Nevada Trustee's Deed and Assignment for Distribution of Trust, Oil and Gas Properties

Description

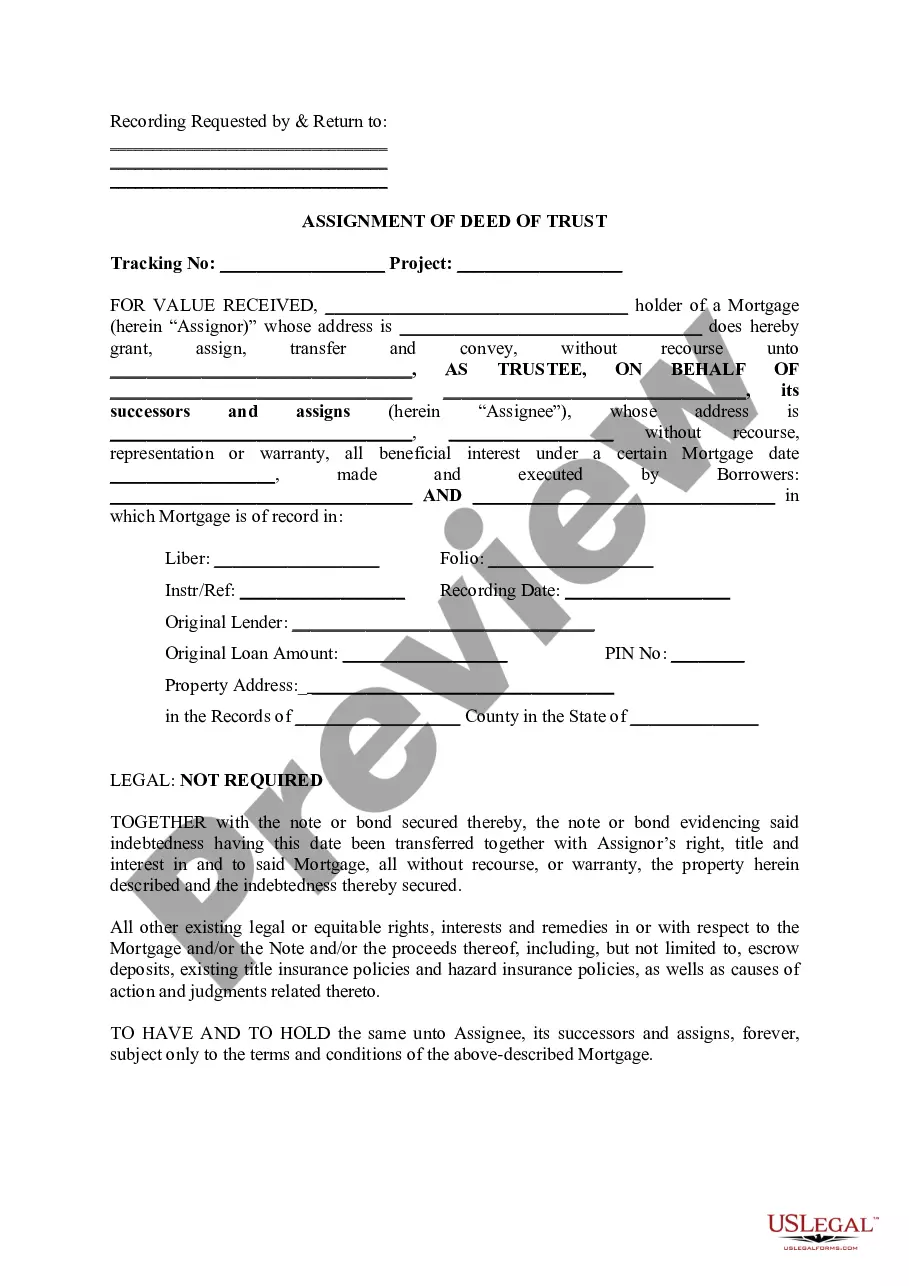

How to fill out Trustee's Deed And Assignment For Distribution Of Trust, Oil And Gas Properties?

Are you presently in the situation that you need to have files for sometimes organization or specific reasons virtually every time? There are plenty of lawful file web templates available on the net, but getting versions you can trust is not straightforward. US Legal Forms gives 1000s of form web templates, such as the Nevada Trustee's Deed and Assignment for Distribution of Trust, Oil and Gas Properties, that happen to be published to satisfy federal and state specifications.

If you are previously familiar with US Legal Forms web site and possess your account, just log in. Afterward, you may obtain the Nevada Trustee's Deed and Assignment for Distribution of Trust, Oil and Gas Properties web template.

Should you not offer an accounts and wish to begin using US Legal Forms, follow these steps:

- Obtain the form you require and make sure it is for your appropriate metropolis/county.

- Utilize the Review switch to check the form.

- Browse the explanation to actually have chosen the correct form.

- In case the form is not what you`re seeking, make use of the Lookup area to discover the form that fits your needs and specifications.

- When you discover the appropriate form, click Purchase now.

- Choose the prices prepare you need, complete the desired information and facts to make your account, and purchase the transaction with your PayPal or Visa or Mastercard.

- Decide on a hassle-free document formatting and obtain your version.

Locate every one of the file web templates you might have purchased in the My Forms menus. You can obtain a additional version of Nevada Trustee's Deed and Assignment for Distribution of Trust, Oil and Gas Properties any time, if required. Just select the needed form to obtain or print out the file web template.

Use US Legal Forms, one of the most substantial collection of lawful types, to conserve some time and prevent blunders. The service gives expertly manufactured lawful file web templates that can be used for a selection of reasons. Make your account on US Legal Forms and start making your way of life easier.

Form popularity

FAQ

Under Nevada trust law, any individual may create a legally valid trust where they act as both the settlor and the beneficiary of the trust. The settlor may also serve as the trustee. This allows the settlor to maintain control of the assets held in the trust.

Whether or not the trustee can withhold funds from you depends on the terms of the trust itself. If the trust requires withholding distributions under certain circumstances, such as the beneficiary reaching a specific age, the trustee must follow those stipulations.

A certificate requires a description of the powers of the trustee in dealing with trust assets, and any restrictions upon those powers. When used in transactions affecting real property, the legal description of the property subject to the transaction should be included.

If the borrower has land, (or uses the money to buy land), then many lenders request a deed of trust as a condition of giving the borrower the money. In Nevada, lenders like a deed of trust (or ?trust deed?) to give them security in case the borrower defaults.

Notice should be mailed to all of at Trust's beneficiaries and other interested parties within ninety (90) days of the Decedent's date of death. Such beneficiaries and other interested parties then have only one hundred twenty (120) days for such mailing to bring an action to contest the validity of the Trust.

Should I Record My Trust? The Clark County, Nevada, Recorder's Office (which serves Las Vegas, Henderson, Boulder City, North Las Vegas, Mesquite among other towns) will accept your trust for filing if you want. It's your choice whether to record the trust or not.

The notice provided by the trustee must contain: (a) The identity of the settlor of the trust and the date of execution of the trust instrument; (b) The name, mailing address and telephone number of any trustee of the trust; (c) Any provision of the trust instrument which pertains to the beneficiary or notice that the ...

To transfer real property into your Trust, a new deed reflecting the name of the Trust must be executed, notarized and recorded with the County Recorder in the County where the property is located. Care must be taken that the exact legal description in the existing deed appears on the new deed.