New York General Form of Agreement to Incorporate

Description

How to fill out General Form Of Agreement To Incorporate?

If you wish to complete, download, or create lawful document templates, utilize US Legal Forms, the most significant collection of legal forms available online.

Take advantage of the site’s straightforward and convenient search to locate the documents you need.

Numerous templates for business and personal uses are categorized by genres and jurisdictions, or keywords. Use US Legal Forms to secure the New York General Form of Agreement to Incorporate in just a few clicks.

Every legal document template you purchase is yours indefinitely. You have access to every form you acquired within your account.

Visit the My documents section and select a form to print or download again. Compete, download, and print the New York General Form of Agreement to Incorporate using US Legal Forms. There are numerous professional and state-specific forms you can use for your business or personal needs.

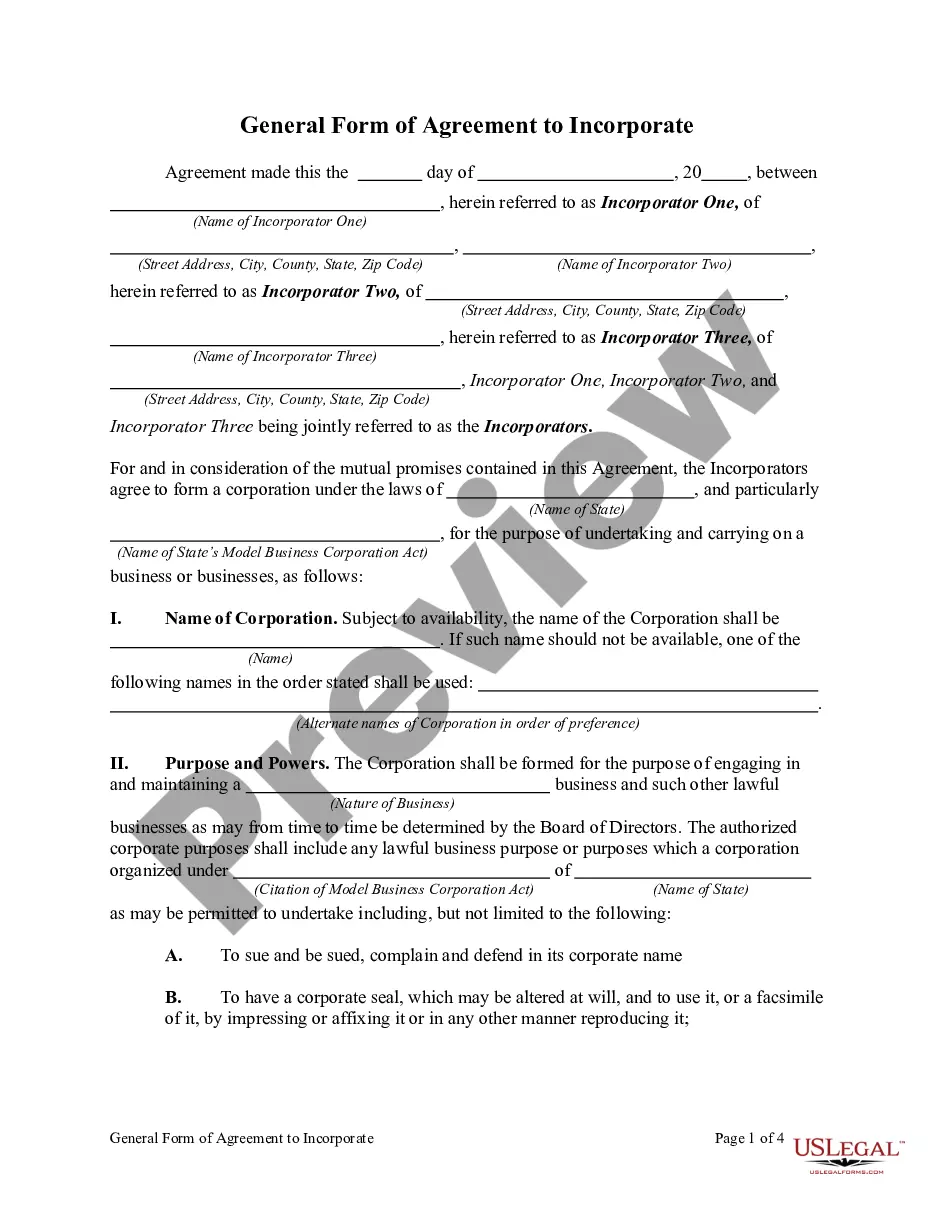

- Step 1. Ensure you have chosen the form for the correct city/state.

- Step 2. Use the Preview feature to examine the form's content. Remember to review the details.

- Step 3. If you are dissatisfied with the form, use the Search field at the top of the page to find other versions in the legal form format.

- Step 4. After locating the form you need, click on the Acquire now button. Choose your preferred pricing plan and provide your information to register for an account.

- Step 5. Complete the transaction. You may use your credit card or PayPal account for the payment.

- Step 6. Choose the format of the legal form and download it to your device.

- Step 7. Fill out, edit, and print or sign the New York General Form of Agreement to Incorporate.

Form popularity

FAQ

In New York, an operating agreement for an LLC is not mandatory, but it is highly recommended. This document lays out the management structure and operating procedures of your LLC, providing clarity and protection for its members. Even though the use of the New York General Form of Agreement to Incorporate is commonly associated with incorporation, it can also guide you in drafting your LLC's operating agreement. US Legal Forms offers resources to help you create a comprehensive operating agreement tailored to your needs.

Forming a general partnership in New York involves two or more individuals agreeing to conduct business together. While New York does not require a formal registration for partnerships, you should draft a partnership agreement to outline roles and responsibilities. Using the New York General Form of Agreement to Incorporate can also help allocate profits and losses more clearly, providing a robust framework for your partnership. Platforms like US Legal Forms can assist in creating this essential document.

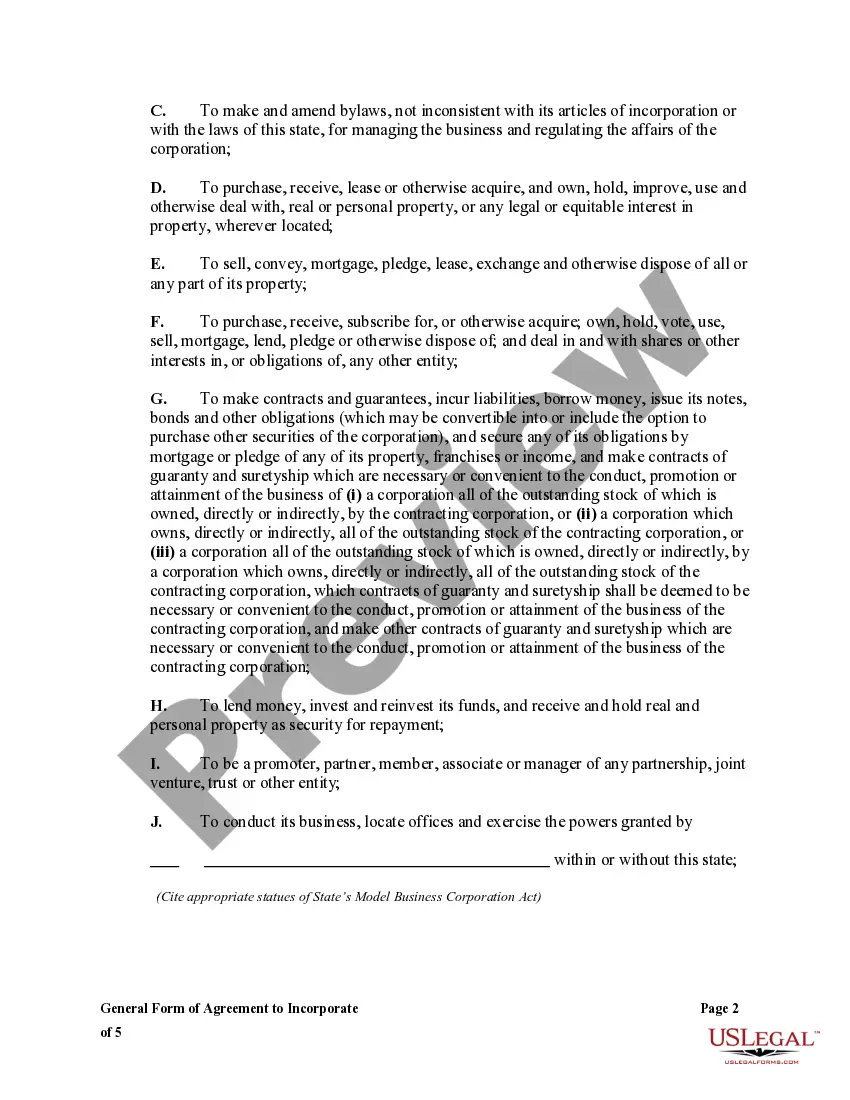

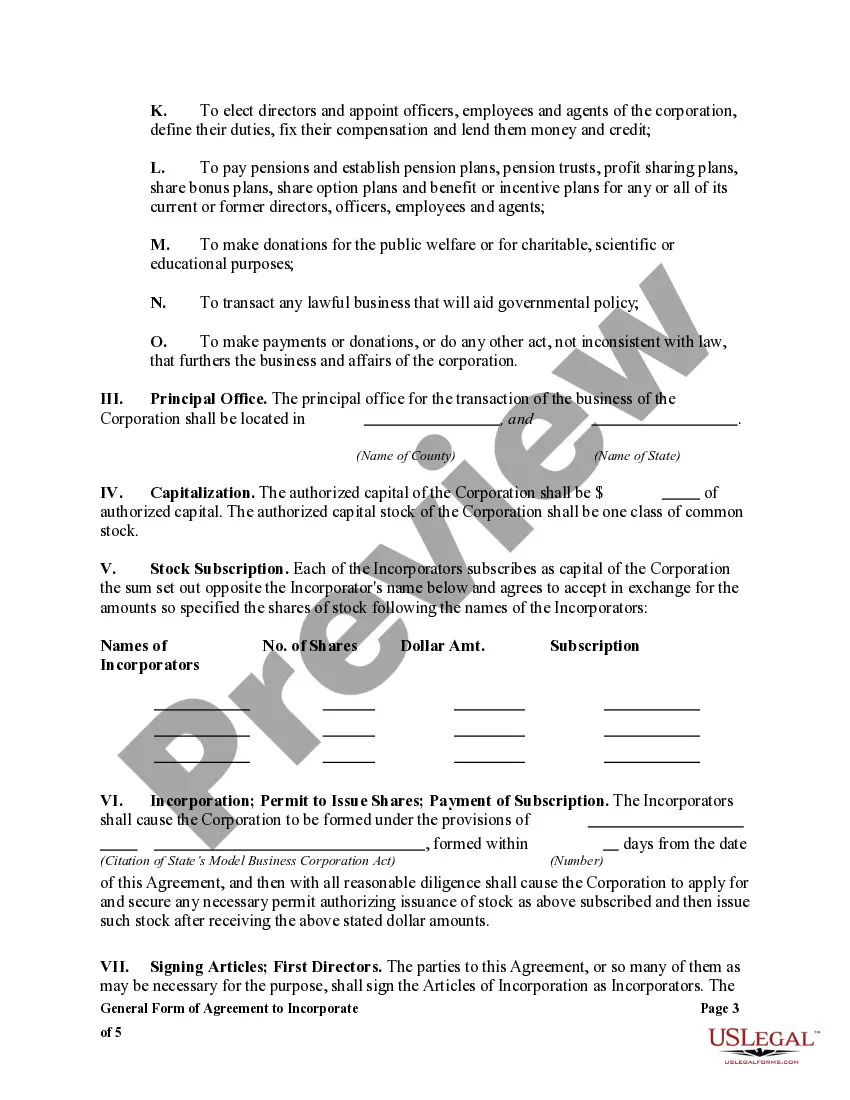

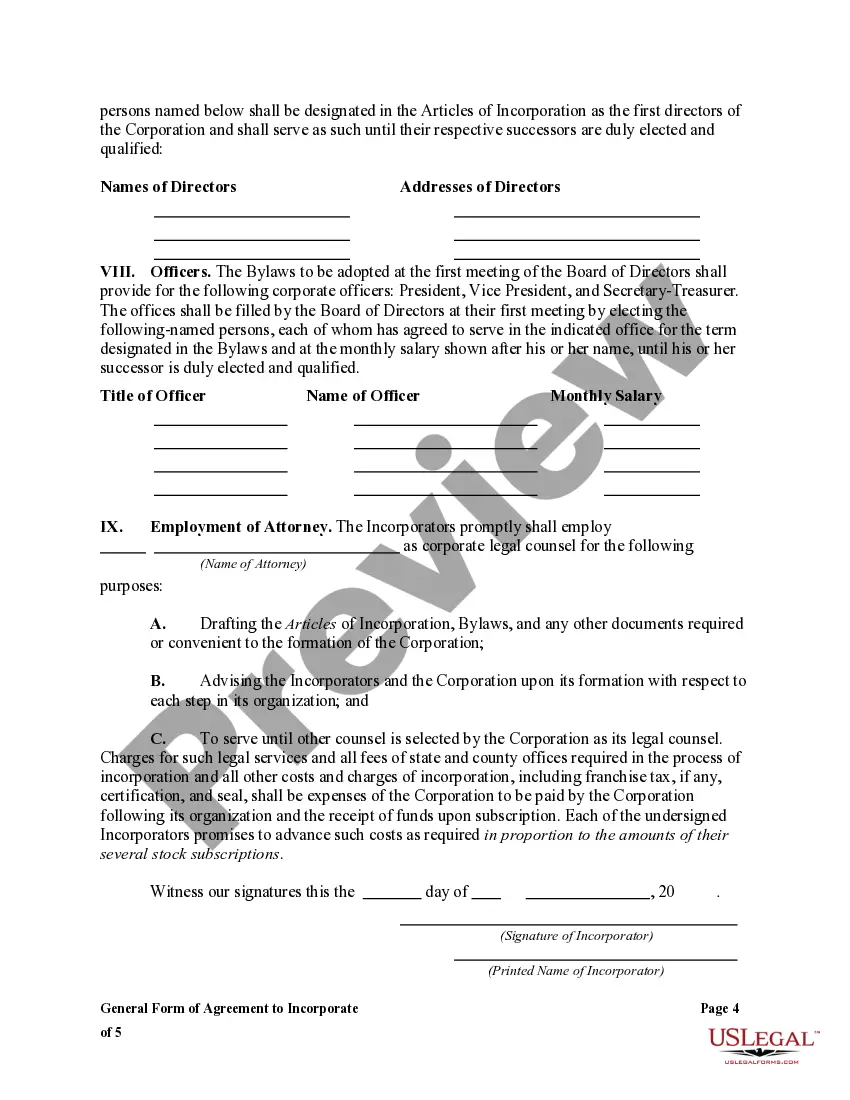

To get incorporated in New York, you must file a Certificate of Incorporation with the New York Department of State. This document outlines key details about your business, including its name and purpose. Additionally, using the New York General Form of Agreement to Incorporate simplifies this process, ensuring you meet all legal requirements efficiently. Consider utilizing platforms like US Legal Forms, which provide easy access to necessary forms and guidance.

Although New York does not mandate an operating agreement for LLCs, having one is beneficial. This document reduces misunderstandings among members and establishes clear guidelines for business operations. Using the New York General Form of Agreement to Incorporate can help you draft an effective operating agreement easily.

Technically, an LLC can operate without an operating agreement in New York, but it is not advisable. Without one, the LLC will have to rely on state laws for governance, which may not align with the members' preferences. An operating agreement helps set the rules and structure, thereby lending clarity and purpose to the operation.

Any limited liability company (LLC) doing business in New York City must file Form NYC 204. This includes LLCs that operate within the city limits or are subject to New York City taxes. Timely filing is crucial to avoid penalties and maintain compliance with local regulations.

While New York state does not legally require LLCs to have an operating agreement, it is advisable for all LLCs to have one. This agreement serves as a foundational document that describes the business’s operational procedures. By having a clear operating agreement, you can protect your members and enhance the LLC’s credibility.

No, you are not required to file an operating agreement with the state of New York. However, it is highly recommended to create one to outline the management structure and operating procedures of your LLC. Having a well-drafted operating agreement can help prevent internal disputes and clarify responsibilities among members.

You need to file NY Form IT-204-LL with the New York State Department of Taxation and Finance. This form is specifically designed for limited liability companies (LLCs) and must be submitted annually. Utilizing the online services offered by the department can streamline your filing process.

To incorporate in New York state, you must first choose a unique name for your corporation. Then, file the New York General Form of Agreement to Incorporate with the Department of State. After submitting the required documents, you should obtain an Employer Identification Number (EIN) from the IRS and register for any necessary state taxes.