Nevada Mineral Deed with Grantor Reserving Nonparticipating Royalty Interest

Description

How to fill out Mineral Deed With Grantor Reserving Nonparticipating Royalty Interest?

Choosing the right legitimate file format can be quite a have difficulties. Naturally, there are tons of themes available on the net, but how would you get the legitimate form you want? Use the US Legal Forms internet site. The assistance gives a huge number of themes, such as the Nevada Mineral Deed with Grantor Reserving Nonparticipating Royalty Interest, that can be used for business and personal needs. All of the varieties are checked out by specialists and satisfy federal and state specifications.

In case you are presently authorized, log in for your profile and click the Obtain key to obtain the Nevada Mineral Deed with Grantor Reserving Nonparticipating Royalty Interest. Make use of your profile to search throughout the legitimate varieties you might have bought in the past. Proceed to the My Forms tab of your profile and have another copy from the file you want.

In case you are a fresh consumer of US Legal Forms, allow me to share straightforward guidelines so that you can comply with:

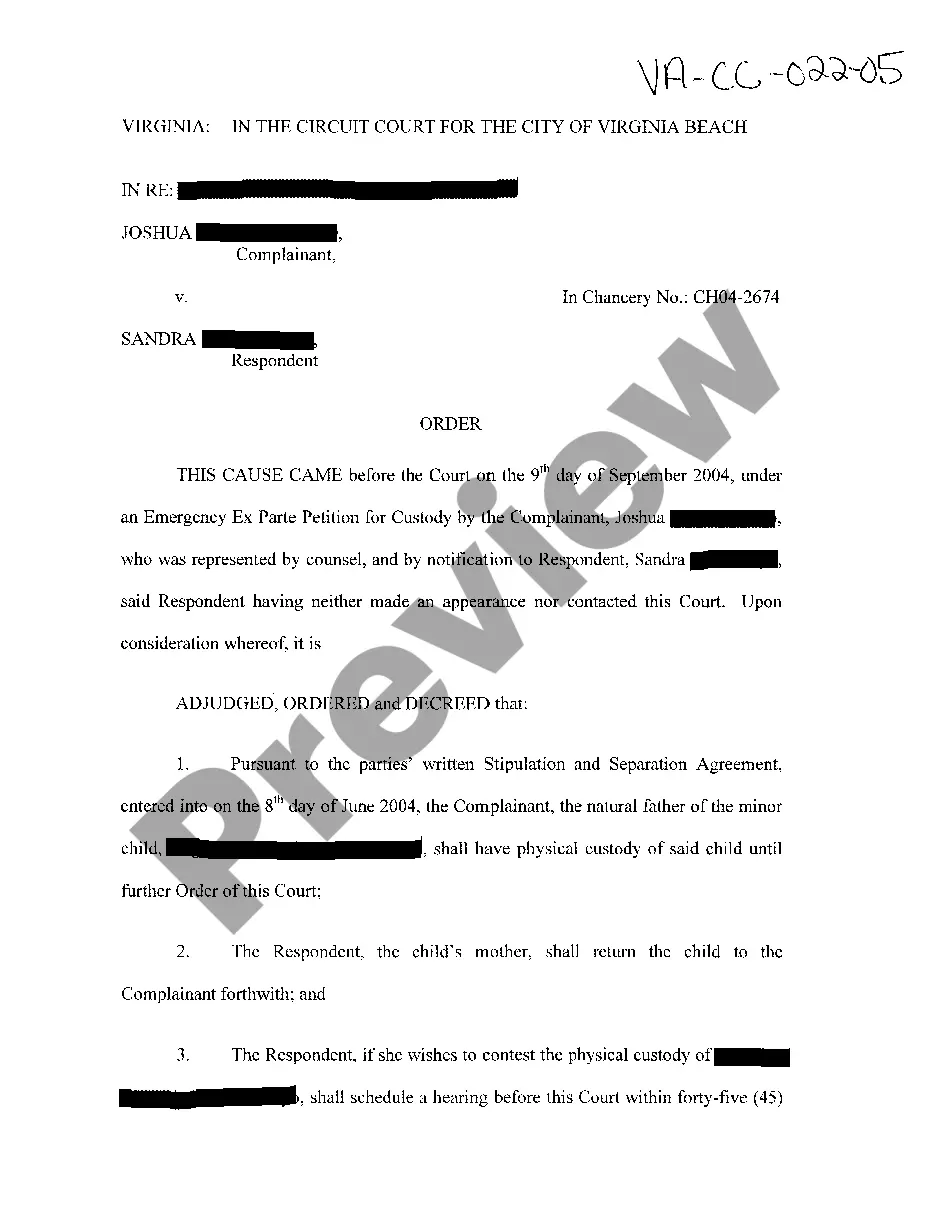

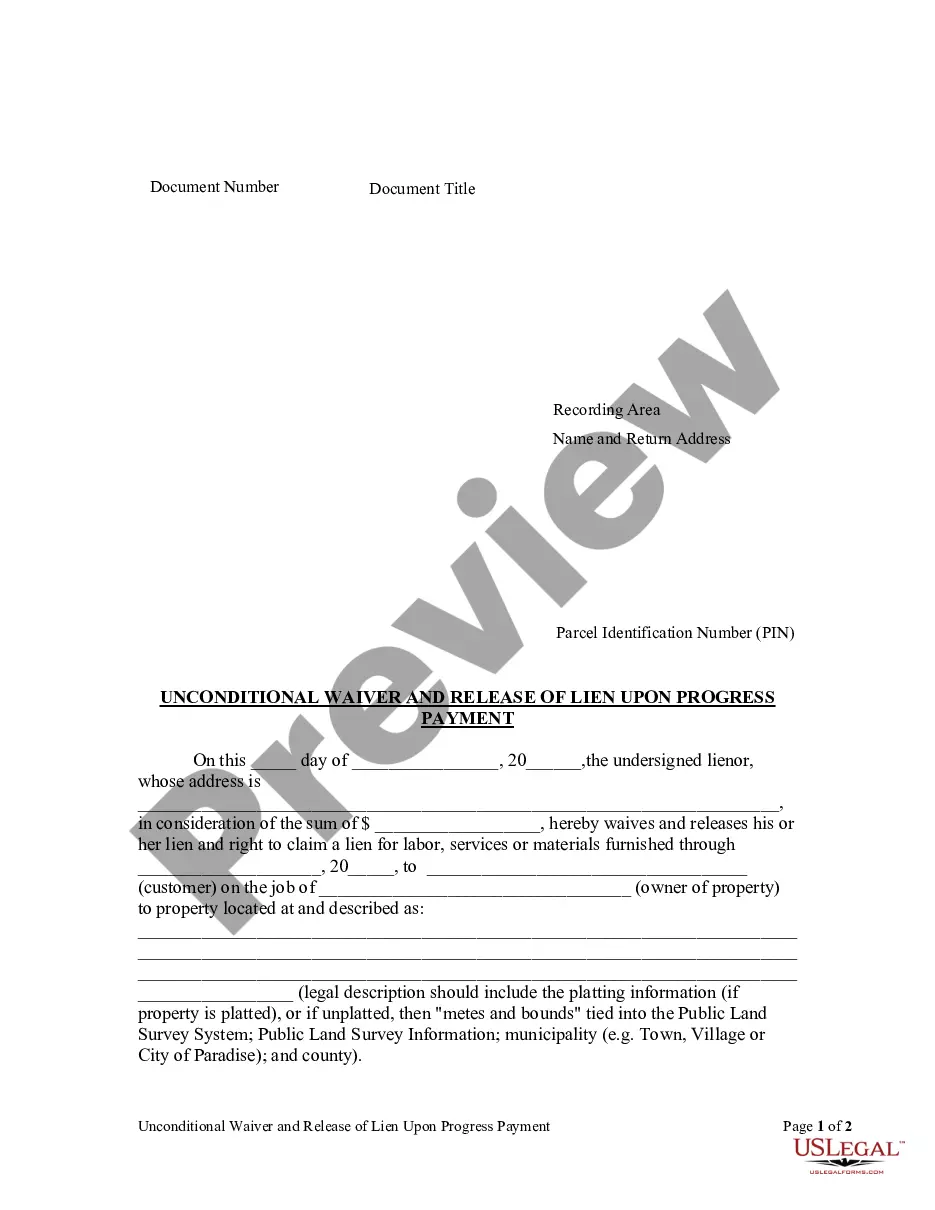

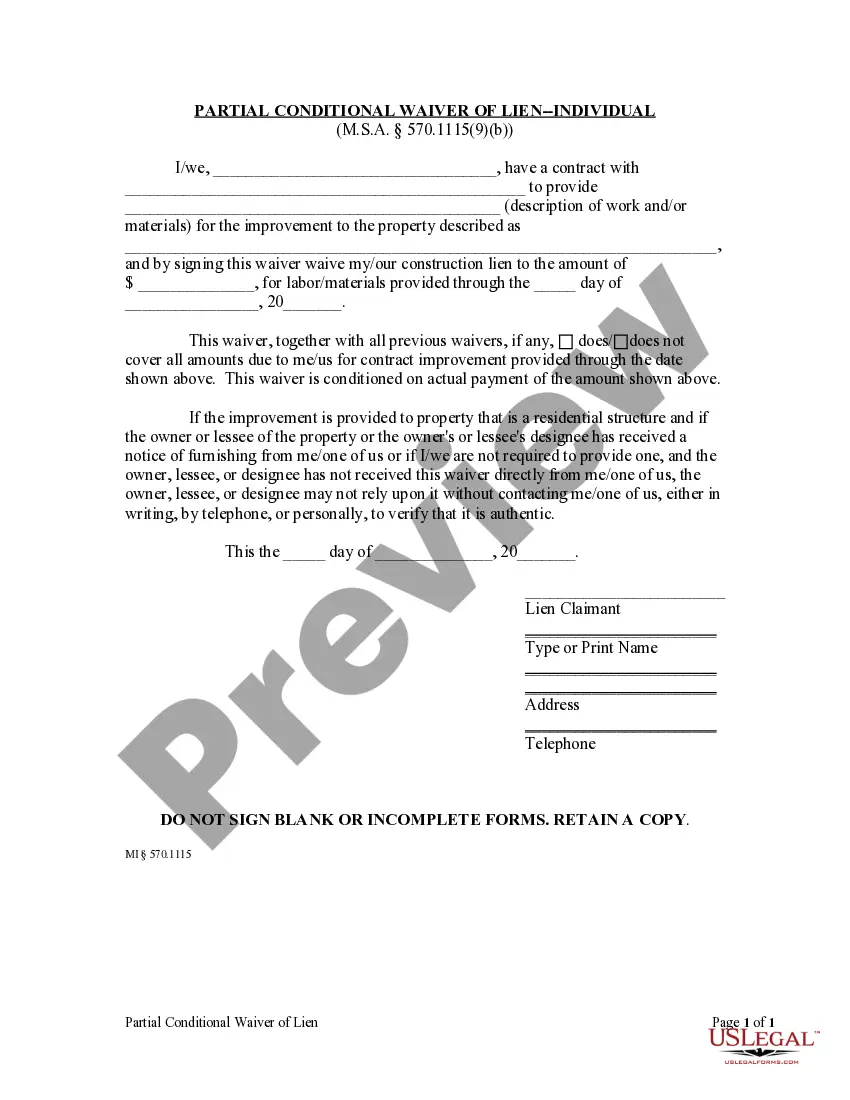

- Initial, ensure you have chosen the right form to your town/region. You may look through the shape using the Review key and study the shape description to make certain this is the best for you.

- In the event the form is not going to satisfy your expectations, make use of the Seach industry to discover the appropriate form.

- Once you are certain that the shape is proper, click on the Purchase now key to obtain the form.

- Pick the pricing prepare you desire and type in the essential info. Make your profile and pay for the transaction using your PayPal profile or Visa or Mastercard.

- Opt for the file format and down load the legitimate file format for your device.

- Complete, revise and printing and sign the attained Nevada Mineral Deed with Grantor Reserving Nonparticipating Royalty Interest.

US Legal Forms is definitely the most significant library of legitimate varieties for which you can find different file themes. Use the service to down load skillfully-created papers that comply with express specifications.

Form popularity

FAQ

Hear this out loud PauseMineral rights deeds are not the same as royalty deeds. Royalty deeds do not allow for surface access, or for the initiation of the extraction and sale of minerals. A royalty owner will only benefit economically if the mineral owner decides to produce and sell the minerals.

Hear this out loud PauseA Texas mineral deed with general warranty, used to convey all of the grantor's oil, gas, and other minerals under real property. This Standard Document has integrated notes with explanations and drafting tips.

Unlike mineral owners, non-participating royalties do not have executive rights in lease negotiations, leasing incentives, or rental payments. They just receive the actual production proceeds.

Hear this out loud PauseThe mineral rights on Texas land can be separated from the surface estate. As an investor, you can buy a unified estate including surface rights and below surface rights, or a split estate, only including the mineral estates.

Hear this out loud PauseOwning a property's ?mineral rights? refers to ownership of the mineral deposits under the surface of a piece of land. The rights to the minerals usually belong to the owner of the surface property, or surface estate. In Texas, though, those rights can be transferred to another party.

A Texas mineral deed with general warranty, used to convey all of the grantor's oil, gas, and other minerals under real property. This Standard Document has integrated notes with explanations and drafting tips.

A royalty deed gives its holder the right to receive a percentage of the profits from the sale of the minerals, if and when they are actually produced. This kind of legal document does not convey all of the mineral rights to the holder, only the right to receive royalties.