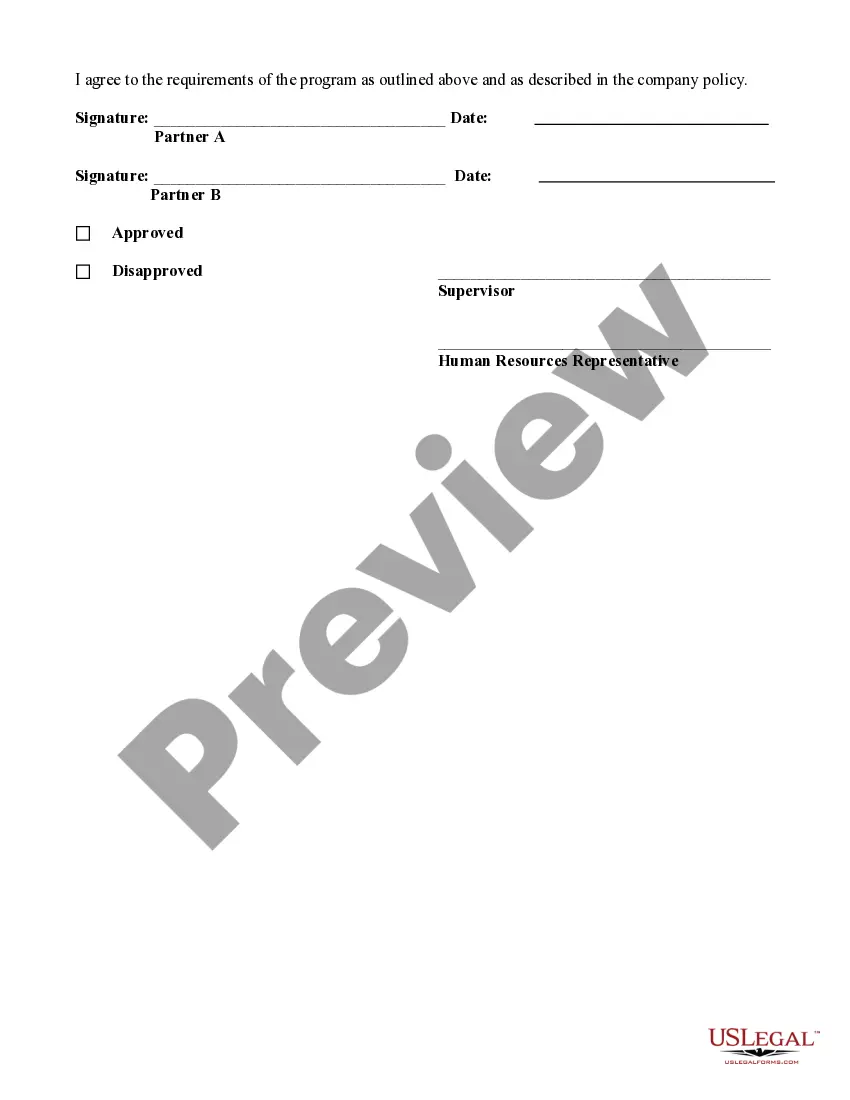

New York Job Share Proposal and Agreement

Description

How to fill out Job Share Proposal And Agreement?

US Legal Forms - one of the largest collections of legal documents in the United States - provides a broad selection of legal form templates that you can download or create.

By using the website, you can access thousands of documents for business and personal purposes, organized by categories, regions, or keywords. You will find the latest versions of documents such as the New York Job Share Proposal and Agreement in just a few minutes.

If you already have an account, Log In to download the New York Job Share Proposal and Agreement from your US Legal Forms library. The Download button will appear on every document you view. You can access all previously saved documents from the My documents tab in your account.

Process the transaction. Use your credit card or PayPal account to complete the transaction.

Select the format and download the form to your device. Make changes. Fill out, edit, print, and sign the saved New York Job Share Proposal and Agreement. Each template you add to your account does not have an expiration date and is yours to keep indefinitely. So, if you wish to download or print another copy, simply visit the My documents section and click on the form you need. Access the New York Job Share Proposal and Agreement with US Legal Forms, the most comprehensive library of legal document templates. Utilize thousands of professional and state-specific templates that cater to your business or personal requirements.

- If you are new to US Legal Forms, here are simple instructions to help you get started.

- Ensure you've selected the right form for your area/state.

- Click on the Review button to examine the document's content.

- Check the document details to confirm that you've chosen the correct form.

- If the form does not meet your needs, use the Search field at the top of the screen to find one that does.

- If you're satisfied with the form, confirm your selection by clicking the Get now button.

- Then, choose the pricing plan you prefer and provide your information to create an account.

Form popularity

FAQ

Work sharing provides employers with an alternative to layoffs when they are faced with a temporary decline in business. Instead of laying off a portion of the workforce to cut costs, an employer may reduce the hours and wages of all employees or a particular group of workers.

A: Yes. Under NYS DOL's new partial unemployment system, ten hours of work in a week - regardless of the total days worked - is equivalent to less than one day worked for certification purposes, as long as you do not earn more than $504 in gross pay (excluding earnings from self-employment) for those ten hours worked.

In New York, the current maximum weekly benefit rate is $504. The minimum PUA benefit rate is 50% of the average weekly benefit amount in New York. For January 27, 2020 - March 31, 2020, the minimum benefit rate is $172. For April 1, 2020 - June 30, 2020, the minimum benefit rate is $182.

NYS DOL's new partial unemployment system uses an hours-based approach. Under the new rules, you can work up to 7 days per week without losing full unemployment benefits for that week, if you work 30 hours or fewer and earn $504 or less in gross pay excluding earnings from self-employment.

A: NYS DOL's new partial unemployment system uses an hours-based approach. Under the new rules, claimants can work up to 7 days per week without losing full unemployment benefits for that week if they work 30 hours or fewer and earn $504 or less in gross pay excluding earnings from self-employment.

Under California's Work Sharing program, an employer facing the same situation could file a Work Sharing plan with EDD reducing the work week of all employees from five days to four days (a 20 percent reduction). The employees would be eligible to receive 20 percent of their weekly Unemployment Insurance benefits.

The voluntary Shared Work program was developed to help Texas employers and employees withstand a slowdown in business such as the impact of COVID-19. Shared Work allows employers to supplement their employees' wages lost because of reduced work hours with partial unemployment benefits.

For What Reasons Can You Be Denied Unemployment?Failing to Meet the Earnings Requirements. To qualify for benefits in New York (as in most states), you must have earned a minimum amount in wages during a 12-month stretch called the "base period."Getting Fired for Misconduct.Quitting Your Last Job.

Hours in Day New York doesn't impose overtime pay at the daily level. Employers must offer a 4-hour minimum shift.

The Shared Work Program helps keep trained, productive employees on the job during temporary business downturns, meaning New York businesses can gear up quickly when conditions improve, and New York workers get to stay on the job. Full-time, part-time and seasonal employees are eligible.