New York Contract with Employee to Work in a Foreign Country

Description

How to fill out Contract With Employee To Work In A Foreign Country?

Are you currently in a situation where you need documentation for either business or personal purposes on a daily basis.

There are many legal document templates available online, but finding ones you can rely on is challenging.

US Legal Forms offers a vast array of document templates, including the New York Contract with Employee to Work in a Foreign Country, designed to meet federal and state regulations.

Once you find the correct form, click Buy now.

Select the pricing plan you desire, fill in the required information to create your account, and pay for the purchase using your PayPal or credit card. Choose a convenient document format and download your copy. To find all the document templates you have purchased, navigate to the My documents section. You can obtain an additional copy of the New York Contract with Employee to Work in a Foreign Country at any time if needed. Simply select the desired form to download or print the document template. Use US Legal Forms, the most extensive collection of legal forms, to save time and minimize errors. The service offers professionally crafted legal document templates that can be utilized for a wide range of purposes. Create an account on US Legal Forms and start simplifying your life.

- If you are already familiar with the US Legal Forms website and possess an account, simply Log In.

- Then, you can download the New York Contract with Employee to Work in a Foreign Country template.

- If you do not have an account and wish to start using US Legal Forms, follow these steps.

- Locate the form you need and confirm it is for the appropriate area/region.

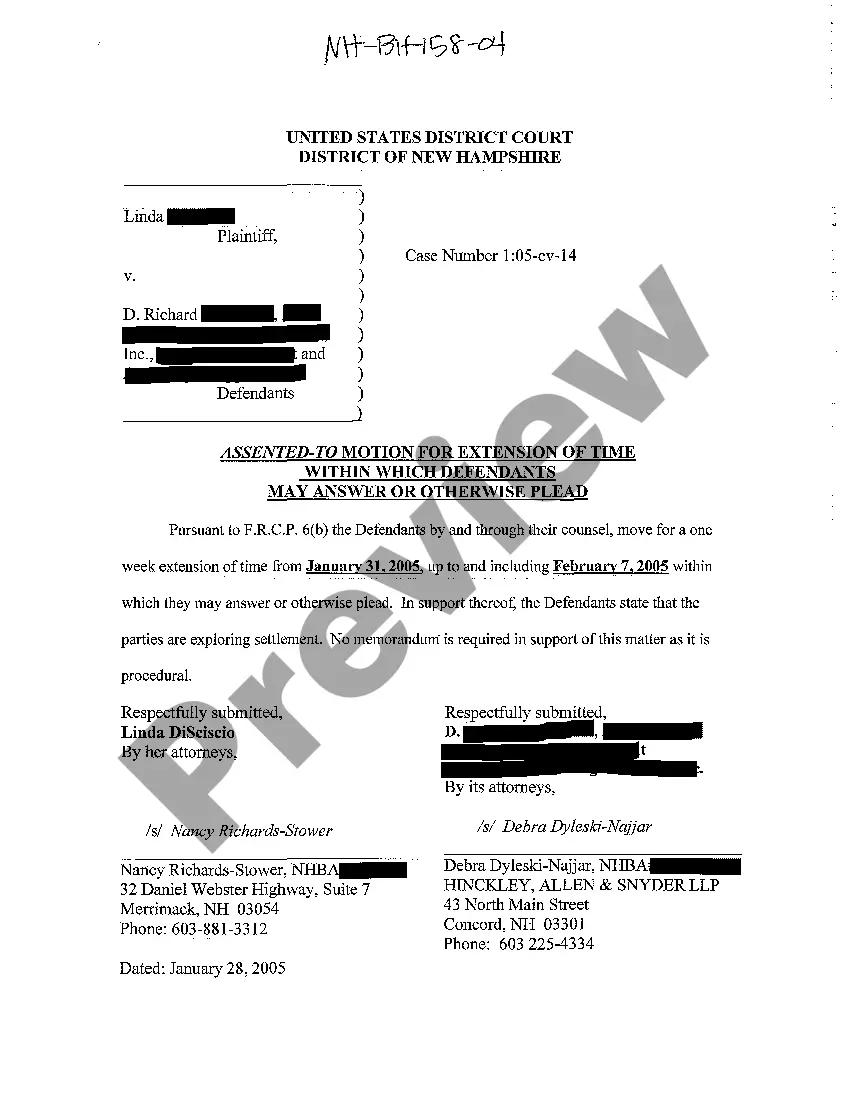

- Use the Preview button to review the form.

- Read the description to ensure that you have selected the correct form.

- If the form is not what you're looking for, use the Search field to find the document that suits your needs and requirements.

Form popularity

FAQ

New York Labor law may apply to out-of-state employees if they are working under a New York contract. Even if the employee works outside of New York, the terms outlined in a New York Contract with Employee to Work in a Foreign Country provide specific legal protections. It is essential for employers to be aware of these laws to ensure compliance. Consulting legal platforms like USLegalForms can help clarify any doubts concerning labor laws.

Yes, as a foreigner, you can obtain a job in New York. However, it typically requires a valid work visa or authorization. Employers often seek candidates who can demonstrate relevant skills and experience, and having a well-prepared New York Contract with Employee to Work in a Foreign Country can facilitate the employment process. The right resources can help you understand the application process and job market.

Yes, a US company can hire a foreign employee to work in another country. However, it is important to establish a New York Contract with Employee to Work in a Foreign Country to address legal and tax implications. This contract can help clarify responsibilities, expectations, and compliance with both US and local laws. Consulting a legal expert ensures that the contract meets all necessary requirements.

Yes, you can sponsor an individual for a work visa in the USA, provided you meet certain criteria. First, you must have a legitimate job offer for the person and a valid reason for their employment. When drafting a New York Contract with Employee to Work in a Foreign Country, be specific about the role and intentions. Utilizing reputable sources like uslegalforms can provide guidance on navigating the sponsorship requirements efficiently.

Sponsoring an employee for a work visa involves several key steps. First, you must determine the appropriate visa category based on the employee's qualifications and the job requirements. Following that, you will draft a clear New York Contract with Employee to Work in a Foreign Country that specifies job terms and compensation. Working with legal experts or resources from uslegalforms can help streamline the visa application process.

New employees in New York State typically need to complete the W-4 form for tax withholding and the New York State IT-2104 form. Additionally, employers may require a completed I-9 form to verify the employee's identity and work authorization. When you establish a New York Contract with Employee to Work in a Foreign Country, ensure you provide these forms to ensure compliance. It’s crucial to keep complete records of all documents.

To hire someone from another country, start by identifying the appropriate work visa for the position. Next, draft a New York Contract with Employee to Work in a Foreign Country that details job responsibilities and expectations. Ensure you adhere to all federal and state regulations. Consider using platforms like uslegalforms to access templates and resources that simplify the hiring process.

Yes, you can sponsor a non-family member to relocate to the USA for work. This process often involves obtaining a work visa for the individual, ensuring compliance with US immigration laws. When creating a New York Contract with Employee to Work in a Foreign Country, it's essential to outline the terms of employment clearly. Utilizing the right legal resources can guide you through the sponsorship process effectively.

Yes, U.S. companies can hire remote workers from abroad, expanding their talent pool beyond borders. This hiring practice often requires careful consideration of contracts, taxes, and legal implications, particularly regarding the New York Contract with Employee to Work in a Foreign Country. Utilizing platforms like uslegalforms can help you draft clear and compliant contracts, ensuring mutual understanding between employers and employees.

Yes, you can work for an American company while living in another country. Many businesses offer remote positions or establish foreign branches to accommodate their workforce's needs, simplifying the New York Contract with Employee to Work in a Foreign Country. Ensure that the employment agreement outlines your rights and obligations while residing abroad for a smooth working experience.