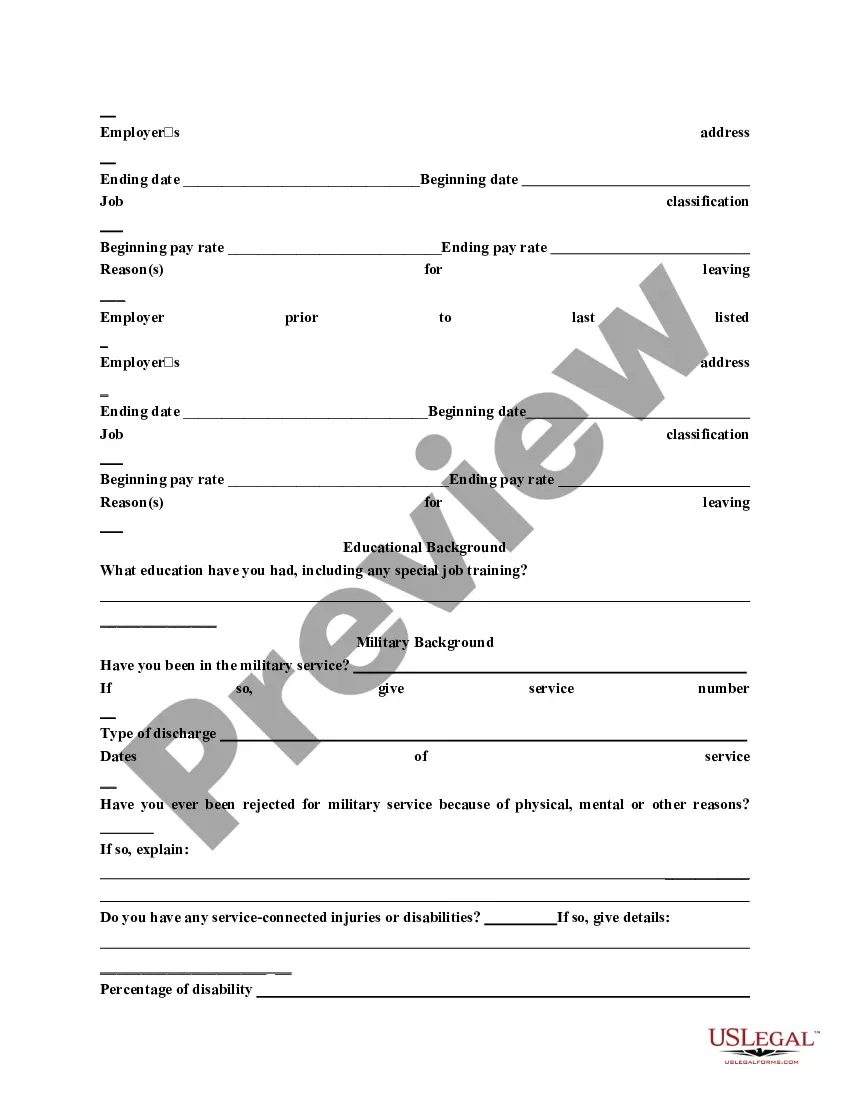

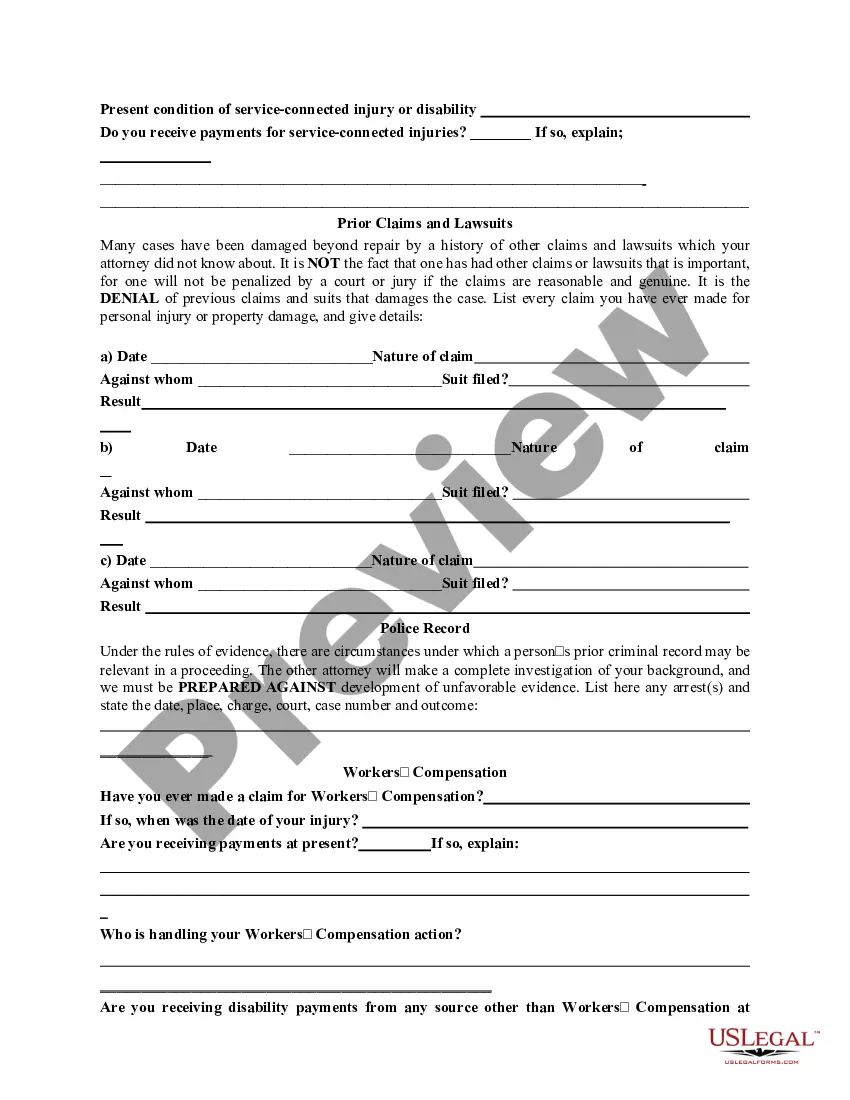

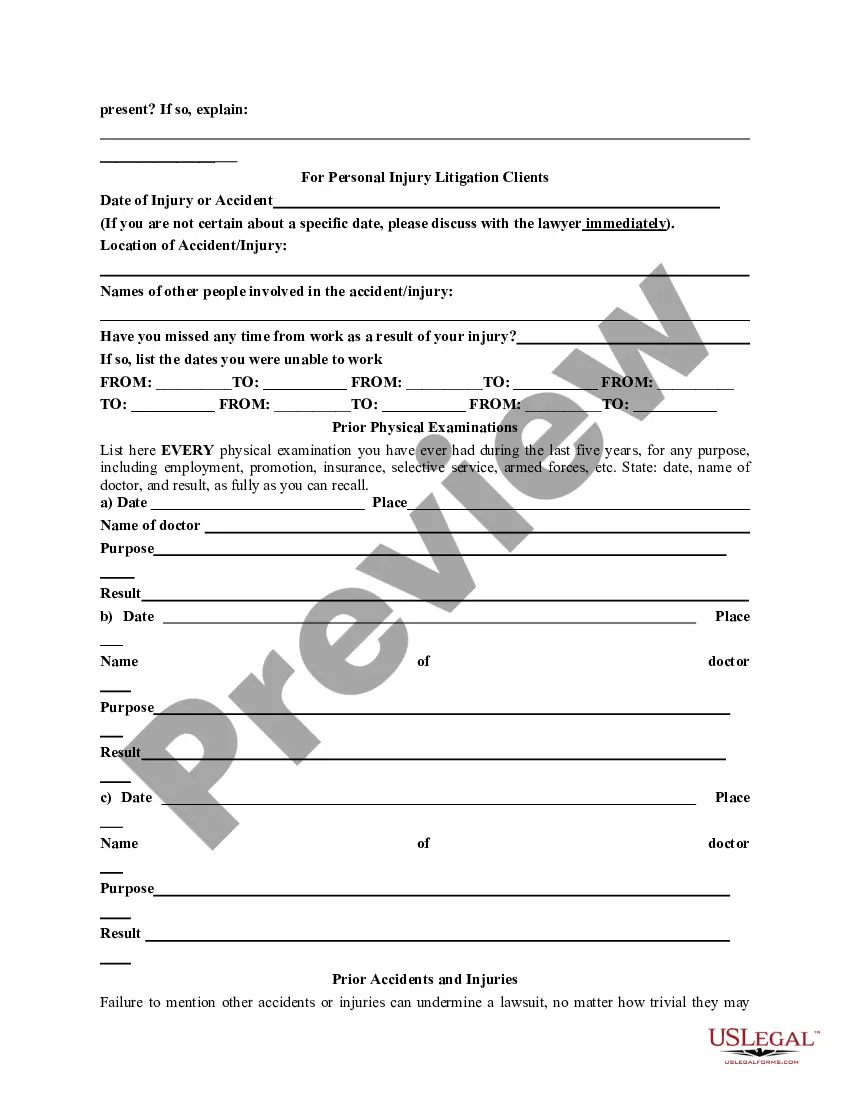

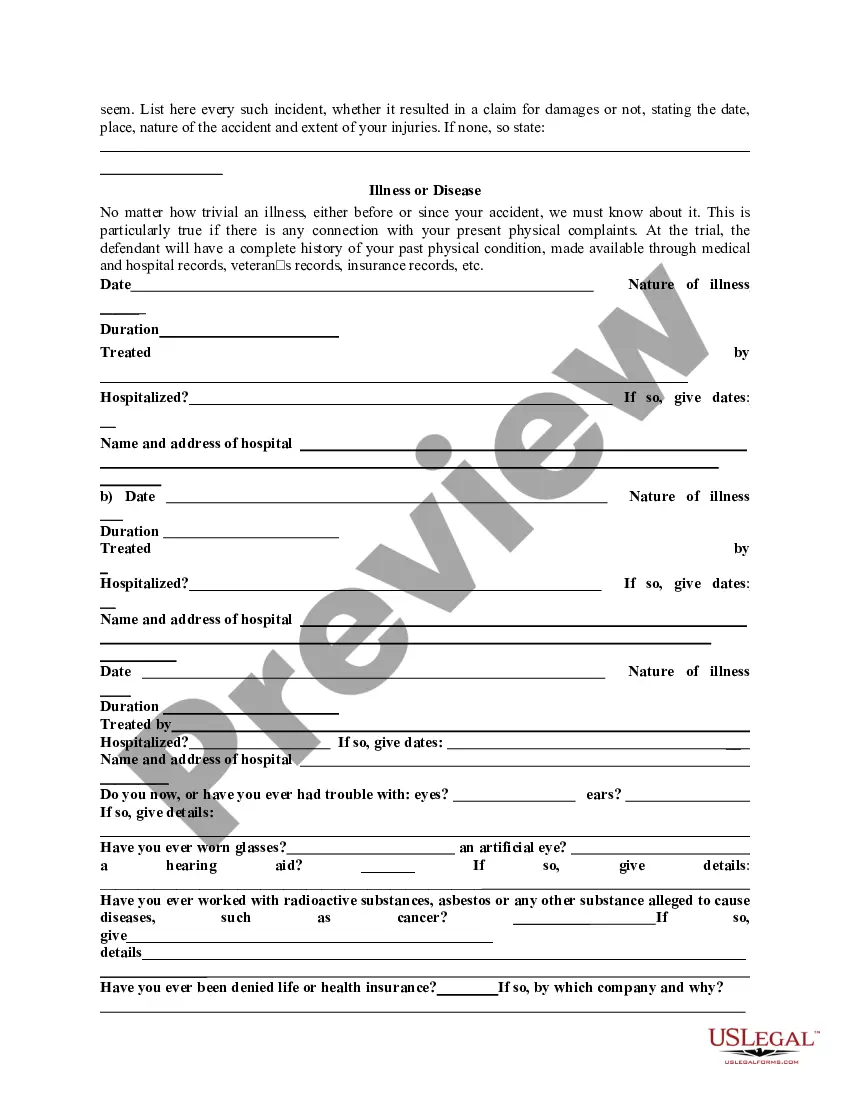

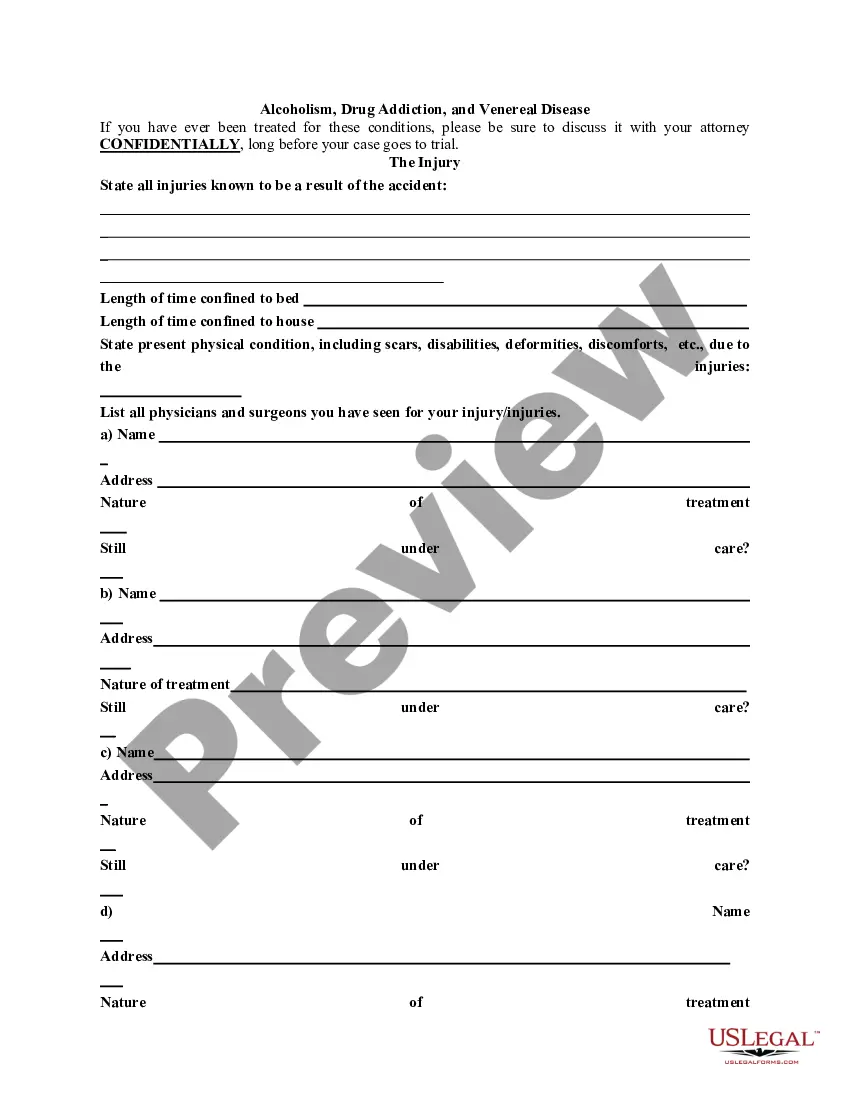

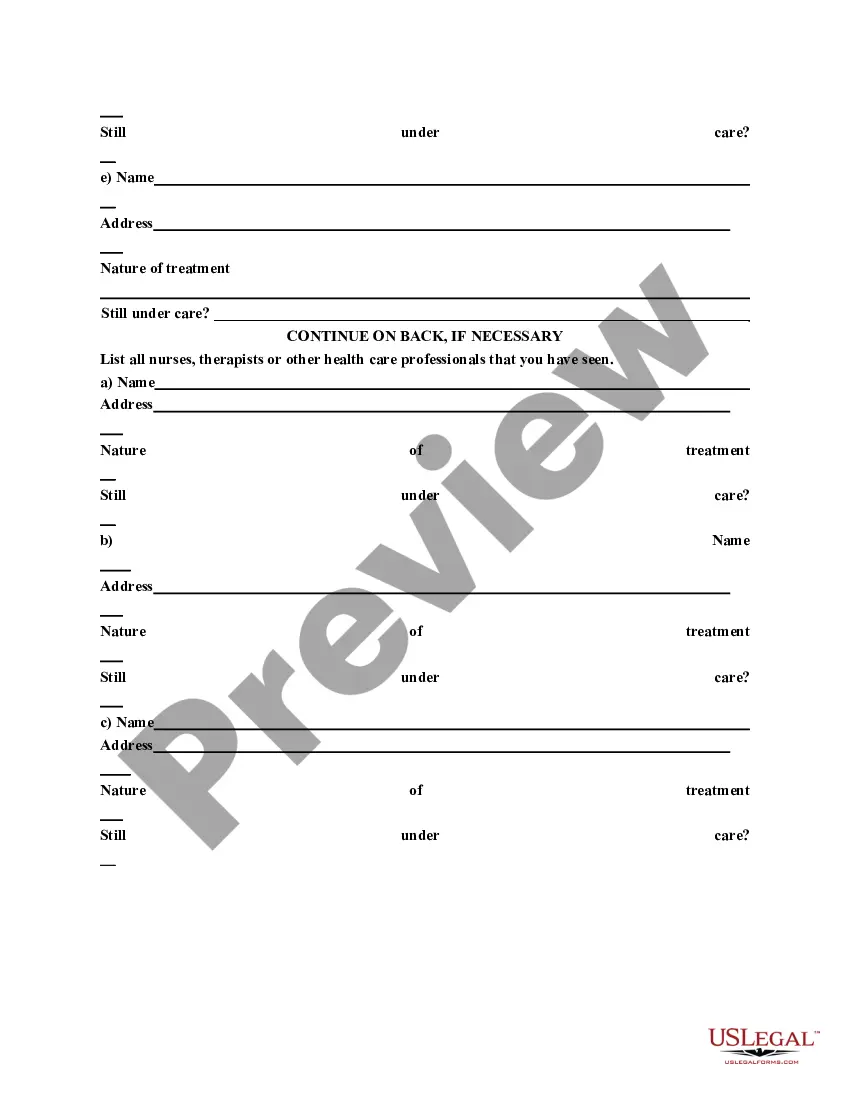

The first part of this questionnaire is designed to be useful in most civil and criminal representations. The last part can be used when screening prospective personal injury litigation clients. The questionnaire can be completed by the attorney during a first meeting with prospective clients or mailed to the client in advance and reviewed at a first meeting.

New York General Information Questionnaire

Description

How to fill out General Information Questionnaire?

If you need to be thorough, download, or create valid document templates, utilize US Legal Forms, the largest collection of legal forms available online.

Use the site’s user-friendly and convenient search feature to find the documents you require.

Various templates for business and personal purposes are categorized by types and states, or keywords. Utilize US Legal Forms to locate the New York General Information Questionnaire with just a few clicks.

Every legal document template you acquire is yours indefinitely. You have access to every form you purchased within your account. Go to the My documents section and choose a form to print or download again.

Acquire and download, and print the New York General Information Questionnaire with US Legal Forms. There are numerous specialized and state-specific forms available for your business or personal needs.

- If you are already a US Legal Forms user, sign in to your account and click on the Download button to get the New York General Information Questionnaire.

- You can also find forms you previously obtained in the My documents section of your account.

- If you are using US Legal Forms for the first time, follow the steps below.

- Step 1. Make sure you have selected the form for the correct city/state.

- Step 2. Use the Preview option to review the details of the form. Don't forget to read the description.

- Step 3. If you are not satisfied with the form, use the Search box at the top of the screen to find other versions of the legal document template.

- Step 4. Once you have found the form you need, click on the Buy now button. Choose the payment plan you prefer and enter your information to create an account.

- Step 5. Complete the purchase. You can use your credit card or PayPal account to finalize the transaction.

- Step 6. Download the format of the legal document and save it to your device.

- Step 7. Fill out, edit, and print or sign the New York General Information Questionnaire.

Form popularity

FAQ

Ing to Form IT-203-I, you must file a New York part-year or nonresident return if: You have any income from a New York source and your New York AGI exceeds your New York State standard deduction. You want to claim a refund for any New York State, New York City, or Yonkers taxes that were withheld from your pay.

As a nonresident, you only pay tax on New York source income, which includes earnings from work performed in New York State, and income from real property located in the state.

Creating the New York Part-Year/Nonresident return (IT-203 Form) To allocate your income, first create the New York part-year or nonresident return (Form IT-203). State Section. New York part-year or nonresident return. Income Subject to Tax.

Request for Information letters We may send you a Request for Information (Form DTF-948 or DTF-948-O) letter if we need documentation to support what you claimed on your personal income tax return.

You must complete Schedule C and attach Form IT-203-B to your return if you are claiming the college tuition itemized deduction. Note: If a student is claimed as a dependent on another person's New York State tax return, only the person who claims the student as a dependent may claim the itemized deduction.

Do I need to file? As a nonresident, you pay tax on your taxable income from California sources. Sourced income includes, but is not limited to: Services performed in California.

North Carolina imposes a tax on the taxable income of every nonresident who received income from: the ownership of any interest in real or tangible personal property in North Carolina; a business, trade, profession, or occupation carried on in North Carolina; or. gambling activities carried on in North Carolina.

To non-residents, living in the city for less than half the year means you won't have to fork out the cash to cover personal income tax, even if you have a residence there. The bad news is that unless you're well-off or own two homes, this is difficult to achieve and impossible for most people.