New York Resolution of Meeting of LLC Members to Specify Amount of Annual Disbursements to Members of the Company

Description

How to fill out Resolution Of Meeting Of LLC Members To Specify Amount Of Annual Disbursements To Members Of The Company?

You can spend hours online attempting to locate the legal document format that meets the state and federal requirements you will require.

US Legal Forms offers a wide array of legal templates that are reviewed by specialists.

You can conveniently download or print the New York Resolution of Meeting of LLC Members to Define the Amount of Annual Disbursements to Members of the Company from the services.

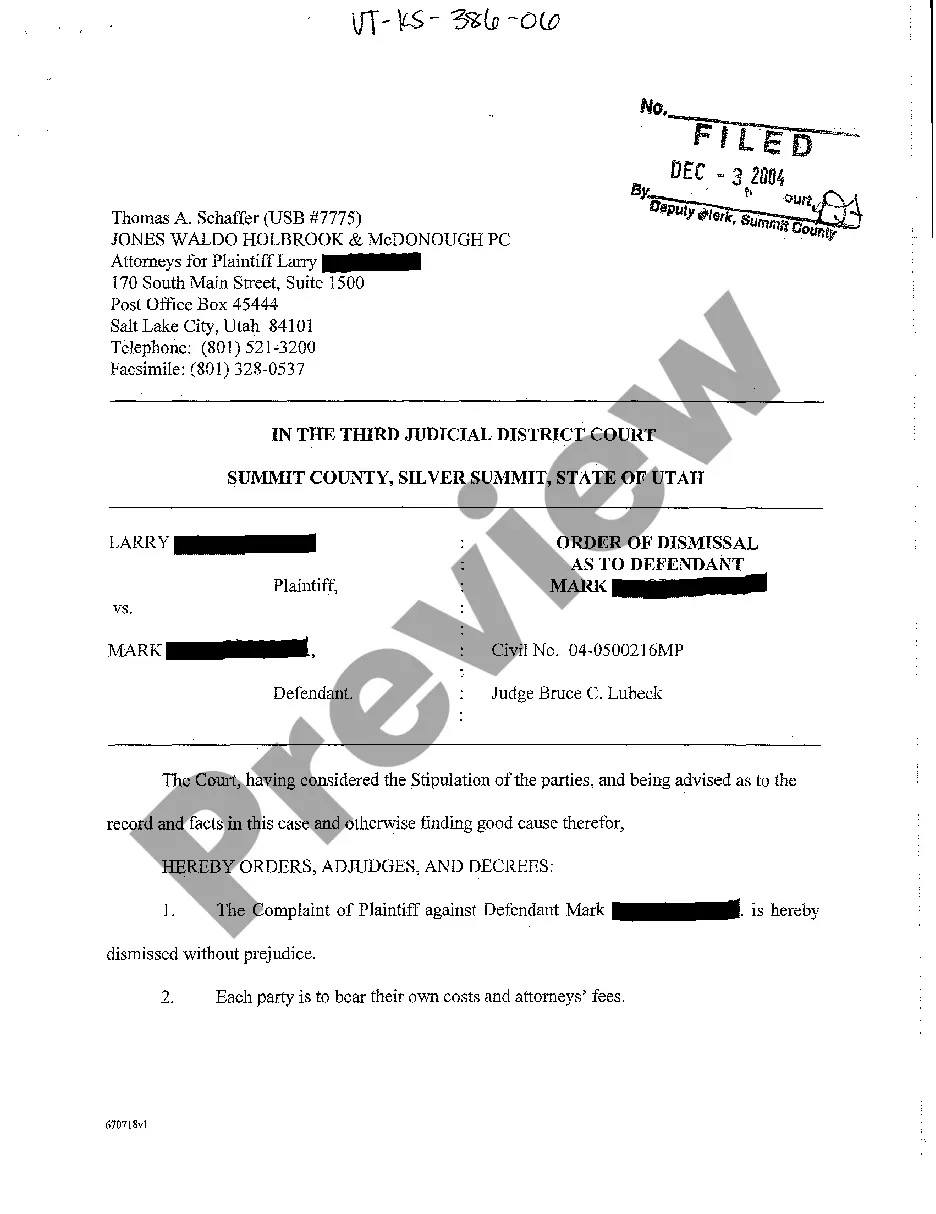

First, ensure that you have selected the correct document format for the state/town of your choice. Check the form outline to confirm that you have chosen the correct template. If available, use the Review button to examine the document format as well.

- If you already possess a US Legal Forms account, you may Log In and click the Acquire button.

- Subsequently, you can complete, modify, print, or sign the New York Resolution of Meeting of LLC Members to Define the Amount of Annual Disbursements to Members of the Company.

- Every legal document template you purchase is yours permanently.

- To obtain an additional copy of any purchased template, go to the My documents tab and click the relevant button.

- If you are using the US Legal Forms website for the first time, follow the straightforward instructions below.

Form popularity

FAQ

To file an annual report for your LLC in New York, you must first gather the necessary information about your business, such as the company name and address. Navigate to the New York Department of State's website, where you can complete the filing online. During this process, consider incorporating a New York Resolution of Meeting of LLC Members to Specify Amount of Annual Disbursements to Members of the Company, as this helps to clarify financial distributions among members. By managing these details effectively, you can ensure compliance and facilitate smoother operations for your LLC.

In New York, both single-member LLCs and multi-member LLCs are typically required to pay an annual filing fee. The amount of filing fee you are required to pay depends on the gross income of your LLC that comes from New York in the previous tax year. The fee can vary from $25 to $4,500.

A resolution can be made by a corporation's board of directors, shareholders on behalf of a corporation, a non-profit board of directors, or a government entity.

A corporate resolution form is used by a board of directors. Its purpose is to provide written documentation that a business is authorized to take specific action. This form is most often used by limited liability companies, s-corps, c-corps, and limited liability partnerships.

Types of Corporate Resolutions A resolution might outline the officers that are authorized to act (trade, assign, transfer or hedge securities and other assets) on behalf of the corporation. The resolution would outline who is authorized to open a bank account, withdraw money, and write checks.

Most LLC Resolutions include the following sections:Date, time, and place of the meeting.Owners or members present.The nature of business or resolution to discuss, including members added or removed, loans made, new contracts written, or changes in business scope or method.More items...

All Resolved clauses within a resolution should use the objective form of the verb (for example, Resolved, that the American Library Association (ALA), on behalf of its members: (1) supports...; (2) provides...; and last resolved urges....") rather than the subjunctive form of the verb (for example, Resolved,

How To Write a Corporate Resolution Step by StepStep 1: Write the Company's Name.Step 2: Include Further Legal Identification.Step 3: Include Location, Date and Time.Step 4: List the Board Resolutions.Step 5: Sign and Date the Document.

Most LLC Resolutions include the following sections:Date, time, and place of the meeting.Owners or members present.The nature of business or resolution to discuss, including members added or removed, loans made, new contracts written, or changes in business scope or method.More items...

An LLC Corporate Resolution Form is a document that describes the management and decision-making processes of the LLC. While LLCs are generally not required to draft a resolution form, it is highly beneficial and important for all businesses to draft corporate resolutions.