New York Certificate of Release of Federal Tax Lien

Description

Key Concepts & Definitions

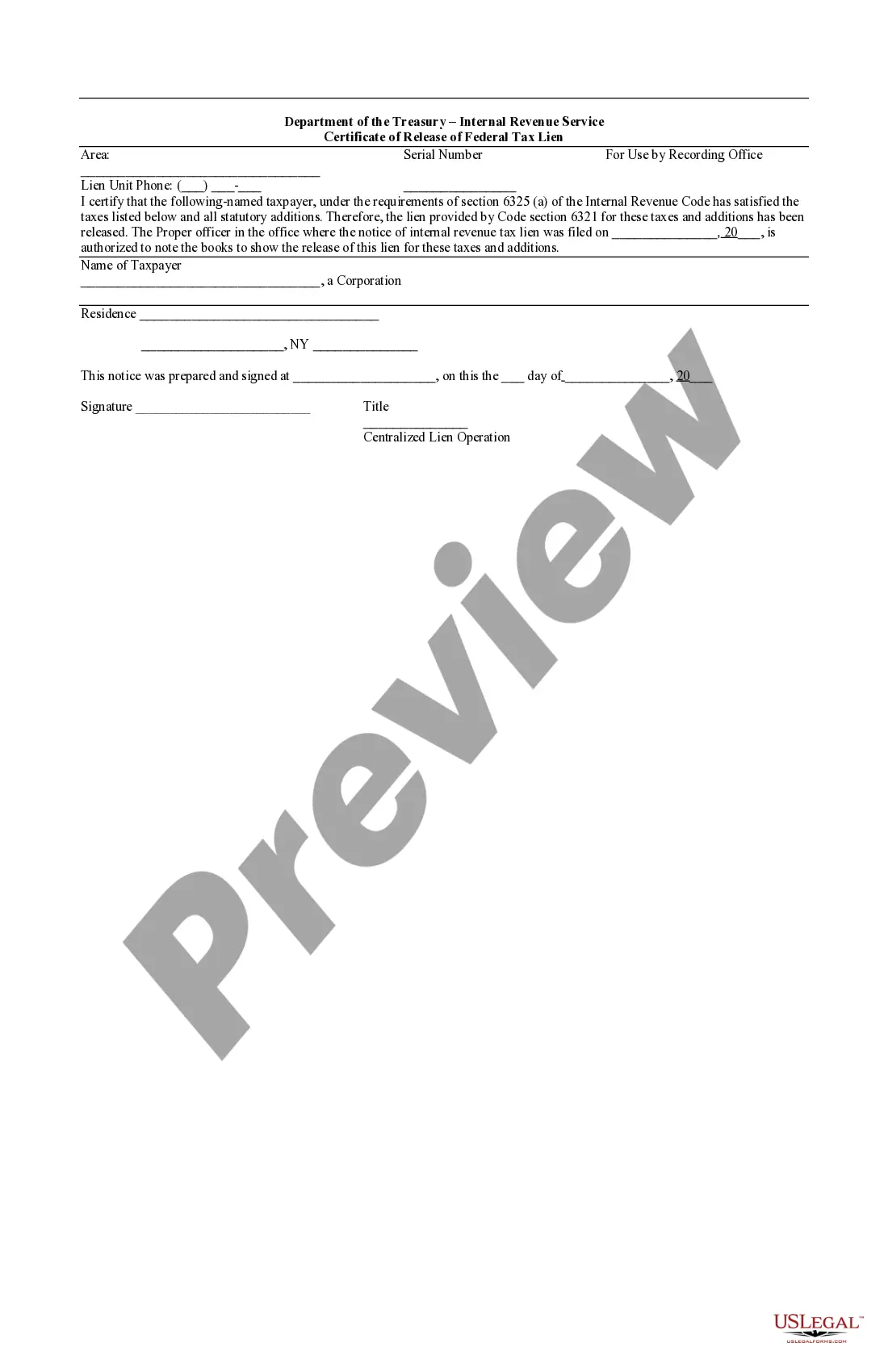

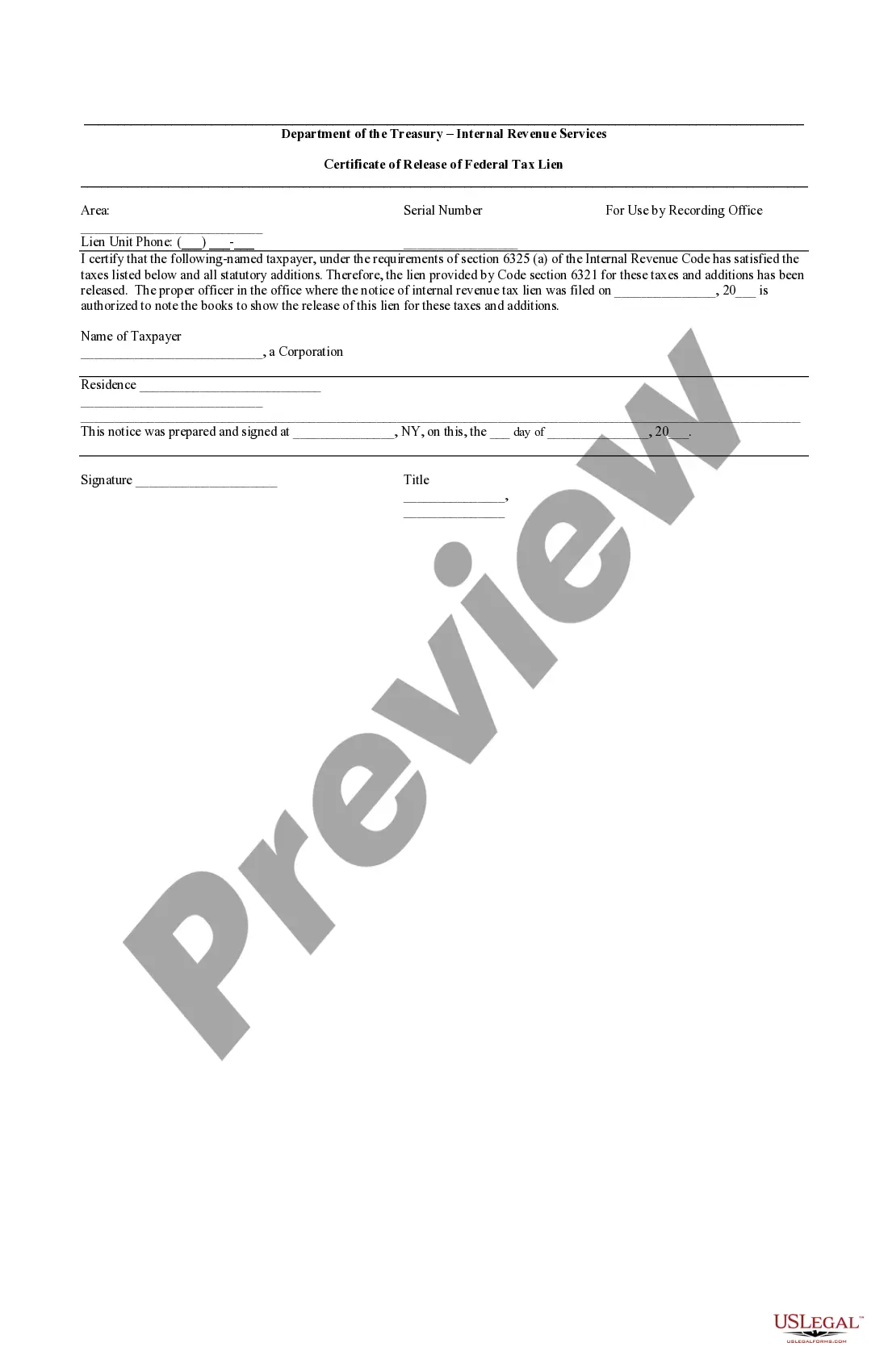

Certificate of Release of Federal Tax Lien: This is an official document from the IRS, signifying that a previously filed Notice of Federal Tax Lien for a specific tax debt has been released because the debt has been either fully paid or otherwise settled.

Tax Lien: A legal claim by the government against the properties of an individual or business for not paying tax debts.

Step-by-Step Guide to Obtaining a Certificate of Release of Federal Tax Lien

- Confirm your federal tax balance: Get a clear understanding of your outstanding tax liability by requesting tax information directly from the IRS.

- Payoff tax debt: Settle the entire amount or negotiate a payment agreement to manage the federal taxes owed.

- Contact revenue advocate: If facing hardship or difficulties, consult a revenue advocate for assistance with the process.

- Apply for a certificate release: Once the debt is settled, request the IRS for a Certificate of Release of Federal Tax Lien.

- Address partial release lien or erroneous NFTL issues: If there are errors or specific sections of the lien to be released differently, address these with the IRS.

- Receive and verify the certificate: Once received, check the certificate for accurate details regarding the release of the property from the lien.

Risk Analysis

Neglecting to manage or inaccurately handling the process for obtaining a certificate of release can lead to ongoing financial and legal implications, such as continued poor credit ratings or complications in selling or refinancing property. Proper attention is needed to ensure all IRS requirements are met for lien release.

Best Practices

- Early Resolution: Tackle tax liabilities as early as possible to avoid the accumulation of interest and penalties.

- Documentation: Keep thorough records of all communications and transactions with the IRS concerning your tax debt and lien release.

- Consult Professionals: Consider obtaining tax help from accountants or lawyers who specialize in tax issues, especially in more complex scenarios.

Common Mistakes & How to Avoid Them

- Ignoring Notices: Do not overlook any IRS notices regarding tax liens; early engagement can simplify resolution processes.

- Inaccurate Information: Verify all submitted information for accuracy to prevent delays in processing your lien release.

- Lack of Follow-up: After settling your tax debt, follow up with the IRS to ensure the release is processed timely.

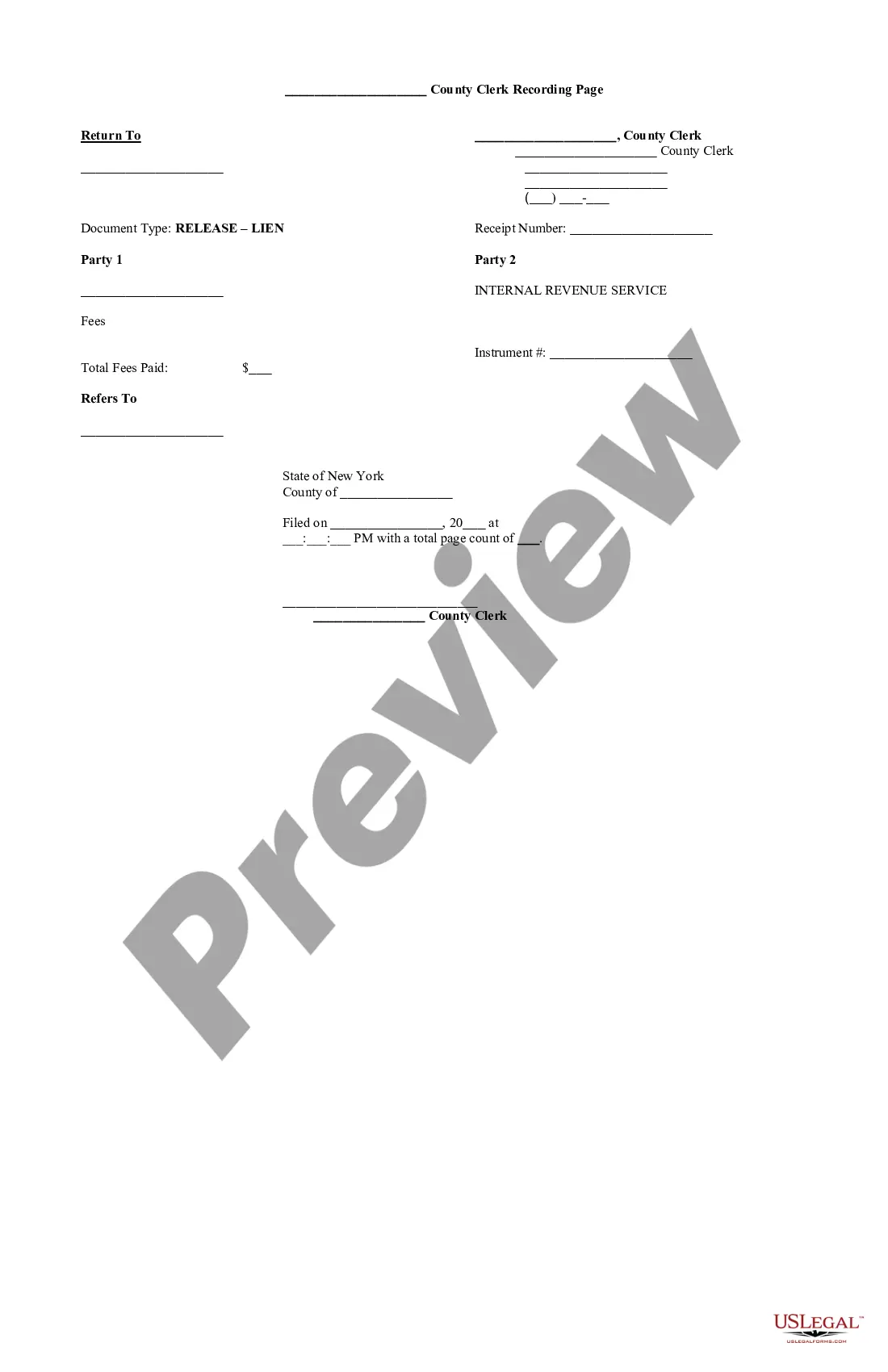

How to fill out New York Certificate Of Release Of Federal Tax Lien?

When it comes to filling out New York Certificate of Release of Federal Tax Lien, you almost certainly imagine an extensive process that involves getting a appropriate sample among countless very similar ones and then needing to pay legal counsel to fill it out to suit your needs. Generally speaking, that’s a sluggish and expensive option. Use US Legal Forms and choose the state-specific form within just clicks.

For those who have a subscription, just log in and then click Download to have the New York Certificate of Release of Federal Tax Lien template.

In the event you don’t have an account yet but need one, follow the point-by-point guideline listed below:

- Be sure the document you’re saving applies in your state (or the state it’s needed in).

- Do it by reading the form’s description and through clicking the Preview option (if accessible) to view the form’s content.

- Click Buy Now.

- Find the suitable plan for your financial budget.

- Subscribe to an account and choose how you want to pay out: by PayPal or by card.

- Save the document in .pdf or .docx format.

- Get the record on your device or in your My Forms folder.

Professional lawyers work on creating our samples to ensure that after downloading, you don't have to worry about enhancing content material outside of your personal info or your business’s information. Be a part of US Legal Forms and get your New York Certificate of Release of Federal Tax Lien example now.

Form popularity

FAQ

The tax lien will still expire at the end of 10 years even if the IRS has more than 10 years to collect unless the IRS timely refiles the lien. If the IRS timely refiles the tax lien, it is treated as continuation of the initial lien.

To release a tax lien, you have to pay the tax debt in full or enter into an Offer of Compromise where the IRS agrees to accept payment of just part of the lien in exchange for a release. Releasing a tax lien means that public records are updated to show that the IRS no longer has any legal claim to your property.

Paying your tax debt - in full - is the best way to get rid of a federal tax lien. The IRS releases your lien within 30 days after you have paid your tax debt. When conditions are in the best interest of both the government and the taxpayer, other options for reducing the impact of a lien exist.

Form 668 (Z): Certificate of Release of Federal Tax Lien Section 6325(a) of the Internal Revenue Code enables us to negotiate for a release of Federal Tax Lien after a liability becomes fully paid or legally unenforceable.

When you pay off your full tax balance or when the IRS runs out of time to collect the balance, the IRS will automatically release your tax lien. This removes the lien from your property. If the lien isn't automatically released, you can write to the IRS to request the release certificate.