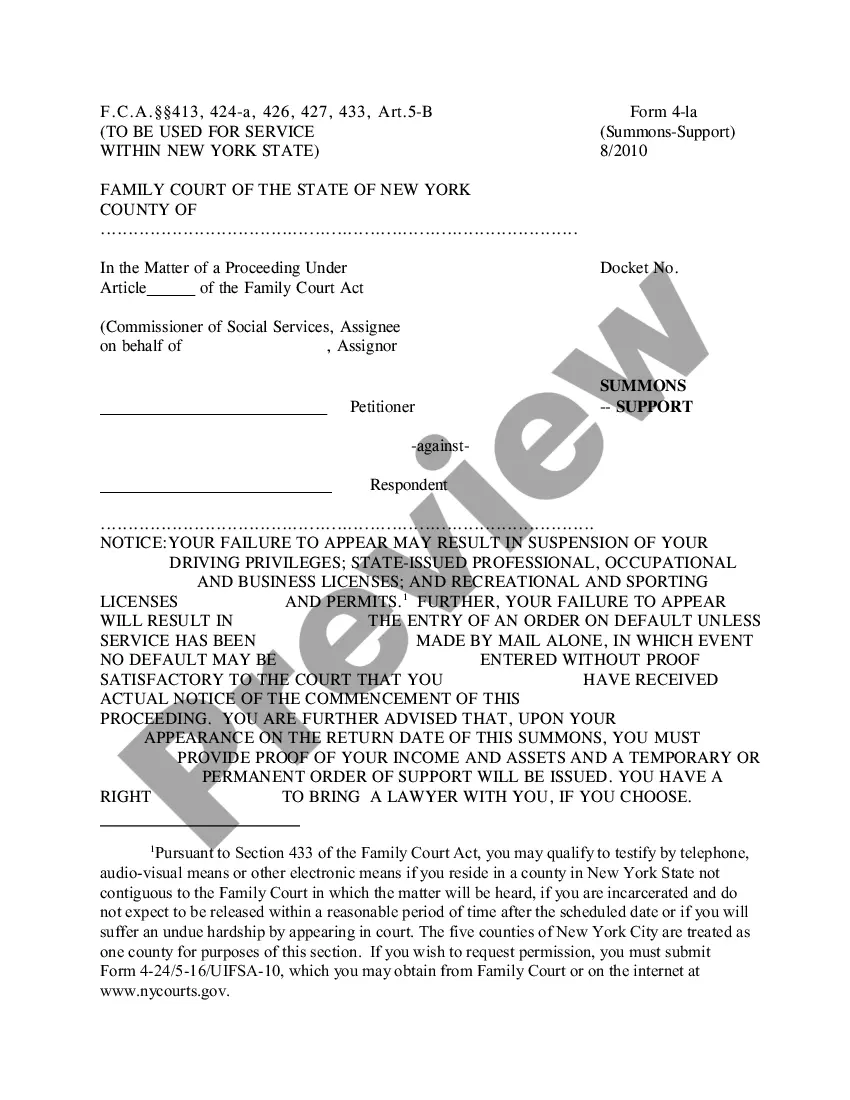

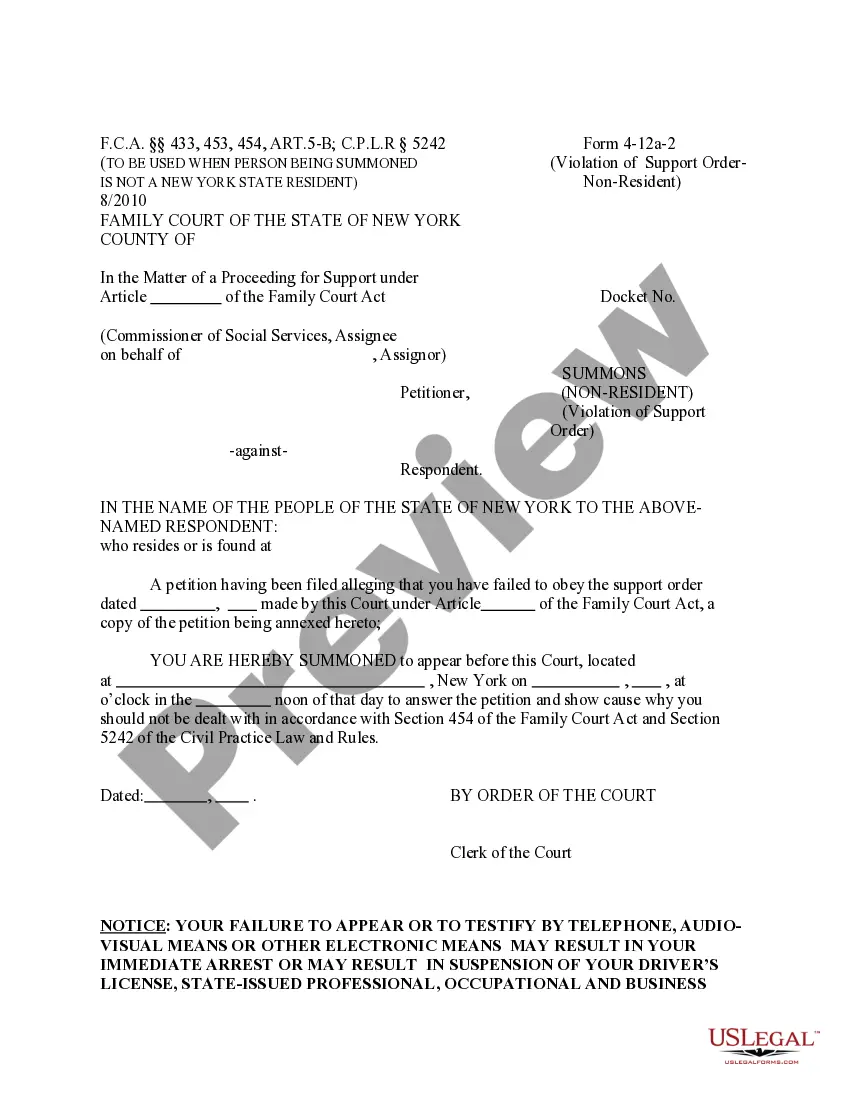

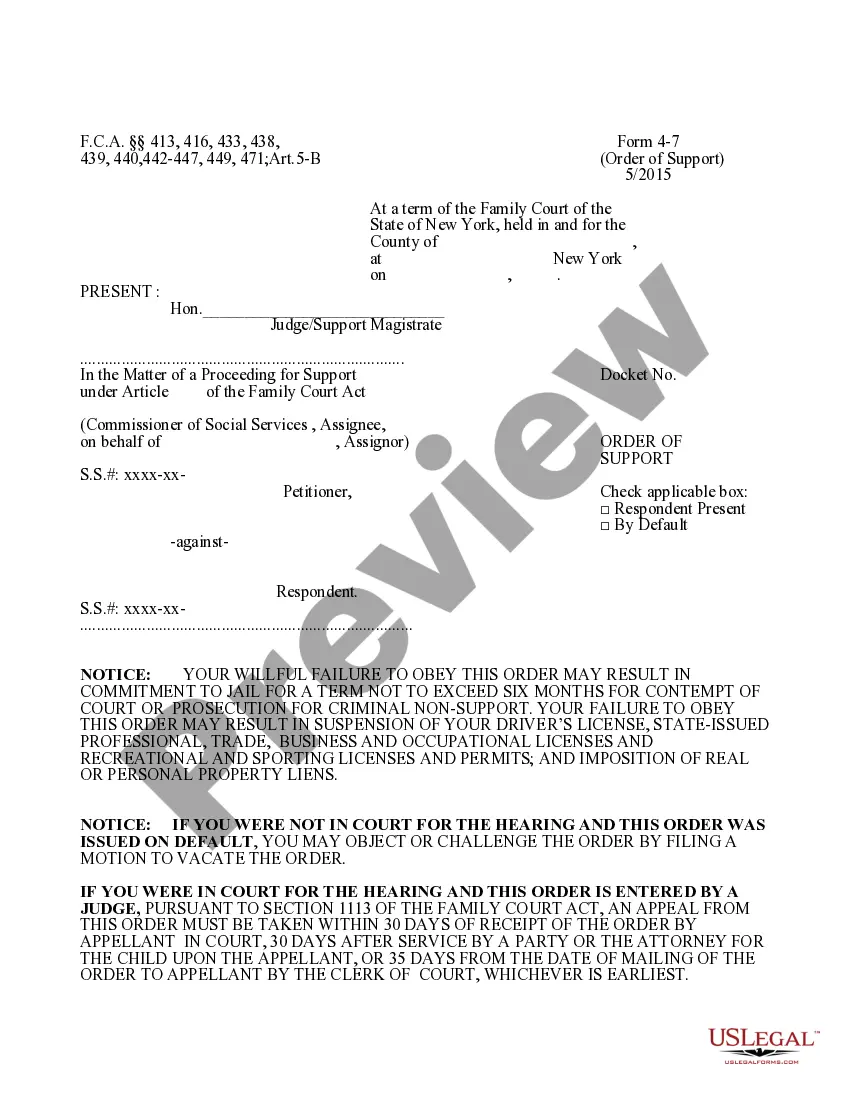

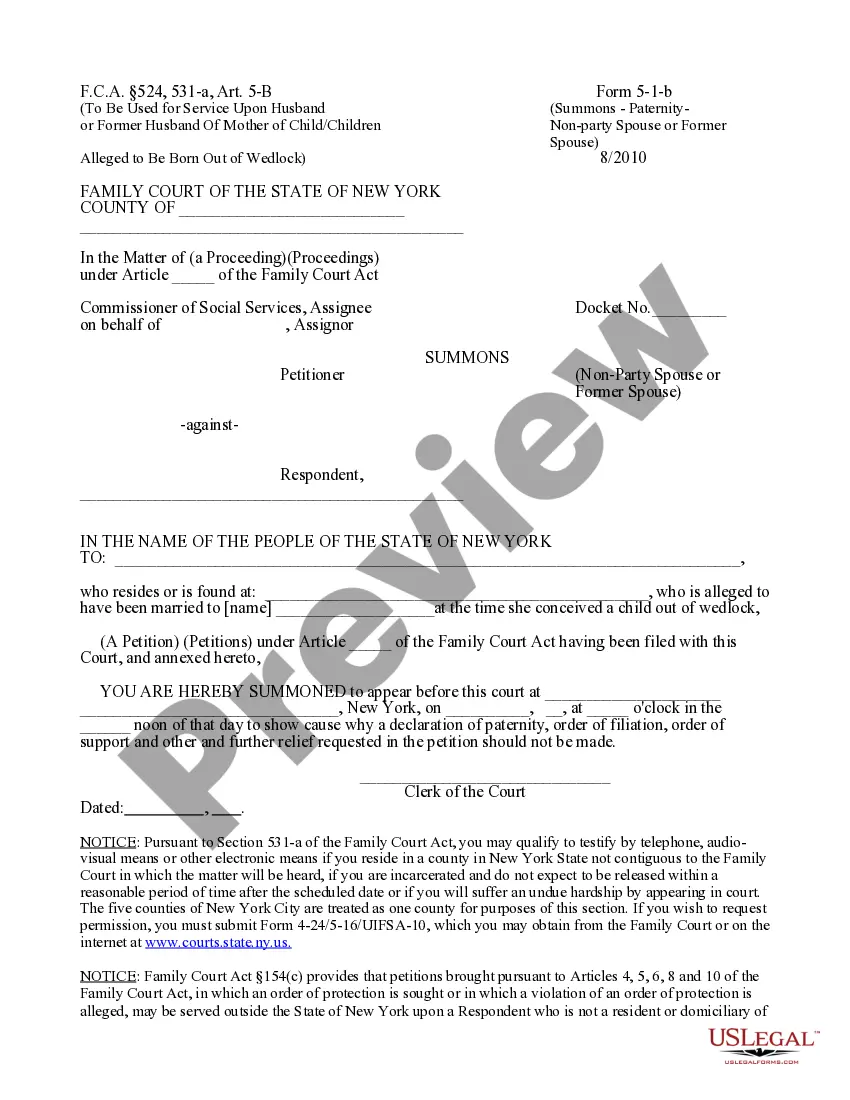

New York Support Summons Non-Resident

Description

How to fill out New York Support Summons Non-Resident?

US Legal Forms is really a unique system to find any legal or tax template for completing, including New York Summons - Support - Nonresident. If you’re sick and tired of wasting time looking for suitable examples and paying money on papers preparation/legal professional service fees, then US Legal Forms is precisely what you’re searching for.

To enjoy all of the service’s advantages, you don't need to download any software but just select a subscription plan and create your account. If you already have one, just log in and look for a suitable sample, save it, and fill it out. Saved documents are all kept in the My Forms folder.

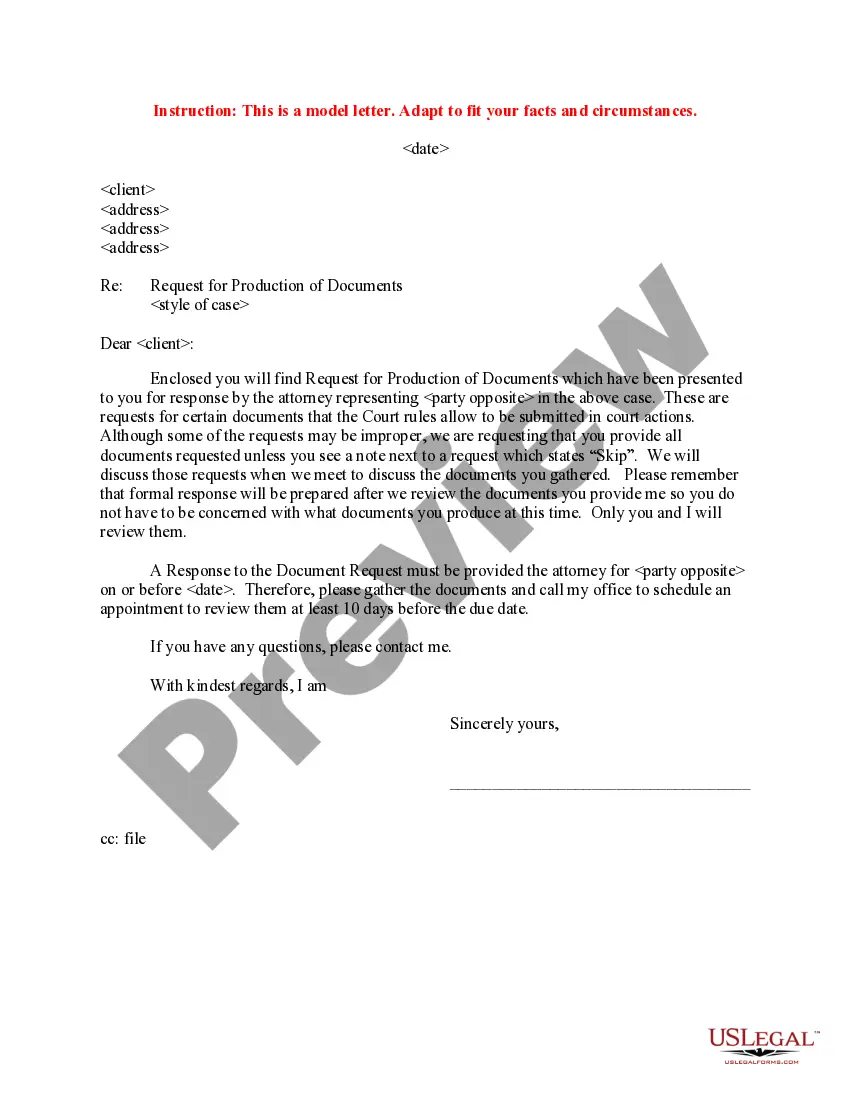

If you don't have a subscription but need to have New York Summons - Support - Nonresident, take a look at the instructions below:

- make sure that the form you’re taking a look at is valid in the state you want it in.

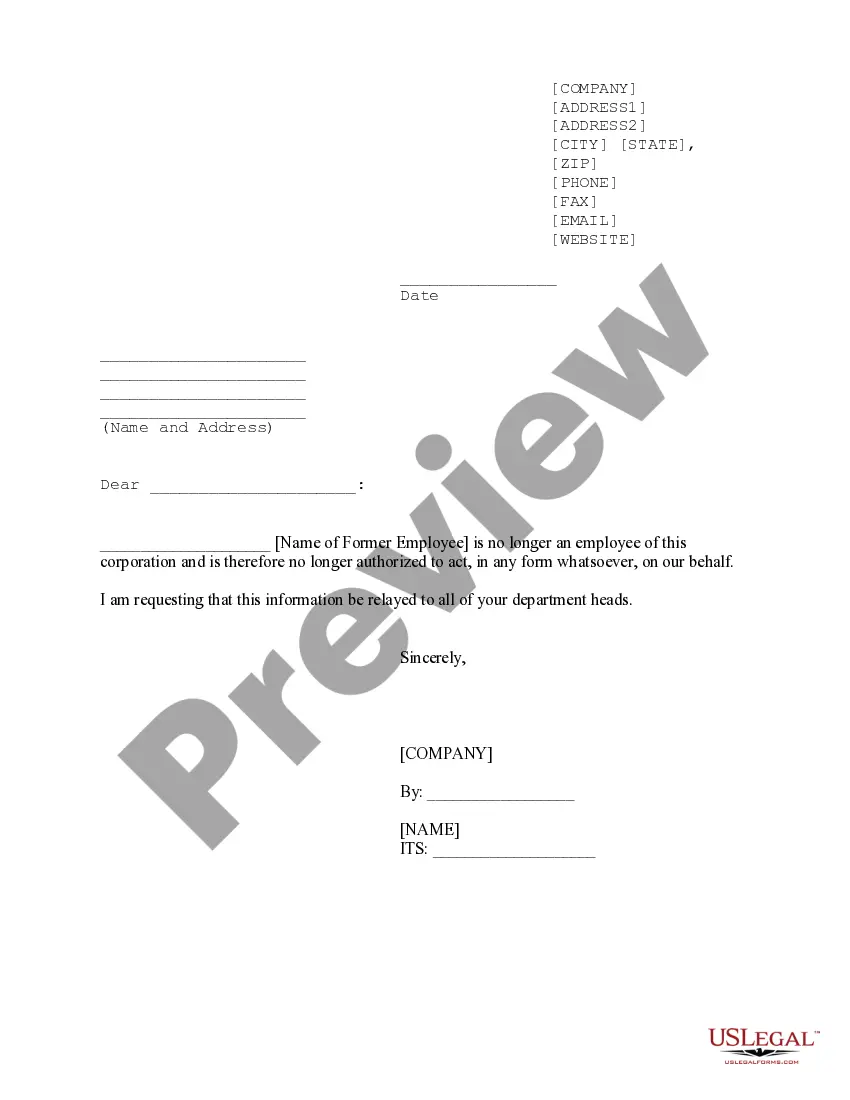

- Preview the example its description.

- Simply click Buy Now to get to the register page.

- Pick a pricing plan and continue registering by entering some information.

- Decide on a payment method to complete the registration.

- Save the document by choosing the preferred format (.docx or .pdf)

Now, complete the file online or print it. If you are unsure regarding your New York Summons - Support - Nonresident form, speak to a attorney to check it before you decide to send or file it. Start without hassles!

Form popularity

FAQ

You must file a nonresident return if you worked or earned income in a state where you're not a resident if that state doesn't have reciprocity with your own state. Make sure that your employer withholds taxes for the state where you live or you could be in for an ugly surprise come tax time.

Nonresidents of New York City are not liable for New York City personal income tax. The rules regarding New York City domicile are also the same as for New York State domicile.

Generally, you must file a New York State income tax return if you're a New York State resident and are required to file a federal return. You may also have to file a New York State return if you're a nonresident of New York and you have income from New York State sources.

Generally, you must file a New York State resident income tax return if you are a New York State resident and meet any of the following conditions:You want to claim a refund of any New York State, New York City, or Yonkers income taxes withheld from your pay. You want to claim any refundable or carryover credits.

Generally, under Tax Law section 631, the New York-source income of a nonresident individual includes all items of income, gain, loss, and deduction entering into the taxpayer's federal adjusted gross income that are attributed to the ownership of any interest in real or tangible property located in New York or a

Generally, you must file a New York State income tax return if you're a New York State resident and are required to file a federal return. You may also have to file a New York State return if you're a nonresident of New York and you have income from New York State sources.

You are subject to New York State tax on income you received from New York sources while you were a nonresident and all income you received while you were a New York State resident. You may have to pay income tax as a resident even if you are not considered a resident for other purposes.