This form is a generic example that may be referred to when preparing such a form for your particular state. It is for illustrative purposes only. Local laws should be consulted to determine any specific requirements for such a form in a particular jurisdiction.

New York Supplementation to and Clarification of Contract for the Sale of Real Property

Description

How to fill out Supplementation To And Clarification Of Contract For The Sale Of Real Property?

If you wish to finalize, acquire, or create legitimate document templates, utilize US Legal Forms, the largest collection of legal templates, which can be accessed online.

Take advantage of the site’s user-friendly and convenient search to find the documents you need.

Numerous templates for corporate and personal purposes are organized by categories and states, or keywords.

Step 4. After locating the document you need, select the Get now button. Choose your preferred payment plan and enter your details to sign up for an account.

Step 5. Complete the payment. You can use your credit card or PayPal account to finish the transaction.

- Utilize US Legal Forms to obtain the New York Supplementation to and Clarification of Contract for the Sale of Real Property with just a few clicks.

- If you are already a US Legal Forms customer, Log In to your account and then click the Download button to retrieve the New York Supplementation to and Clarification of Contract for the Sale of Real Property.

- You can also access forms you previously downloaded from the My documents tab of your account.

- If you are using US Legal Forms for the first time, refer to the guidelines below.

- Step 1. Ensure you have selected the template for the appropriate city/state.

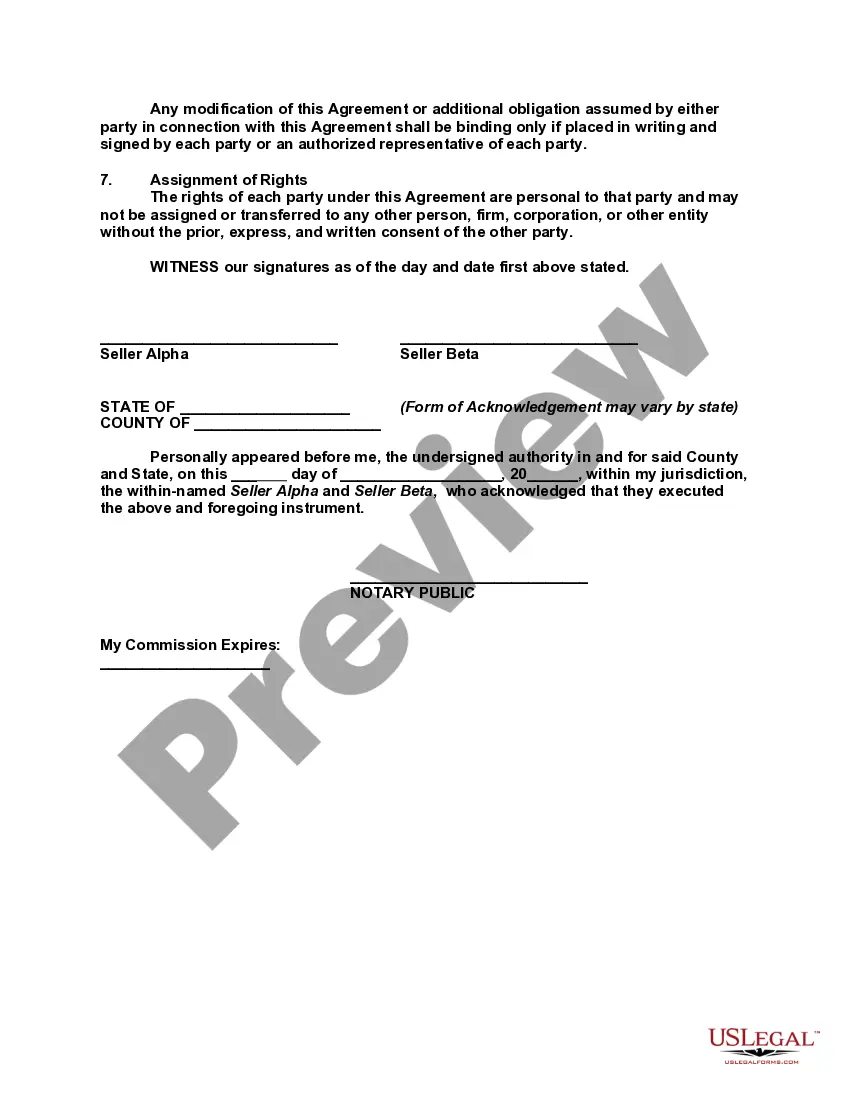

- Step 2. Utilize the Preview option to view the document's content. Be sure to read the details.

- Step 3. If you are unsatisfied with the document, use the Search field at the top of the screen to find alternative versions in the legal document library.

Form popularity

FAQ

In real estate, a supplement refers to an additional document or attachment that modifies or clarifies a primary contract. When working with a New York Supplementation to and Clarification of Contract for the Sale of Real Property, a supplement can help address any changes, additional terms, or clarifications needed to finalize the agreement. This ensures all parties involved have a clear understanding of the terms and conditions, thus protecting everyone’s interests. Engaging a professional can help you draft these supplements effectively.

Form TP 584 is a crucial document required for real estate transactions in New York City. This form, which is part of the New York Supplementation to and Clarification of Contract for the Sale of Real Property framework, provides necessary information about the transfer of property. It aids in calculating transfer taxes and ensuring compliance with local regulations. Completing this form accurately is vital to avoid delays in your real estate process.

A seller may back out of a real estate contract in New York, but it typically involves serious legal considerations. If the contract includes a New York Supplementation to and Clarification of Contract for the Sale of Real Property, it may outline specific terms that permit a seller to withdraw. However, doing so could lead to potential legal disputes and financial consequences. It is essential to consult with a legal expert before making such a decision.

To avoid the NYC transfer tax, you can consider structuring your real estate transactions carefully. One method is to utilize a New York Supplementation to and Clarification of Contract for the Sale of Real Property to ensure that the transaction qualifies for exemptions. Additionally, consulting a tax professional can help identify specific exemptions that apply to your property transfer. By planning ahead and utilizing available resources, you can minimize or avoid this tax.

The continuing lien deduction in New York refers to the ability to deduct certain liens from a property’s assessed value for tax purposes. This can be particularly beneficial when dealing with property sales or transfers as outlined in the New York Supplementation to and Clarification of Contract for the Sale of Real Property. Understanding these liens and their deductions is essential for both buyers and sellers, and consulting with experts can provide clarity in these matters.

To transfer ownership of a property in New York, you will need to complete a deed that names both the current owner and the new owner. This deed must then be filed with the local county clerk's office to make the transfer official. Consultation regarding the New York Supplementation to and Clarification of Contract for the Sale of Real Property can provide valuable insights into the necessary steps and paperwork required for a successful ownership transfer.

In New York, the supplemental transfer tax refers to the tax that may be imposed on real estate transfers in certain situations, such as when the property is not owner-occupied. This tax, along with any other relevant fees, needs to be considered when engaging in transactions under the New York Supplementation to and Clarification of Contract for the Sale of Real Property. Understanding these taxes is crucial, so seeking advice from professionals can help clarify the implications.

To transfer a property title to a family member in New York, you will need to prepare a new deed that names the family member as the property owner. You must also file this deed with the county clerk's office where the property is located. It is advisable to consult professionals knowledgeable in New York Supplementation to and Clarification of Contract for the Sale of Real Property to ensure the transfer complies with all legal requirements.

To assign a contract, both parties typically need to agree and provide written consent. The original contract should not prohibit assignment, and the assignee must accept the obligations under the agreement. Familiarizing yourself with the New York Supplementation to and Clarification of Contract for the Sale of Real Property can clarify these requirements and help you avoid common pitfalls in the assignment process.

The amended New York Real Property Law Chapter 50 Article 14 provides regulations concerning real property transactions, including how to handle contracts for sale. This law ensures that buyers and sellers adhere to specific protocols designed to protect their rights. Understanding these regulations enables individuals to navigate the New York Supplementation to and Clarification of Contract for the Sale of Real Property more effectively.