature of the services provided. For self-employed individuals operating under a New York General Home Repair Services Contract - Long Form - Self-Employed, it is essential to understand the tax implications to ensure compliance.