New York Proposal Approval of Nonqualified Stock Option Plan

Description

How to fill out Proposal Approval Of Nonqualified Stock Option Plan?

Are you presently within a place where you will need files for either enterprise or specific purposes just about every day? There are plenty of lawful papers themes available on the net, but locating ones you can rely is not effortless. US Legal Forms gives 1000s of kind themes, much like the New York Proposal Approval of Nonqualified Stock Option Plan, that happen to be written to meet state and federal needs.

When you are presently familiar with US Legal Forms site and get an account, simply log in. Next, you can obtain the New York Proposal Approval of Nonqualified Stock Option Plan template.

Should you not come with an accounts and would like to start using US Legal Forms, adopt these measures:

- Get the kind you will need and ensure it is for your appropriate town/area.

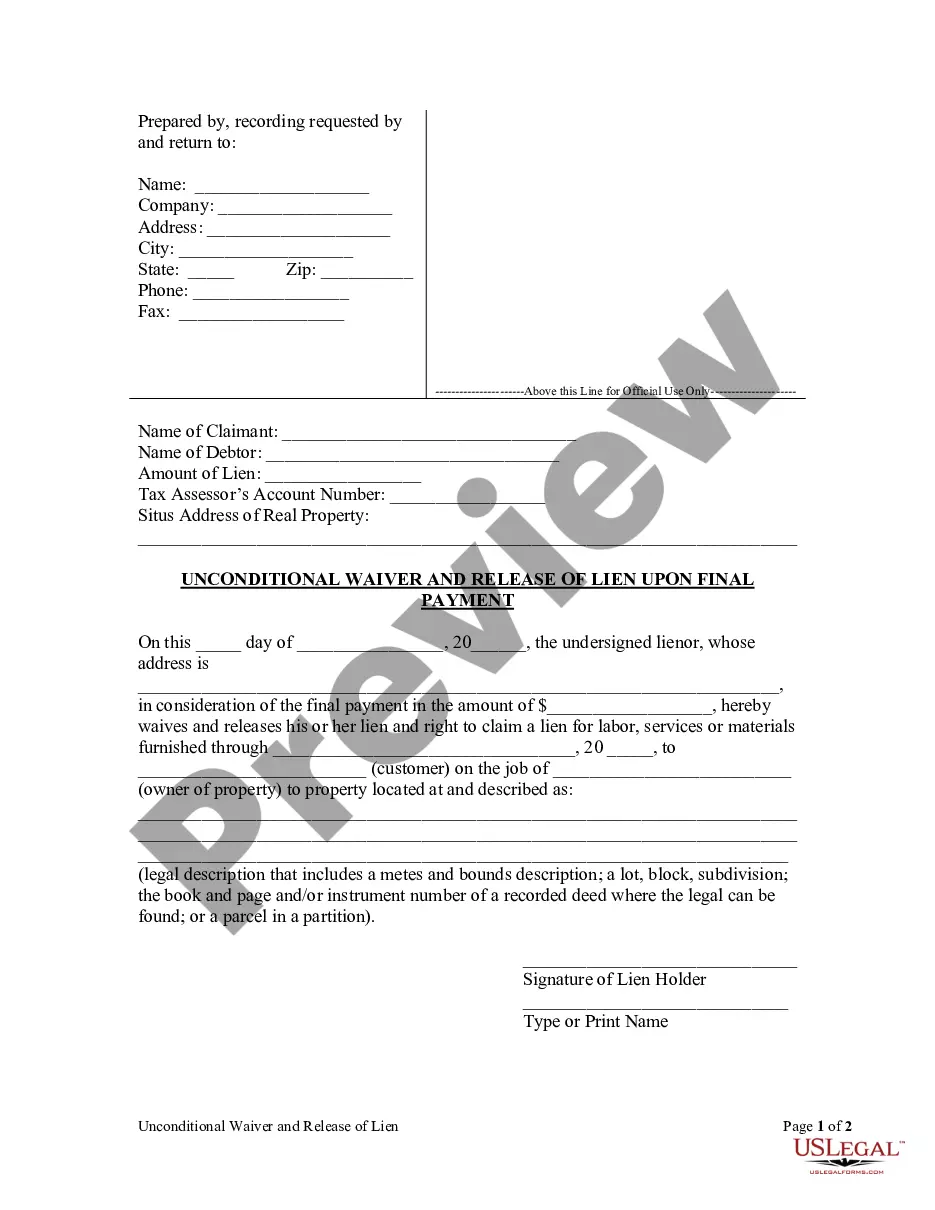

- Utilize the Preview switch to examine the shape.

- Browse the information to ensure that you have chosen the correct kind.

- If the kind is not what you`re trying to find, use the Search field to get the kind that meets your needs and needs.

- When you get the appropriate kind, simply click Acquire now.

- Select the prices plan you would like, complete the specified information to make your money, and buy your order making use of your PayPal or charge card.

- Choose a convenient data file file format and obtain your backup.

Locate every one of the papers themes you may have bought in the My Forms menus. You can aquire a additional backup of New York Proposal Approval of Nonqualified Stock Option Plan any time, if necessary. Just go through the necessary kind to obtain or printing the papers template.

Use US Legal Forms, by far the most extensive selection of lawful types, to save time as well as prevent mistakes. The assistance gives skillfully produced lawful papers themes which you can use for a variety of purposes. Produce an account on US Legal Forms and commence making your life a little easier.

Form popularity

FAQ

The US federal tax laws do not generally address the level of approval required for equity awards, but the tax rules that govern the qualification of so-called incentive stock options require that the options be granted under a shareholder-approved plan.

A stock option is a right to buy a set number of shares of the company's stock at a set price (the ?exercise price?) within a fixed period of time. The Lifecycle of a Non-Qualified Stock Option (NQSO) *When private, a company's FMV is based on the company's valuation; when public, it is based on the stock price.

Non-qualified stock options require payment of income tax of the grant price minus the price of the exercised option. NSOs might be provided as an alternative form of compensation. Prices are often similar to the market value of the shares.

If a stock option isn't an ISO, it's typically referred to as a nonqualified stock option. NQOs don't qualify for special tax treatment. The favorable tax treatment is the main advantage of ISOs for employees, and this includes long-term capital gains and no recognition of income when they exercise their options.

Nonqualified: Employees generally don't owe tax when these options are granted. When exercising, tax is paid on the difference between the exercise price and the stock's market value. They may be transferable. Qualified or Incentive: For employees, these options may qualify for special tax treatment on gains.

Failure to get board approval Let's start with an obvious one that founders routinely miss in the early days: Stock option grants must be approved by the board. If the board doesn't approve (either at a board meeting or by unanimous written consent), the stock options haven't actually been granted.

When compared to ISOs, RSUs are less risky and not dependant on the stock price at any given time. They offer a more predictable revenue stream and guarantee at least some money as long as the company's stock has value by the vesting date.

NQOs are unrestricted. As such, they can be offered to anyone. That means that you can extend them to not just standard employees, but also directors, contractors, vendors, and even other third parties. ISOs, on the other hand, can only be issued to standard employees.