New York Accredited Investor Representation Letter

Description

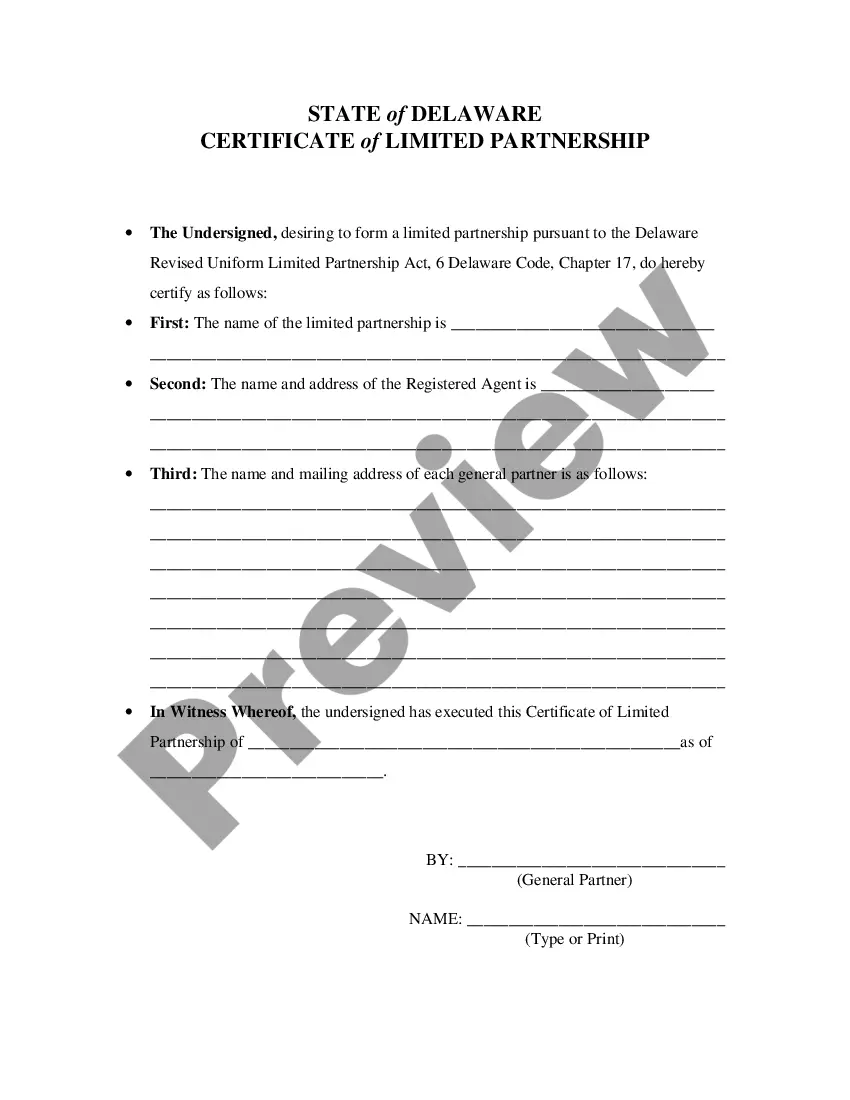

How to fill out Accredited Investor Representation Letter?

US Legal Forms - one of the largest collections of legal documents in the United States - offers a broad selection of legal document templates that you can download or print.

By utilizing the website, you can access thousands of forms for business and personal purposes, organized by categories, states, or keywords. You can obtain the latest versions of documents such as the New York Certified Investor Representation Letter in no time.

If you already have an account, Log In and download the New York Certified Investor Representation Letter from the US Legal Forms library. The Download button will appear on each form you view. You can access all previously saved forms from the My documents section of your account.

Complete the transaction. Use your credit card or PayPal account to finalize the purchase.

Select the format and download the document to your device. Edit. Fill out, revise, print, and sign the saved New York Certified Investor Representation Letter. Each template you added to your account has no expiration date and is yours indefinitely. So, to download or print another copy, just go to the My documents section and click on the document you need. Access the New York Certified Investor Representation Letter with US Legal Forms, one of the most extensive collections of legal document templates. Utilize thousands of professional and state-specific templates that meet your business or personal requirements.

- Make sure you have selected the correct form for your city/state.

- Click the Preview button to examine the form's content.

- Review the form's details to ensure you have chosen the correct document.

- If the form does not meet your needs, utilize the Search function at the top of the screen to find the one that does.

- If you are satisfied with the form, confirm your choice by clicking the Purchase now button.

- Then, select the payment plan you prefer and provide your details to create an account.

Form popularity

FAQ

Some documents that can prove an investor's accredited status include:Tax filings or pay stubs;A letter from an accountant or employer confirming their actual and expected annual income; or.IRS Forms like W-2s, 1040s, 1099s, K-1s or other tax documentation that report income.

In lieu of providing income or net assets information, you may provide a professional letter from a licensed CPA, attorney, investment advisor or registered broker-dealer. The letter should state that the professional service provider has a reasonable belief that you are an Accredited Investor.

A qualified institutional buyer (QIB) representation letter for an unlegended Rule 144A offering of securities by a Canadian issuer. The QIB representation letter relates to a concurrent public offering in Canada and an offering in the United States conducted in reliance on Rule 144A under the Securities Act.

A qualified institutional buyer (QIB) is a class of investor that by virtue of being a sophisticated investor, does not require the regulatory protection that the Securities Act's registration provisions gives to investors.

The Applicant's most recent publicly available information appearing in a recognized securities manual, provided that such information is as of a date within 16 months preceding the date of this Application in the case of a U.S. Applicant and within 18 months preceding such date for a non-U.S. Applicant.

Investor Representation Letter means a letter from initial investors of a Bond offering that includes but is not limited to a certification that they reasonably meet the standards of a Sophisticated Investor or Qualified Institutional Buyer, that they are purchasing Bonds for their own account, that they have the

Accredited Investor Definition Income: Has an annual income of at least $200,000, or $300,000 if combined with a spouse's income. This level of income should be sustained from year to year. Professional: Is a knowledgeable employee of certain investment funds or holds a valid Series 7, 65 or 82 license.

In a Rule 506(b) offering, investors can self-certify, so this is where the opportunity for an investor to falsify their qualifications comes in. In a Rule 506(c) offering, investors must provide reasonable assurance to the Syndicator that they are accredited, which must be dated within 90 days of the investment.

A QIB can be an insurance company, a bank, a 401(k) plan, an employee benefit plan, a trust fund, a business development company (BDC), a charity, or even an entity owned by qualified investors.