Nevada Letter regarding Wage Statement

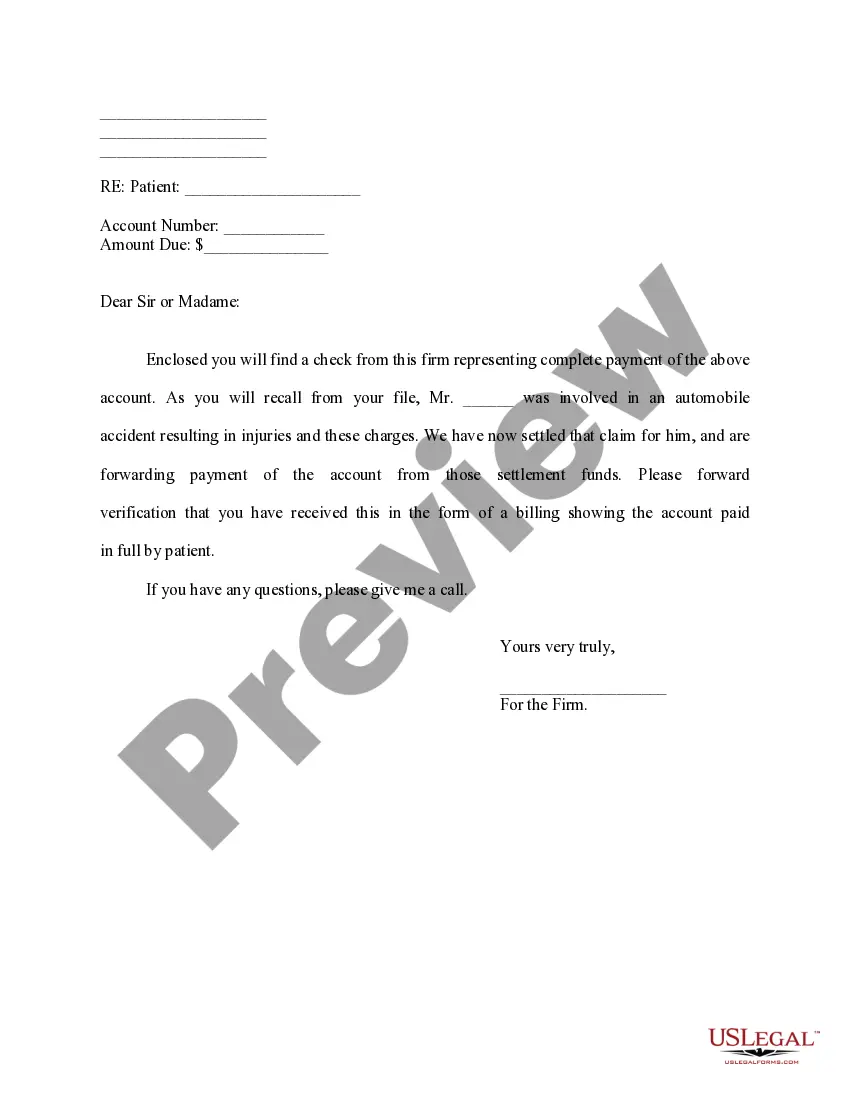

Description

How to fill out Letter Regarding Wage Statement?

US Legal Forms - one of the biggest libraries of authorized types in the States - offers a wide range of authorized record themes it is possible to download or printing. Using the web site, you can find 1000s of types for enterprise and personal functions, sorted by types, claims, or keywords.You will find the most recent types of types such as the Nevada Letter regarding Wage Statement within minutes.

If you already possess a subscription, log in and download Nevada Letter regarding Wage Statement in the US Legal Forms library. The Acquire option can look on every single type you perspective. You get access to all earlier delivered electronically types inside the My Forms tab of your account.

In order to use US Legal Forms the first time, listed here are straightforward recommendations to help you get started off:

- Ensure you have picked the proper type for your area/area. Click on the Review option to analyze the form`s articles. See the type description to ensure that you have selected the right type.

- In the event the type doesn`t fit your needs, utilize the Research discipline at the top of the screen to find the the one that does.

- When you are happy with the form, verify your choice by clicking the Acquire now option. Then, pick the prices program you like and give your credentials to register on an account.

- Approach the purchase. Utilize your credit card or PayPal account to finish the purchase.

- Select the format and download the form on the system.

- Make changes. Fill out, revise and printing and indication the delivered electronically Nevada Letter regarding Wage Statement.

Each and every format you added to your bank account does not have an expiration time and is the one you have eternally. So, if you wish to download or printing another version, just proceed to the My Forms section and then click on the type you will need.

Get access to the Nevada Letter regarding Wage Statement with US Legal Forms, the most comprehensive library of authorized record themes. Use 1000s of specialist and state-particular themes that meet your organization or personal requires and needs.

Form popularity

FAQ

Effective July 1, 2023, each employer shall pay a wage to each employee of not less than $10.50 per hour worked if the employer offers qualified health benefits, or $11.25 per hour if the employer does not offer qualified health benefits.

Payroll Laws & Pay Periods in Nevada Employers in Nevada must establish a regular payday, which cannot be more than 31 days after the end of the pay period. Pay periods must be at least semimonthly and cannot exceed 31 days. Employers are also required to provide itemized wage statements to employees on each payday.

A.) If the employee quits employment, they must receive their final wages within 7 days or by the next regular pay day, whichever is earlier. If the employee is discharged, they must receive their final wages within 3 days (Nevada Revised Statutes 680.020-NRS 608.040). Q.)

Workers who are owed back wages in Nevada may either (1) file a wage and hour claim with the Office of the Labor Commissioner, or (2) bring a civil lawsuit.

Under Nevada minimum wage laws, the minimum hourly wage is $7.25 per hour with insurance, and $8.25 per hour without insurance. ing to Nevada wage and hour laws, an employer must pay 1 1/2 times an employee's regular wage rate whenever an employee works: More than 40 hours in any scheduled week of work; or.

Yes, employers in Nevada are generally required to provide pay stubs or a written statement of wages to their employees with each paycheck.

Effective July 1, 2023, each employer shall pay a wage to each employee of not less than $10.50 per hour worked if the employer offers qualified health benefits, or $11.25 per hour if the employer does not offer qualified health benefits.

In Nevada, the law says that an employer can only withhold wages for the purposes of taxes, or for purposes that the employer has expressly consented to ? such as healthcare payments or for a corporate savings plan.