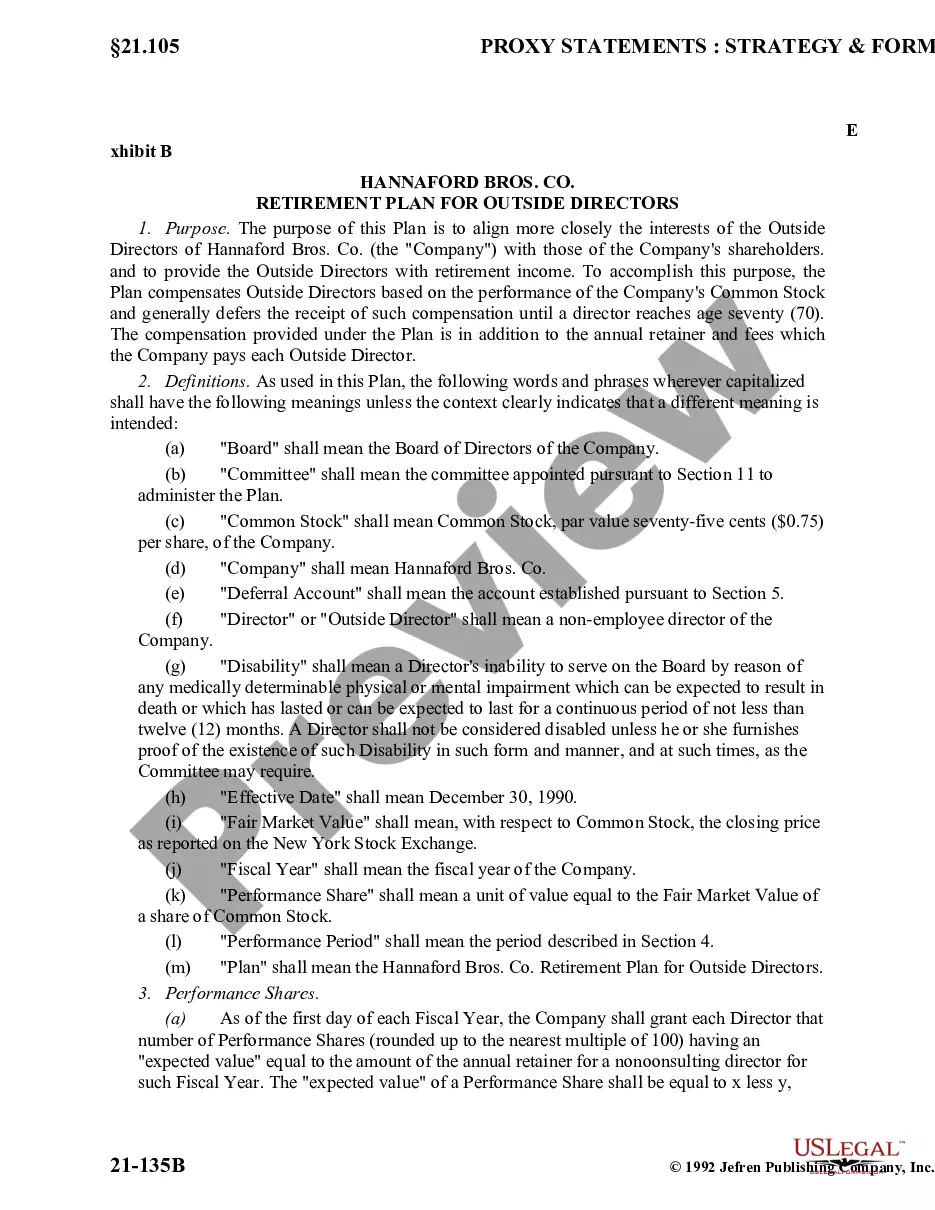

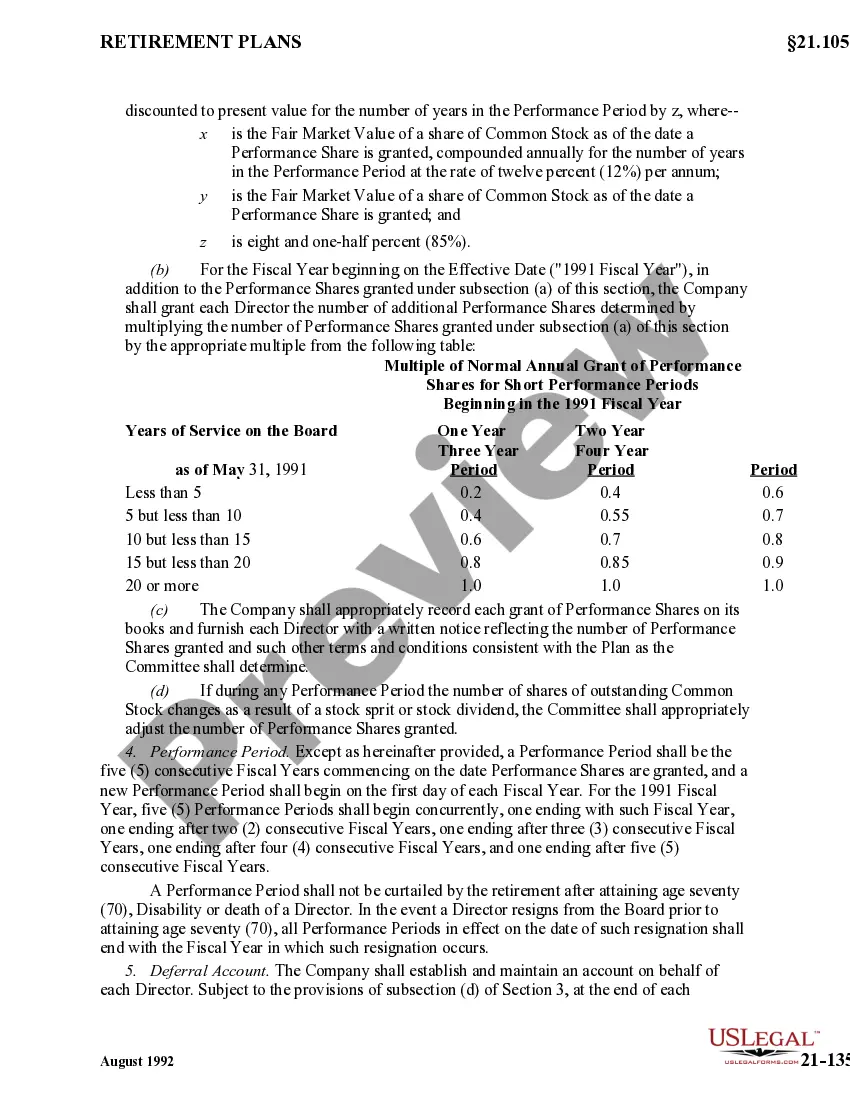

New York Retirement Plan for Outside Directors

Description

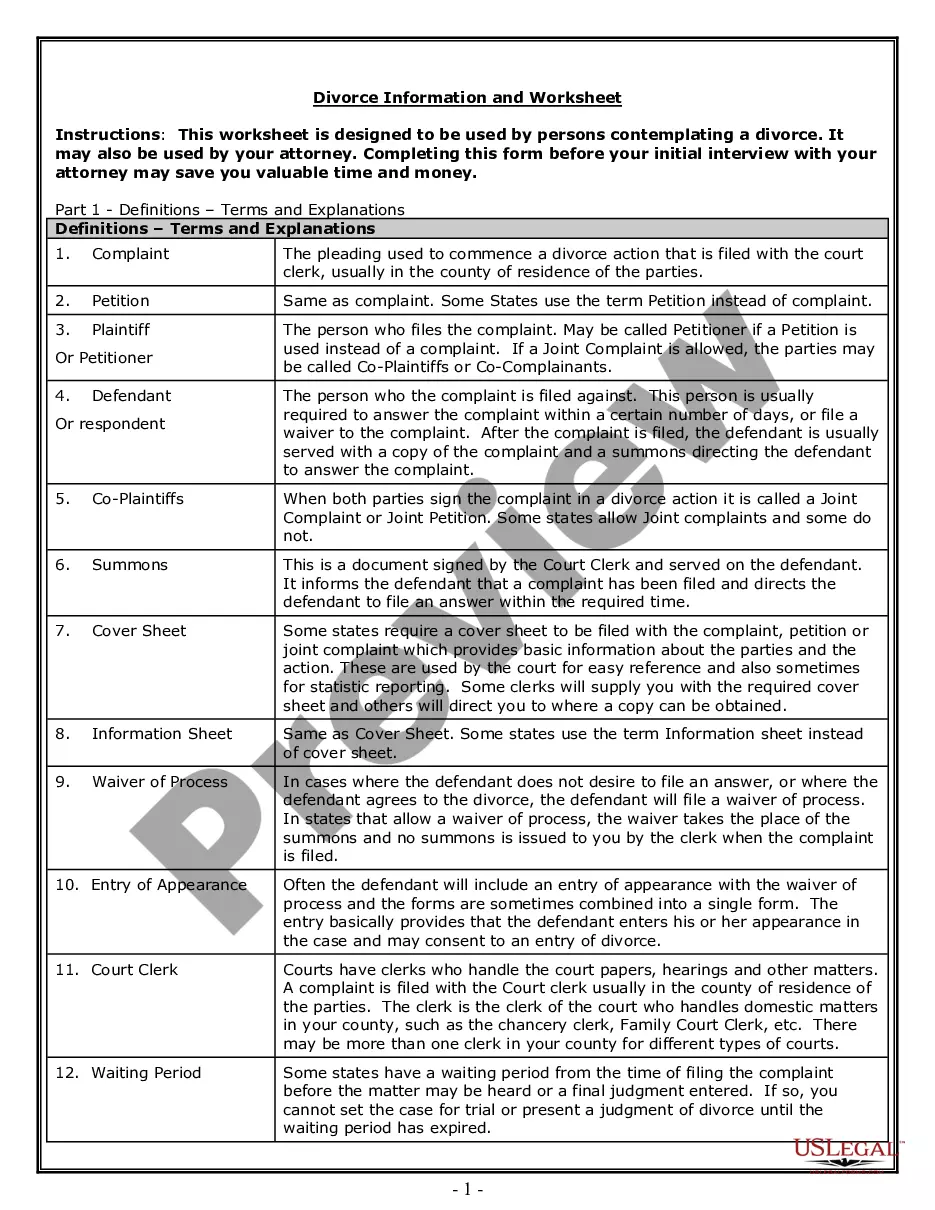

How to fill out Retirement Plan For Outside Directors?

US Legal Forms - one of several greatest libraries of authorized types in the United States - gives an array of authorized file web templates it is possible to obtain or printing. Making use of the website, you can find a large number of types for enterprise and personal purposes, categorized by types, suggests, or keywords and phrases.You can get the latest models of types just like the New York Retirement Plan for Outside Directors within minutes.

If you have a membership, log in and obtain New York Retirement Plan for Outside Directors in the US Legal Forms library. The Download switch can look on each and every kind you view. You have access to all in the past downloaded types within the My Forms tab of your own profile.

If you want to use US Legal Forms the first time, listed below are straightforward instructions to help you started off:

- Make sure you have selected the correct kind for the metropolis/county. Click the Preview switch to examine the form`s content. Browse the kind outline to actually have chosen the correct kind.

- In case the kind doesn`t fit your demands, make use of the Research field towards the top of the display screen to get the one who does.

- In case you are satisfied with the form, confirm your choice by visiting the Get now switch. Then, pick the costs plan you favor and provide your accreditations to register for the profile.

- Method the deal. Make use of charge card or PayPal profile to accomplish the deal.

- Choose the format and obtain the form on your system.

- Make modifications. Fill out, edit and printing and sign the downloaded New York Retirement Plan for Outside Directors.

Each and every template you included in your money does not have an expiry particular date and is your own permanently. So, in order to obtain or printing an additional duplicate, just go to the My Forms portion and click on in the kind you require.

Obtain access to the New York Retirement Plan for Outside Directors with US Legal Forms, probably the most comprehensive library of authorized file web templates. Use a large number of skilled and condition-distinct web templates that fulfill your organization or personal requirements and demands.

Form popularity

FAQ

Deferred compensation plans are funded informally. There's essentially a promise from the employer to pay the deferred funds, plus any investment earnings, to the employee at the time specified. In contrast, with a 401(k), a formally established account exists.

The pre-tax 457 and 401(k) allow you to put aside a portion of your pay before federal, state, and local income taxes are taken out. Your taxes will be reduced as a result of the contributions you make, and your contributions and their earnings will accumulate tax-deferred.

A defined contribution plan such as a 401(k) lets employees (and sometimes employers) contribute to an investment account. A defined benefit plan, on the other hand, promises employees a set benefit at retirement and puts the responsibility of providing that benefit ? including the investment risk ? on the employer.

DCP is comprised of two programs: a 457 Plan and a 401(k) Plan, both of which offer pre-tax and Roth (after-tax) options.

The 403(b) has a much higher limit than the 457(b), which lacks a separate contribution limit for employers. 457(b)s only allow $22,500 in contributions from any source in 2023 ($23,000 in 2024), whereas 403(b)s allows total contributions of $66,000, including $22,500 from an employee.

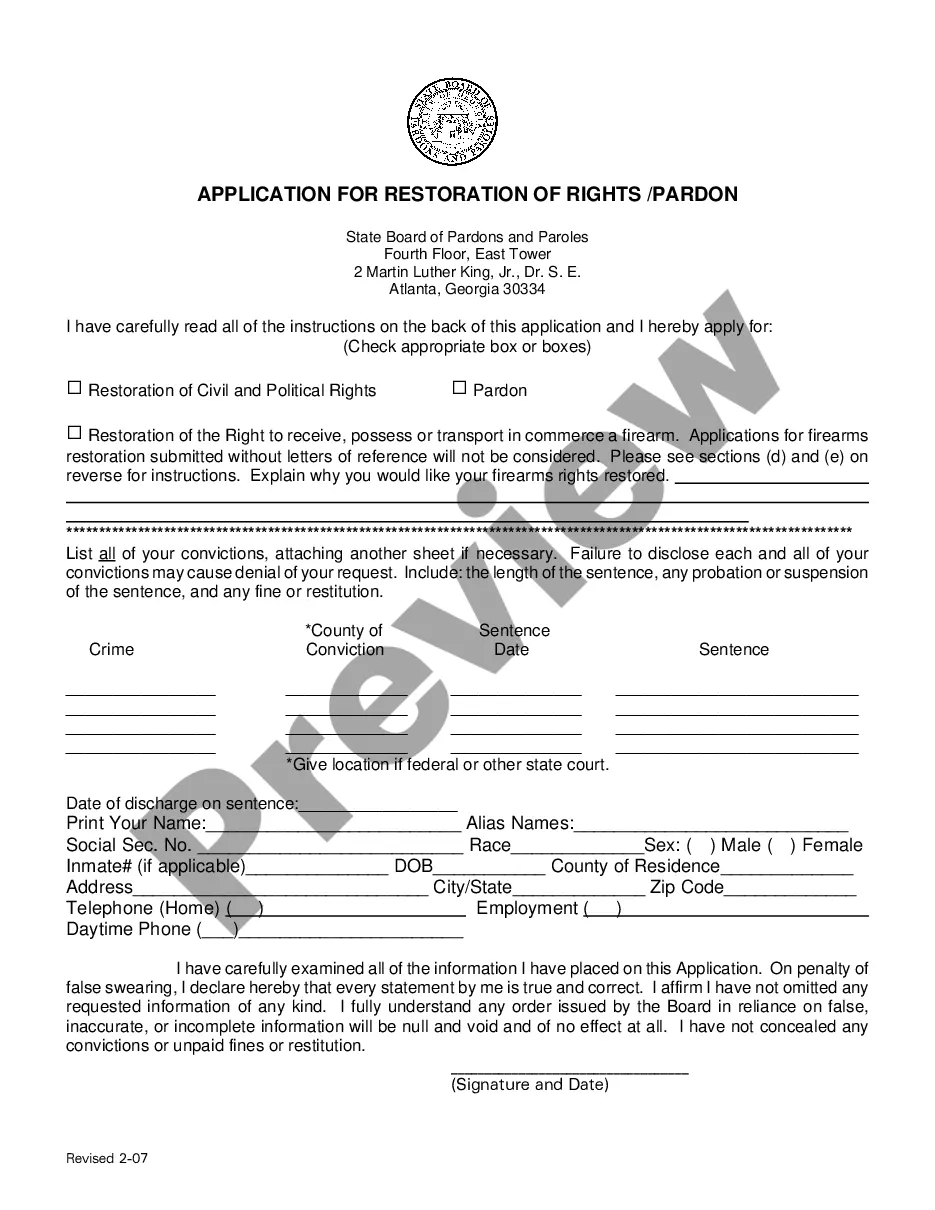

The employer must have been in business for at least two years, and employees must be 18 or older. Employees who are eligible to participate in the program will be automatically enrolled in the New York Secure Choice Savings, but employees are not required to participate. They can choose to opt-out at any time.

Qualified deferred compensation plans are pension plans governed by the Employee Retirement Income Security Act (ERISA), a key set of federal regulations for retirement plans. They include 401(k) plans and 403(b) plans.

Federal income tax is also delayed when you defer income, but you do pay Social Security and Medicare taxes. A deferred comp plan is most beneficial when you can reduce both your present and future tax rates by deferring your income. Unfortunately, it's challenging to project future tax rates.