Whether a trust is to be revocable or irrevocable is very important, and the trust instrument should so specify in plain and clear terms. This form is a partial revocation of a trust (as to specific property) by the trustor pursuant to authority given to him/her in the trust instrument. This form is a generic example that may be referred to when preparing such a form for your particular state. It is for illustrative purposes only. Local laws should be consulted to determine any specific requirements for such a form in a particular jurisdiction.

New York Partial Revocation of Trust and Acknowledgment of Receipt of Notice of Partial Revocation by Trustee

Description

How to fill out Partial Revocation Of Trust And Acknowledgment Of Receipt Of Notice Of Partial Revocation By Trustee?

You can spend numerous hours online trying to locate the sanctioned document template that meets the state and federal requirements you need.

US Legal Forms offers an extensive collection of legal forms that are reviewed by professionals.

It is easy to download or print the New York Partial Revocation of Trust and Acknowledgment of Receipt of Notice of Partial Revocation by Trustee from our platform.

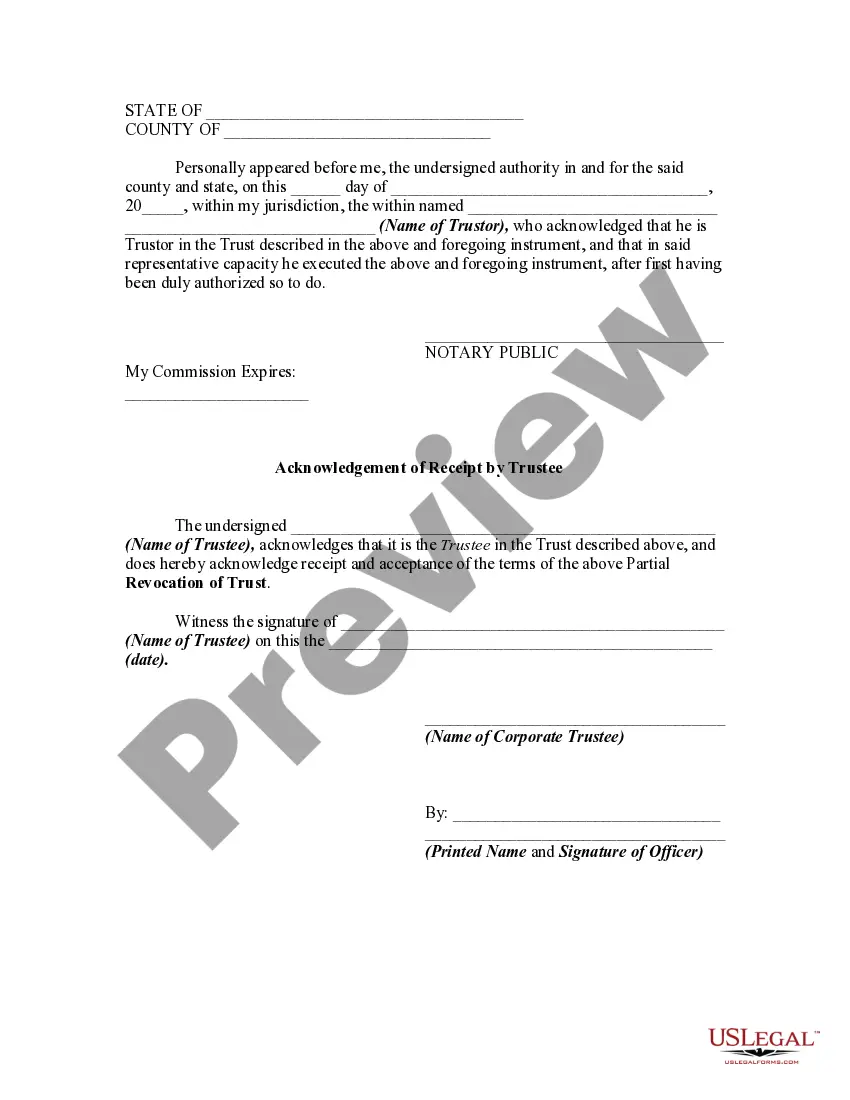

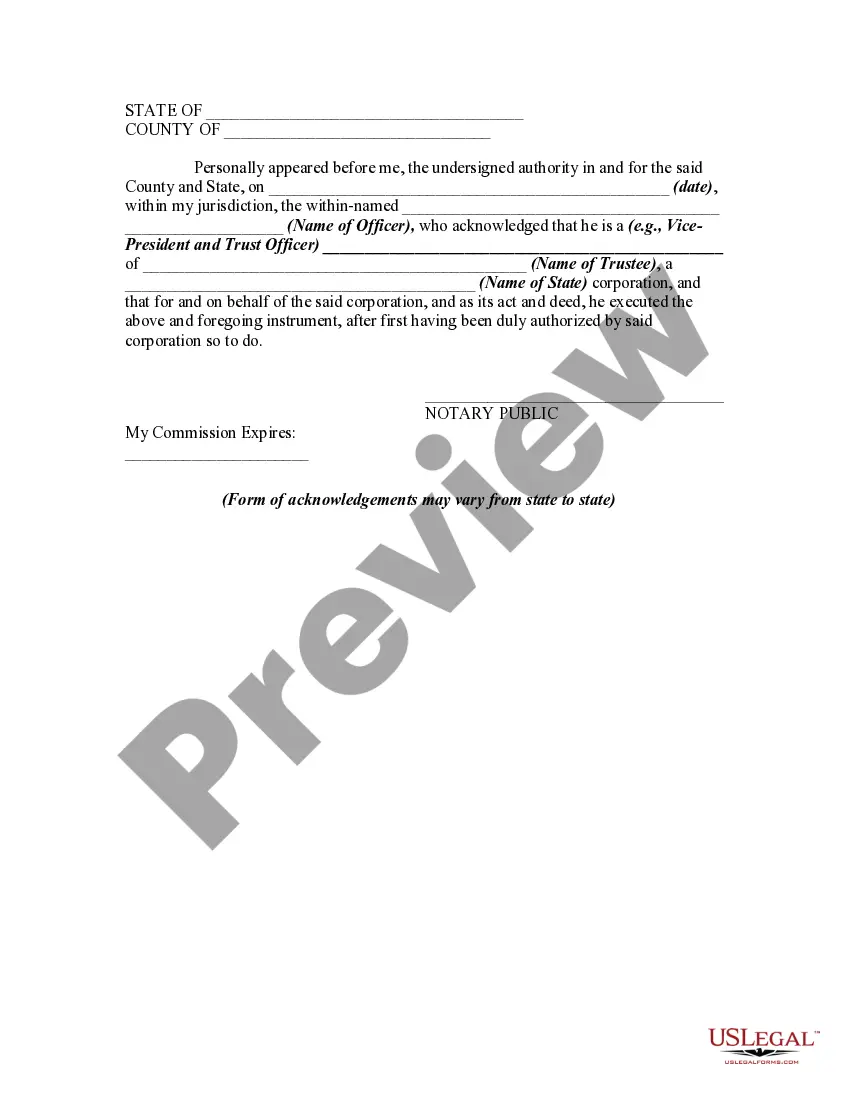

If available, use the Review button to examine the document template as well.

- If you already have a US Legal Forms account, you can Log In and click the Acquire button.

- Then, you can complete, edit, print, or sign the New York Partial Revocation of Trust and Acknowledgment of Receipt of Notice of Partial Revocation by Trustee.

- Every legal document template you purchase is yours indefinitely.

- To obtain an additional copy of the acquired form, visit the My documents section and click the relevant button.

- If this is your first time using the US Legal Forms website, follow the simple instructions below.

- First, ensure you have selected the correct document template for the region/city of your choice.

- Review the form description to confirm you have chosen the right template.

Form popularity

FAQ

An example of revocation is when a trustor decides to cancel certain terms of an existing trust document. For instance, if a specific asset is no longer intended to be part of the trust, the trustor can execute a partial revocation. This action follows the procedures outlined in the New York Partial Revocation of Trust and Acknowledgment of Receipt of Notice of Partial Revocation by Trustee, making sure that all parties are properly notified.

A notice of revocation informs interested parties that a trust or specific provisions within it have been revoked. For example, if a trustee decides to revoke a portion of a trust, they may serve a formal notice to beneficiaries and interested parties. This process aligns with the requirements of the New York Partial Revocation of Trust and Acknowledgment of Receipt of Notice of Partial Revocation by Trustee, ensuring that everyone is aware of the changes.

In New York, an executor is generally required to provide an accounting to beneficiaries to ensure transparency during the estate administration process. This accounting helps beneficiaries understand how the estate's assets are managed and distributed. By being informed about procedures such as the New York Partial Revocation of Trust and Acknowledgment of Receipt of Notice of Partial Revocation by Trustee, beneficiaries can stay better informed regarding their rights.

A trust can become null and void if it lacks essential components like a clear purpose, a valid trustor, or proper legal documentation. Additionally, if a trust fails to comply with state laws or is established under fraudulent circumstances, it may be invalidated. In New York, understanding the nuances of the New York Partial Revocation of Trust and Acknowledgment of Receipt of Notice of Partial Revocation by Trustee can help you ensure your trust remains valid.

Trusts can generally be revoked through a formal written document that states the trust's revocation, signed by the grantor. In many cases, you may also need to notify the trustee and beneficiaries. If you are considering a New York Partial Revocation of Trust and Acknowledgment of Receipt of Notice of Partial Revocation by Trustee, it is beneficial to follow legal procedures closely. For additional assistance, uslegalforms can provide templates and guidance tailored to your needs.

Revoking a revocable trust typically involves creating a written declaration that clearly states your intent to revoke the trust. In New York, it is advisable to include a formal notice to all beneficiaries and keep a copy for your records. The Acknowledgment of Receipt of Notice of Partial Revocation by Trustee can be useful in this process, ensuring that all parties are informed. If you need assistance, uslegalforms offers tools and resources to guide you through the revocation.

In New York, to revoke a will, you should create a new will with clear intent or physically destroy the original document. You may also explicitly state in the new will that it revokes any previous documents. It’s crucial to ensure that the new will meets NY state laws and reflects your current wishes. Consulting a legal expert can help you understand your options better.

To terminate an irrevocable trust in New York, you generally need the consent of all the beneficiaries, along with a court’s approval. You would also require a formal document outlining the intent to revoke the trust, which should be executed correctly. Furthermore, if you are the trustee, an Acknowledgment of Receipt of Notice of Partial Revocation by Trustee may be necessary to document the process. Legal advice is recommended to navigate these complexities.

A trust can be broken by various factors, including the explicit terms set forth in the trust document, beneficiary agreements, or legal challenges in court. Changes in circumstances, such as the death of the grantor or the completion of the trust's purpose, can also dissolve a trust. Understanding the elements concerning New York Partial Revocation of Trust and Acknowledgment of Receipt of Notice of Partial Revocation by Trustee will provide clarity on how a trust may terminate.

Deactivating a trust usually involves following the terms laid out in the trust document regarding its termination. Depending on the specific provisions, a successful deactivation may require the consent of beneficiaries and the trustee. It's crucial to consult legal resources or professionals knowledgeable in areas like New York Partial Revocation of Trust and Acknowledgment of Receipt of Notice of Partial Revocation by Trustee to navigate this process smoothly.