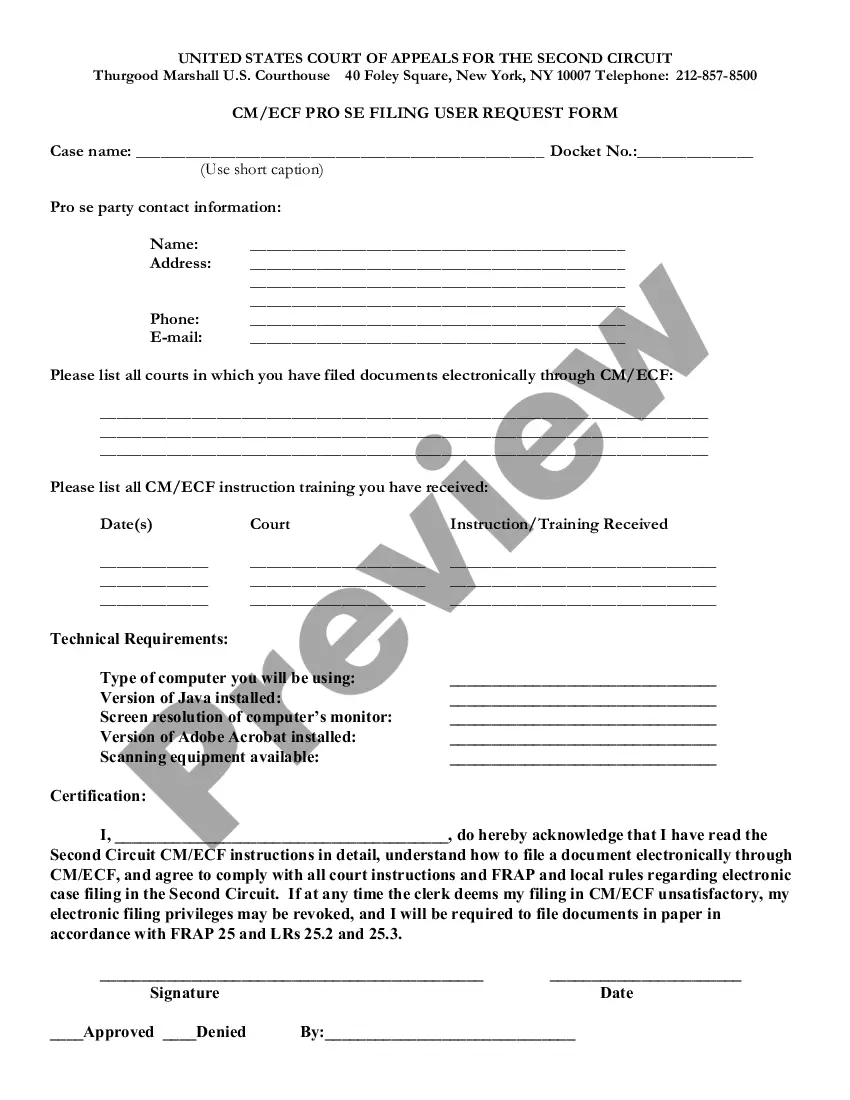

New York Electronic Services Form

Description

How to fill out Electronic Services Form?

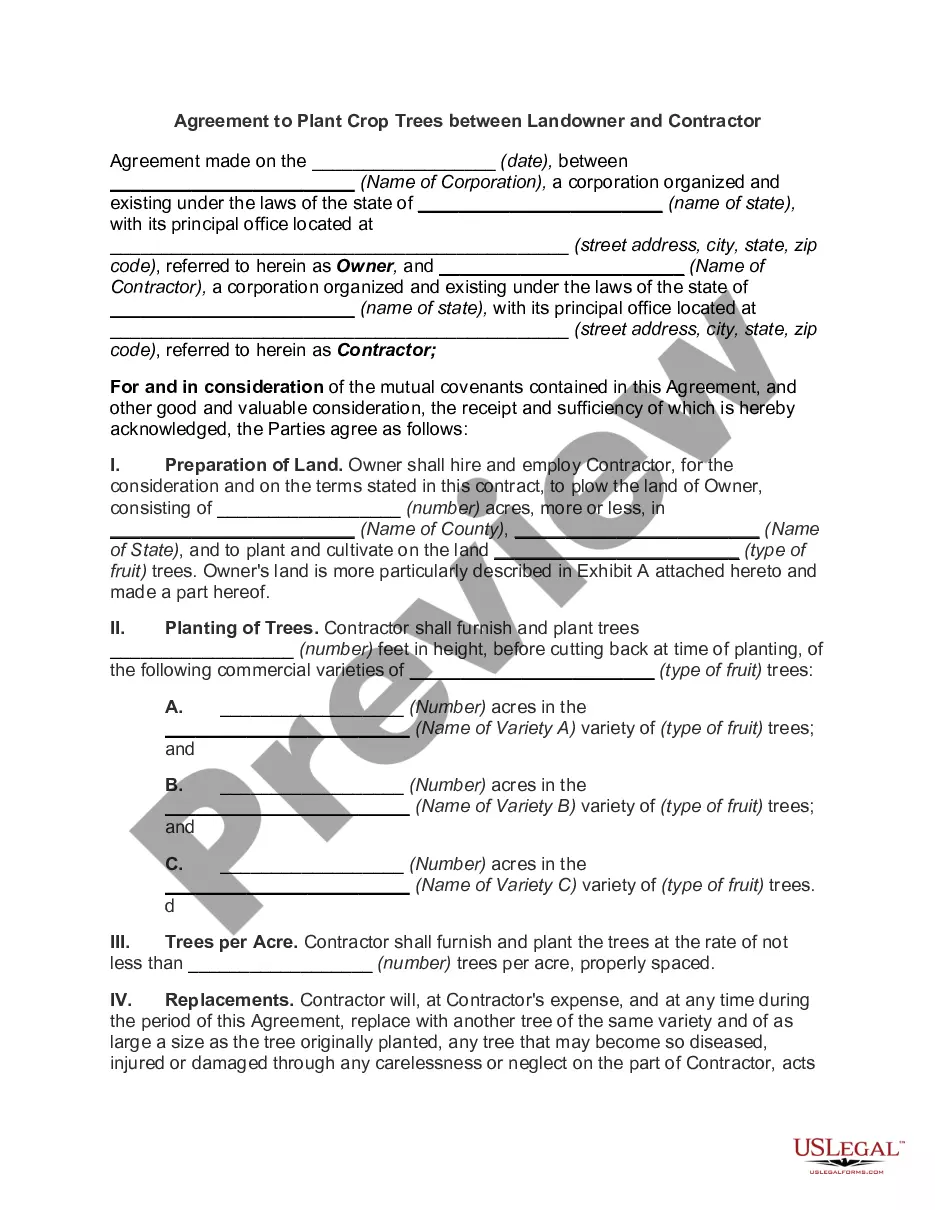

Choosing the best lawful record design might be a have a problem. Obviously, there are a lot of templates accessible on the Internet, but how do you get the lawful type you need? Take advantage of the US Legal Forms web site. The support delivers 1000s of templates, like the New York Electronic Services Form, that can be used for business and personal requires. All the forms are checked by pros and meet federal and state needs.

When you are previously authorized, log in to the profile and then click the Acquire button to find the New York Electronic Services Form. Make use of profile to check from the lawful forms you possess acquired in the past. Go to the My Forms tab of your own profile and have an additional copy from the record you need.

When you are a brand new customer of US Legal Forms, allow me to share simple instructions for you to adhere to:

- First, make certain you have chosen the correct type to your metropolis/area. You can check out the shape while using Review button and study the shape explanation to make certain it is the right one for you.

- When the type does not meet your requirements, make use of the Seach area to discover the appropriate type.

- When you are positive that the shape is proper, click on the Buy now button to find the type.

- Pick the pricing strategy you want and enter in the required information and facts. Design your profile and pay for the transaction utilizing your PayPal profile or Visa or Mastercard.

- Select the document file format and down load the lawful record design to the gadget.

- Total, edit and print and sign the obtained New York Electronic Services Form.

US Legal Forms will be the largest catalogue of lawful forms in which you will find different record templates. Take advantage of the service to down load appropriately-created documents that adhere to condition needs.

Form popularity

FAQ

Individuals must file on Form NYC-202 or NYC-202S. Single-member LLCs must file on Form NYC-202. Partnerships (including any incorporated entity other than a single-member LLC treated as a partnership for federal income tax purposes) or other unincorporated organiza- tions must file Form NYC-204 or Form 204EZ.

We've got the steps here; plus, important considerations for each step. Step 1: Enter your personal information. ... Step 2: Account for all jobs you and your spouse have. ... Step 3: Claim your children and other dependents. ... Step 4: Make other adjustments. ... Step 5: Sign and date your form.

Any partnership that carries on or liquidates any trade, business, profession or occupation wholly or partly within New York City and has a total gross income from all business regardless of where carried on of more than $25,000 (prior to any deduction for cost of goods sold or services performed) must file an ...

If you are single and have one job, or married and filing jointly then claiming one allowance makes the most sense. An individual can claim two allowances if they are single and have more than one job, or are married and are filing taxes separately.

New York City residents must pay a personal income tax, which is administered and collected by the New York State Department of Taxation and Finance. Most New York City employees living outside of the five boroughs (hired on or after January 4, 1973) must file form NYC-1127.

The Tax Department accepts electronically filed amended returns. Advantages of electronic filing include: faster refunds. instant filing confirmation.

Individuals, estates and trusts must file on Form NYC-202, and partnerships or other unincorporated organizations must file Form NYC-204. may use Form NYC-202 EZ. q If you are filing for a period of less than 12 months, refer to Form NYC-202 EZ to determine whether you may use that form.

All city residents' income, no matter where it is earned, is subject to New York City personal income tax. Nonresidents of New York City are not liable for New York City personal income tax. The rules regarding New York City domicile are also the same as for New York State domicile.