This is a rider to the software/services master agreement order form. It provides that a related entity of the customer may use the software purchased from the vendor.

Nevada Related Entity

Description

How to fill out Related Entity?

Choosing the right legal file design can be a have difficulties. Obviously, there are tons of layouts accessible on the Internet, but how can you get the legal develop you require? Use the US Legal Forms web site. The services delivers 1000s of layouts, for example the Nevada Related Entity, that you can use for company and private needs. All of the types are checked out by experts and meet up with federal and state demands.

In case you are currently registered, log in in your accounts and then click the Obtain button to find the Nevada Related Entity. Utilize your accounts to search with the legal types you have acquired earlier. Proceed to the My Forms tab of your accounts and have one more duplicate of the file you require.

In case you are a whole new user of US Legal Forms, listed here are straightforward instructions so that you can stick to:

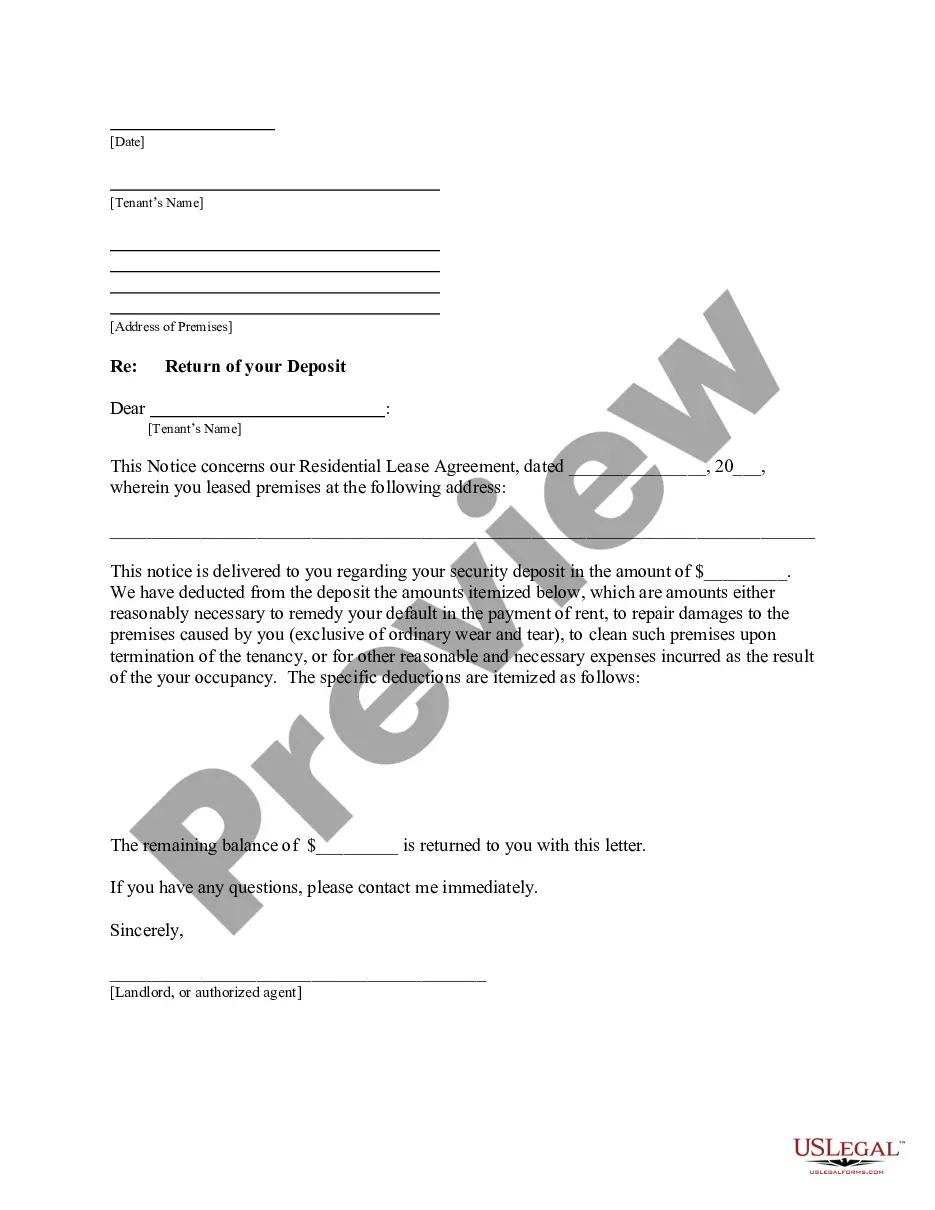

- Initial, ensure you have chosen the right develop to your city/county. It is possible to check out the shape making use of the Review button and read the shape description to make sure it is the right one for you.

- When the develop fails to meet up with your expectations, take advantage of the Seach area to obtain the correct develop.

- When you are certain that the shape is suitable, click on the Buy now button to find the develop.

- Opt for the costs program you need and type in the essential information and facts. Build your accounts and purchase the order using your PayPal accounts or Visa or Mastercard.

- Select the submit formatting and obtain the legal file design in your system.

- Complete, modify and printing and indication the obtained Nevada Related Entity.

US Legal Forms may be the biggest catalogue of legal types in which you can discover numerous file layouts. Use the company to obtain professionally-produced papers that stick to condition demands.

Form popularity

FAQ

If you haven't yet received or applied for a Nevada State Business License, please contact the Nevada Secretary of State at (775) 684- 5708 or complete your registration online at . LINE-BY-LINE INSTRUCTIONS FOR COMPLETING THE NEVADA BUSINESS REGISTRATION - PLEASE COMPLETE IN ENGLISH.

A company that is registered in Nevada can order certified copies of its formation documents from the secretary of state of Nevada. It usually takes about four to seven business days in addition to mailing time to process them. It's possible for companies to get certified copies within seven to nine business days.

The Default Status A business entity is considered to be in the Nevada business status default list if it has failed to submit their annual list or annual report along with the applicable fees by the due date pursuant to NRS 78.150 to 78.185 for business corporations and NRS 86.263 for a limited liability company.

General Rules for LLC Names Your LLC Name Must Be Unique. You cannot choose a business name in use by any other LLC or corporation in the State of Nevada. ... Your LLC Name Must Not Be Confusable with Another. Business Name. ... Your LLC Name Must Contain Certain Words. ... Your LLC Name May Have Other General Restrictions.

A Nevada corporation is a business incorporated in the state of Nevada, a state known to be business-friendly through its tax and corporate law statutes.

To see if a name is available, visit the Nevada Business Search page at the Secretary of State website. Enter your desired LLC name into the search field and click ?Search.?

An entity number can be found on any document filed with the Secretary of State and is given to each recognized corporate entity in Nevada. You can search by entity number to determine the legally recognized name of a business using a doing-business-as (DBA) alias.

The Nevada tax ID number is also known as the Nevada Business Identification Number (NVBID). The NVBID is used to identify businesses that are required to file various state business tax returns. The NVBID is a nine-digit number that the Nevada Department of Taxation assigns.