New York Long Term Incentive Program for Senior Management

Description

How to fill out Long Term Incentive Program For Senior Management?

Are you currently inside a placement that you require documents for both business or specific functions just about every time? There are tons of legitimate papers templates available on the Internet, but getting ones you can rely isn`t easy. US Legal Forms delivers 1000s of kind templates, like the New York Long Term Incentive Program for Senior Management, that happen to be written to satisfy federal and state needs.

Should you be already knowledgeable about US Legal Forms site and possess a free account, simply log in. Afterward, you are able to obtain the New York Long Term Incentive Program for Senior Management format.

Unless you offer an bank account and wish to begin using US Legal Forms, abide by these steps:

- Find the kind you want and ensure it is to the correct metropolis/area.

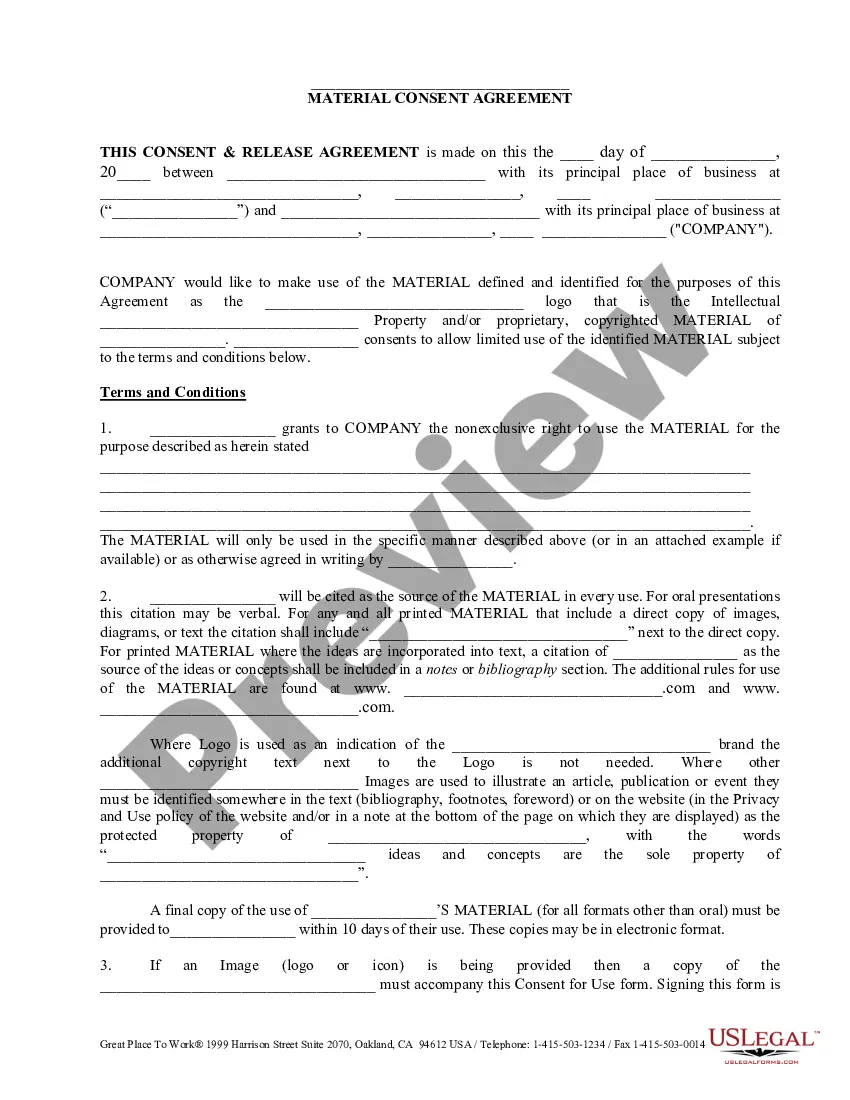

- Make use of the Review option to check the form.

- See the outline to ensure that you have selected the appropriate kind.

- If the kind isn`t what you`re seeking, utilize the Search area to get the kind that meets your requirements and needs.

- Whenever you obtain the correct kind, click on Buy now.

- Select the prices prepare you desire, fill out the required information and facts to produce your bank account, and pay for your order utilizing your PayPal or charge card.

- Select a practical document format and obtain your backup.

Get all of the papers templates you might have purchased in the My Forms food selection. You can get a additional backup of New York Long Term Incentive Program for Senior Management whenever, if necessary. Just click on the required kind to obtain or printing the papers format.

Use US Legal Forms, probably the most comprehensive variety of legitimate varieties, to save lots of efforts and steer clear of blunders. The services delivers appropriately manufactured legitimate papers templates that you can use for a variety of functions. Create a free account on US Legal Forms and begin producing your way of life easier.

Form popularity

FAQ

Criteria to Determine LTI Eligibility The most common criteria used to determine whether an employee is eligible for long-term incentives is job level. Individual employee performance, salary grade/level and job title are also frequently used as factors to determine eligibility for LTI awards.

These incentives can range from one-time bonuses to long-term benefits such as stock options or other equity awards. Incentives are also used to motivate managers and executives, providing them with a sense of accomplishment and recognition from the organization.

What are common LTI Vehicles? Stock Options. ... Stock Appreciation Rights. ... Time-based Restricted Stock/Restricted Stock Units. ... Performance Shares/Units. ... Long-term Cash Units. ... Performance Cash Units.

A MIP can be either an equity incentive plan or a cash incentive plan. It doesn't always have to result in a company giving away equity, as certain factors may preclude them from doing so. Cash-based plans usually involve either a cash bonus, pension contribution or shadow equity.

Long-Term Incentives (LTIs) are a form of variable compensation that is earned in the present but whose payment is deferred and spread over time. This can be cash compensation but often is in the form of stock or stock options.

term incentive plan (LTIP) is a company policy that rewards employees for reaching specific goals that lead to increased shareholder value. In a typical LTIP, the employee, usually an executive, must fulfill various conditions or requirements.

Through LTIPs, a new long-term incentive can be granted to an employee every year, rather than a one-time incentive, similar to a holiday bonus.

The paper concludes that the way executives frame choices, perceive value, assess probability, evaluate temporal effects and respond to uncertainty means that LTIPs are generally not efficient and are often not effective in meeting their objectives.