New York Articles of Incorporation Certificate - Nonprofit Corporation - Tax Exempt

Description

What Is a New York Articles of Incorporation Certificate?

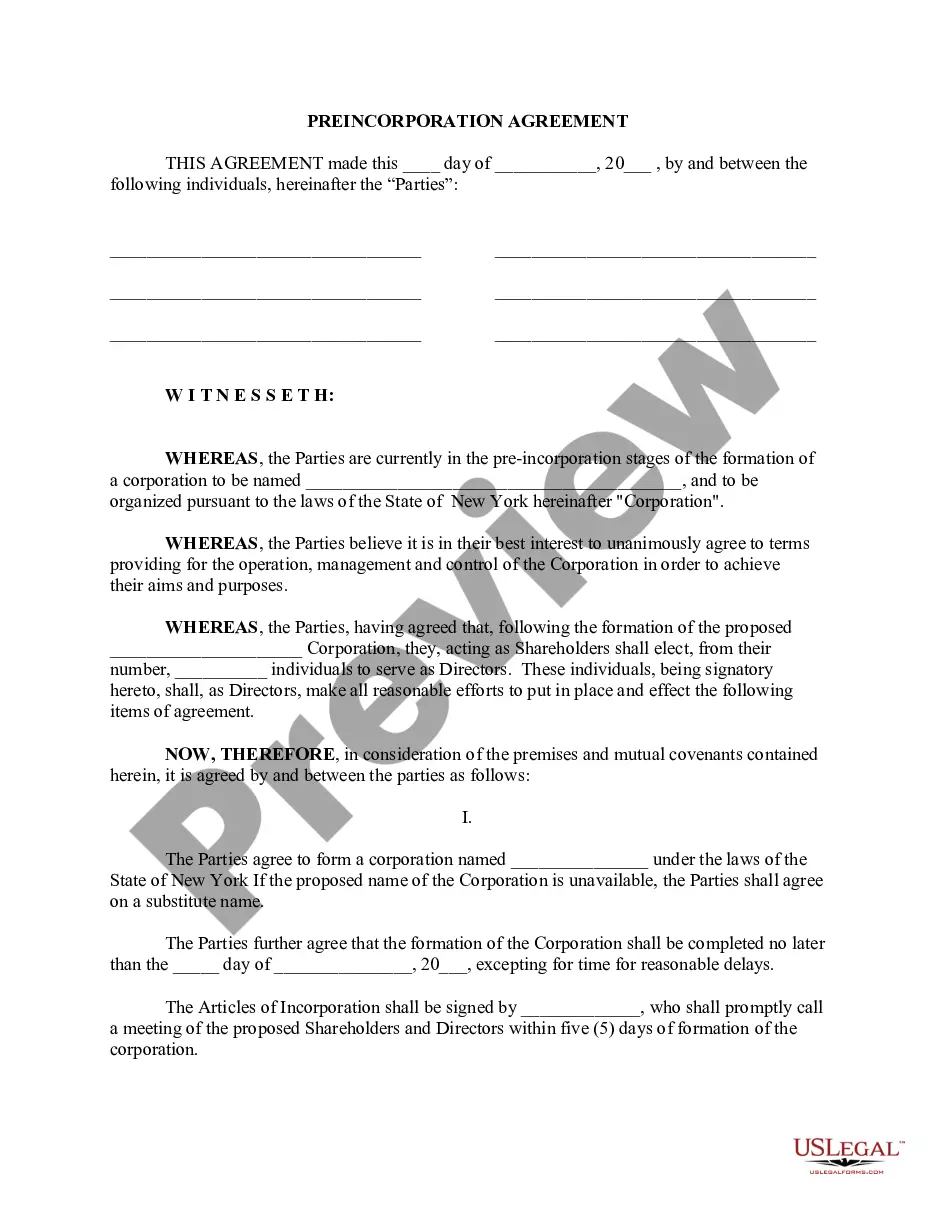

The New York Articles of Incorporation Certificate is an official document that formally establishes a corporation's legal existence in the state of New York. It includes key details such as the corporations name, purpose, duration, corporate structure, and information regarding shares and initial directors.

Key Concepts & Definitions

- Articles of Incorporation: Legal documents filed with the state government to legally document the creation of a corporation.

- Certificate of Incorporation: A certificate issued by the state once the articles of incorporation are accepted, representing the company's legal existence.

- Incorporator: The individual or entity who submits the articles of incorporation for a company.

Step-by-Step Guide to Filing New York Articles of Incorporation

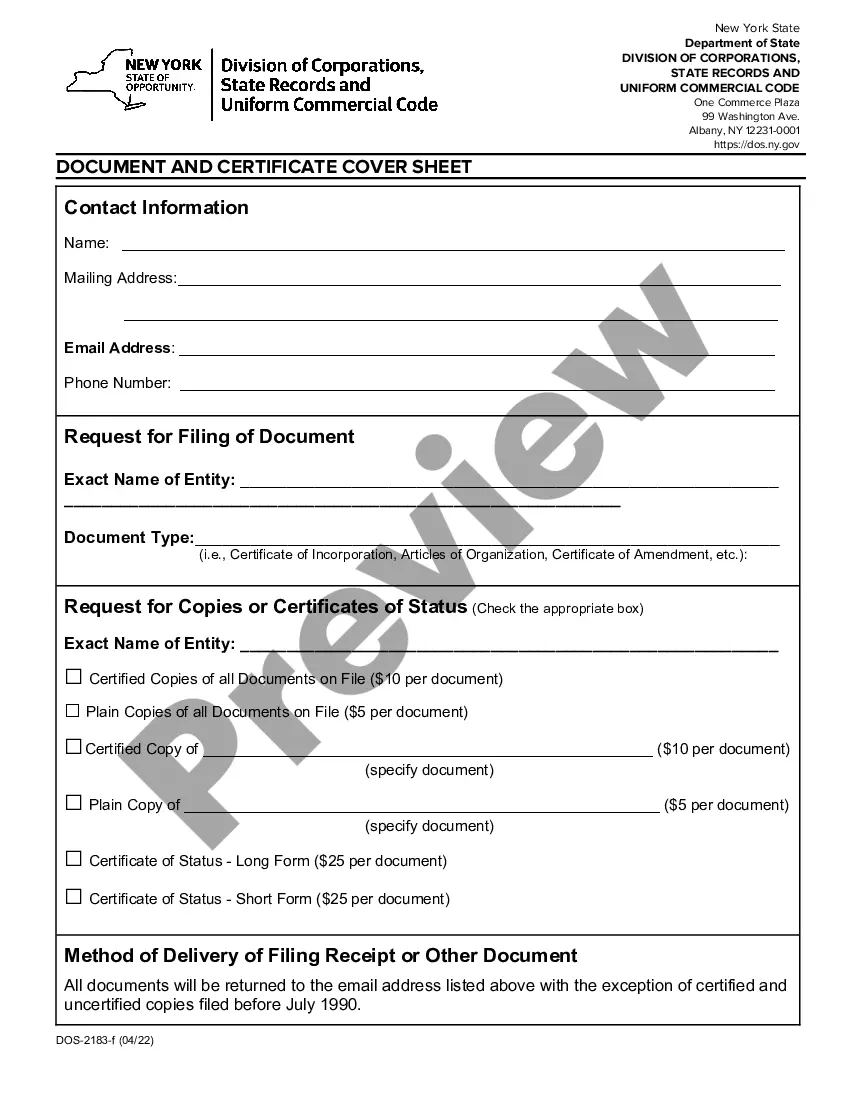

- Determine if your desired business name is available through the New York Department of States business entity database.

- Prepare the Articles of Incorporation, which should include the company name, corporate purpose, county in which the office will be located, stock details, and information on the incorporators.

- File the Articles of Incorporation with the New York Department of State along with the required filing fee.

- Receive the Certificate of Incorporation from the state once your filing has been approved.

Risk Analysis

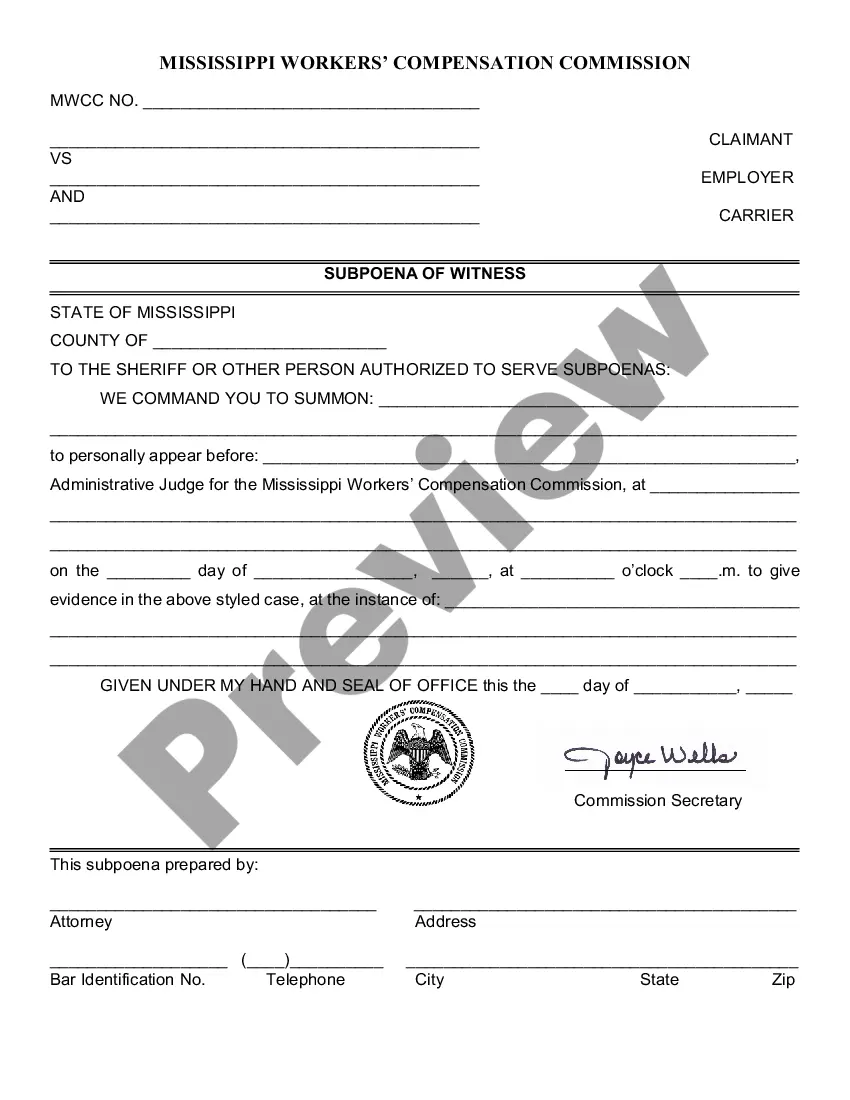

- Non-compliance Risks: Failing to accurately or completely fill out the required documents can lead to rejection of the application or future legal issues.

- Operational Risks: Incorrect or unclear designation of the business purpose may restrict the company's operations.

- Financial Risks: There are costs associated with filing the Articles and potential additional fees if you need to correct errors or amend the documents later.

Best Practices

- Ensure the business name is unique and complies with New York state regulations.

- Clearly outline the corporate purpose and operational boundaries in the Articles of Incorporation.

- Consult with a legal professional to mitigate potential risks and ensure compliance.

Common Mistakes & How to Avoid Them

- Ignoring Detail: Omitting essential details like office location or director information can delay the process. Ensure all required information is included.

- Neglecting Legal Advice: Many incorporators try to save costs by not engaging a legal advisor, which can lead to costly errors. Always seek professional advice.

- Poor Planning: Failing to plan for future amendments or expansions can lead to more paperwork and fees. Plan your corporate structure with flexibility in mind.

FAQ

- How long does it take to get a certificate? Usually, it takes 3-6 weeks; expedited services are available for an additional fee.

- What is the cost of filing the Articles of Incorporation in New York? The base fee is currently around $125, but this can vary depending on the corporation's structure and any additional services.

- Can the Articles of Incorporation be filed online? Yes, New York allows for online filing, which can speed up the process.

How to fill out New York Articles Of Incorporation Certificate - Nonprofit Corporation - Tax Exempt?

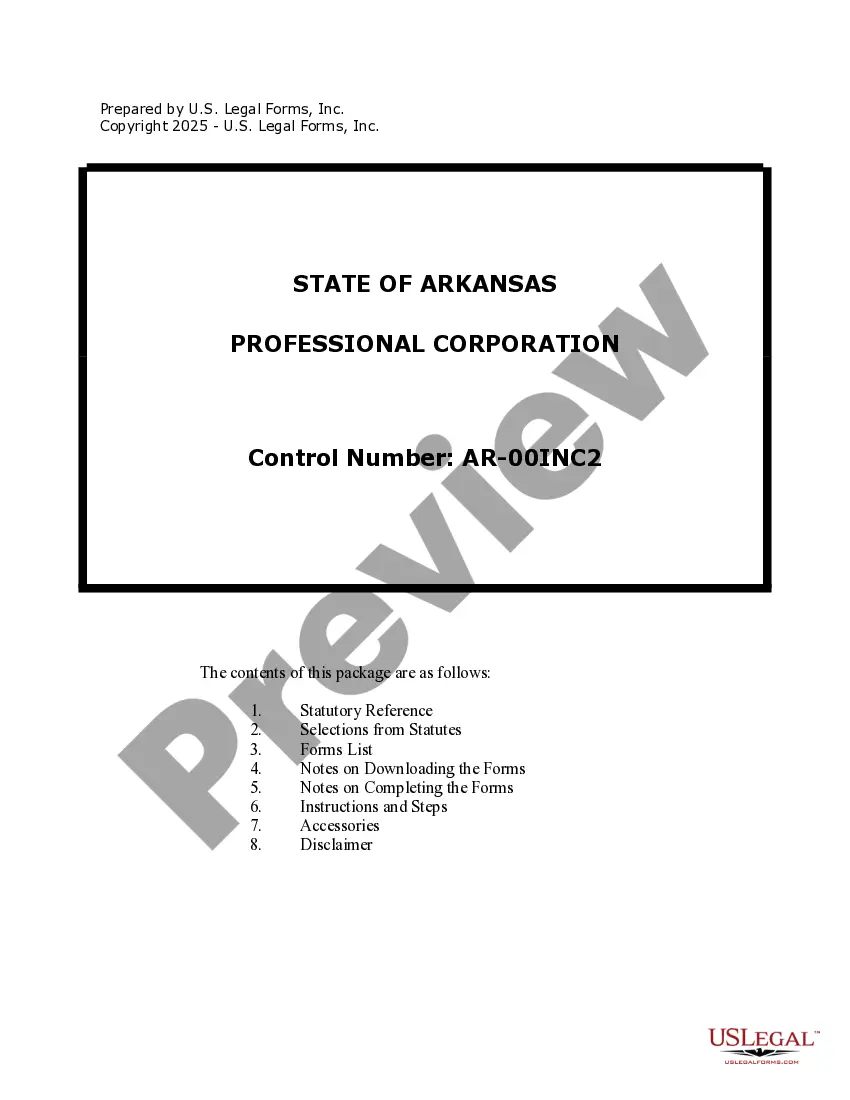

US Legal Forms is a special system to find any legal or tax form for filling out, such as New York Articles of Incorporation Certificate - Nonprofit Corporation - Tax Exempt. If you’re fed up with wasting time looking for perfect examples and paying money on file preparation/lawyer service fees, then US Legal Forms is exactly what you’re trying to find.

To experience all of the service’s benefits, you don't have to download any software but simply choose a subscription plan and register an account. If you have one, just log in and find the right template, save it, and fill it out. Saved files are all kept in the My Forms folder.

If you don't have a subscription but need New York Articles of Incorporation Certificate - Nonprofit Corporation - Tax Exempt, have a look at the instructions listed below:

- make sure that the form you’re looking at is valid in the state you want it in.

- Preview the form and read its description.

- Click on Buy Now button to access the sign up page.

- Select a pricing plan and keep on registering by providing some info.

- Pick a payment method to complete the registration.

- Save the file by selecting your preferred format (.docx or .pdf)

Now, submit the document online or print it. If you are unsure regarding your New York Articles of Incorporation Certificate - Nonprofit Corporation - Tax Exempt form, contact a legal professional to check it before you send or file it. Begin hassle-free!

Form popularity

FAQ

Nonprofits are also exempt from paying sales tax and property tax. While the income of a nonprofit organization may not be subject to federal taxes, nonprofit organizations do pay employee taxes (Social Security and Medicare) just like any for-profit company.

For the most part, nonprofits are exempt from most individual and corporate taxes. There are certain circumstances, however, they may need to make payments. For example, if your nonprofit earns any income from activities unrelated to its purpose, it will owe income taxes on that amount.

Exempt organizations Once an organization has received its exempt organization certificate, all of its purchases, including purchases of tangible personal property and services, food and drink, payment of admission charges, and rent paid for hotel occupancy, are exempt from sales tax.

Incorporate. Apply for an EIN. Provide a detailed business purpose. File Form 1023 with the IRS. Pay the necessary filing fees. When to file. Complete the state-level application (if applicable).

A nonprofit organization is one that doesn't intend to make a profit, whether it's performing charitable, trade or other activities. Nonprofits form as corporations at the state level, applying with their Secretary of State's Office.After that, nonprofits are under no obligation to apply for federal tax-exempt status.

Nonprofit organizations may include religious, educational, or charitable organizations and may not be required to pay federal taxes. However, if you are an employee of a nonprofit organization you must pay Social Security taxes on your earnings of $108.28 or more.

To be tax-exempt under section 501(c)(3) of the Internal Revenue Code, an organization must be organized and operated exclusively for exempt purposes set forth in section 501(c)(3), and none of its earnings may inure to any private shareholder or individual.

Most nonprofit organizations qualify for federal income tax exemption under one of 25 subsections of Section 501(c) of the Internal Revenue Code. Most associations are tax-exempt under Sections 501(c)(3) or (c)(6), and a smaller number under Sections 501(c)(4) or (c)(5).

Non-profit status may make an organization eligible for certain benefits, such as state sales, property, and income tax exemptions; however, this corporate status does not automatically grant exemption from federal income tax.