New York Business Incorporation Package to Incorporate Corporation

Description

How to fill out New York Business Incorporation Package To Incorporate Corporation?

US Legal Forms is actually a special system where you can find any legal or tax template for completing, including New York Business Incorporation Package to Incorporate Corporation. If you’re fed up with wasting time seeking ideal examples and spending money on papers preparation/attorney service fees, then US Legal Forms is exactly what you’re looking for.

To enjoy all the service’s benefits, you don't have to download any application but just select a subscription plan and register an account. If you already have one, just log in and find an appropriate template, download it, and fill it out. Saved files are saved in the My Forms folder.

If you don't have a subscription but need to have New York Business Incorporation Package to Incorporate Corporation, check out the recommendations listed below:

- make sure that the form you’re looking at applies in the state you need it in.

- Preview the form its description.

- Click Buy Now to get to the sign up page.

- Select a pricing plan and proceed registering by entering some information.

- Decide on a payment method to finish the registration.

- Download the file by selecting the preferred format (.docx or .pdf)

Now, complete the file online or print out it. If you feel unsure regarding your New York Business Incorporation Package to Incorporate Corporation form, speak to a legal professional to review it before you send out or file it. Begin without hassles!

Form popularity

FAQ

The cost to start a New York limited liability company (LLC) is $200. This fee is paid to the New York Secretary of State when filing the LLC's Articles of Organization.

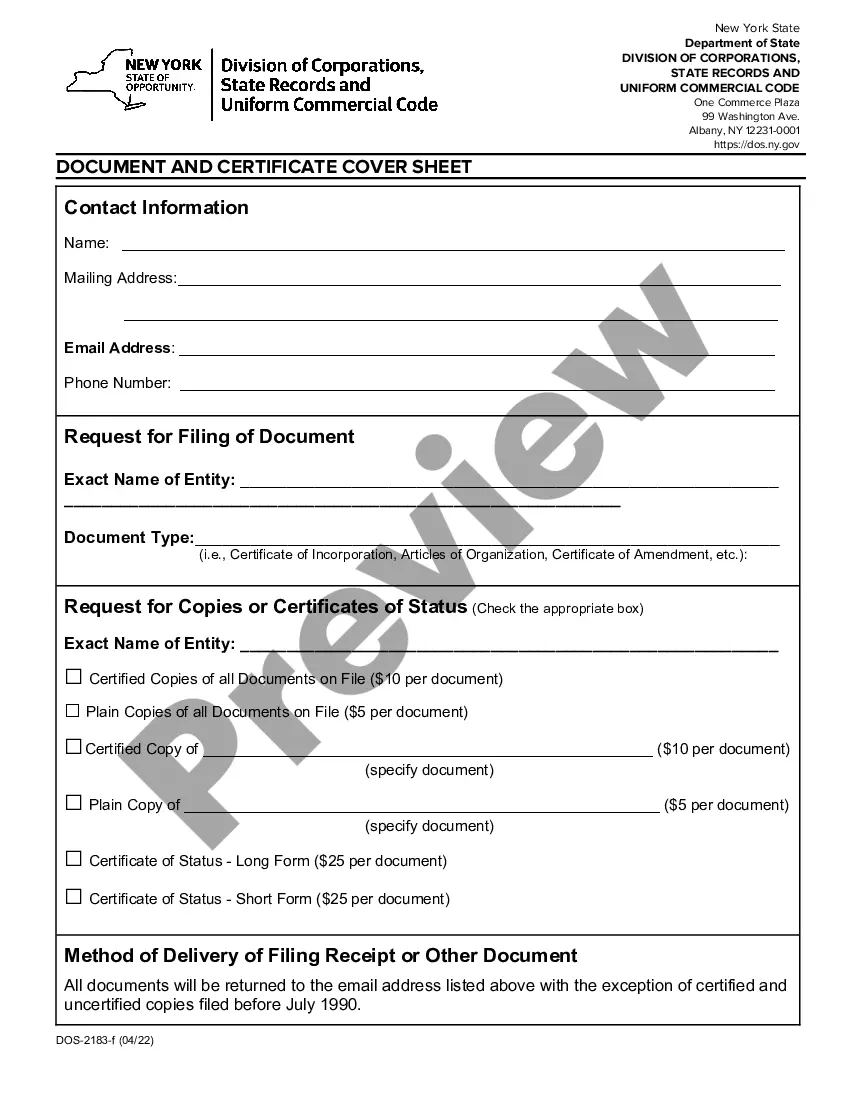

The fee for filing the Certificate of Incorporation is $125. The fee may be paid by cash, check, money order, MasterCard, Visa or American Express.

Choose a corporate name. File Certificate of Incorporation. Appoint a registered agent. Prepare corporate bylaws. Appoint directors and hold first board meeting. Issue stock. File a New York Biennial Statement.

What Is the Cheapest State to Incorporate? Delaware remains one of the more affordable states in which to form an LLC (14th lowest filing fee of 50 states). Delaware also ranks well for incorporation fees (17th lowest filing fee of 50 states).

Registered Office. Business Activity. Director's Details. Shareholders' Details. Shareholders' Details. Secretary Details (Not Compulsory) Person with Significant Control (PSC) Details Where the person is not a director, shareholder or secretary.

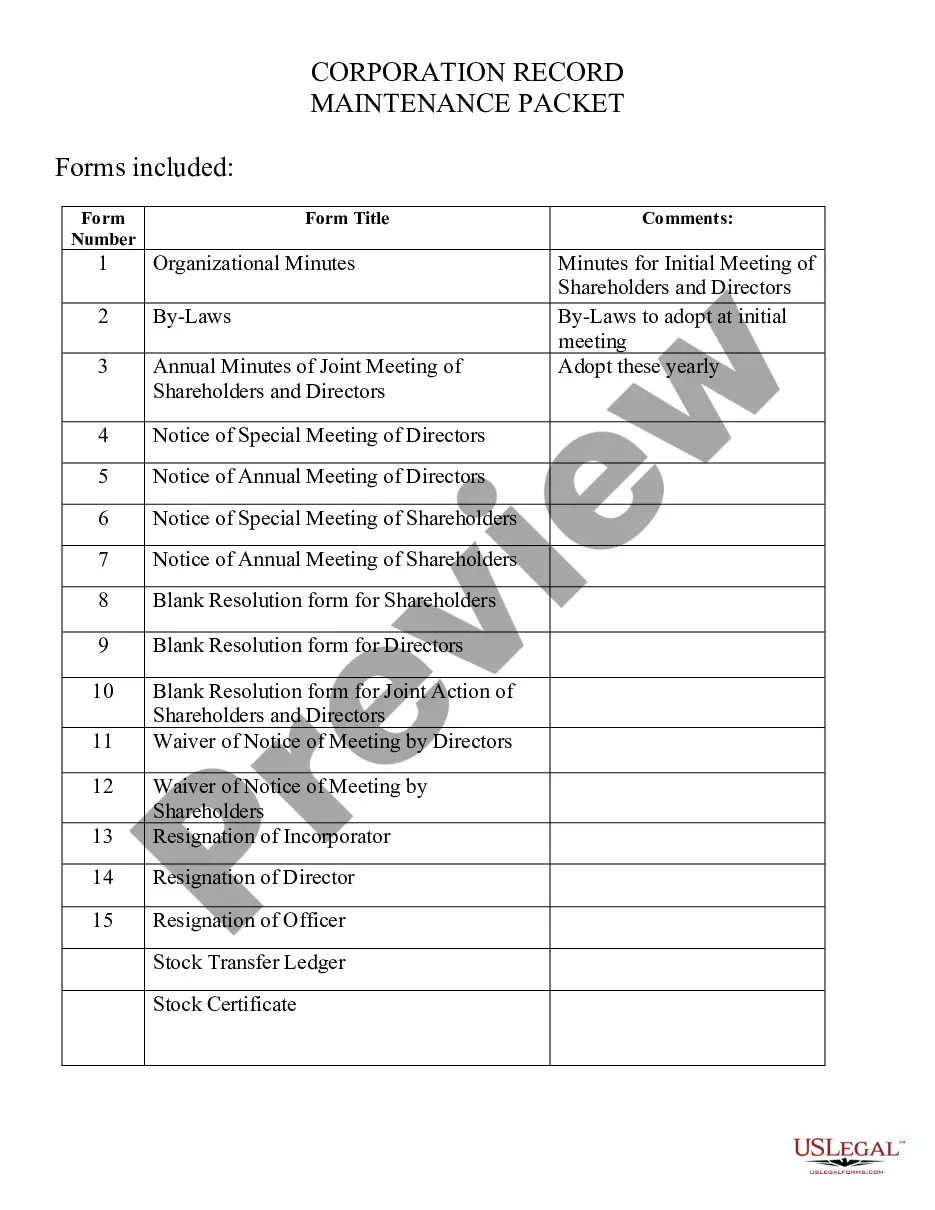

Business Name Reservation Form (Corps and LLCs) Articles of Incorporation (Corps only) Articles of Organization (LLCs only) Corporate Bylaws (Corps only) Operating Agreement (LLCs only)

Choose a corporate name. File Certificate of Incorporation. Appoint a registered agent. Prepare corporate bylaws. Appoint directors and hold first board meeting. Issue stock. File a New York Biennial Statement.

Please note that New York State law does not require a corporation to have a seal. Your telephone book's yellow pages or a yellow pages information operator (your area code + 555-1212) may be helpful in locating a legal stationery store.

For corporations, limited partnerships and limited liability companies, who must file with the State, the filing fee is $25, though corporations must also pay an additional county- specific fee. The corporation county fee is $100 for any county in New York City and $25 for any other county in New York State.