New York Assignment of Mortgage

Description

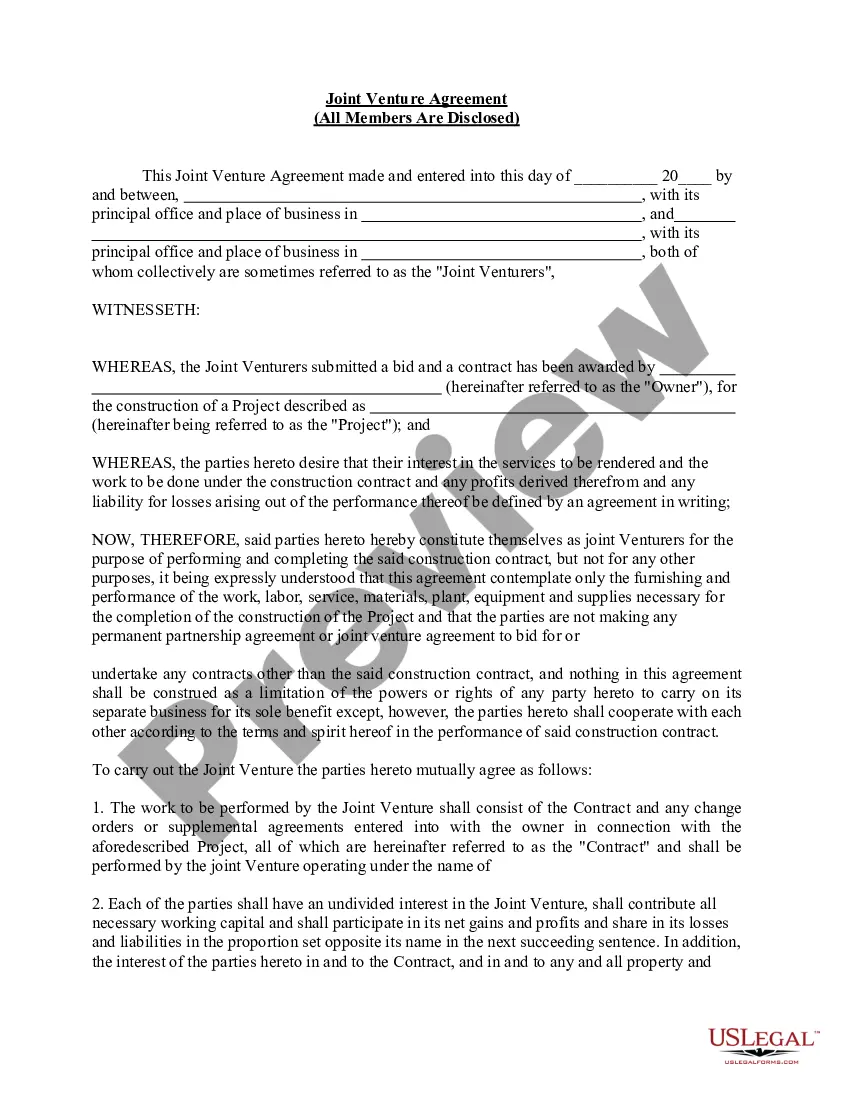

How to fill out Assignment Of Mortgage?

If you have to comprehensive, obtain, or printing lawful document layouts, use US Legal Forms, the biggest collection of lawful types, which can be found on the web. Utilize the site`s simple and easy hassle-free search to obtain the documents you will need. Numerous layouts for organization and person purposes are sorted by classes and states, or search phrases. Use US Legal Forms to obtain the New York Assignment of Mortgage in a number of mouse clicks.

If you are already a US Legal Forms consumer, log in for your account and then click the Acquire key to find the New York Assignment of Mortgage. You can even accessibility types you earlier downloaded inside the My Forms tab of your own account.

Should you use US Legal Forms the first time, follow the instructions beneath:

- Step 1. Make sure you have selected the shape for your proper area/nation.

- Step 2. Take advantage of the Preview solution to check out the form`s content. Never forget to see the information.

- Step 3. If you are unsatisfied with the develop, use the Lookup field towards the top of the display to discover other versions in the lawful develop template.

- Step 4. Once you have discovered the shape you will need, click on the Get now key. Select the pricing program you like and include your references to sign up for the account.

- Step 5. Method the transaction. You may use your Мisa or Ьastercard or PayPal account to perform the transaction.

- Step 6. Find the format in the lawful develop and obtain it on the gadget.

- Step 7. Full, modify and printing or sign the New York Assignment of Mortgage.

Each lawful document template you buy is your own property for a long time. You have acces to each and every develop you downloaded within your acccount. Go through the My Forms segment and select a develop to printing or obtain once again.

Compete and obtain, and printing the New York Assignment of Mortgage with US Legal Forms. There are thousands of expert and state-particular types you can use to your organization or person requirements.

Form popularity

FAQ

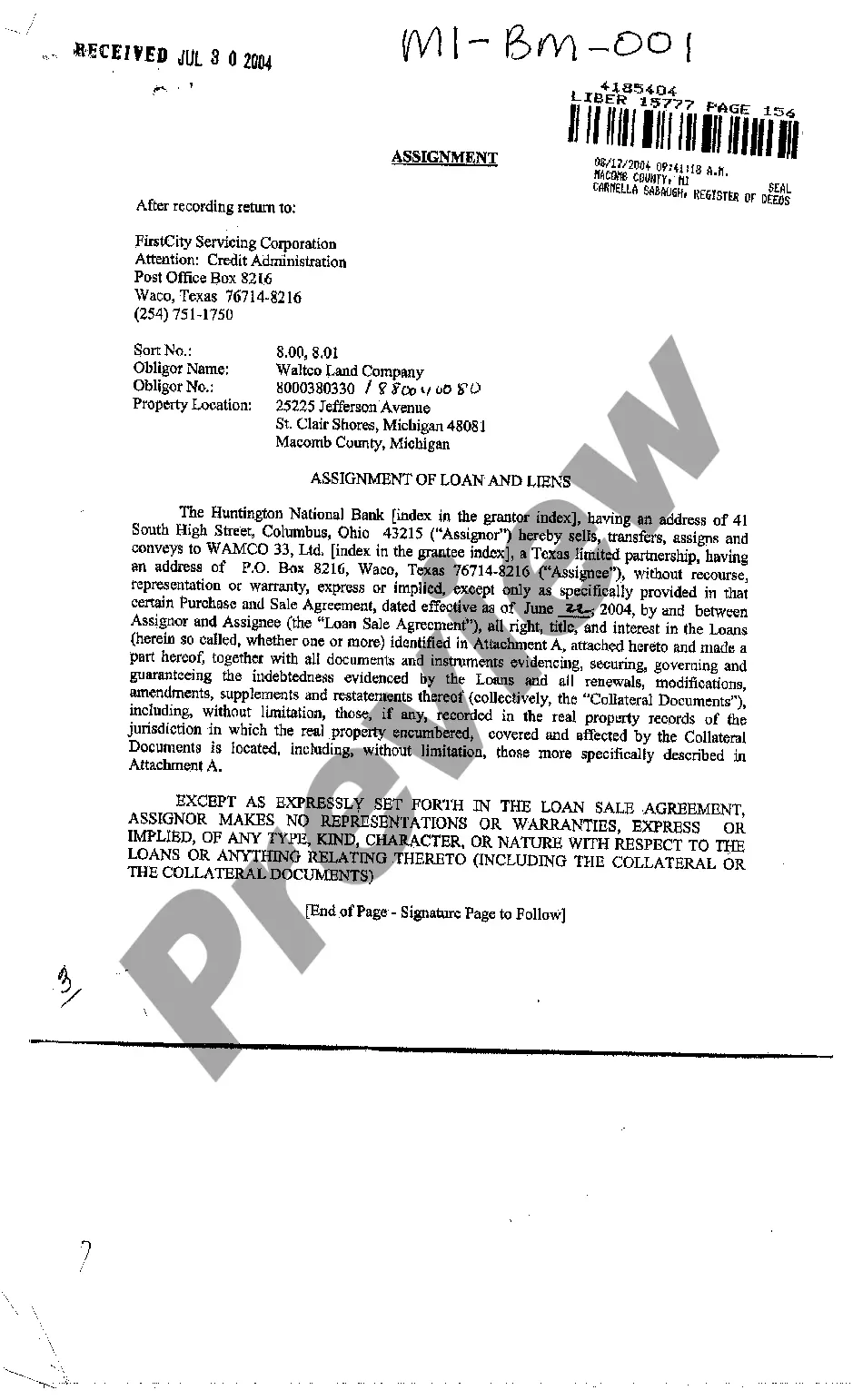

The purpose of the mortgage or deed of trust is to provide security for the loan that's evidenced by a promissory note. Loan Transfers. Banks often sell and buy mortgages from each other. An "assignment" is the document that is the legal record of this transfer from one mortgagee to another.

The transfer of an obligation (in this case, your obligation to pay the mortgage) is called an ?assignment.? All mortgages will have an assignment clause and almost all (if not all) will require you to get written approval from the lender to assign ownership from you to an LLC.

An assignment of mortgage gives the loan seller's rights under the mortgage, including the right to foreclose if the borrower doesn't make payments, to the new owner of the loan.

The most common example of an Assignment of Mortgage is when a mortgage lender transfers/sells the mortgage to another lender. This can be done more than once until the balance is paid. The lender does not have to inform the borrower that the mortgage is being assigned to another party.

Under Section 275, a mortgage that is assigned continues to secure a bona fide obligation and an enforceable lien, rather than becoming a ?dormant? mortgage and is thus exempt from the payment of New York mortgage recording tax.

Mortgages are assigned using a document called an assignment of mortgage. This legally transfers the original lender's interest in the loan to the new company. After doing this, the original lender will no longer receive the payments of principal and interest.

If it does not have an assignment or failed to record it as required by state law, this may result in the dismissal of the foreclosure action. Recording rules may require that the foreclosing party record the assignment before starting the foreclosure.

An assignment of mortgage is a legal term that refers to the transfer of the security instrument that underlies your mortgage loan ? aka your home. When a lender sells the mortgage on, an investor effectively buys the note, and the mortgage is assigned to them at this time.