The New York Industrial and Commercial Abatement Program (ICAP) Preliminary Application is an application submitted prior to the commencement of a construction or renovation project by a property owner or developer to the New York City Department of Housing Preservation and Development (HPD). This application is required to obtain potential tax abatement for eligible projects. It includes information about the project, the proposed construction/renovation, estimated costs, environmental impact assessment, and potential benefits for the community. There are two types of ICAP Preliminary Applications: 1. Small Project Preliminary Application: This application is required for projects with estimated construction costs of $5 million or less. 2. Large Project Preliminary Application: This application is required for projects with estimated construction costs greater than $5 million.

New York Industrial And Commercial Abatement Program Preliminary Application

Description

How to fill out New York Industrial And Commercial Abatement Program Preliminary Application?

How much time and resources do you typically spend on composing formal paperwork? There’s a better option to get such forms than hiring legal experts or wasting hours browsing the web for a proper blank. US Legal Forms is the premier online library that provides professionally designed and verified state-specific legal documents for any purpose, including the New York Industrial And Commercial Abatement Program Preliminary Application.

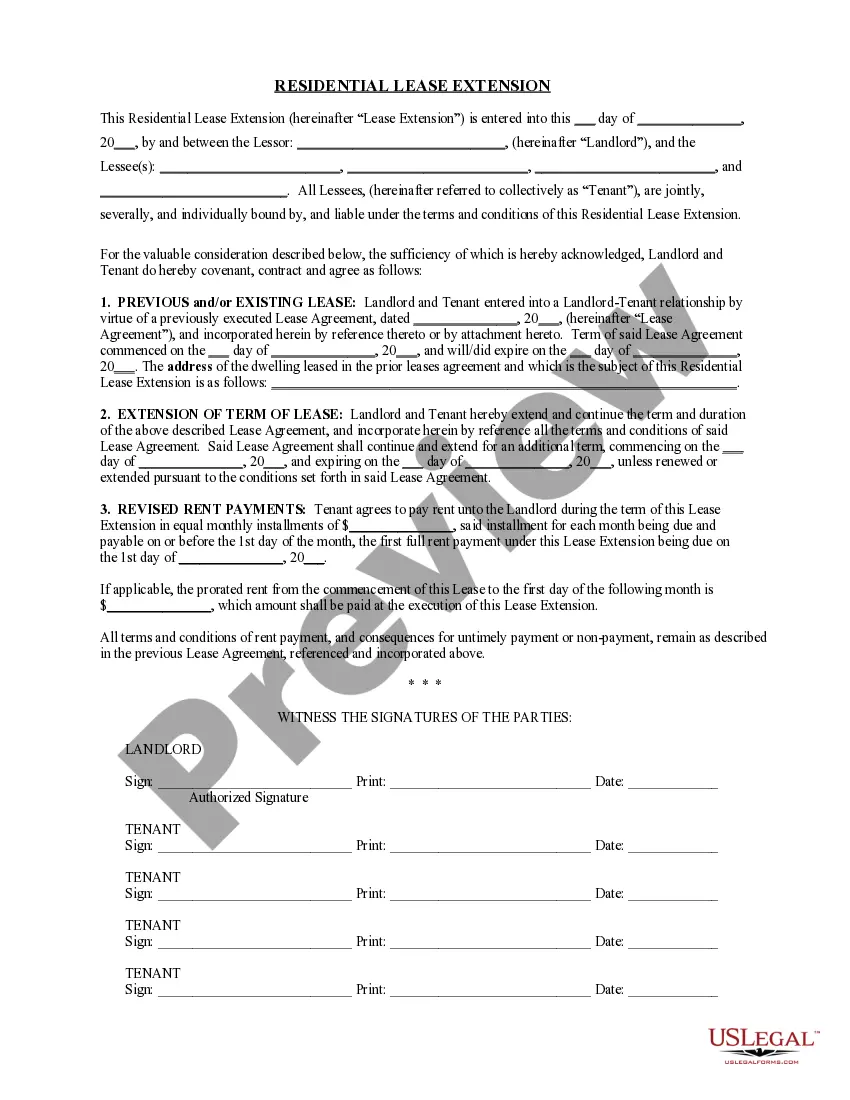

To get and prepare an appropriate New York Industrial And Commercial Abatement Program Preliminary Application blank, follow these easy steps:

- Examine the form content to ensure it meets your state regulations. To do so, check the form description or take advantage of the Preview option.

- In case your legal template doesn’t meet your needs, find a different one using the search tab at the top of the page.

- If you are already registered with our service, log in and download the New York Industrial And Commercial Abatement Program Preliminary Application. Otherwise, proceed to the next steps.

- Click Buy now once you find the right blank. Choose the subscription plan that suits you best to access our library’s full opportunities.

- Register for an account and pay for your subscription. You can make a transaction with your credit card or via PayPal - our service is absolutely safe for that.

- Download your New York Industrial And Commercial Abatement Program Preliminary Application on your device and fill it out on a printed-out hard copy or electronically.

Another advantage of our library is that you can access previously downloaded documents that you safely store in your profile in the My Forms tab. Pick them up at any moment and re-complete your paperwork as often as you need.

Save time and effort preparing formal paperwork with US Legal Forms, one of the most reliable web services. Join us today!

Form popularity

FAQ

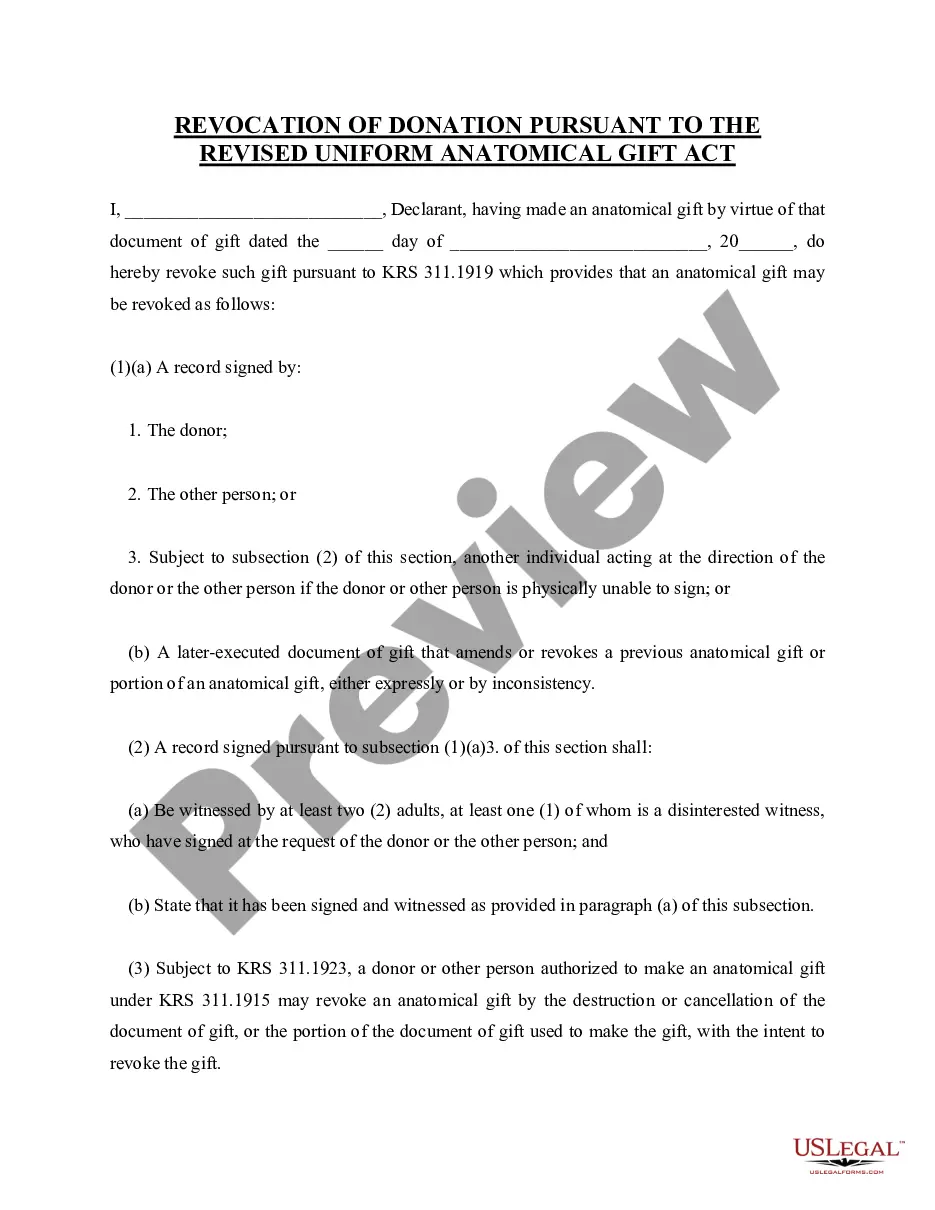

The 2023-2024 renewal period has ended. This program provides abatements for property taxes for periods of up to 25 years. To be eligible, industrial and commercial buildings must be built, modernized, expanded, or otherwise physically improved.

A tax abatement doesn't provide certainty over how much property taxes are ultimately owed. Even during the abatement period, tax bills can change.

421-a Tax Abatement Enhanced 35-year Benefit Benefits are available primarily for rental projects. The benefit includes 100% real estate tax exemption for up to three years during the construction period and an additional 35 years after construction.

Owners of cooperative units and condominiums who meet the eligibility requirements for the Cooperative and Condominium Property Tax Abatement can have their property taxes reduced. The amount of the abatement is based on the average assessed value of the residential units in the development.

The reduction percentage is between 17.5% and 28.1% if the owners meet certain requirements to apply for the abatement. The abatement is solely for a co-op and condo owner that uses the unit as their primary residence. If you purchased a condo unit as an investment property, you will not be eligible.

What is a 421a Tax Abatement In NYC? A 421a tax abatement lowers your property tax bill by applying credits against the total amount you owe. It is most commonly granted to property developers in exchange for including affordable housing and the benefit lasts for 10 to 25 years.

The reduction percentage is between 17.5% and 28.1% if the owners meet certain requirements to apply for the abatement. The abatement is solely for a co-op and condo owner that uses the unit as their primary residence. If you purchased a condo unit as an investment property, you will not be eligible.

To determine the beginning and end dates for tax benefits given to a building for either of these two programs, log on to .nyc.gov/finance.