A Flexible Benefits Plan benefits is a plan that allows employees to select from a pool of choices, some or all of which may be tax-advantaged. Potential choices include cash, retirement plan contributions, vacation days, and insurance. It is also called a cafeteria plan.

New York Medical Care Reimbursement Request - Flexible Benefits Plan

Description

How to fill out Medical Care Reimbursement Request - Flexible Benefits Plan?

Are you currently in a situation where you require documents for either business or personal purposes almost all the time.

There are numerous valid document templates accessible online, but finding trustworthy ones is not easy.

US Legal Forms offers a vast array of template forms, including the New York Medical Care Reimbursement Request - Flexible Benefits Plan, which are designed to comply with state and federal regulations.

Select a convenient document format and download your copy.

Find all the document templates you have purchased in the My documents section. You can obtain an additional copy of the New York Medical Care Reimbursement Request - Flexible Benefits Plan anytime, if necessary. Just click on the desired form to download or print the document template.

- If you are already familiar with the US Legal Forms website and have an account, simply Log In.

- Then, you can download the New York Medical Care Reimbursement Request - Flexible Benefits Plan template.

- If you do not have an account and want to start using US Legal Forms, follow these steps.

- Find the form you need and make sure it's for the correct city/region.

- Use the Preview button to review the form.

- Check the details to ensure you've selected the right form.

- If the form isn’t what you’re looking for, use the Search field to locate a form that meets your needs.

- Once you find the appropriate form, click Buy now.

- Choose the pricing plan you want, fill in the required information to create your account, and complete your purchase using your PayPal or credit card.

Form popularity

FAQ

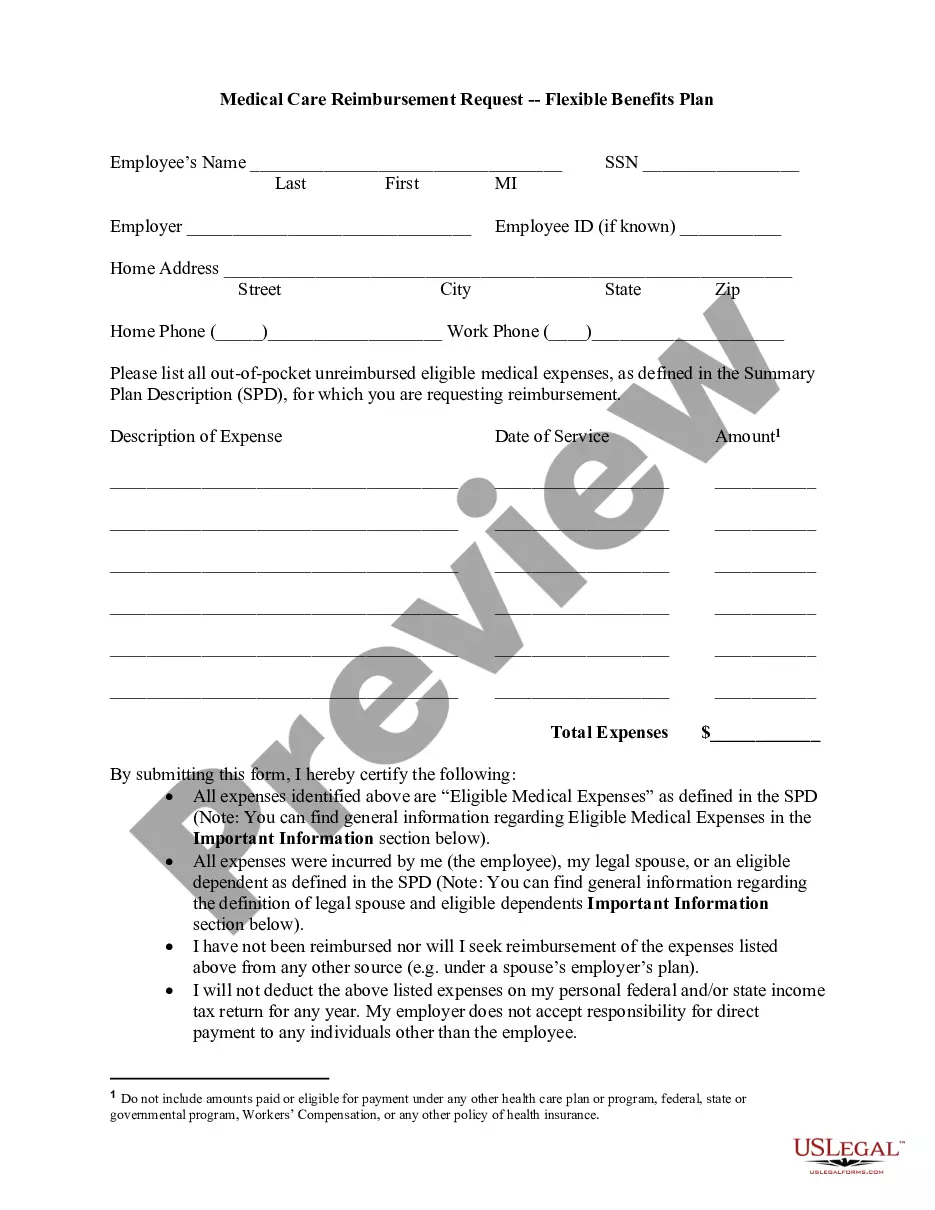

You can submit FSA claims to the designated claims processor specified in your Flexible Spending Account documentation. For the New York Medical Care Reimbursement Request - Flexible Benefits Plan, ensure that you follow the outlined submission methods, whether online or by mail. Timely submission completes the claims process efficiently, so be sure to adhere to deadlines.

The flexible benefit program in NYC allows employees to allocate pre-tax dollars toward various qualified expenses, such as medical care. The New York Medical Care Reimbursement Request - Flexible Benefits Plan is a key component of this program, enabling participants to reimburse themselves for eligible healthcare costs. This program offers financial flexibility and tax savings.

You can find information about the New York City flexible benefits program IRC 125 on the city’s official benefits website. This resource provides comprehensive details on eligible plans, including the New York Medical Care Reimbursement Request - Flexible Benefits Plan. Take a look at the website to explore your options and get the resources you need.

Yes, there is a grace period for FSA in NYC. This grace period allows you additional time to incur expenses and submit your claims after the plan year ends. Make sure to review your plan's specific details to understand how long the grace period lasts and when to submit your New York Medical Care Reimbursement Request - Flexible Benefits Plan.

To submit your FSA claim to NYC, use the New York Medical Care Reimbursement Request - Flexible Benefits Plan form. Complete the form with the necessary details and attach your receipts. You can submit your claim online or via mail, depending on your preference, and follow the guidelines to ensure timely reimbursement.

New York City's flexible benefits program is intended to provide employees with various options to manage their health-related expenses. This program includes multiple accounts such as the FSA, allowing users to choose how they want to utilize their benefits. By submitting your New York Medical Care Reimbursement Request - Flexible Benefits Plan, you can access funds for out-of-pocket medical expenses. For comprehensive support, uslegalforms offers helpful tools to navigate this program efficiently.

The NYC healthcare Flexible Spending Account is a program designed to help city employees manage their healthcare costs more effectively. This account allows individuals to set aside pre-tax dollars for eligible medical expenses, making them more affordable. By participating, employees can easily submit their New York Medical Care Reimbursement Request - Flexible Benefits Plan to claim reimbursements for qualified expenses. For a seamless experience, uslegalforms offers useful resources tailored to these programs.

Yes, you can request reimbursement from your Flexible Spending Account (FSA) for eligible medical expenses. When you have a valid expense, simply submit your New York Medical Care Reimbursement Request - Flexible Benefits Plan alongside the required documentation. This process is straightforward, and it also allows for quick access to your funds. If you need guidance, uslegalforms can assist you in preparing and submitting your request.

Flex benefits often cover a range of medical expenses, including deductibles, copayments, and certain over-the-counter items. When filing your New York Medical Care Reimbursement Request - Flexible Benefits Plan, you can submit claims for eligible expenses incurred by you or your dependents. It's important to keep all receipts and documents, as these will support your reimbursement request. For detailed information, consider navigating the user-friendly uslegalforms platform.

On your tax return, dependent care FSA contributions are generally reported on Form 1040 in the section for child and dependent care expenses. You can use the funds to compute any allowable tax credits, thus reducing your taxable income. It is vital to keep records of your contributions and reimbursements to ensure an accurate filing. Understanding the implications of the New York Medical Care Reimbursement Request - Flexible Benefits Plan allows you to maximize your tax benefits.