A New York Certificate of Merger of Domestic Entity and Foreign LLC into Foreign LLC is a document used to merge two or more limited liability companies (LCS) into one. The certificate is filed with the New York Department of State, Division of Corporations. The certificate must include the name of each of the merging LCS, the name of the surviving LLC, the address of each LLC, the date of dissolution of the merging LCS, and the date of filing of the certificate. The certificate must also be signed by an authorized representative of each of the entities. There are two types of New York Certificate of Merger of Domestic Entity and Foreign LLC into Foreign LLC: Certificate of Merger of Domestic LLC and Foreign LLC into Foreign LLC, and Certificate of Merger of Domestic Entity and Foreign LLC into Foreign LLC. The former is used to merge two LCS, one of which is domestic and the other foreign, into a foreign LLC. The latter is used to merge a domestic entity, such as a corporation or partnership, and a foreign LLC into a foreign LLC.

New York Certificate of Merger of Domestic Entity And Foreign LLC Into Foreign LLC

Description

Key Concepts & Definitions

Certificate of Merger of Domestic Entity and Foreign LLC: A legal document issued by a state's Division of Corporations that evidences the merger of a domestic entity (such as a limited liability company, or LLC) with a foreign LLC. This certificate is crucial for validating the merger under the jurisdiction's commercial laws. Department of State: The state governmental body responsible for registering and managing business entity operations, including processing certificates of merger. Domestic Entity: A business that is registered and operates under the laws of the state in which it was formed.

Step-by-Step Guide to Obtaining a Certificate of Merger

- Determine the type of entities involved in the merger (domestic LLC, foreign LLC, etc.).

- Prepare the plan of merger, which includes the terms and conditions agreed upon by both entities.

- Obtain approval from the members or managers of both entities as required by law.

- File the articles of merger with the Department of State in the state where the domestic entity is registered.

- Pay the necessary filing fees and submit any additional documentation required by the division of corporations, particularly in states like New York.

- Wait for the Department of State to process your application and issue the certificate of merger.

Risk Analysis of Merging Domestic and Foreign LLCs

- Regulatory Compliance: Ensuring adherence to multiple jurisdictions' laws can be complex and costly.

- Litigation Risks: Increased exposure to potential legal disputes arising from differences in business practices or violations of agreements.

- Financial Impact: Mergers can lead to significant costs in terms of legal fees, restructuring, and integration processes.

- Cultural Differences: Overlooking cultural differences between domestic and foreign entity operations can result in management challenges and workforce integration issues.

Key Takeaways

Obtaining a certificate of merger between a domestic entity and a foreign LLC is a critical step in expanding business operations across state lines or international borders. It offers legal protections but comes with considerable obligations and potential risks, particularly concerning regulatory compliance and financial commitments.

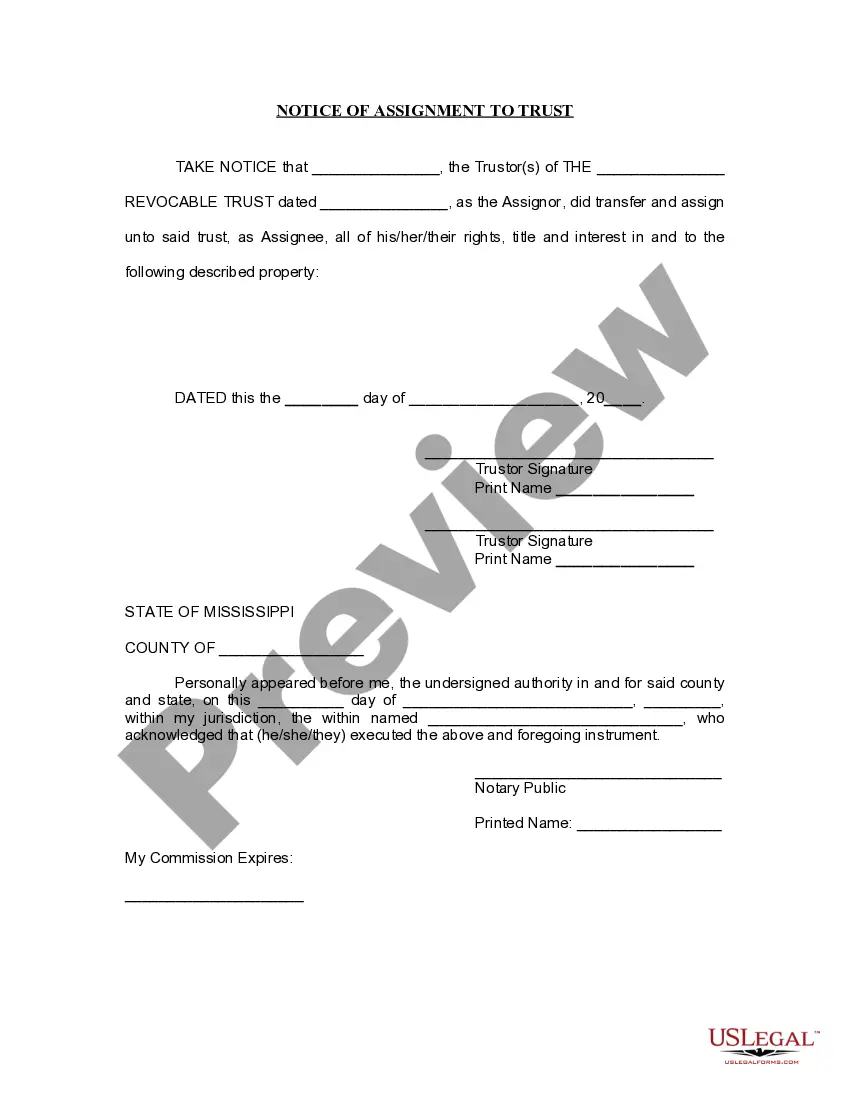

How to fill out New York Certificate Of Merger Of Domestic Entity And Foreign LLC Into Foreign LLC?

US Legal Forms is the most straightforward and cost-effective way to find appropriate formal templates. It’s the most extensive web-based library of business and personal legal paperwork drafted and checked by attorneys. Here, you can find printable and fillable blanks that comply with national and local regulations - just like your New York Certificate of Merger of Domestic Entity And Foreign LLC Into Foreign LLC.

Getting your template takes just a couple of simple steps. Users that already have an account with a valid subscription only need to log in to the website and download the form on their device. Later, they can find it in their profile in the My Forms tab.

And here’s how you can get a properly drafted New York Certificate of Merger of Domestic Entity And Foreign LLC Into Foreign LLC if you are using US Legal Forms for the first time:

- Look at the form description or preview the document to make certain you’ve found the one corresponding to your requirements, or locate another one utilizing the search tab above.

- Click Buy now when you’re certain about its compatibility with all the requirements, and judge the subscription plan you prefer most.

- Register for an account with our service, sign in, and purchase your subscription using PayPal or you credit card.

- Decide on the preferred file format for your New York Certificate of Merger of Domestic Entity And Foreign LLC Into Foreign LLC and download it on your device with the appropriate button.

After you save a template, you can reaccess it anytime - simply find it in your profile, re-download it for printing and manual fill-out or import it to an online editor to fill it out and sign more proficiently.

Take advantage of US Legal Forms, your reputable assistant in obtaining the corresponding official paperwork. Give it a try!

Form popularity

FAQ

First, you must fully dissolve the corporation. Then, you form a new LLC, and all assets are transferred to the new company before the transition is complete. You need to know the positives of converting a corporation to an LLC and the cost of changing from a corporation to know if it makes sense for your business.

One common reason for changing a corporation to an LLC is to avoid double taxation. A corporation faces double taxation because the income it earns is taxed first within its hands, and then a second time in the hands of its shareholders.

In fact, strictly speaking, New York law does not allow a corporation to convert to an LLC. Instead, you must engage in a process called ?statutory merger,? which requires you to create a new LLC and then ?merge? the old corporation into that new entity.

The completed Certificate of Merger, together with the filing fee of $60, should be forwarded to: New York Department of State, Division of Corporations, One Commerce Plaza, 99 Washington Avenue, Albany, NY 12231.

New York law has no provisions for entity domestication. If you plan to move your company to New York your can choose between qualifying your existing company as New York Foreign Entity, or dissolving it in the original state of registration and forming a new company in New York.

However, New York is one of only about ten states that do not allow statutory conversions of corporations to LLCs. Instead, New York only allows statutory mergers. Unlike statutory conversions, statutory mergers do require you to form a separate LLC before you can convert?or, more accurately, merge?your business.

Section 204 of the New York State Limited Liability Company Law includes provisions relating to the use of certain words and phrases in the name of the LLC. Generally, the name of the entity may not include a word or phrase restricted by another statute unless one has complied with the restriction.

Generally, you will be going through 4 steps: Step 1: Form a new LLC. Step 2: Transfer assets and liabilities. Step 3: Exchange for LLC memberships. Step 4: Dissolve the corporation. Step 1: Establish a new LLC. Step 2: Prepare a merger agreement or plan.