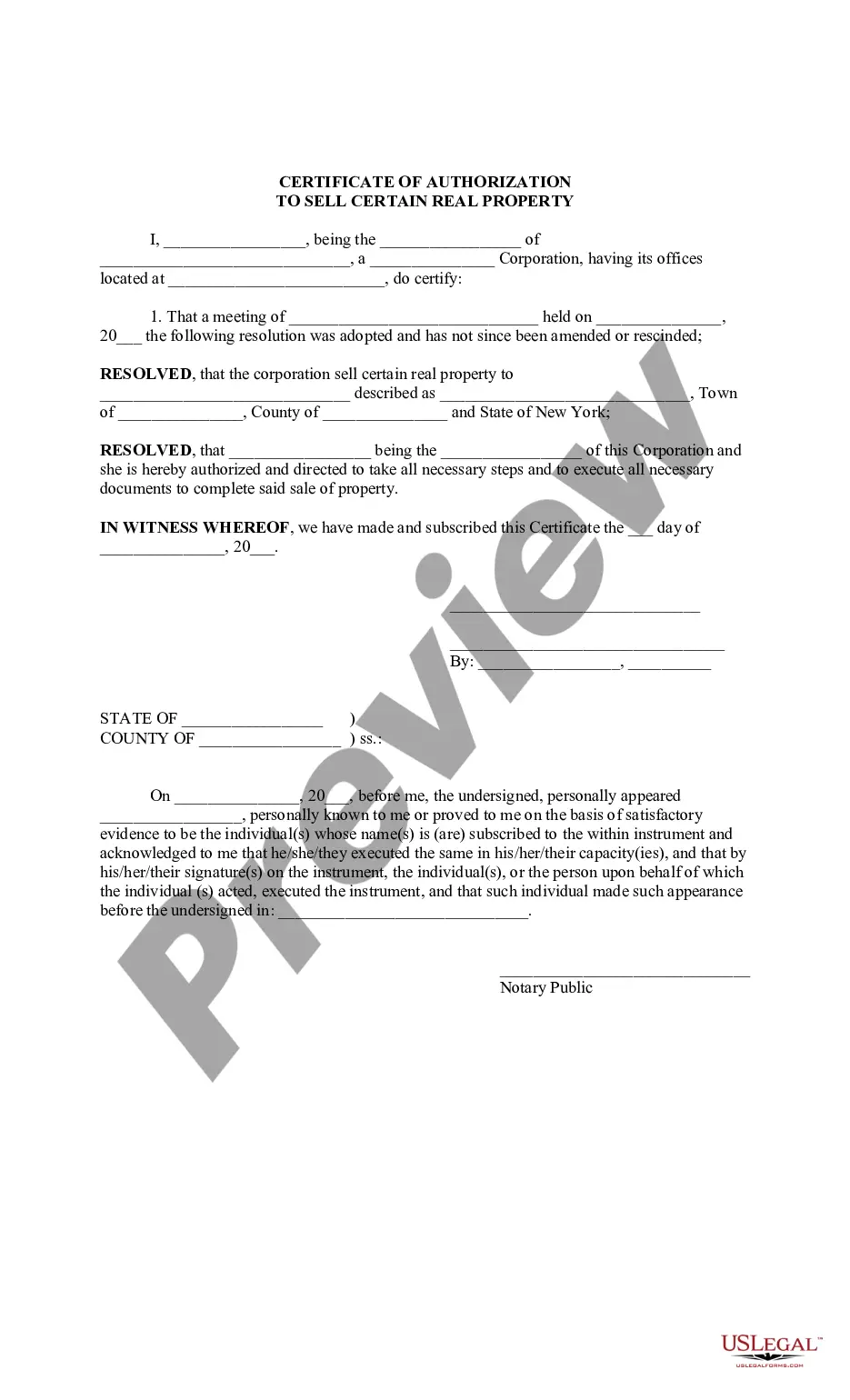

New York Certificate of Authorization to Sell Real Property

Description

How to fill out New York Certificate Of Authorization To Sell Real Property?

When it comes to submitting New York Certificate of Authorization to Sell Real Property, you probably visualize a long procedure that involves finding a perfect form among countless very similar ones and after that needing to pay legal counsel to fill it out for you. In general, that’s a sluggish and expensive choice. Use US Legal Forms and choose the state-specific form within clicks.

In case you have a subscription, just log in and click Download to find the New York Certificate of Authorization to Sell Real Property form.

In the event you don’t have an account yet but need one, stick to the step-by-step guideline below:

- Make sure the document you’re saving applies in your state (or the state it’s required in).

- Do this by reading the form’s description and by visiting the Preview function (if available) to view the form’s content.

- Click on Buy Now button.

- Choose the appropriate plan for your budget.

- Sign up to an account and select how you want to pay: by PayPal or by card.

- Save the file in .pdf or .docx file format.

- Find the file on your device or in your My Forms folder.

Skilled lawyers work on creating our samples so that after downloading, you don't have to bother about editing and enhancing content outside of your personal information or your business’s details. Join US Legal Forms and receive your New York Certificate of Authorization to Sell Real Property example now.

Form popularity

FAQ

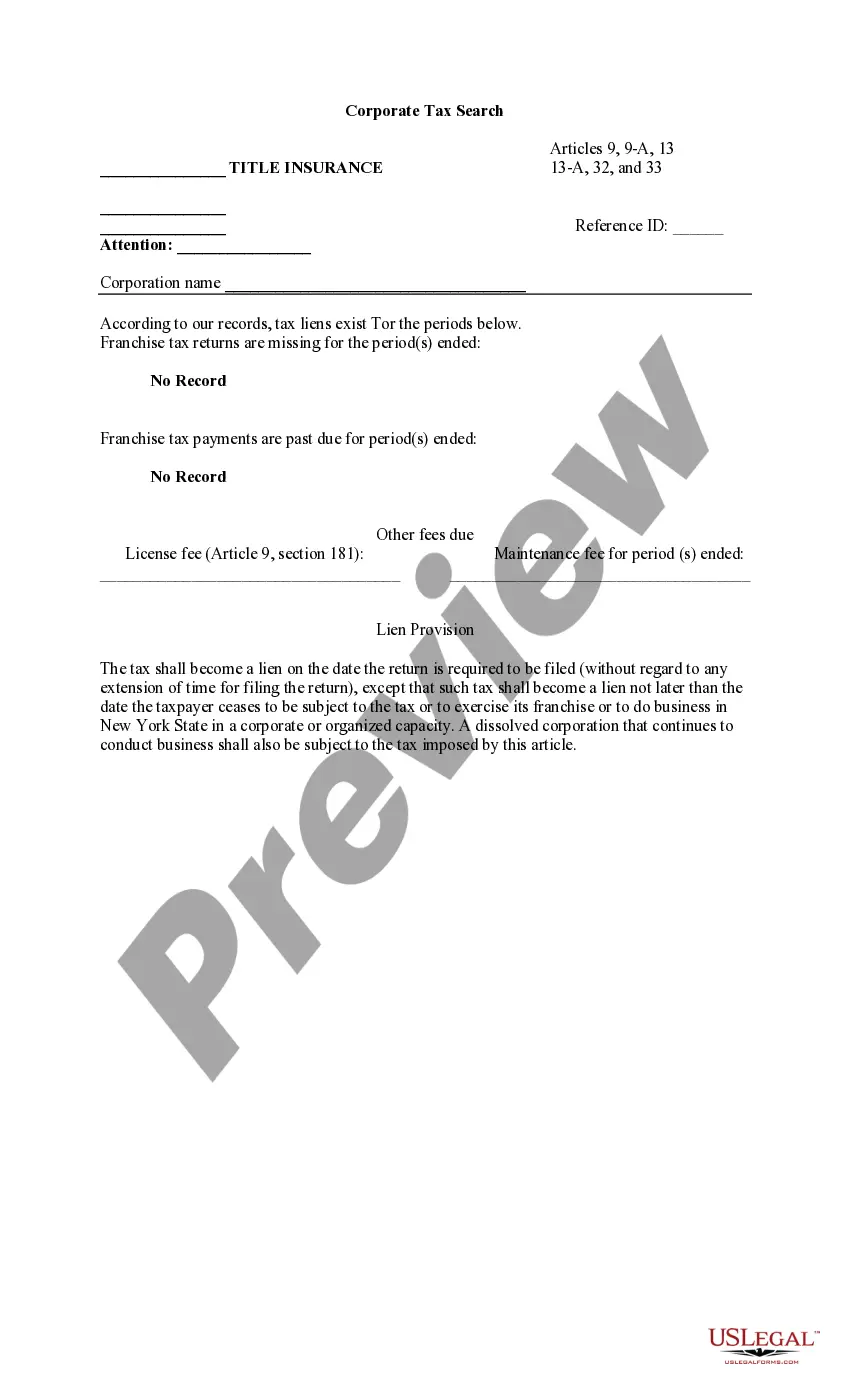

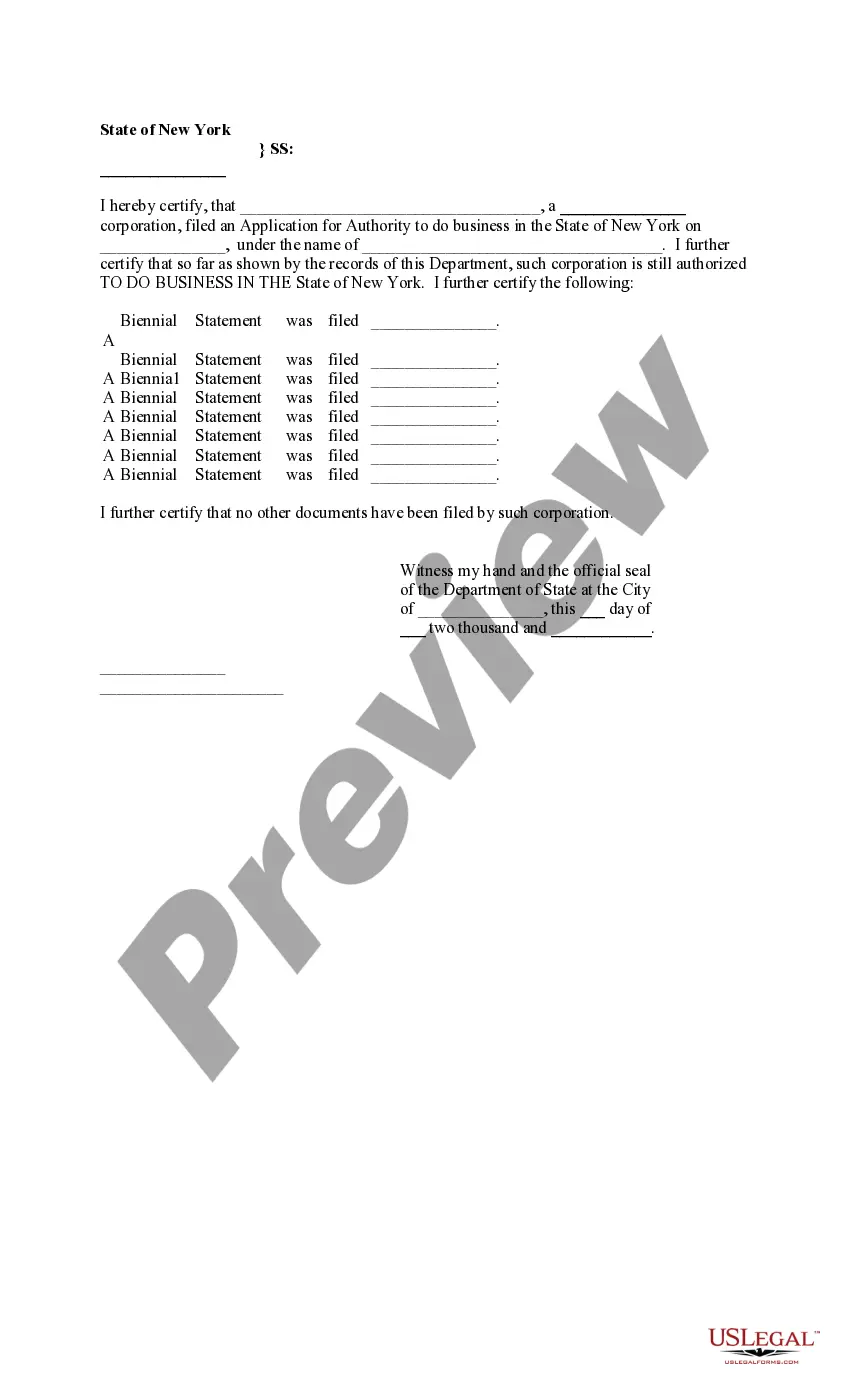

To apply for a Certificate of Authority use New York Business Express. Your application will be processed and, if approved, we'll mail your Certificate of Authority to you. You cannot legally make any taxable sales until you have received your Certificate of Authority.

If you go this route, your certificate will arrive within four to six weeks. Delays can occur if the office needs to request additional information. When you receive the certificate, it should be displayed prominently at your office or place of business.

Resale Certificate. Even though it's important for your taxes, your resale number isn't the same as a tax ID number. Your business's TIN goes on federal tax returns, and if you need to pay state taxes on your business income, you can apply for a state TIN. The resale number involves state sales tax.

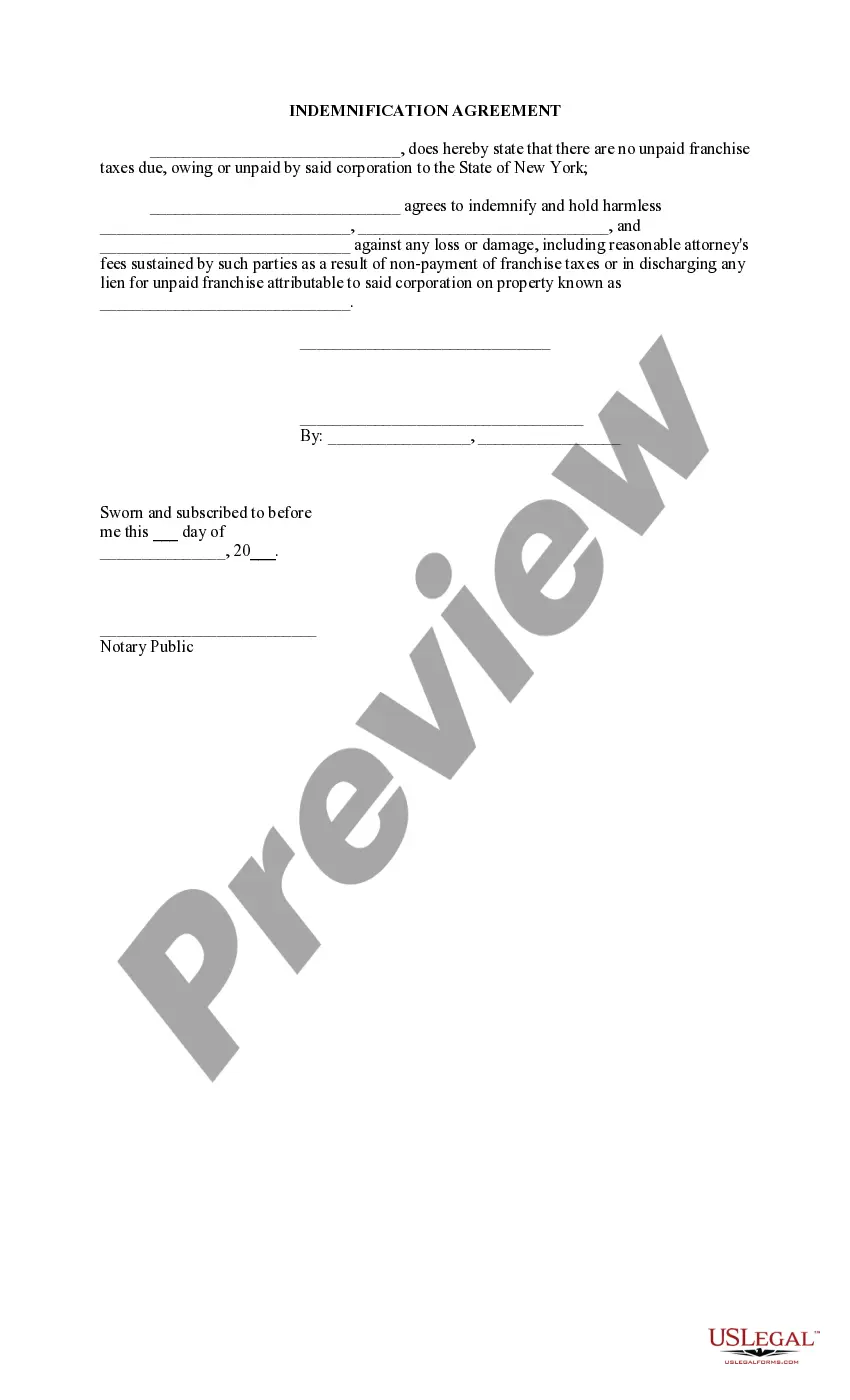

A resale certificate indicates the item was in good faith that the purchaser would resell the item and report tax on the final sale. As a seller, you may also accept resale certificates from others who wish to purchase items for resale.A description of the property to be purchase.

Form ST-120, Resale Certificate, is a sales tax exemption certificate. This certificate is only for use by a purchaser who: A is registered as a New York State sales tax vendor and has a valid. Certificate of Authority issued by the Tax Department and is making.

To apply for a Certificate of Authority use New York Business Express. Your application will be processed and, if approved, we'll mail your Certificate of Authority to you. You cannot legally make any taxable sales until you have received your Certificate of Authority.

A resale certificate is also called a sales tax certificate, reseller permit, or sales tax exemption certificate.It does not exempt you from paying sales tax on items you use in your business (e.g., office supplies). Qualifying goods are either items you plan to resell or use as parts in products or services you sell.

You must have a General Vendor license if you sell, lease, or offer to sell or lease goods or services in a public place that is not a store. You do NOT need a General Vendor license to sell:Call 311 or visit nyc.gov/health for information about food cart vendor licenses and permits.