New York General Partnership for Business

Description

How to fill out General Partnership For Business?

If you want to be thorough, obtain, or print authentic document templates, utilize US Legal Forms, the largest selection of legal forms available online.

Take advantage of the site's user-friendly search to locate the documents you require.

A variety of templates for business and personal purposes are organized by categories and states, or keywords.

Step 4. Once you have found the form you need, click the Purchase now button. Choose the pricing plan you prefer and enter your information to create an account.

Step 5. Complete the transaction. You can use your Visa, MasterCard, or PayPal account for the payment.

- Use US Legal Forms to access the New York General Partnership for Business with just a few clicks.

- If you are already a US Legal Forms customer, Log In to your account and click on the Download button to find the New York General Partnership for Business.

- You can also view forms you have previously downloaded in the My documents section of your account.

- If you are using US Legal Forms for the first time, follow the steps below.

- Step 1. Ensure you have selected the form for the correct state/country.

- Step 2. Use the Review option to check the form's details. Make sure to read the description.

- Step 3. If you are not satisfied with the form, utilize the Search bar at the top of the screen to find other versions of your legal form template.

Form popularity

FAQ

IT-201 and IT-203 are tax forms in New York used by individuals and partnerships. The IT-201 form is for residents and allows them to report their income and claim deductions. In contrast, the IT-203 form is specifically designed for non-residents and part-year residents. Understanding these forms is crucial for anyone involved in a New York general partnership for business, as it impacts tax obligations.

Example of a General Partnership For example, let's say that Fred and Melissa decide to open a baking store. The store is named F&M Bakery. By opening a store together, Fred and Melissa are both general partners in the business, F&M Bakery.

The state of New York does not have a general business license that all general partnerships are required to obtain. However, depending on what industry you operate in, your business may need licenses or permits to enable you to run your company in a compliant fashion.

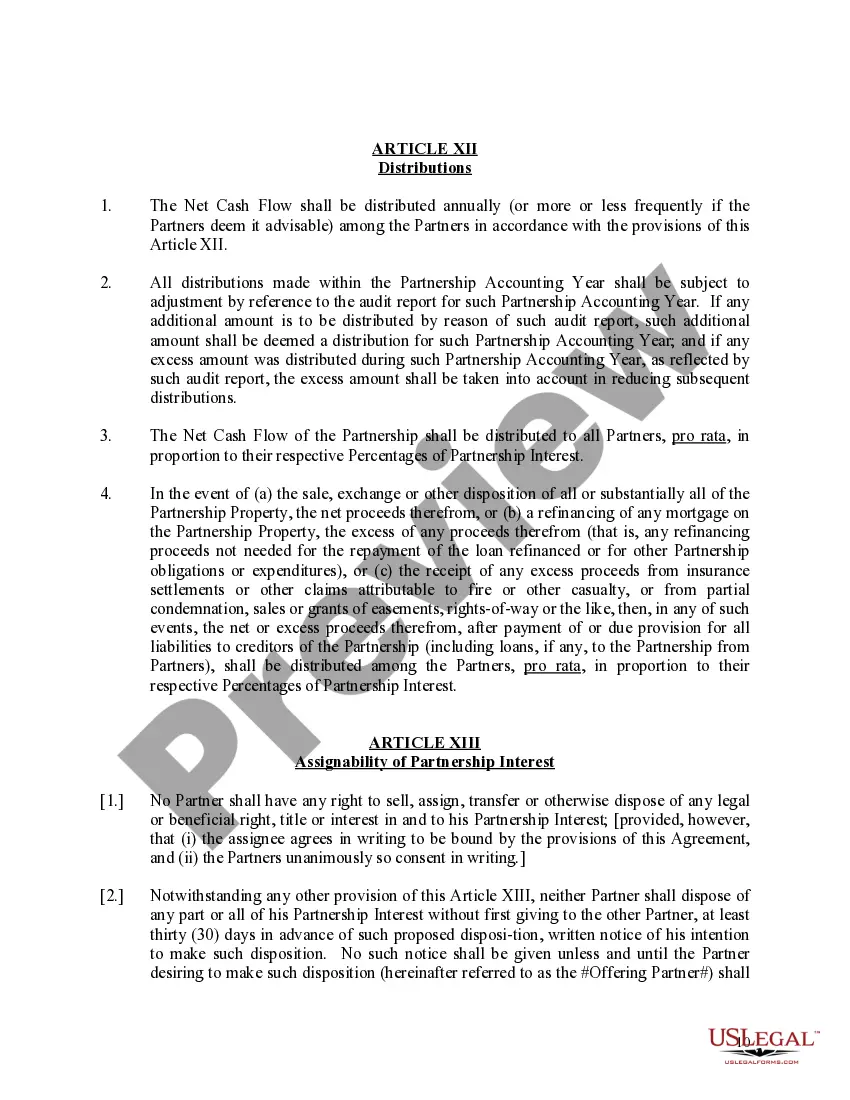

A general partnership is a business entity made of two or more partners who agree to establish and run a business.

While there are no formal filing or registration requirements needed to create a partnership, partnerships must comply with registration, filing, and tax requirements applicable to any business.

For New York State income tax purposes, a partnership is a syndicate, group, pool, joint venture, or other unincorporated organization that is carrying on a trade or business and is classified as a partnership for federal income tax purposes.

It is not mandatory to register a partnership firm as per the provisions of the Partnership Act, 1932. However, it is better to register a partnership firm. If the firm is not registered it cannot avail any legal benefits provided to the firm under the Partnership Act, 1932.

A general partnership has no separate legal existence distinct from the partners. Unlike a private limited company or limited liability partnership, it does not need to be registered at or make regular filings to Companies House, which can help keep things simple.

A general partnership is a business arrangement by which two or more individuals agree to share in all assets, profits, and financial and legal liabilities of a jointly-owned business.

General PartnershipA Certificate of Assumed Name (following an agreement of the partners) with the clerk of the county/ies in which the business is conducted. Personal liability is joint and individual for the general partners who are responsible for the obligations of the partnership.