New York Work for Hire Addendum - Self-Employed

Description

How to fill out Work For Hire Addendum - Self-Employed?

Are you currently in a situation where you need documents for either business or personal purposes constantly.

There are numerous legal form templates available online, but finding reliable ones is not simple.

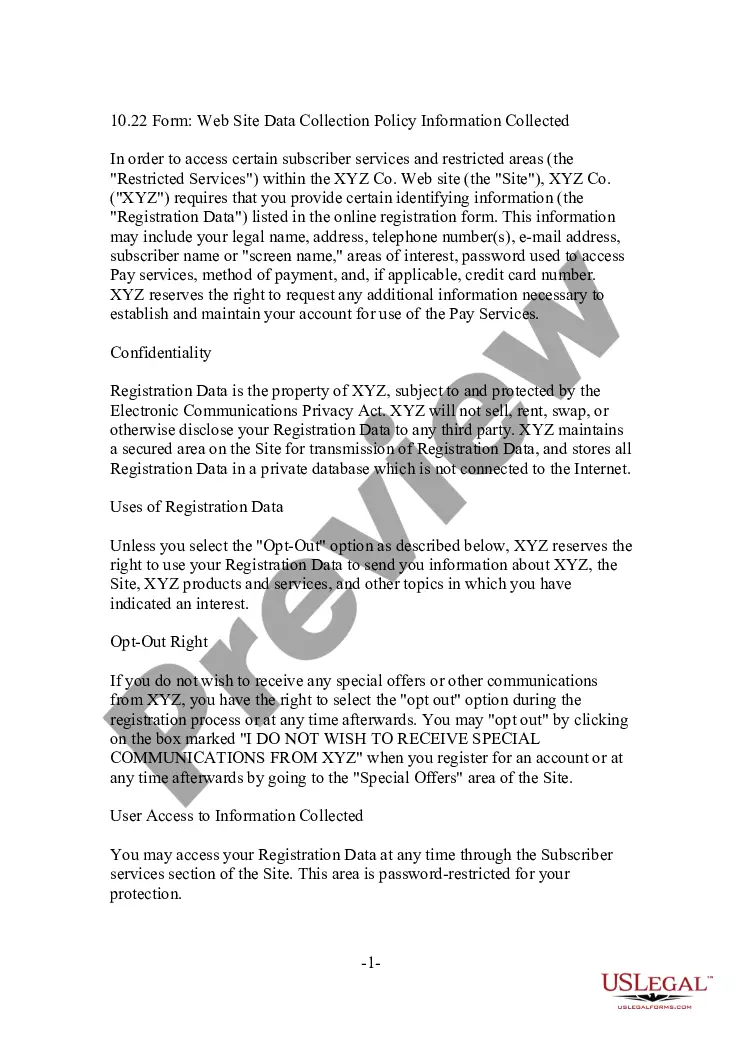

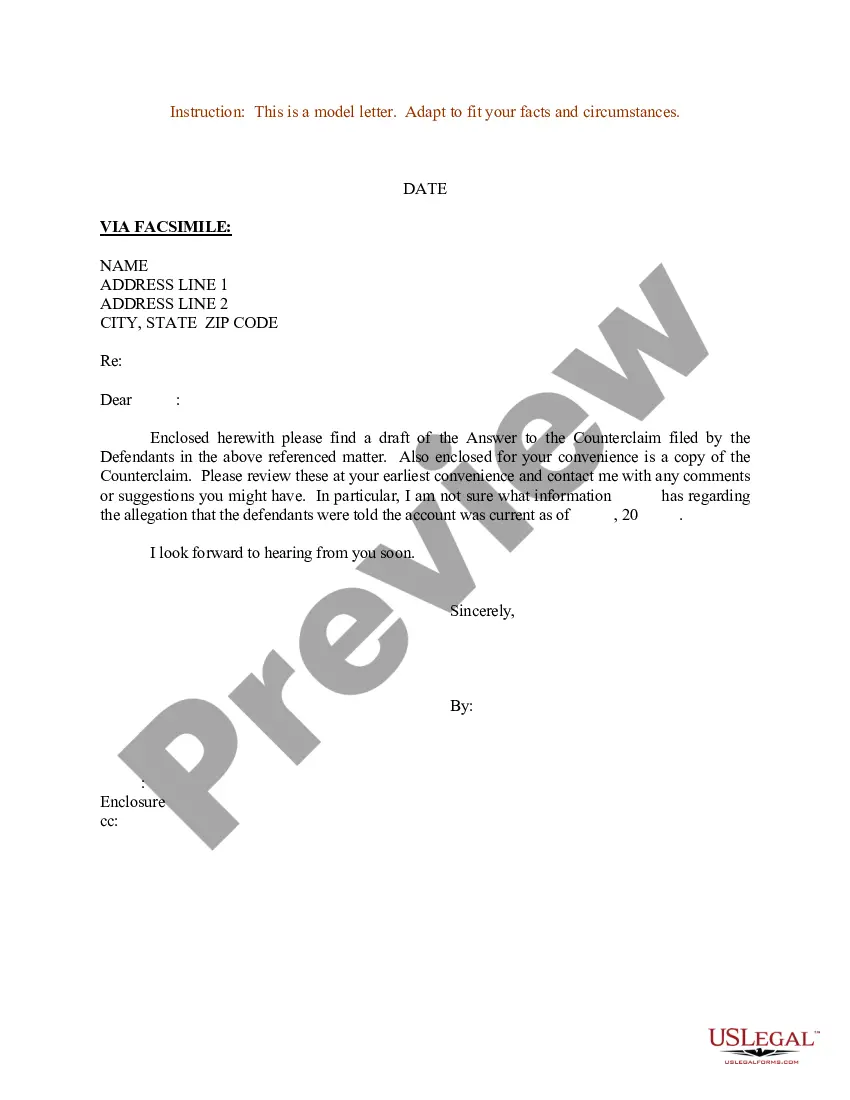

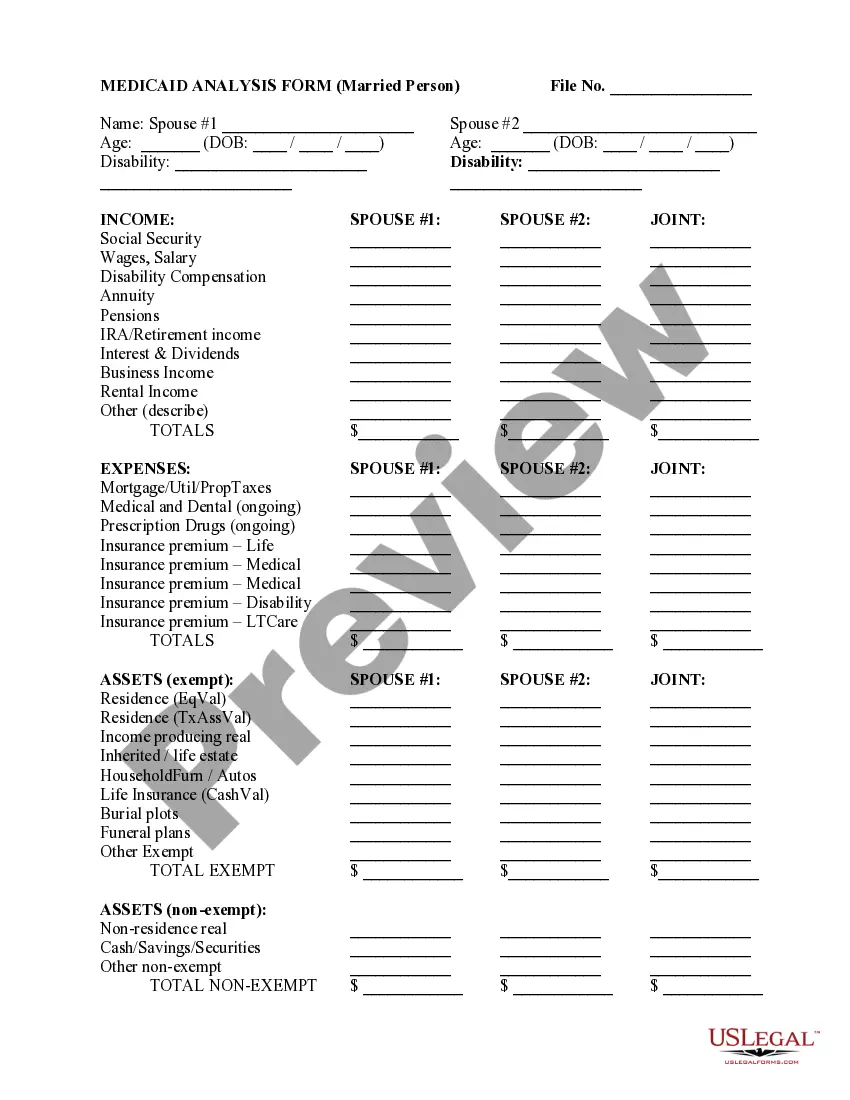

US Legal Forms provides thousands of form templates, such as the New York Work for Hire Addendum - Self-Employed, designed to comply with federal and state requirements.

Select the pricing plan you desire, provide the necessary information to create your account, and pay for your order using PayPal or credit card.

Choose a convenient file format and download your copy.

- If you are already familiar with the US Legal Forms website and have an account, simply Log In.

- After that, you can download the New York Work for Hire Addendum - Self-Employed template.

- If you do not have an account and wish to start using US Legal Forms, follow these steps.

- Find the form you need and ensure it is for the correct area/county.

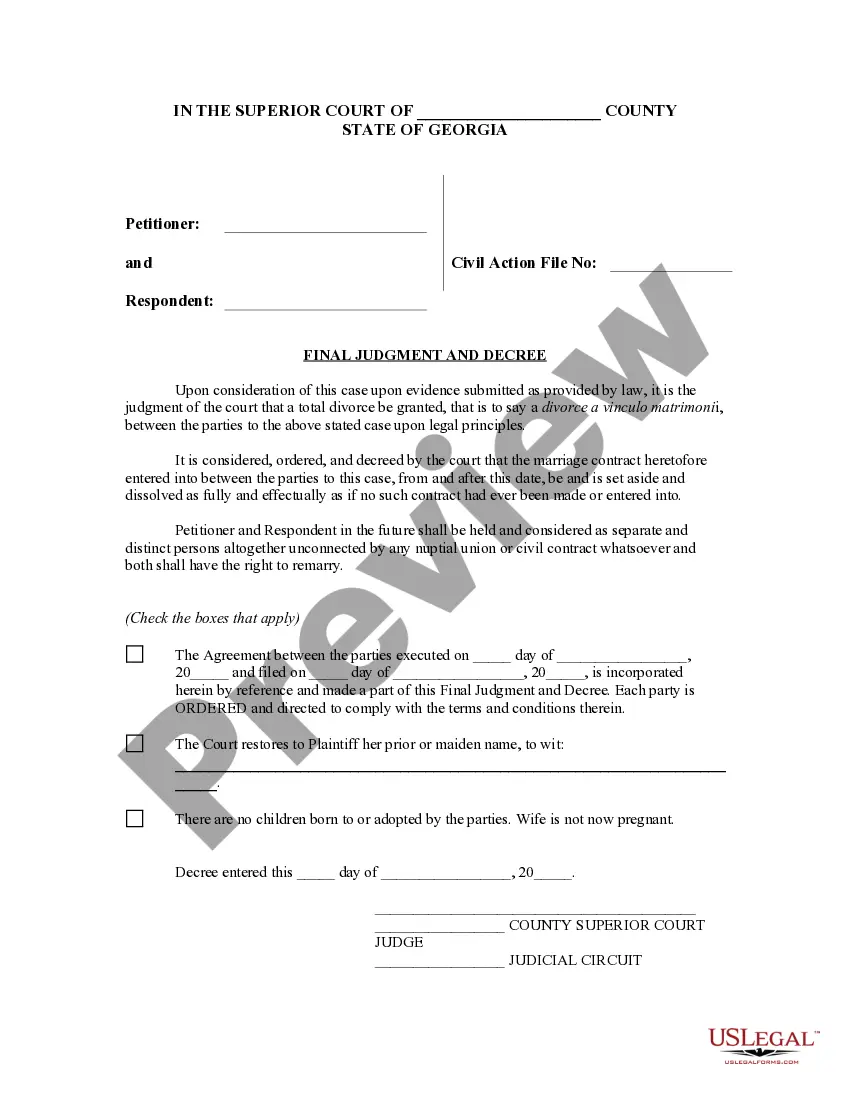

- Use the Preview button to review the form.

- Check the details to ensure you have selected the correct form.

- If the form isn’t what you’re looking for, use the Search field to find the form that meets your needs and specifications.

- Once you locate the appropriate form, click Acquire now.

Form popularity

FAQ

If you are an independent contractor, then you are self-employed. The earnings of a person who is working as an independent contractor are subject to self-employment tax. To find out what your tax obligations are, visit the Self-Employed Individuals Tax Center.

An independent contractor is a self-employed person or entity contracted to perform work foror provide services toanother entity as a nonemployee. As a result, independent contractors must pay their own Social Security and Medicare taxes.

Remember that an independent contractor is considered to be self-employed, so in effect, you are running your own one-person business. Any income that you earn as an independent contractor must be reported on Schedule C. You'll then pay income taxes on the total profit.

1099 contractors are easier to hireyou simply draft up an agreement and get working. There are very few legal ramifications; you can let them go at any time. And importantly, 1099 contractors may be less expensive than hiring a permanent full-time person.

The three types of self-employed individuals include:Independent contractors. Independent contractors are individuals hired to perform specific jobs for clients, meaning that they are only paid for their jobs.Sole proprietors.Partnerships.

If you are an independent contractor, then you are self-employed. The earnings of a person who is working as an independent contractor are subject to self-employment tax. To find out what your tax obligations are, visit the Self-Employed Individuals Tax Center.

Independent contractors are self-employed workers who provide services for an organisation under a contract for services. Independent contractors are not employees and are typically highly skilled, providing their clients with specialist skills or additional capacity on an as needed basis.

Elements of a Work-for-Hire AgreementScope of the projectexactly what is to be done or produced.Due date of the projectnegotiated with regard to both parties' schedules.Rights to be sold.Payment terms.Confidentiality terms (if any)Arbitration terms (if any)Severabilitygetting out of the agreement.

If you are a business owner or contractor who provides services to other businesses, then you are generally considered self-employed. For more information on your tax obligations if you are self-employed (an independent contractor), see our Self-Employed Individuals Tax Center.

Becoming an independent contractor is one of the many ways to be classified as self-employed. By definition, an independent contractor provides work or services on a contractual basis, whereas, self-employment is simply the act of earning money without operating within an employee-employer relationship.