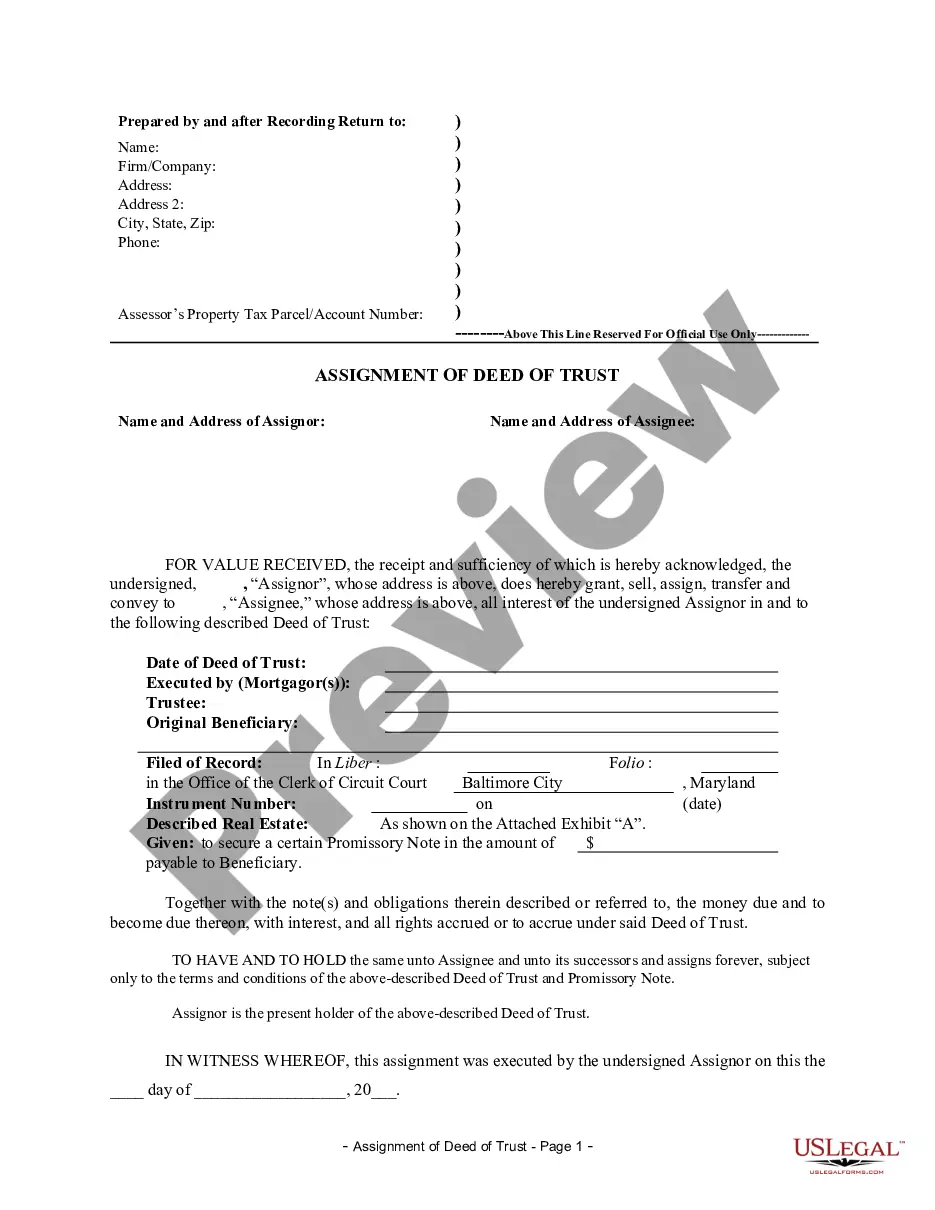

This form is a generic example that may be referred to when preparing such a form for your particular state. It is for illustrative purposes only. Local laws should be consulted to determine any specific requirements for such a form in a particular jurisdiction.

New York Agreement Dissolving Business Interest in Connection with Certain Real Property

Description

How to fill out Agreement Dissolving Business Interest In Connection With Certain Real Property?

Selecting the optimal authorized document template can be challenging.

Clearly, there are numerous templates accessible online, but how do you find the specific legal form you need.

Utilize the US Legal Forms website. This service offers thousands of templates, including the New York Agreement Dissolving Business Interest in Connection with Certain Real Property, suitable for both business and personal use.

If the form does not meet your requirements, use the Search field to locate the correct form. Once you are confident that the form is suitable, click the Acquire now button to obtain the form. Choose your preferred payment plan and enter the required information. Create your account and place an order using your PayPal account or credit card. Select the document format and download the legal document template to your device. Complete, amend, print, and sign the acquired New York Agreement Dissolving Business Interest in Connection with Certain Real Property. US Legal Forms is the largest repository of legal forms where you can discover various document templates. Utilize this service to download expertly crafted documents that adhere to state standards.

- All documents are reviewed by professionals and comply with federal and state requirements.

- If you are already registered, Log In to your account and click the Download button to obtain the New York Agreement Dissolving Business Interest in Connection with Certain Real Property.

- You can use your account to search for the legal documents you have previously purchased.

- Visit the My documents tab of your account and download another copy of the document you need.

- If you are a new user of US Legal Forms, follow these simple steps.

- First, ensure you have selected the appropriate form for your city/region. You can browse the form using the Preview button and review the form description to confirm it suits your needs.

Form popularity

FAQ

To dissolve a real estate partnership, begin by reviewing the partnership agreement for any specific instructions. Typically, partners need to agree on the dissolution terms and settle all debts and obligations. After that, you can formally file documents with the appropriate state authority. Considering a New York Agreement Dissolving Business Interest in Connection with Certain Real Property can provide a clear outline for this process, ensuring compliance with local laws.

Dissolving an LLC can lead to several drawbacks. First, it may disrupt business operations and potentially harm relationships with clients and suppliers. Additionally, you must settle all debts and liabilities, which could strain finances. Finally, members may face tax implications, particularly in terms of gains from the sale of assets associated with the New York Agreement Dissolving Business Interest in Connection with Certain Real Property.

A partnership itself cannot be classified as a disregarded entity, but a single-member LLC can be. However, certain partnerships operating as pass-through entities can mimic some disregarded entity benefits. Understanding these distinctions is crucial when considering a New York Agreement Dissolving Business Interest in Connection with Certain Real Property.

Dissolving a business in New York involves several steps, including filing necessary documents like a Certificate of Dissolution. The process may also require notifying creditors and detailing asset distribution, particularly if engaging in a New York Agreement Dissolving Business Interest in Connection with Certain Real Property. Using platforms like uslegalforms can guide you through the paperwork and ensure everything is legally compliant.

A partnership is a business entity formed by two or more individuals who share ownership and responsibilities for the operation. It allows for flexible management and tax treatment as profits and losses flow through to personal tax returns. Partnerships can enter agreements for dissolving business interests in connection with certain real property in New York, ensuring a compliant exit strategy.

When a partnership transitions to a single-member LLC, this change affects ownership and liability structure. This new entity might offer limited liability protection while simplifying the management process under a New York Agreement Dissolving Business Interest in Connection with Certain Real Property. Additionally, it can provide tax benefits by allowing the owner to report income directly on personal tax returns.

The TR 570 form is essential for anyone in New York looking to dissolve a business entity. Specifically, it documents the distribution of assets for partnerships or corporations involved in a New York Agreement Dissolving Business Interest in Connection with Certain Real Property. Proper completion of this form ensures compliance with state regulations and aids in the smooth dissolution process.

A request for consent to dissolution in NYC is a formal document that must be submitted to obtain approval from interested parties before dissolving an LLC. This document outlines the intent to dissolve and seeks agreement from all members. Following this step ensures that the dissolution process proceeds smoothly, including the filing of a New York Agreement Dissolving Business Interest in Connection with Certain Real Property. If you need assistance with this process, consider using the uslegalforms platform to streamline your requirements.

Dissolving an LLC refers to the formal process of ending its existence, which involves filing documents and notifying the state. Terminating an LLC is often used interchangeably with dissolving but can also refer to internal decisions made to cease operation without completing formal dissolution steps. It is crucial to file a New York Agreement Dissolving Business Interest in Connection with Certain Real Property to legally complete the dissolution process and avoid future liabilities.