New York Employee Evaluation Form for Sole Trader

Description

How to fill out Employee Evaluation Form For Sole Trader?

Are you in a situation where you need documentation for both business or particular activities almost every day? There are numerous legal document templates available online, but finding ones you can trust isn’t simple.

US Legal Forms offers thousands of template forms, such as the New York Employee Assessment Form for Sole Proprietor, which are designed to comply with federal and state regulations.

If you are already familiar with the US Legal Forms website and have an account, just Log In. Then, you can download the New York Employee Assessment Form for Sole Proprietor template.

Locate all the document templates you have acquired in the My documents section. You can obtain an additional copy of the New York Employee Assessment Form for Sole Proprietor at any time if required. Just revisit the necessary form to download or print the document template.

Utilize US Legal Forms, the largest collection of legal forms, to save time and prevent errors. The service provides well-crafted legal document templates that you can use for various purposes. Create an account on US Legal Forms and start making your life a bit easier.

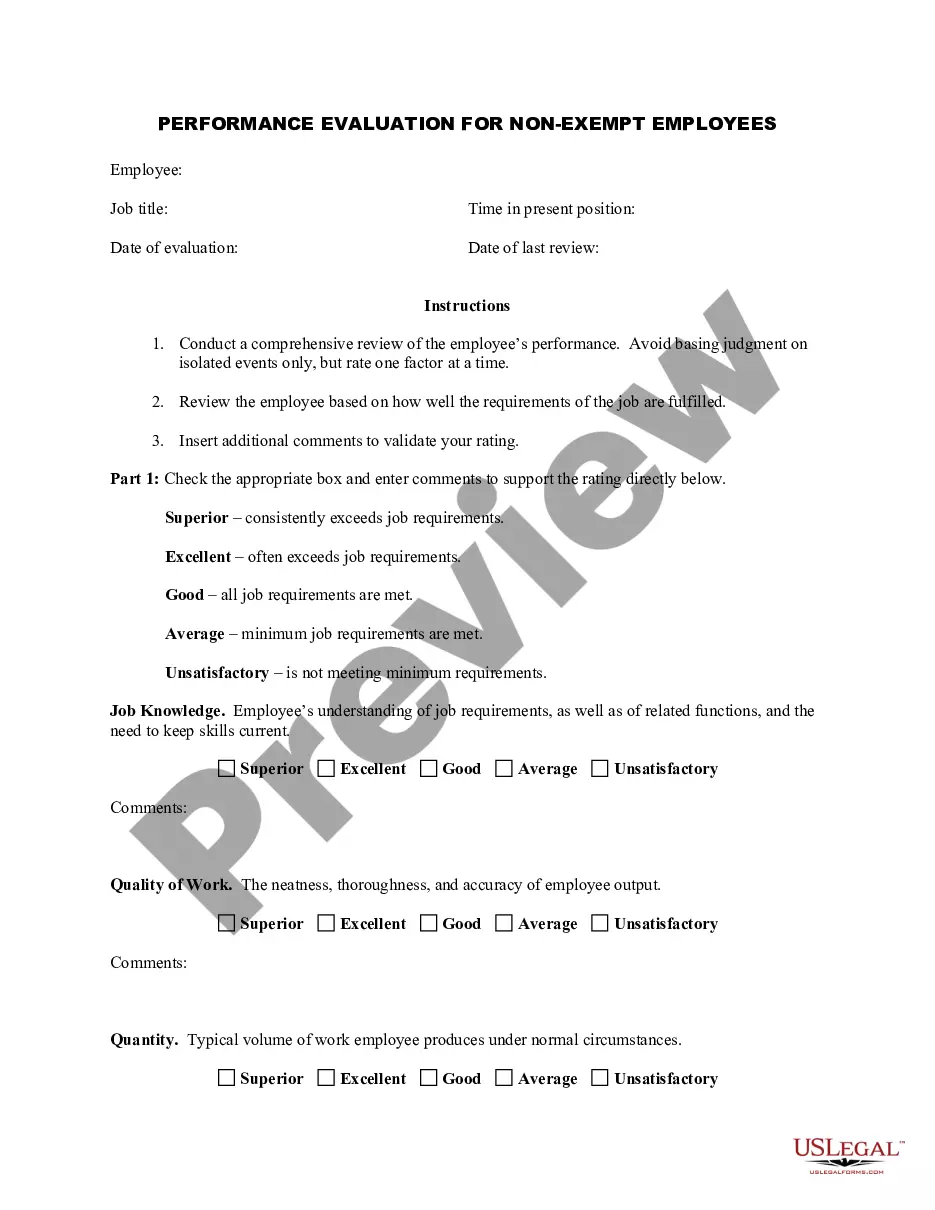

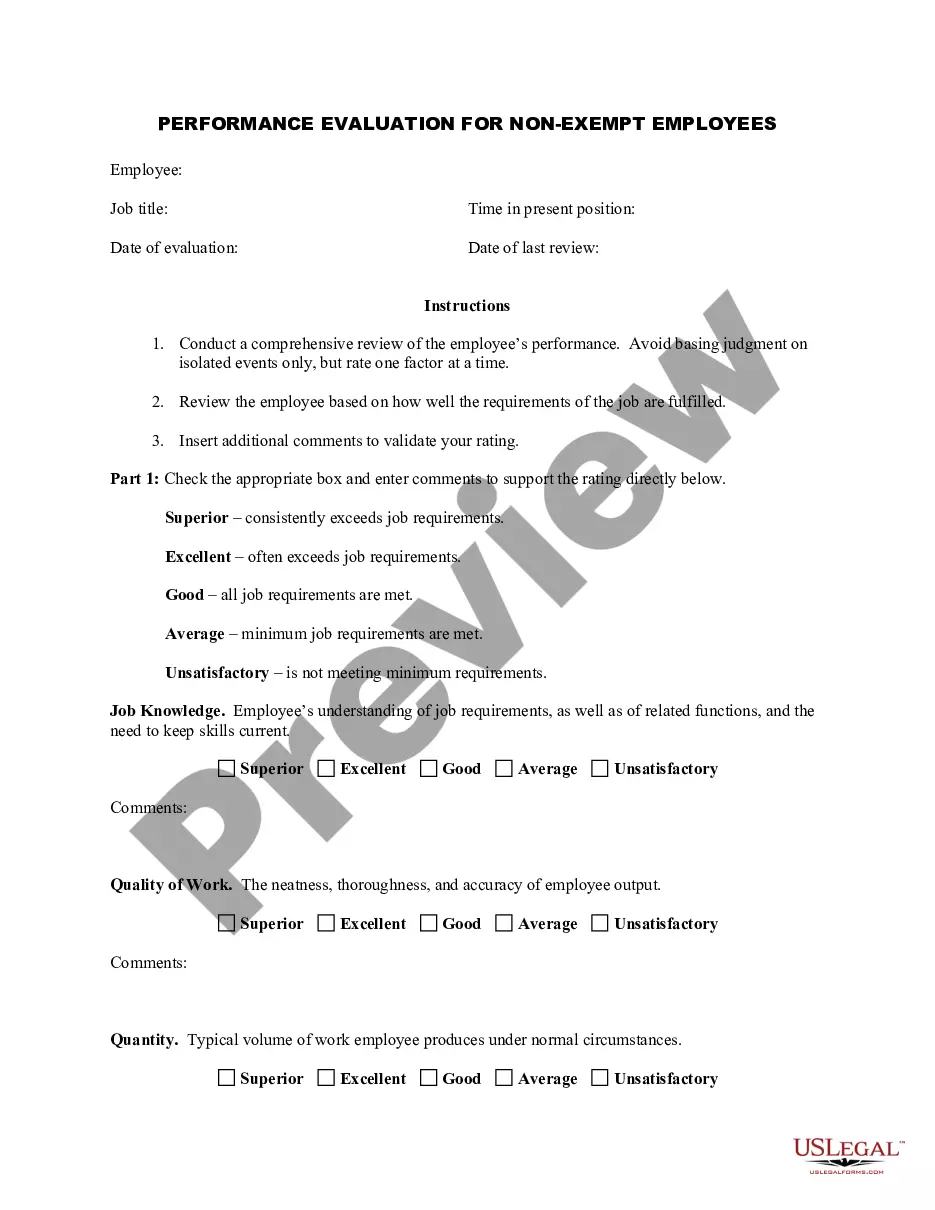

- Select the form you need and confirm it is for the correct city/state.

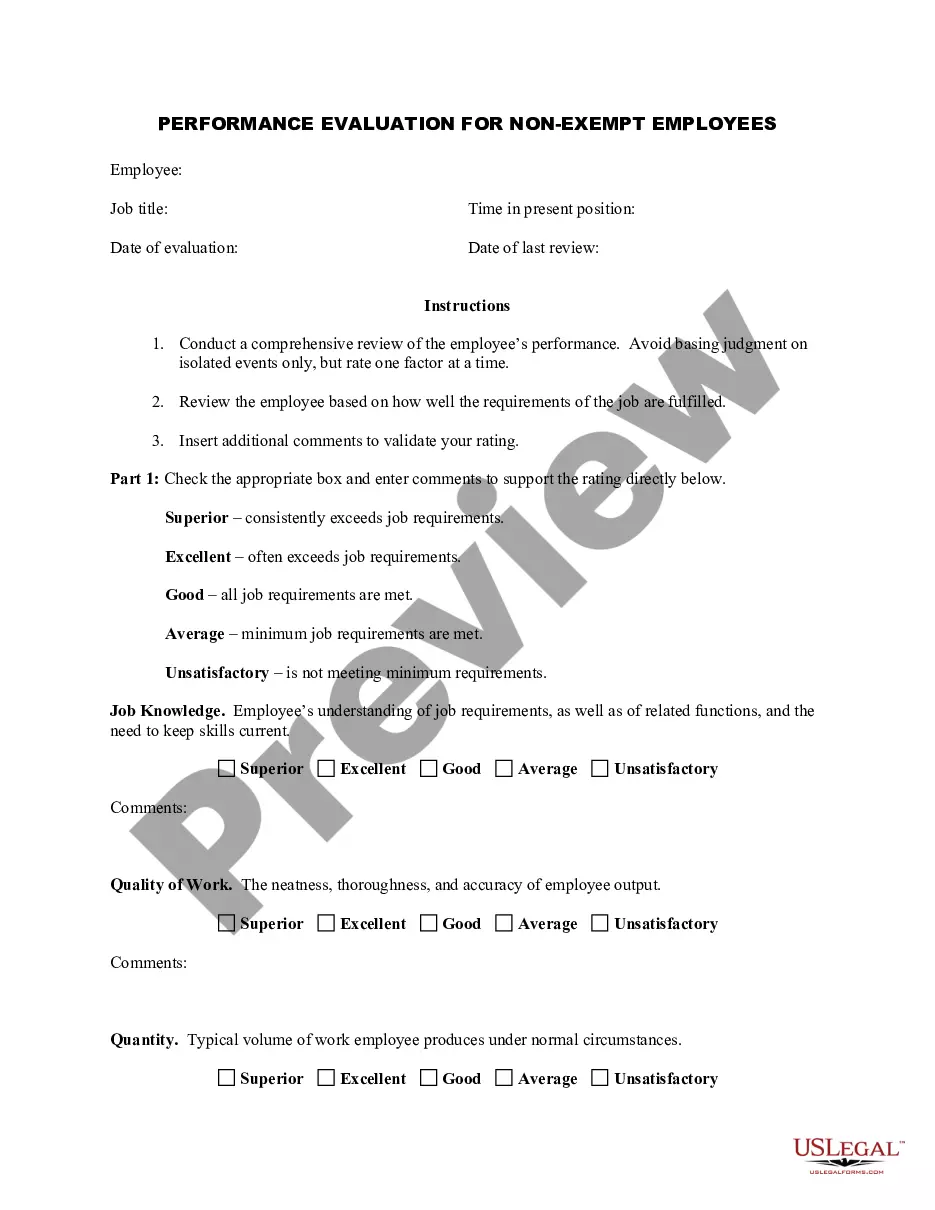

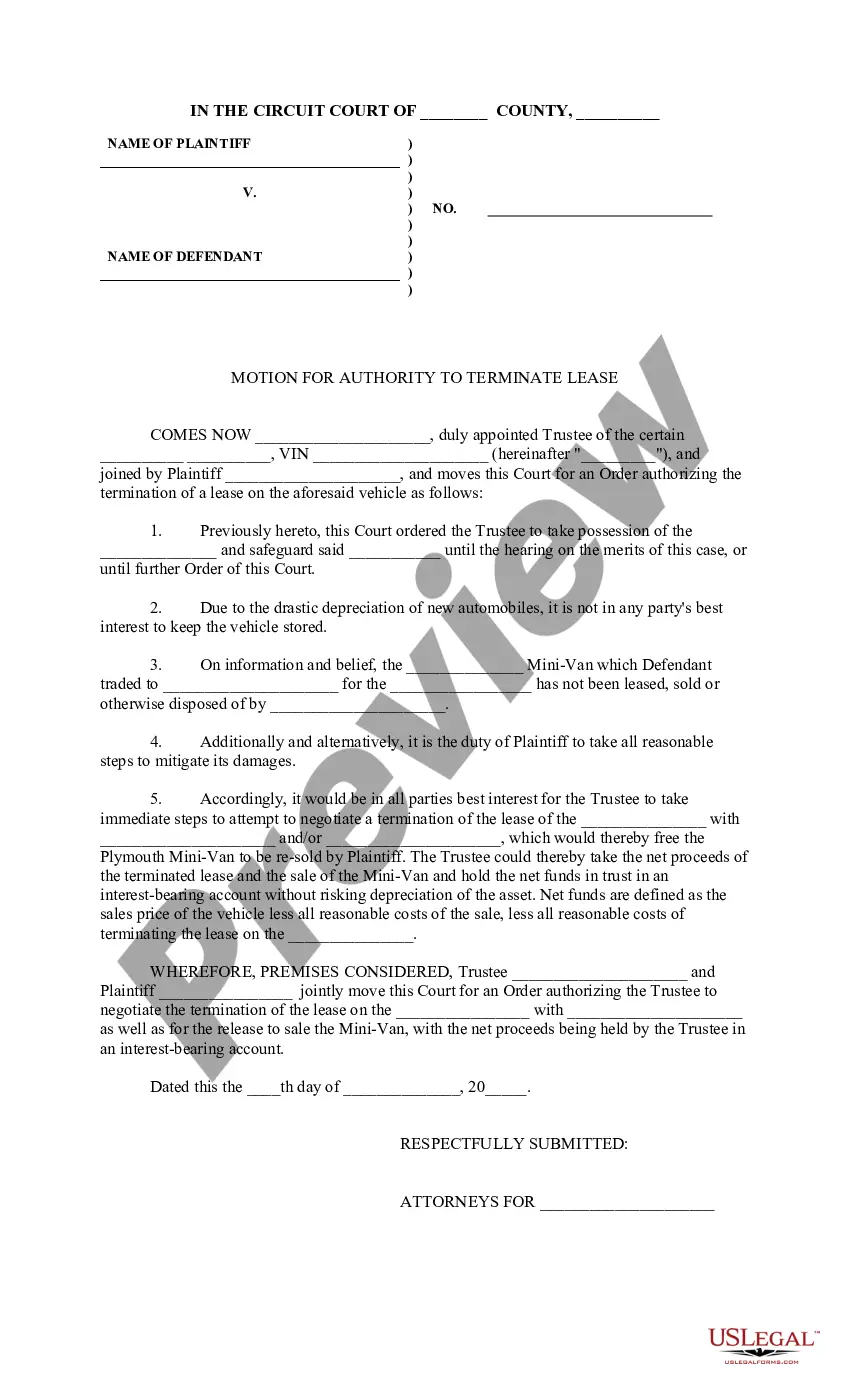

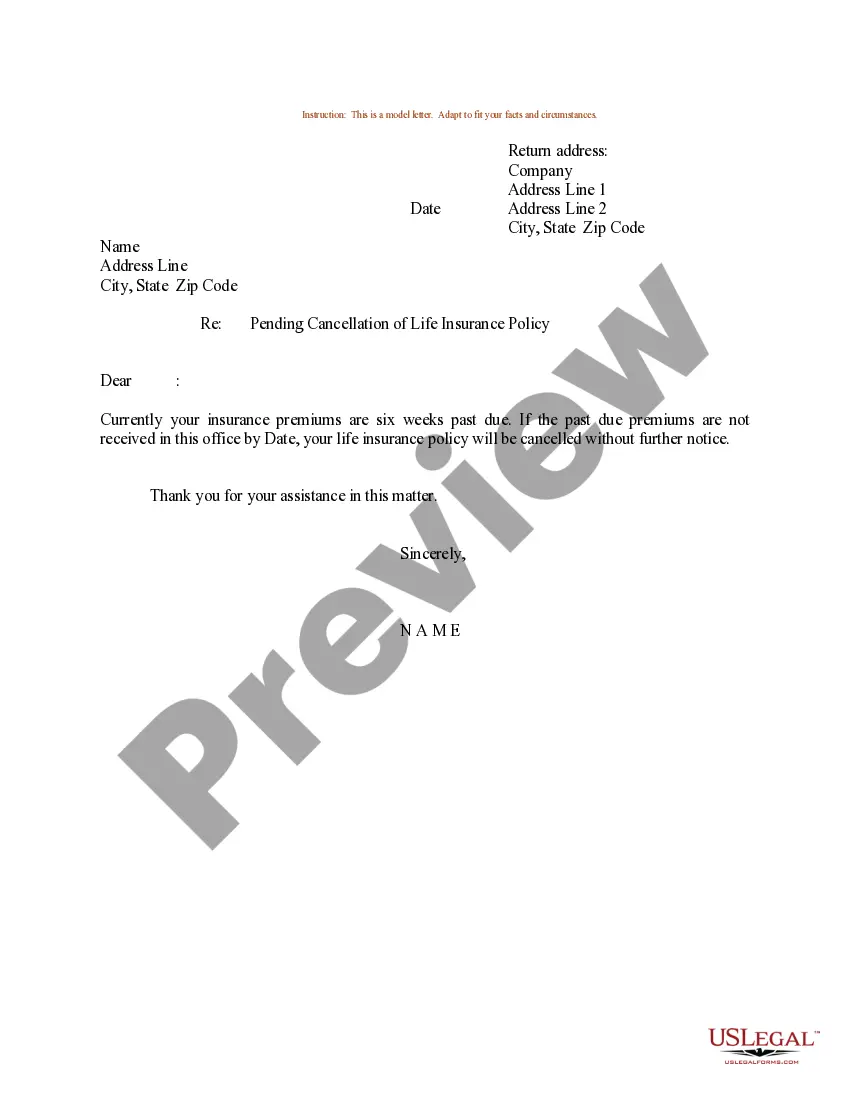

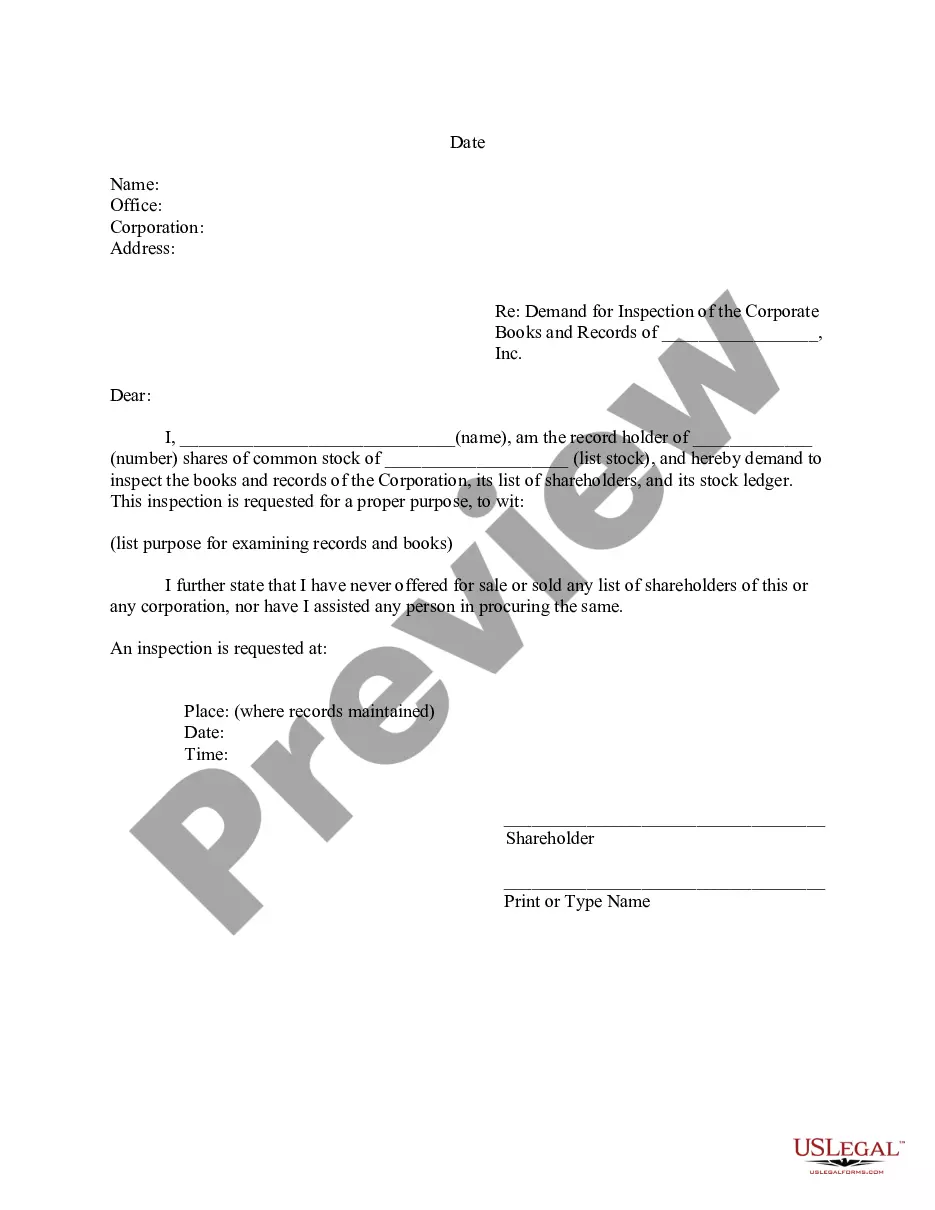

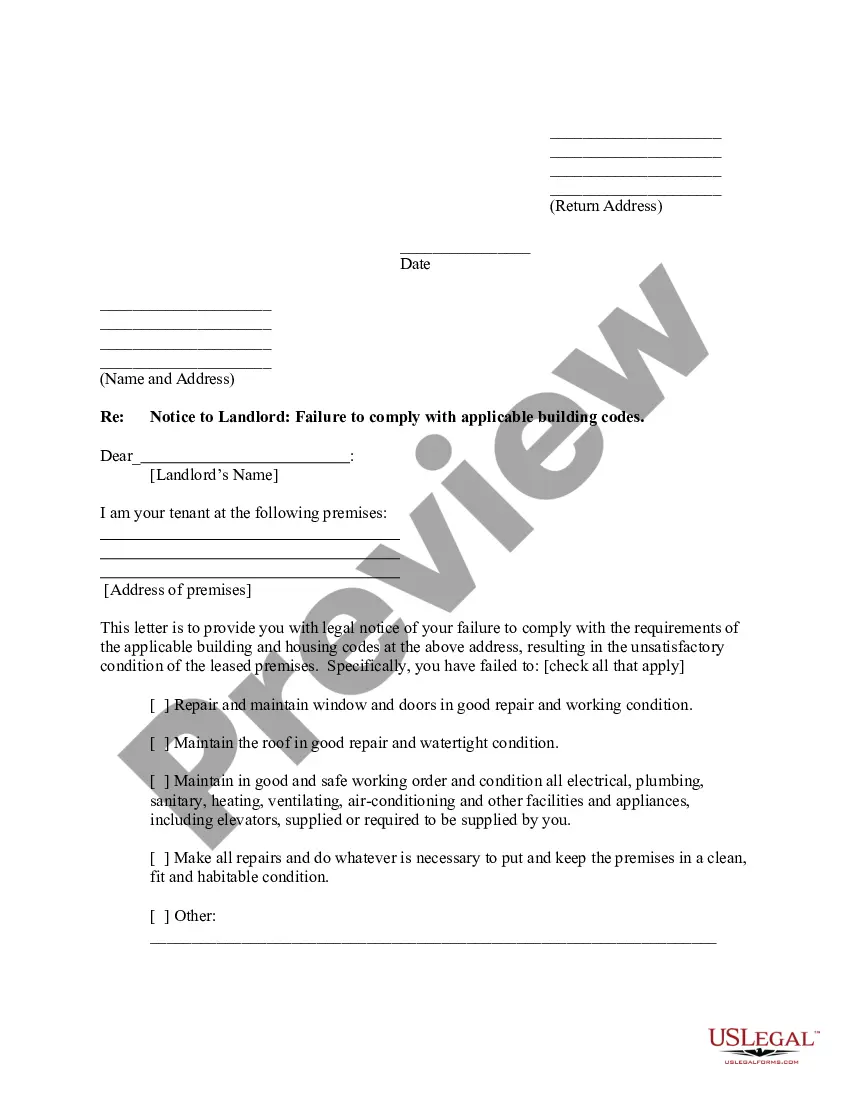

- Utilize the Review feature to examine the form.

- Read the description to ensure you have chosen the correct form.

- If the form is not what you’re looking for, use the Search bar to find the form that meets your needs and requirements.

- Once you find the correct form, click on Get now.

- Choose the pricing plan you prefer, fill in the necessary details to create your account, and make your payment using PayPal or Visa/Mastercard.

- Choose a convenient file format and download your copy.

Form popularity

FAQ

Form NYS-1 is used to remit to New York State the personal income taxes that you have withheld from your employees' wages or from certain other payments (for example, pensions).

Amended NYS-45-ATT250 or fewer employees or payees, you can amend either: by paper using Form NYS-45-ATT (mark the Amended box on the form), or. online using Wage Reporting Upload (NYS-45-ATT).more than 250 employees or payees, you must amend online using Wage Reporting Upload (NYS-45-ATT).

Electronic filing is mandatory for withholding tax filings (NYS-45 and NYS-1) You must electronically file and pay your withholding tax returns. Filers of paper returns may be subject to penalties and delays in processing.

If the due date falls on a Saturday, Sunday, or legal holiday, Form IT-204-LL and the annual filing fee may be filed on the next business day. If you fail to timely file Form IT-204-LL, or fail to pay the full amount of the filing fee by the due date, you may be subject to penalties and interest.

Form NYS-1If you withhold less than $700 during a calendar quarter, remit the taxes withheld with your quarterly return, Form NYS-45. If you have more than one payroll within a week (Sunday through Saturday), you are not required to file until after the last payroll in the week.

NYS-1, Return of Tax Withheld When a calendar quarter ends between payrolls paid within a week, any accumulated tax required to be withheld of at least $700 must be remitted with Form NYS-1 after the last payroll in the quarter.

Form NYS-1If you withhold less than $700 during a calendar quarter, remit the taxes withheld with your quarterly return, Form NYS-45. If you have more than one payroll within a week (Sunday through Saturday), you are not required to file until after the last payroll in the week.

Form NYS-45, Quarterly Combined Withholding, Wage Reporting, and Unemployment Insurance Return.

NYS-45, Quarterly Combined Withholding, Wage Reporting, and Unemployment Insurance Return. All employers required to withhold tax from wages must file Form NYS-45, Quarterly Combined Withholding, Wage Reporting, and Unemployment Insurance Return, each calendar quarter.

General information. Form NYS-1 is used to remit to New York State the personal income taxes that you have withheld from your employees' wages or from certain other payments (for example, pensions).