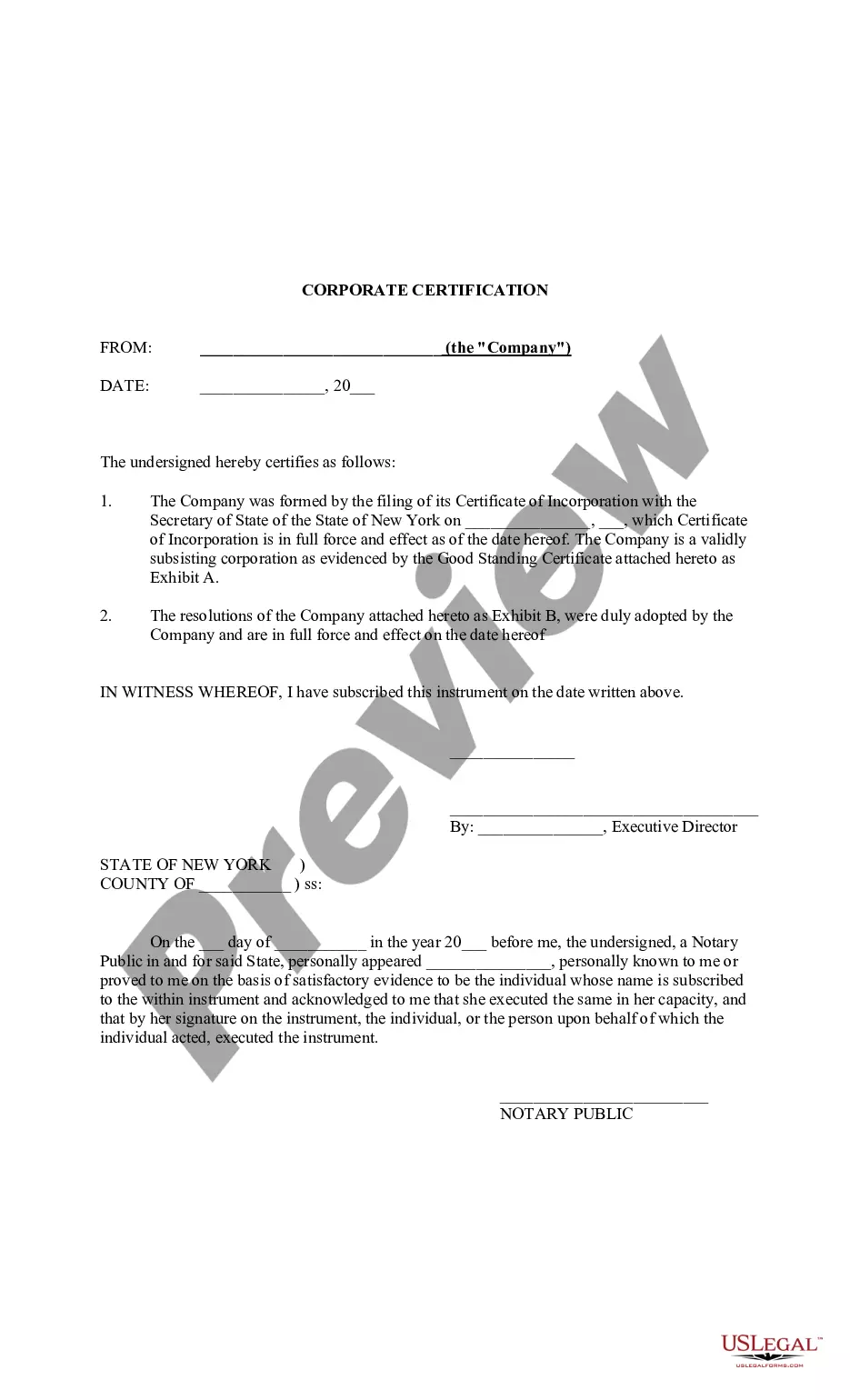

New York Corporate Certification

Description

Get your form ready online

Our built-in tools help you complete, sign, share, and store your documents in one place.

Make edits, fill in missing information, and update formatting in US Legal Forms—just like you would in MS Word.

Download a copy, print it, send it by email, or mail it via USPS—whatever works best for your next step.

Sign and collect signatures with our SignNow integration. Send to multiple recipients, set reminders, and more. Go Premium to unlock E-Sign.

If this form requires notarization, complete it online through a secure video call—no need to meet a notary in person or wait for an appointment.

We protect your documents and personal data by following strict security and privacy standards.

Make edits, fill in missing information, and update formatting in US Legal Forms—just like you would in MS Word.

Download a copy, print it, send it by email, or mail it via USPS—whatever works best for your next step.

Sign and collect signatures with our SignNow integration. Send to multiple recipients, set reminders, and more. Go Premium to unlock E-Sign.

If this form requires notarization, complete it online through a secure video call—no need to meet a notary in person or wait for an appointment.

We protect your documents and personal data by following strict security and privacy standards.

Looking for another form?

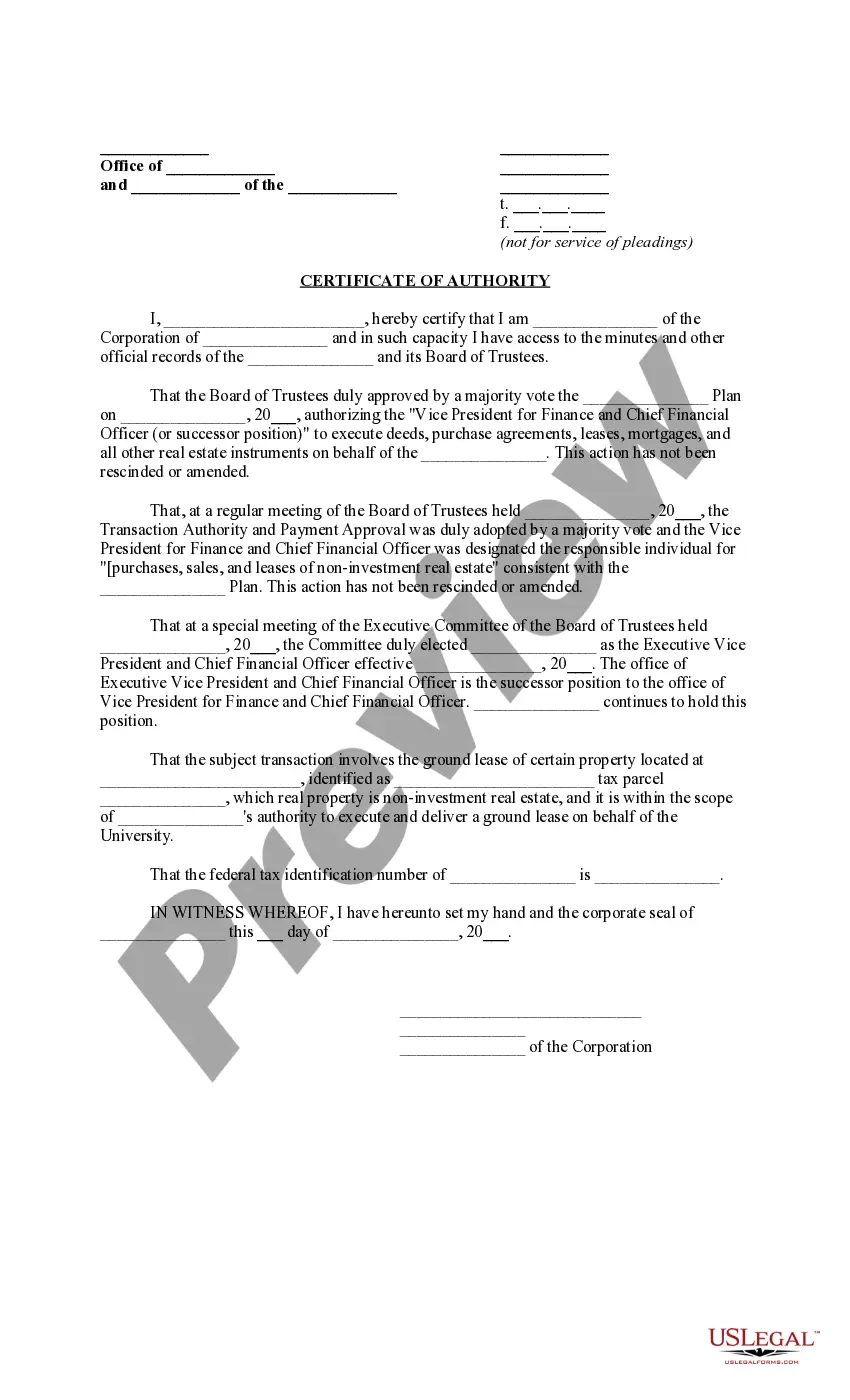

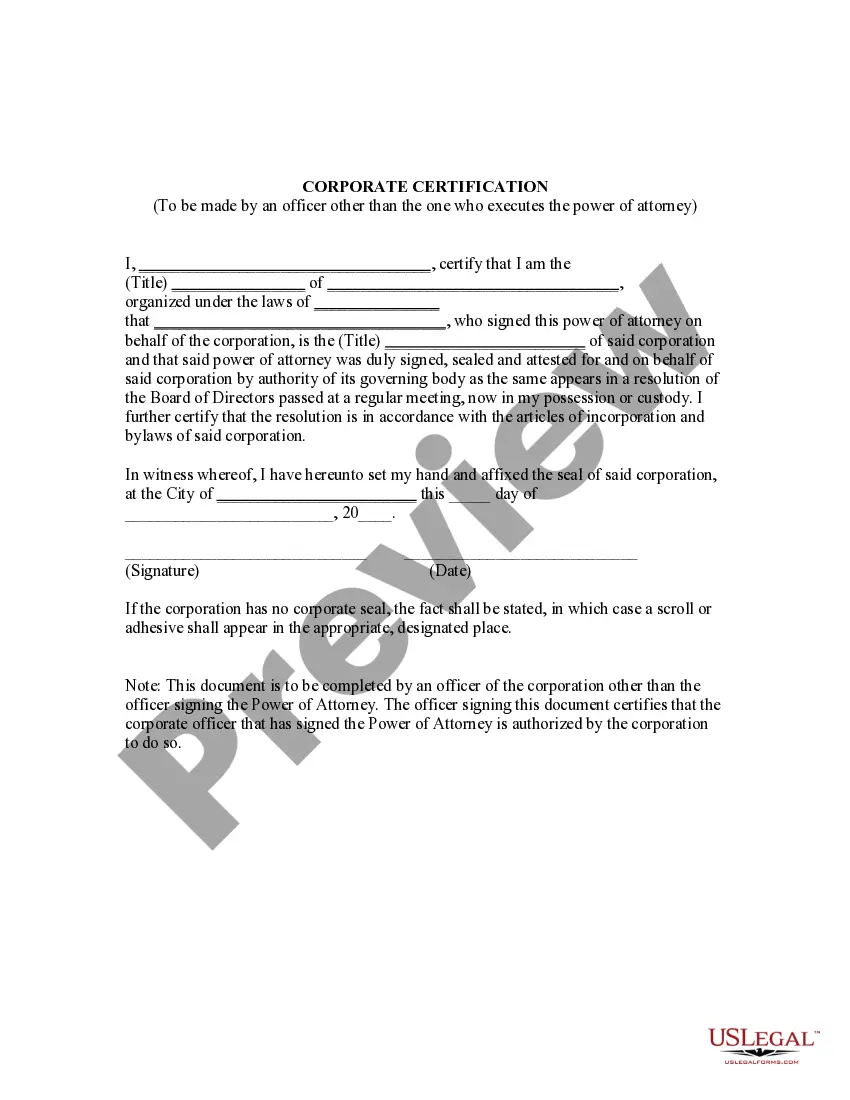

How to fill out New York Corporate Certification?

In terms of completing New York Corporate Certification, you almost certainly imagine a long process that consists of getting a ideal form among countless similar ones and after that needing to pay out an attorney to fill it out to suit your needs. In general, that’s a slow-moving and expensive choice. Use US Legal Forms and select the state-specific template within clicks.

If you have a subscription, just log in and click Download to have the New York Corporate Certification sample.

If you don’t have an account yet but want one, stick to the step-by-step manual below:

- Make sure the document you’re saving is valid in your state (or the state it’s required in).

- Do so by reading the form’s description and through clicking on the Preview function (if readily available) to see the form’s content.

- Click on Buy Now button.

- Pick the suitable plan for your financial budget.

- Sign up for an account and select how you would like to pay: by PayPal or by credit card.

- Download the document in .pdf or .docx format.

- Get the document on your device or in your My Forms folder.

Professional lawyers work on creating our templates to ensure that after saving, you don't have to worry about editing content outside of your individual details or your business’s info. Join US Legal Forms and receive your New York Corporate Certification example now.

Form popularity

FAQ

Paying NY Certificate Service $87.25 means that they are either sending you a fraudulent certificate or they are charging you money to contact the state on your behalf with the same information you write on the form and make you pay $62.25 extra to do so.

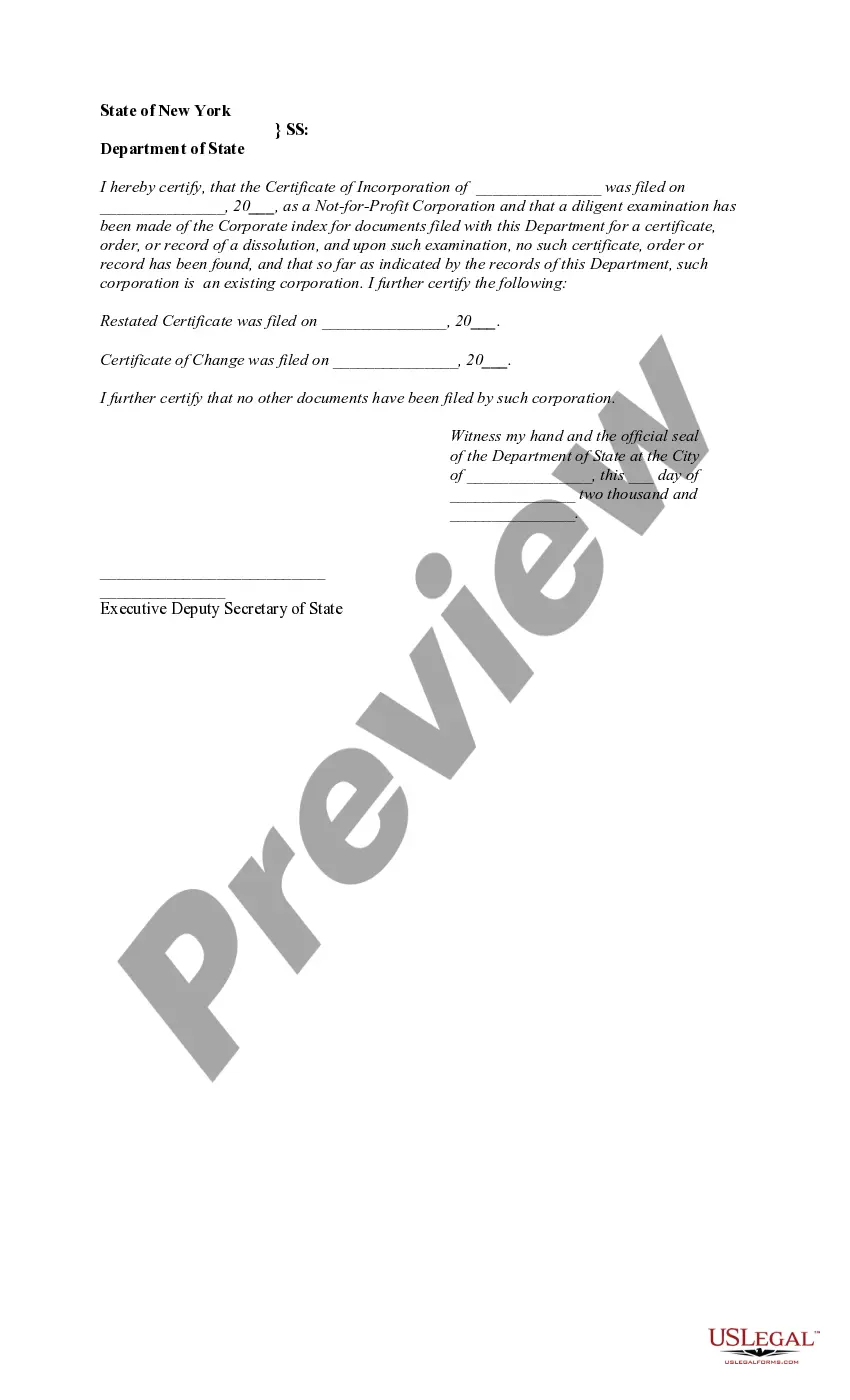

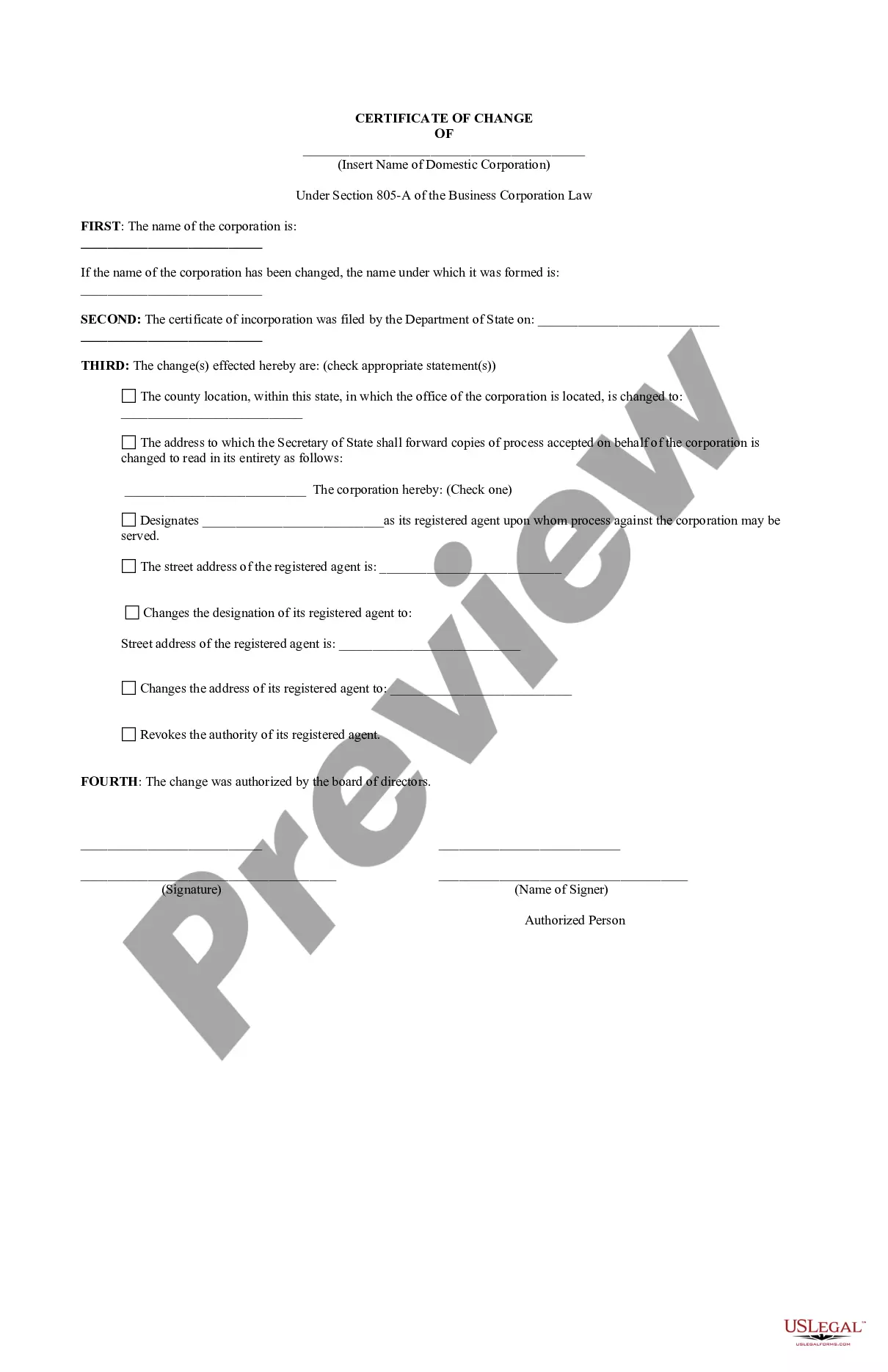

Filed with the Division of Corporations may be obtained by submitting a written request to the New York State Department of State, Division of Corporations, One Commerce Plaza, 99 Washington Avenue, Albany, NY 12231.

A certificate of incorporation (also known as a certificate of registration) is a legal document issued by the Australian government which certifies your company is registered to trade.

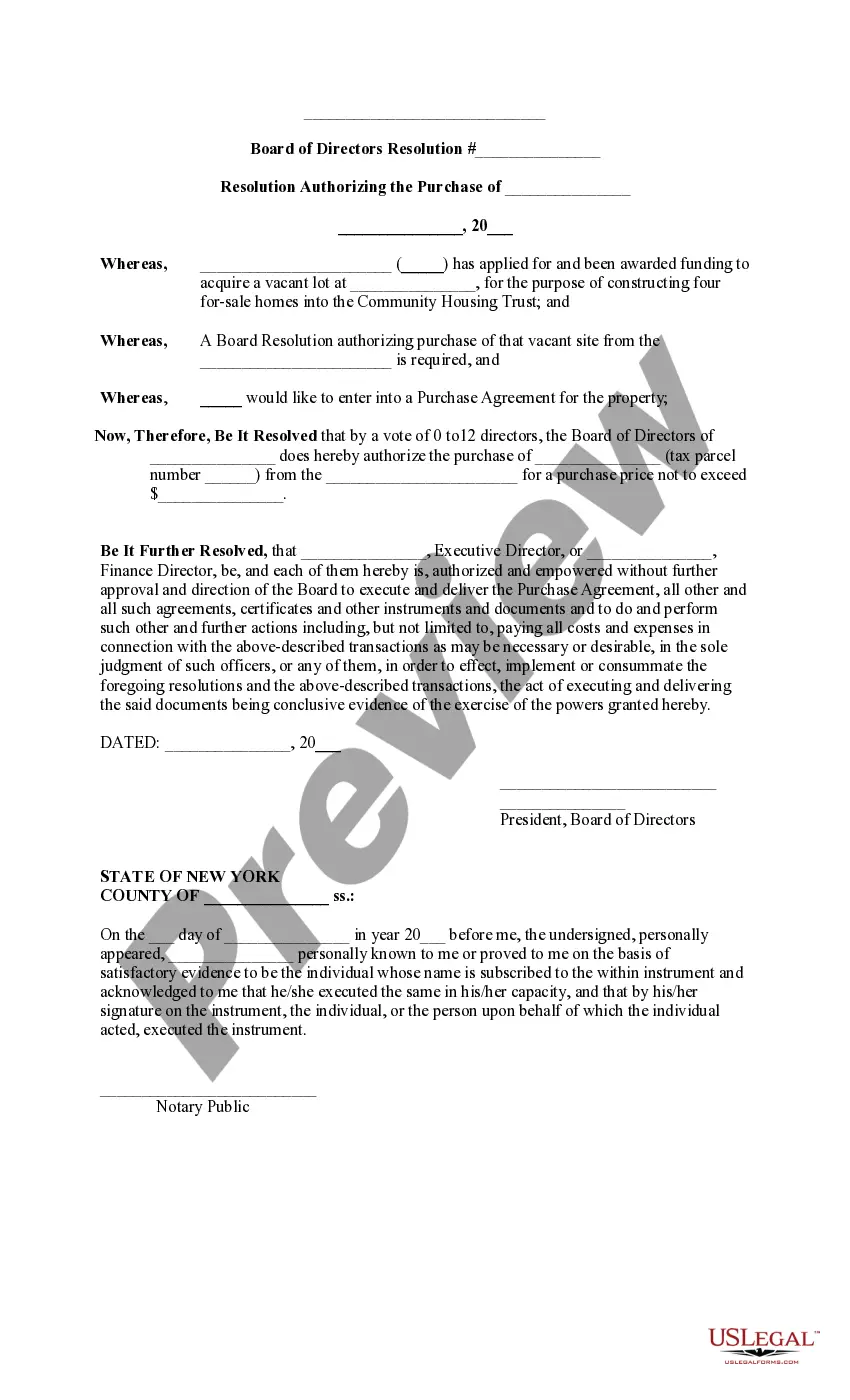

A new corporation founded in New York State must file a Certificate of Incorporation. This certificate is filed with the NYS Department of State (NYSDOS). Businesses should consult an attorney to learn about legal structures. Completed applications, with a fee, must be sent to the NYSDOS.

The use of a corporate seal is permissible, but it is not required. d83ddc49California Corporations Code section 207(a) it authorizes a corporation to adopt, use and alter a corporate seal at will, but FAILURE TO AFFIX A SEAL on a document DOES NOT AFFECT the document's VALIDITY.

For corporations, limited partnerships and limited liability companies, who must file with the State, the filing fee is $25, though corporations must also pay an additional county- specific fee. The corporation county fee is $100 for any county in New York City and $25 for any other county in New York State.

Please note that New York State law does not require a corporation to have a seal. Your telephone book's yellow pages or a yellow pages information operator (your area code + 555-1212) may be helpful in locating a legal stationery store.

Choose a corporate name. File Certificate of Incorporation. Appoint a registered agent. Prepare corporate bylaws. Appoint directors and hold first board meeting. Issue stock. File a New York Biennial Statement. Comply with other tax and regulatory requirements.

To apply for a Certificate of Authority use New York Business Express. Your application will be processed and, if approved, we'll mail your Certificate of Authority to you. You cannot legally make any taxable sales until you have received your Certificate of Authority.