New York Deferred Compensation Investment Account Plan

Description

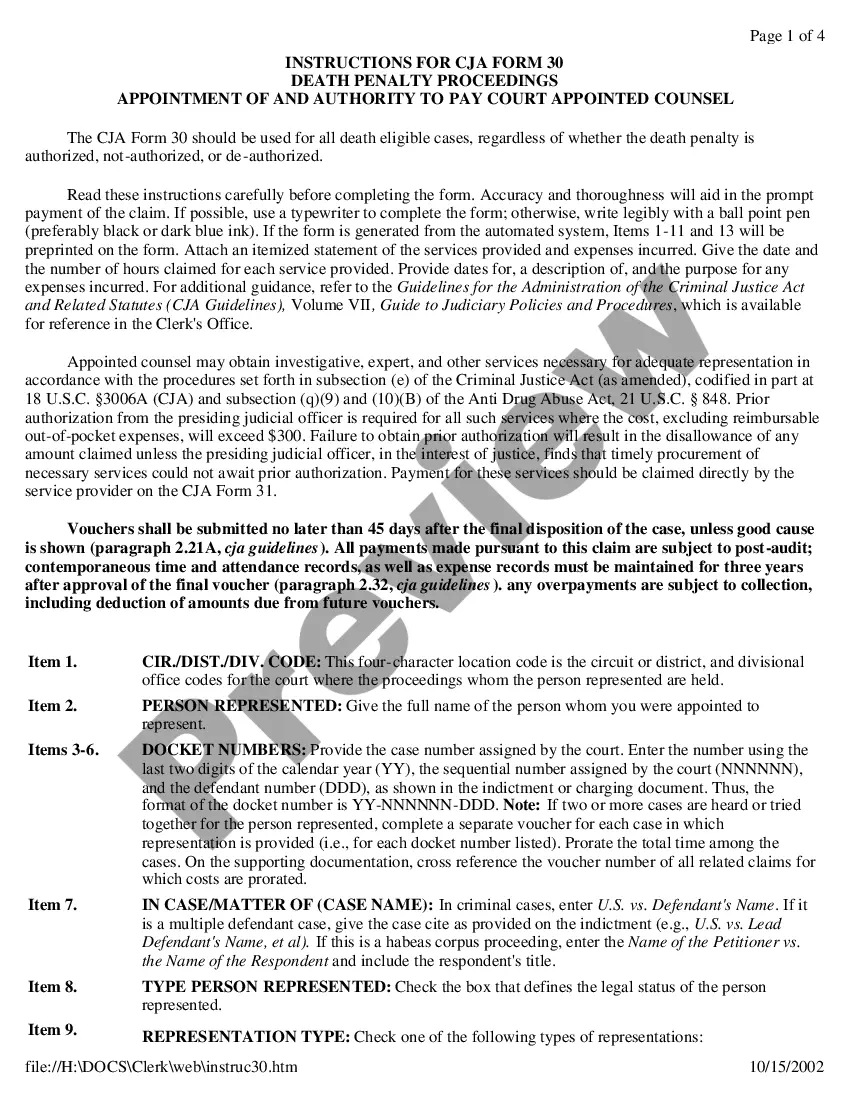

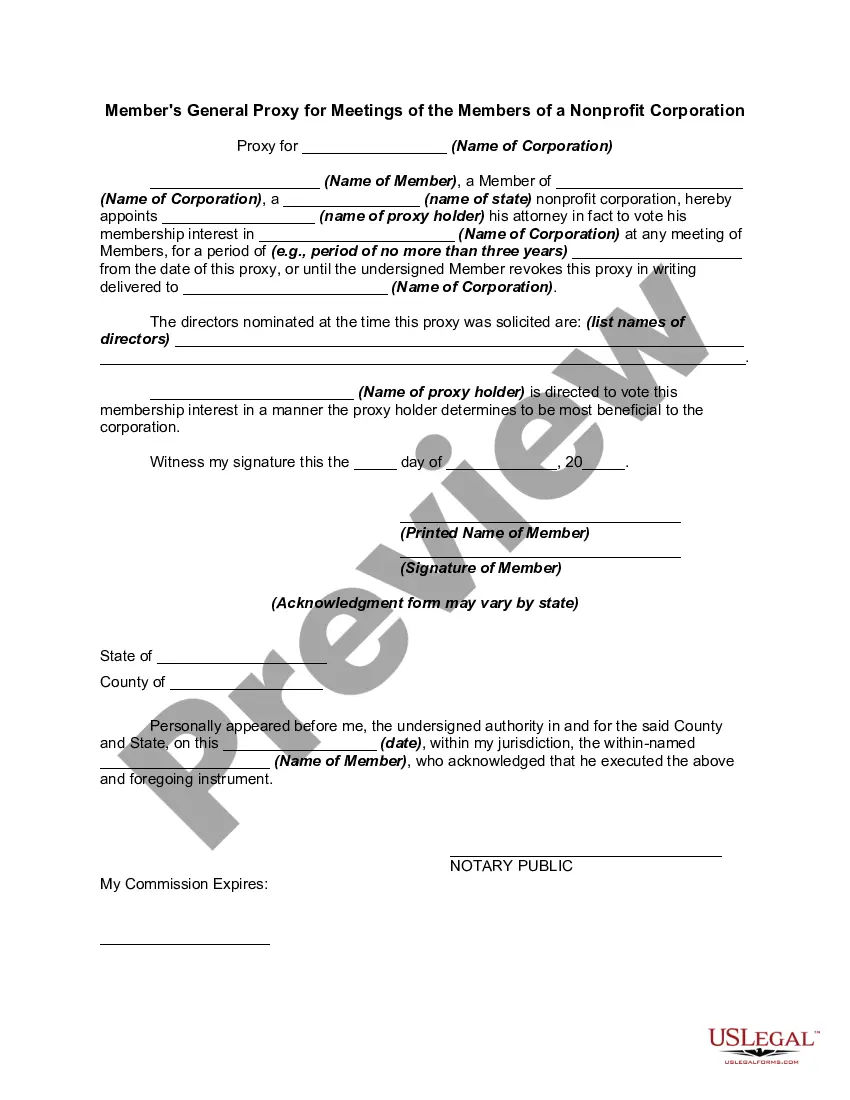

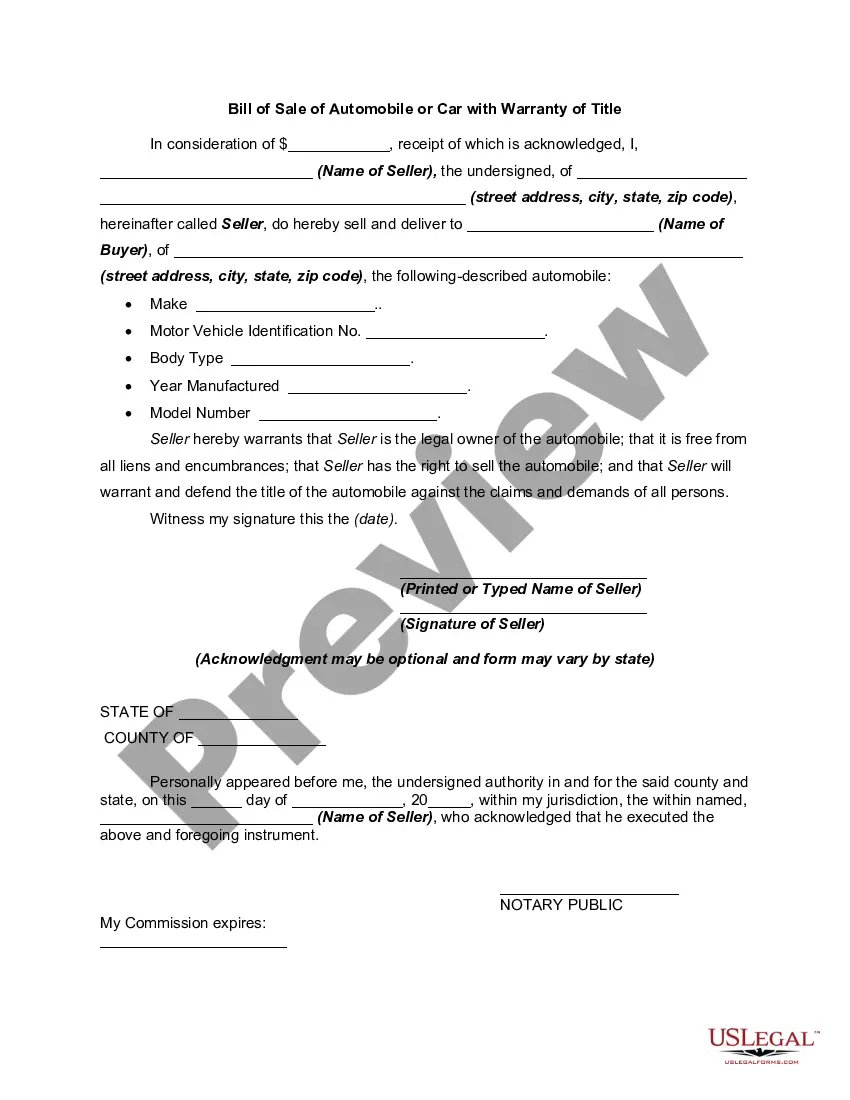

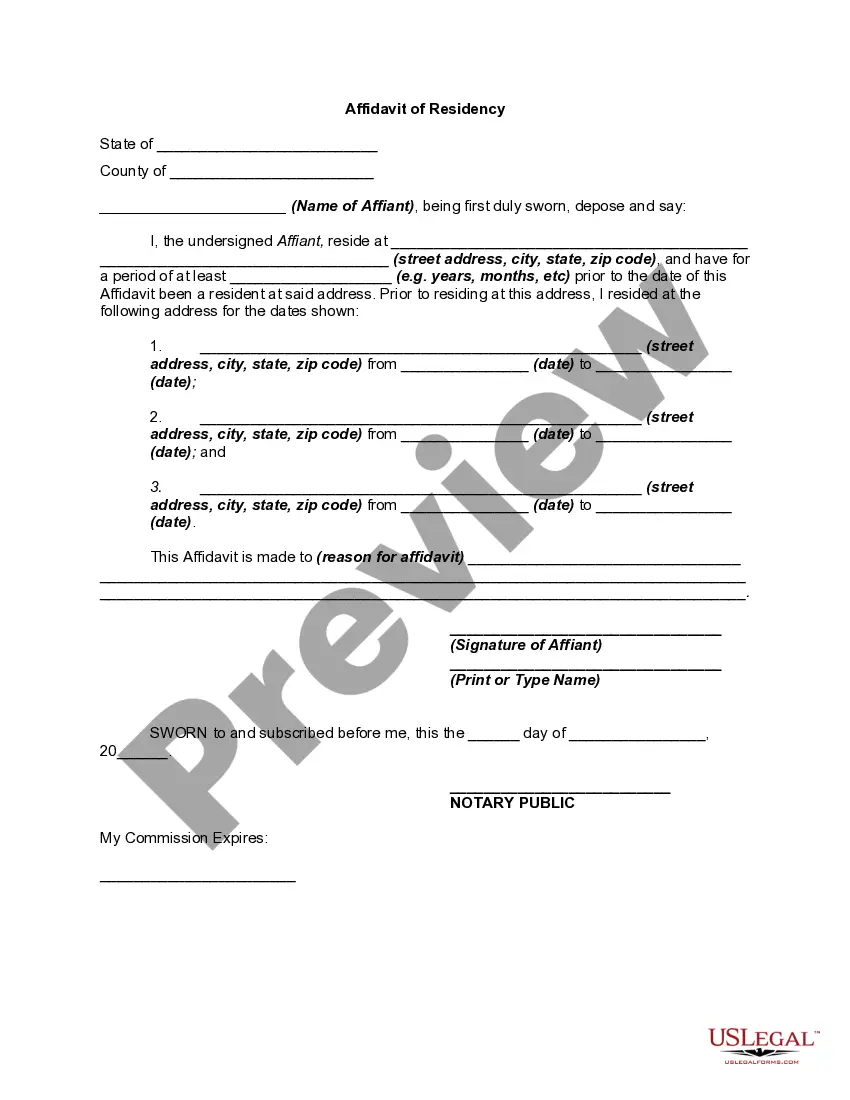

How to fill out Deferred Compensation Investment Account Plan?

US Legal Forms - one of several most significant libraries of lawful forms in America - offers a variety of lawful document layouts you are able to obtain or printing. Making use of the website, you can find 1000s of forms for business and person uses, sorted by groups, claims, or key phrases.You can get the most up-to-date versions of forms such as the New York Deferred Compensation Investment Account Plan in seconds.

If you currently have a monthly subscription, log in and obtain New York Deferred Compensation Investment Account Plan from your US Legal Forms local library. The Acquire key will appear on every kind you view. You get access to all earlier downloaded forms within the My Forms tab of the profile.

If you want to use US Legal Forms for the first time, listed here are easy recommendations to help you started:

- Make sure you have selected the proper kind for the city/area. Click on the Preview key to check the form`s content. Browse the kind outline to ensure that you have selected the correct kind.

- When the kind does not satisfy your specifications, use the Lookup discipline at the top of the display screen to obtain the one who does.

- In case you are satisfied with the shape, confirm your decision by clicking on the Acquire now key. Then, pick the rates prepare you like and supply your references to sign up on an profile.

- Method the transaction. Make use of your charge card or PayPal profile to accomplish the transaction.

- Pick the format and obtain the shape on the system.

- Make changes. Fill up, change and printing and indication the downloaded New York Deferred Compensation Investment Account Plan.

Every template you included with your account does not have an expiration day and is the one you have eternally. So, in order to obtain or printing one more copy, just proceed to the My Forms portion and click in the kind you will need.

Gain access to the New York Deferred Compensation Investment Account Plan with US Legal Forms, probably the most comprehensive local library of lawful document layouts. Use 1000s of specialist and condition-specific layouts that fulfill your organization or person requires and specifications.

Form popularity

FAQ

Deferred compensation plans are funded informally. There's essentially a promise from the employer to pay the deferred funds, plus any investment earnings, to the employee at the time specified. In contrast, with a 401(k), a formally established account exists.

The Plan is a voluntary retirement savings plan offered by New York State and your employer, to allow public employees like you to put aside money from each paycheck toward retirement. The Plan can help bridge the gap between what you have in your pension and Social Security, and how much you'll need in retirement.

Why Is Deferred Compensation Better Than a 401(k)? Deferred compensation is often considered better than a 401(k) for high-paid executives looking to reduce their tax burden. As well, contribution limits on deferred compensation plans can be much higher than 401(k) limits.

Deferring income to retirement might help avoid high state income taxes (ex: California, New York, etc) if you're planning to move to a low-tax state. The biggest risk of deferred compensation plans is they're not guaranteed; if your company goes bankrupt, you might receive none of the income you deferred.

Remember, when received, deferred compensation is taxable as income. If you're still employed, it's added to your income, which could increase your tax rate. I advise using a deferred comp plan on a limited basis, if at all, for shorter-term goals.

The plans carry some inherent risk for the employees in that the deferred payments are unsecured and not guaranteed. So if the organization faces bankruptcy and creditor claims, the employees may not receive their promised funds. (In contrast, qualified plans such as 401(k)s are protected from bankruptcy creditors).

The New York City Deferred Compensation Plan (DCP) allows eligible New York City employees a way to save for retirement through convenient payroll deductions. DCP is comprised of two programs: a 457 Plan and a 401(k) Plan, both of which offer pre-tax and Roth (after-tax) options.

Deferred compensation has the potential to increase capital gains over time when offered as an investment account or a stock option. Rather than simply receiving the amount that was initially deferred, a 401(k) and other deferred compensation plans can increase in value before retirement.