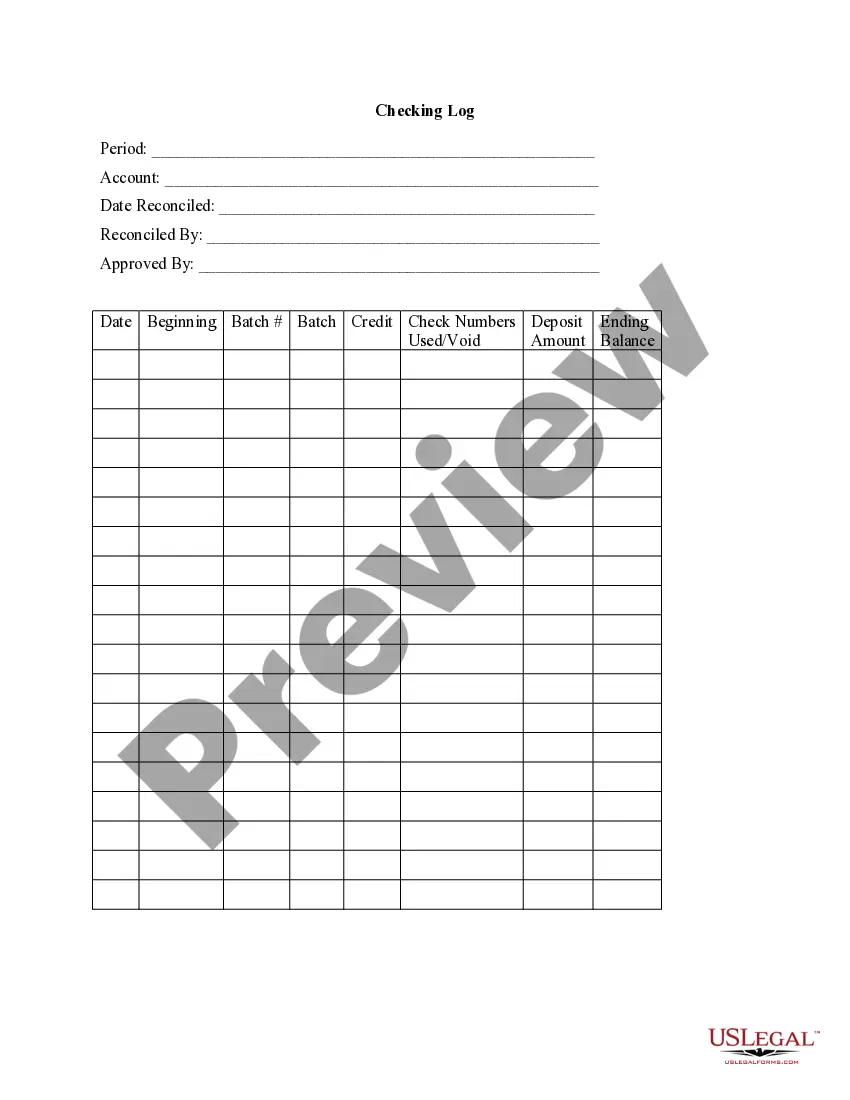

New York Checking Log

Description

How to fill out Checking Log?

If you need to finalize, obtain, or create legal document templates, utilize US Legal Forms, the largest assortment of legal templates, readily available on the web.

Take advantage of the site's user-friendly and efficient search feature to find the documents you require.

Various templates for businesses and specific tasks are categorized and suggested by topics or key phrases.

Every legal document template you purchase is yours permanently. You have access to every form you saved in your account. Click the My documents section and select a document to print or download again.

Stay competitive and obtain, and print the New York Checking Log with US Legal Forms. There are thousands of professional and state-specific templates you can use for your business or specific needs.

- Use US Legal Forms to find the New York Checking Log within a few clicks.

- If you are already a US Legal Forms user, sign in to your account and click the Download button to retrieve the New York Checking Log.

- You can also access documents you previously saved in the My documents section of your account.

- If you are using US Legal Forms for the first time, follow the instructions below.

- Step 1. Ensure you have chosen the form for the correct city/state.

- Step 2. Utilize the Review option to examine the contents of the form. Be sure to read the summary.

- Step 3. If you are not satisfied with the form, use the Search field at the top of the screen to find alternative versions of the legal form template.

- Step 4. Once you have found the form you need, select the Buy now button. Choose the pricing plan you prefer and enter your details to register for an account.

- Step 5. Complete the transaction. You can use your Visa or MasterCard or PayPal account to finalize the transaction.

- Step 6. Select the format of the legal document and download it to your device.

- Step 7. Complete, review, and print or sign the New York Checking Log.

Form popularity

FAQ

You can make an estimated income tax payment with an Individual or Fiduciary Online Services account. Pay directly from your bank account, or by credit card for a fee. If you need to make an estimated tax payment for a partnership, see Partnership information.

All employers required to withhold tax from wages must file Form NYS-45, Quarterly Combined Withholding, Wage Reporting, and Unemployment Insurance Return, each calendar quarter. If you withhold less than $700 during a calendar quarter, remit taxes withheld with your quarterly return, Form NYS-45.

Form NYS-1If you withhold less than $700 during a calendar quarter, remit the taxes withheld with your quarterly return, Form NYS-45. If you have more than one payroll within a week (Sunday through Saturday), you are not required to file until after the last payroll in the week.

Amended NYS-45-ATT250 or fewer employees or payees, you can amend either: by paper using Form NYS-45-ATT (mark the Amended box on the form), or. online using Wage Reporting Upload (NYS-45-ATT).more than 250 employees or payees, you must amend online using Wage Reporting Upload (NYS-45-ATT).

Electronic filing is mandatory for withholding tax filings (NYS-45 and NYS-1) You must electronically file and pay your withholding tax returns. Filers of paper returns may be subject to penalties and delays in processing.

You cannot amend Form NYS-45 online. If you need to amend your return, file paper Form NYS-45-X, Amended Quarterly Combined Withholding, Wage Reporting, and Unemployment Insurance Return.

Make your check or money order payable to New York State Income Tax. Be sure to write your social security number, the tax year, and Income Tax on it. Be sure to complete all information on the voucher. If filing a joint return, include information for both spouses.

Make your check, money order or cashier's check payable to U.S. Treasury.

Make your check or money order payable to New York State Income Tax. Be sure to write your social security number, the tax year, and Income Tax on your payment. Before mailing in your payment, consider paying online.

Make your check or money order payable to New York State Income Tax for the full amount you owe and write your social security number and 2011 Income Tax on it. Mail voucher and payment to: NYS Personal Income Tax, Processing Center, PO Box 4124, Binghamton NY 13902-4124.