New York Assignment of Deed of Trust

Description

How to fill out Assignment Of Deed Of Trust?

Are you within a situation that you need to have papers for possibly organization or specific functions just about every working day? There are a variety of authorized file templates available online, but getting kinds you can trust isn`t straightforward. US Legal Forms offers a huge number of form templates, just like the New York Assignment of Deed of Trust, that are written to meet federal and state specifications.

When you are currently familiar with US Legal Forms website and have a free account, simply log in. After that, you are able to obtain the New York Assignment of Deed of Trust template.

If you do not have an account and need to begin to use US Legal Forms, follow these steps:

- Get the form you will need and ensure it is to the appropriate city/area.

- Take advantage of the Review key to analyze the shape.

- Read the description to ensure that you have chosen the appropriate form.

- When the form isn`t what you`re searching for, use the Search discipline to obtain the form that fits your needs and specifications.

- When you discover the appropriate form, click on Acquire now.

- Select the pricing prepare you need, fill in the specified details to create your account, and pay money for the order with your PayPal or credit card.

- Select a handy paper file format and obtain your copy.

Find all of the file templates you may have bought in the My Forms food list. You may get a extra copy of New York Assignment of Deed of Trust any time, if necessary. Just go through the needed form to obtain or print out the file template.

Use US Legal Forms, probably the most comprehensive collection of authorized forms, to conserve efforts and stay away from mistakes. The service offers expertly manufactured authorized file templates that you can use for a variety of functions. Create a free account on US Legal Forms and start producing your lifestyle a little easier.

Form popularity

FAQ

If property is acquired by a transfer in trust, other than by a transfer in trust by gift, bequest, or devise, its basis is the same as it would be in the hands of the trust's grantor, increased by the gain or decreased by the loss recognized to the grantor under the law in effect as of the date of such transfer ( Code ...

Transfer Taxes This means that gifts to trusts and distributions of principal from trusts to beneficiaries are not subject to income tax. There are two types of transfer taxes that can be relevant to trusts: the gift tax and the estate tax.

The main difference between a deed and a deed of trust is that a deed is a transfer of ownership, while a deed of trust is a security interest. A deed of trust is used to secure a loan, while a deed is used to transfer ownership of a property.

A properly-conveyed deed should be recorded to provide notice to the world of ownership. Title to real property can be held by one person or by multiple people. Title can also be held by a trust or a business entity.

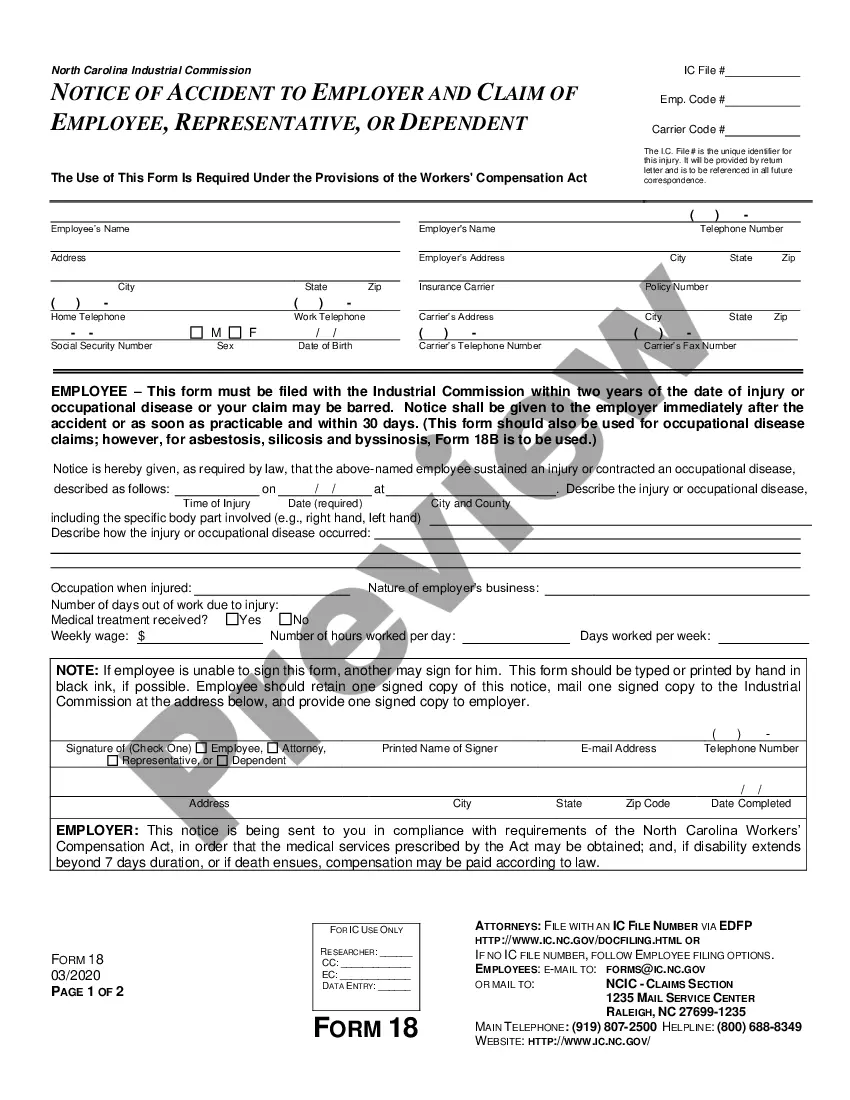

In real estate law, "assignment" is simply the transfer of a deed of trust from one party to another. This usually happens when the beneficiary of a trust deed sells their loan to another lender.

If the deed is going to be recorded in the county clerk's office, it must include the addresses of both the grantor and the grantee. The deed also must be delivered to the grantee and the grantee must accept it, in order to transfer the property.

To transfer real property into your Trust, a new deed reflecting the name of the Trust must be executed, notarized and recorded with the County Recorder in the County where the property is located. Care must be taken that the exact legal description in the existing deed appears on the new deed.

The key disadvantages of placing a house in a trust include the following: Extra paperwork: Moving property in a trust requires the house owner to transfer the asset's legal title. This involves preparing and signing an additional deed, and some people may consider this cumbersome.