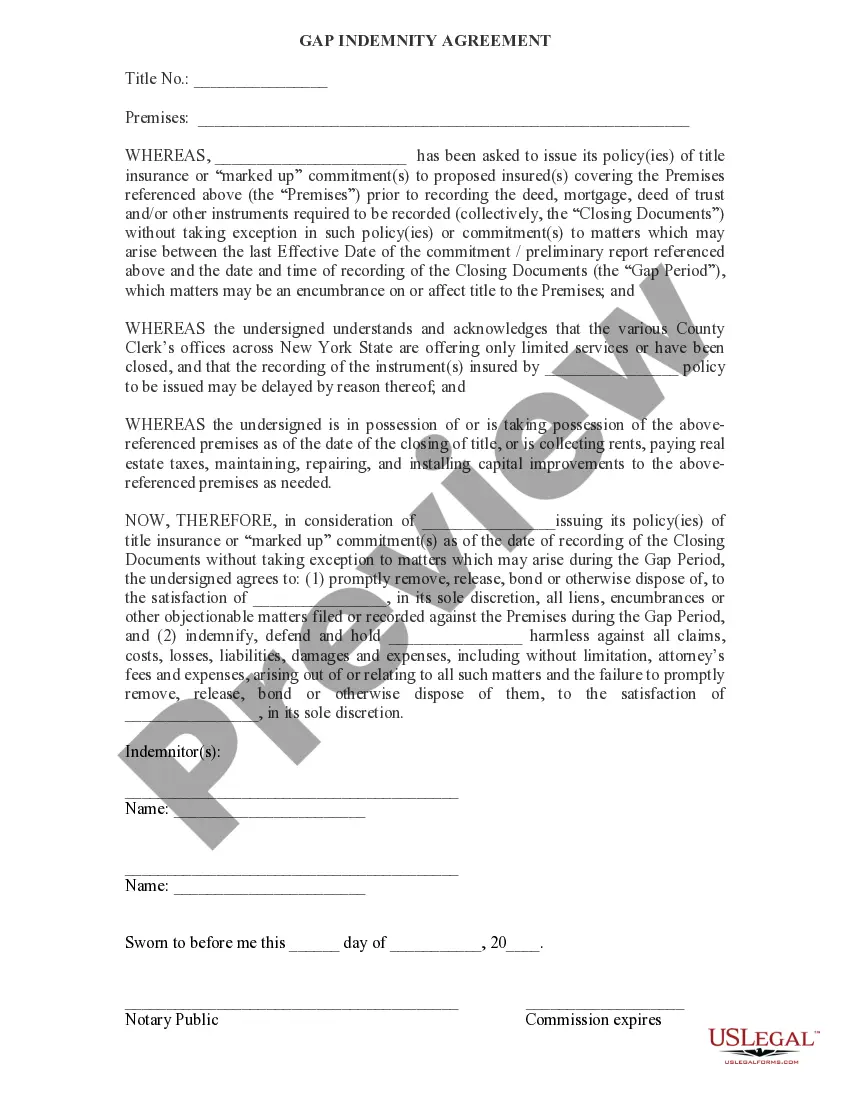

The New York Gap Indemnity Agreement is a legal agreement between a lender and a borrower that is unique to the state of New York. The agreement serves to protect the lender from any financial losses resulting from the borrower’s default on the loan. The agreement also outlines the responsibilities of both the lender and the borrower in the event of a default. The New York Gap Indemnity Agreement consists of three main types: the unconditional gap indemnity agreement, the conditional gap indemnity agreement, and the limited gap indemnity agreement. The unconditional gap indemnity agreement is a full coverage agreement that requires the borrower to indemnify the lender for all losses incurred due to the borrower’s default on the loan. The conditional gap indemnity agreement requires the borrower to only indemnify the lender for certain losses, such as foreclosure costs and attorney fees. The limited gap indemnity agreement is a limited coverage agreement that only requires the borrower to indemnify the lender for certain losses in the event of a default. Overall, the New York Gap Indemnity Agreement is an important document for lenders and borrowers in the state of New York. It helps to protect lenders from financial losses in the event of a borrower’s default and outlines the responsibilities of both parties.

New York Gap Indemnity Agreement

Description

Get your form ready online

Our built-in tools help you complete, sign, share, and store your documents in one place.

Make edits, fill in missing information, and update formatting in US Legal Forms—just like you would in MS Word.

Download a copy, print it, send it by email, or mail it via USPS—whatever works best for your next step.

Sign and collect signatures with our SignNow integration. Send to multiple recipients, set reminders, and more. Go Premium to unlock E-Sign.

If this form requires notarization, complete it online through a secure video call—no need to meet a notary in person or wait for an appointment.

We protect your documents and personal data by following strict security and privacy standards.

Make edits, fill in missing information, and update formatting in US Legal Forms—just like you would in MS Word.

Download a copy, print it, send it by email, or mail it via USPS—whatever works best for your next step.

Sign and collect signatures with our SignNow integration. Send to multiple recipients, set reminders, and more. Go Premium to unlock E-Sign.

If this form requires notarization, complete it online through a secure video call—no need to meet a notary in person or wait for an appointment.

We protect your documents and personal data by following strict security and privacy standards.

Looking for another form?

Key Concepts & Definitions

A Gap Indemnity Agreement is a specialized form of insurance coverage designed to cover the 'gap' between the actual cash value of an asset and the amount still owed on it. This is most commonly seen in auto insurance, where if a vehicle is totaled, the insurance payout may be less than the remaining car loan amount. The agreement ensures the borrower is not out-of-pocket for the difference. This concept is sometimes referred to as 'GAP insurance.'

Step-by-Step Guide

- Evaluate Your Need: Determine if gap insurance is appropriate for you, considering factors such as your car's depreciation rate and your loan terms.

- Review Your Existing Insurance Policy: Check if your current auto insurance policy includes gap coverage or offers it as an optional rider.

- Consider Your Financing Agreement: Analyze your loan terms to understand how much you might owe in the event of a total loss.

- Purchase a Gap Indemnity Agreement: If your current insurer doesn't offer GAP coverage or if you find a better rate elsewhere, purchase a standalone policy.

- Keep Records: Safely store all related documents for easy access if you need to file a claim.

Risk Analysis

The primary risk associated with not having a Gap Indemnity Agreement is financial vulnerability. In the event that a financed car is totaled, without GAP coverage, the loan's outstanding balance could greatly exceed the insurance payoff, leading to significant out-of-pocket expenses. Another risk is overpaying for coverage that might not be necessary if the loan is small or the vehicle depreciates slowly.

Key Takeaways

Gap Indemnity Agreements provide an important safety net for individuals financing high-value assets against total loss situations. It is essential for consumers to assess their need based on their financial and insurance situation to prevent potential financial setbacks.

How to fill out New York Gap Indemnity Agreement?

US Legal Forms is the most simple and affordable way to locate appropriate legal templates. It’s the most extensive web-based library of business and personal legal documentation drafted and verified by lawyers. Here, you can find printable and fillable templates that comply with federal and local regulations - just like your New York Gap Indemnity Agreement.

Obtaining your template requires only a few simple steps. Users that already have an account with a valid subscription only need to log in to the web service and download the document on their device. Afterwards, they can find it in their profile in the My Forms tab.

And here’s how you can get a professionally drafted New York Gap Indemnity Agreement if you are using US Legal Forms for the first time:

- Read the form description or preview the document to make certain you’ve found the one corresponding to your needs, or find another one utilizing the search tab above.

- Click Buy now when you’re sure of its compatibility with all the requirements, and select the subscription plan you prefer most.

- Register for an account with our service, sign in, and pay for your subscription using PayPal or you credit card.

- Select the preferred file format for your New York Gap Indemnity Agreement and save it on your device with the appropriate button.

Once you save a template, you can reaccess it anytime - simply find it in your profile, re-download it for printing and manual fill-out or upload it to an online editor to fill it out and sign more effectively.

Benefit from US Legal Forms, your trustworthy assistant in obtaining the required official paperwork. Try it out!

Form popularity

FAQ

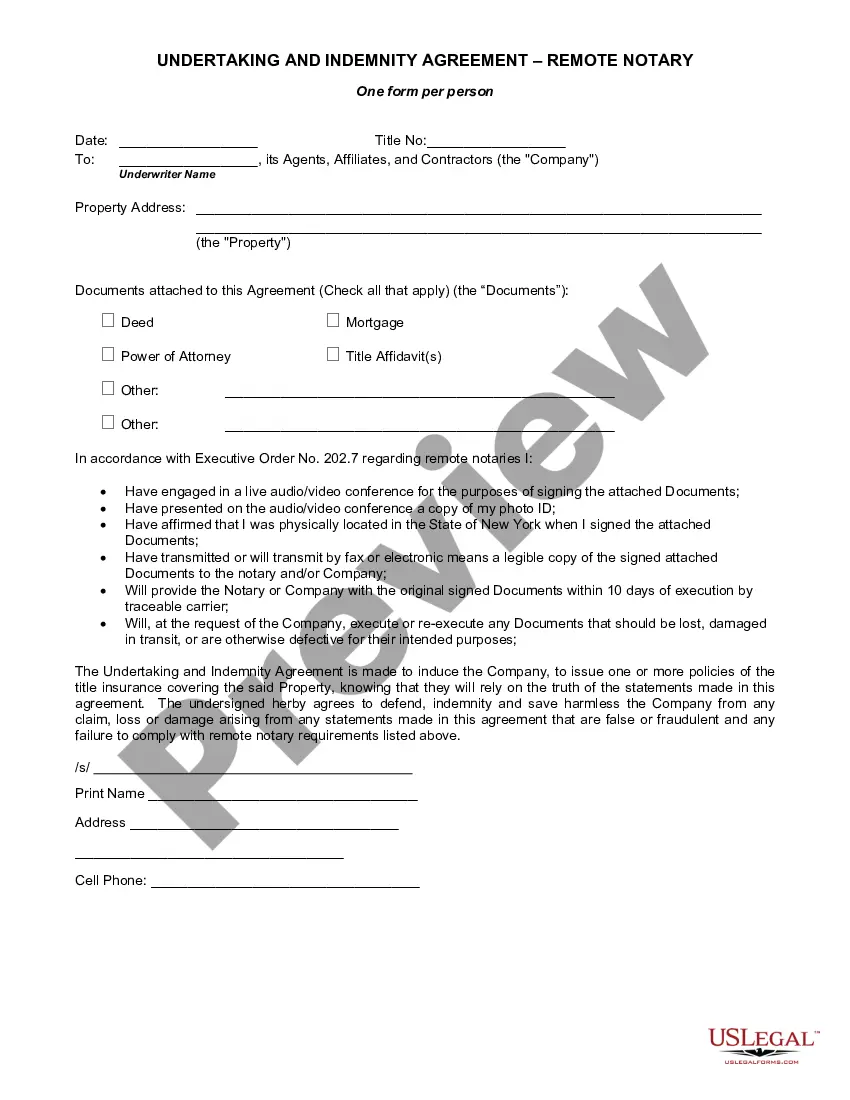

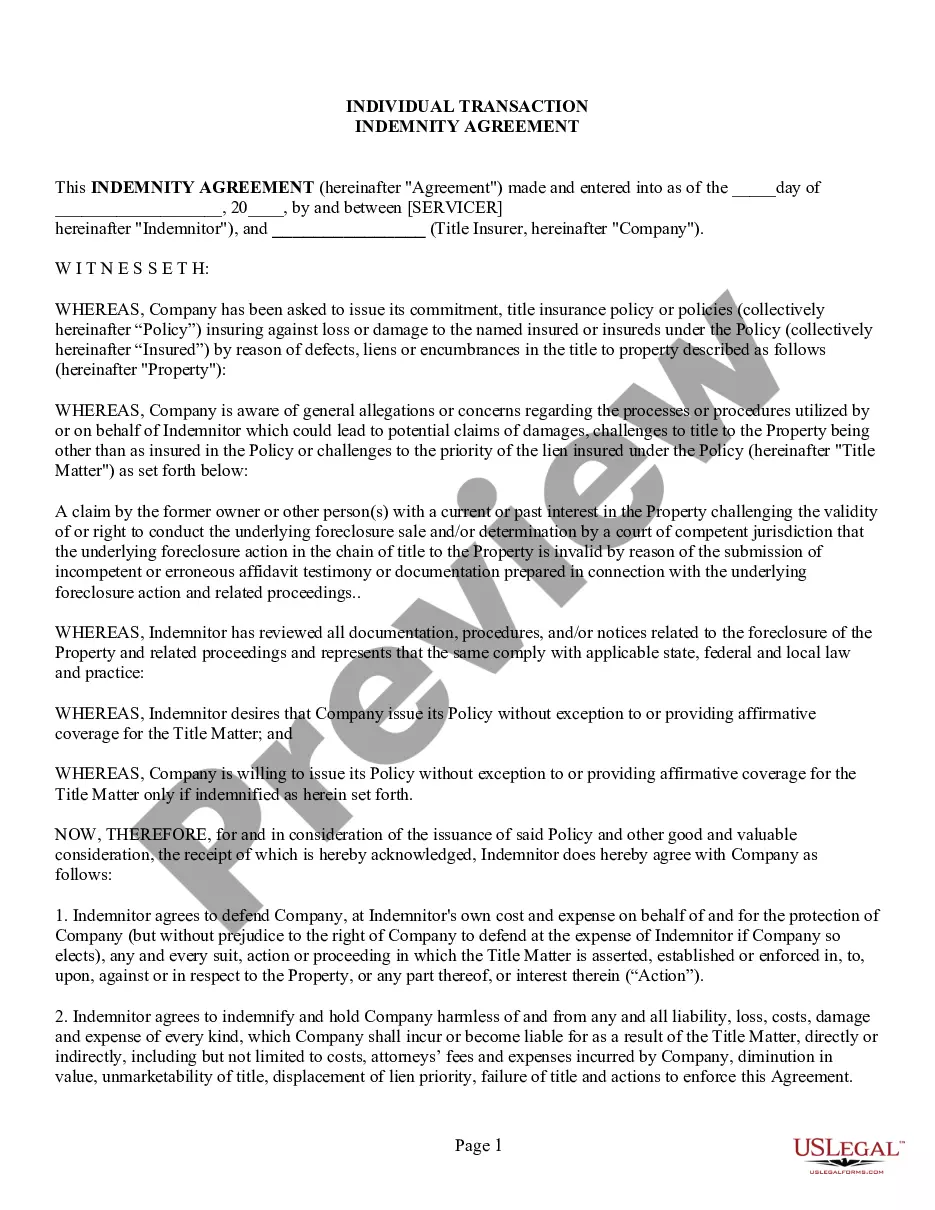

An indemnity requested by a title insurance company from either a borrower or a seller to minimize its risk during the time between closing a real estate transaction and the actual recording of the instrument.

: to reduce or eliminate a difference between two people, groups, or things. often + between. We hope to close the gap between well-funded suburban schools and the struggling schools in poorer communities.

Gap insurance is an endorsement added to the title policy that provides additional coverage for title defects that may arise during a gap period.

The Gap Between the Closing and Disbursal of Funds There is often a gap in time between the actual closing and disbursal of funds, and recording of the deed or mortgage at the county. Title insurance insures this ?gap? in time should a title defect arise prior to the new deed of mortgage being filed.

A mutual indemnity agreement, also known as a mutual indemnity treaty, is an agreement (not a legally binding contract) between specific underwriters within a state to indemnify or hold one another harmless for some loss or damage for specific actions that may cause damage or loss related to a potential title claim.