Nevada Special Military Power of Attorney for Automobile Use and Registration

Description

How to fill out Special Military Power Of Attorney For Automobile Use And Registration?

You might spend hours online searching for the legal document template that meets the federal and state requirements you need.

US Legal Forms offers thousands of legal forms that have been reviewed by experts.

You can easily download or print the Nevada Special Military Power of Attorney for Automobile Use and Registration from the service.

If available, use the Review button to check the document template as well. If you wish to find another variation of the form, use the Lookup field to locate the template that suits you and your needs. Once you have identified the template you want, click Buy now to proceed. Select the pricing plan you desire, enter your credentials, and register for your account on US Legal Forms. Complete the transaction. You can use your credit card or PayPal account to pay for the legal form. Choose the format of the document and download it to your system. Make modifications to your document if necessary. You can complete, modify, sign, and print the Nevada Special Military Power of Attorney for Automobile Use and Registration. Obtain and print thousands of document templates using the US Legal Forms website, which offers the largest collection of legal forms. Utilize professional and state-specific templates to address your business or personal needs.

- If you already have a US Legal Forms account, you can Log In and click the Obtain button.

- After that, you can complete, modify, print, or sign the Nevada Special Military Power of Attorney for Automobile Use and Registration.

- Every legal document template you purchase is yours for a long time.

- To get another copy of any acquired form, visit the My documents tab and click the appropriate button.

- If you are using the US Legal Forms website for the first time, follow the simple instructions below.

- First, ensure you have selected the correct document template for the county/city of your choice.

- Review the form information to ensure you have chosen the right type.

Form popularity

FAQ

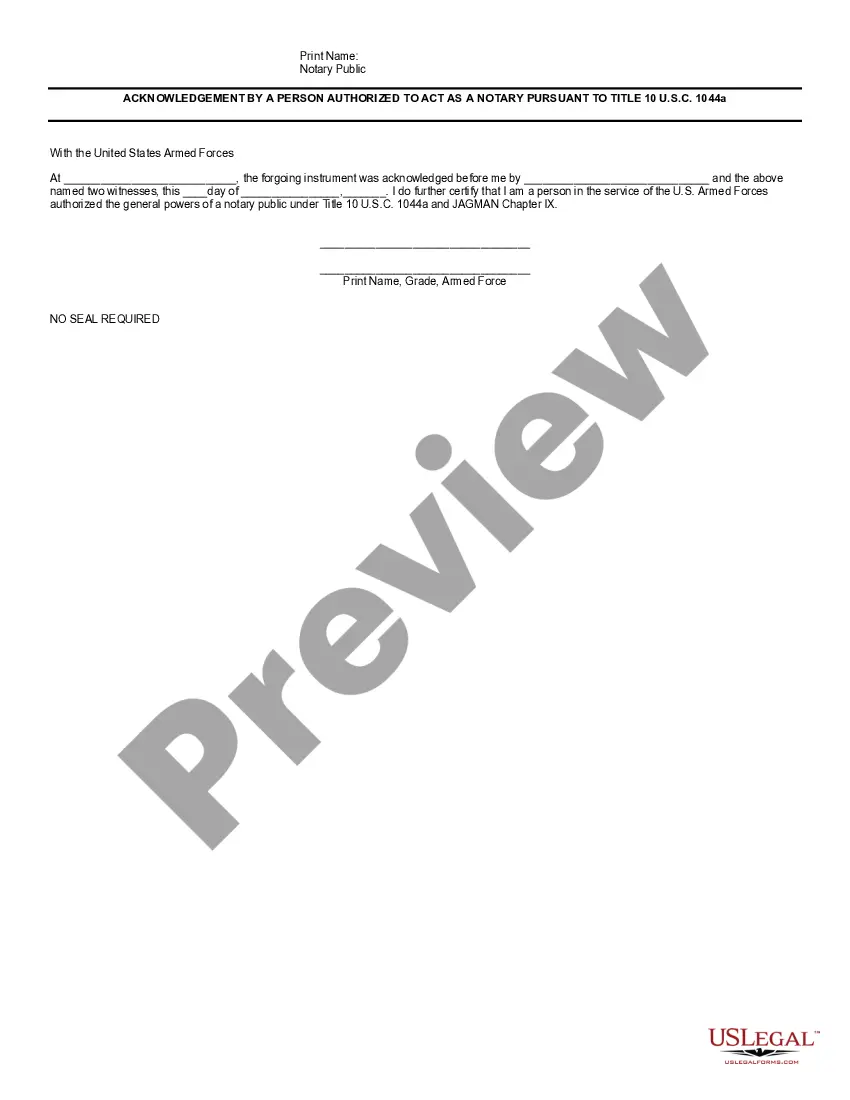

Acquiring a Power of Attorney for your vehicle is straightforward. Begin by identifying the specific powers you want to grant regarding automobile use and registration. Using USLegalForms, you can access a Nevada Special Military Power of Attorney for Automobile Use and Registration template that suits your needs. After filling out the form, ensure you sign it before a notary, which will make it legally binding and effective for your car-related transactions.

To obtain a Nevada Special Military Power of Attorney for Automobile Use and Registration, start by gathering the necessary information, such as your personal details and those of the person you wish to appoint. Next, visit a reliable platform like USLegalForms, where you can find templates tailored for military personnel. Complete the form according to your situation, then sign it in front of a notary. This process ensures you have the legal authority to manage automobile matters while serving.

Filling out a power of attorney for vehicle transactions involves specifying the vehicle details and the powers you grant to your agent. For the Nevada Special Military Power of Attorney for Automobile Use and Registration, include the vehicle's VIN, make, model, and year. Make sure to sign the document in front of a notary to validate it. Platforms like US Legal Forms can simplify this process by providing templates and guidance tailored to your needs.

To properly fill out a power of attorney form, start by clearly indicating the powers you wish to grant. For the Nevada Special Military Power of Attorney for Automobile Use and Registration, specify the details related to vehicle transactions. Ensure that both you and your agent sign the form in front of a notary. Using US Legal Forms can help you access the correct form and instructions for your state.

The new law regarding power of attorney in Oklahoma includes updates on how documents are executed and recognized. It is important to stay informed about these changes, especially if you are utilizing a Nevada Special Military Power of Attorney for Automobile Use and Registration in connection with Oklahoma. For detailed and accurate information, consider consulting legal experts or visiting platforms like US Legal Forms that provide comprehensive resources on power of attorney laws.

Filling out a Nevada Special Military Power of Attorney for Automobile Use and Registration requires attention to detail. First, include the principal's and agent's full names, addresses, and specific powers granted. Ensure you sign and date the document in the presence of a notary public to make it legally binding. Using resources like US Legal Forms can guide you through the process with clear instructions.

To obtain a Nevada Special Military Power of Attorney for Automobile Use and Registration, you need to complete the appropriate form and have it notarized. You can find the necessary forms on the US Legal Forms platform, which provides easy access to state-specific documents. After filling out the form, ensure you submit it to the relevant authorities for vehicle registration. This process helps facilitate smooth transactions related to your vehicle.

To get a power of attorney for a car title, you need to fill out a specific form that grants authority over the title to another person. Typically, you can obtain this form from your state’s DMV or a legal service provider. For military members, the Nevada Special Military Power of Attorney for Automobile Use and Registration provides a convenient way to manage your vehicle title while fulfilling your service commitments.

A power of attorney for a car in Nevada is a legal document that allows someone to handle matters related to vehicle ownership, including registration and title transfers. This document ensures that your vehicle can be managed even when you are not physically present. For military personnel, the Nevada Special Military Power of Attorney for Automobile Use and Registration offers a tailored solution for addressing automobile needs from anywhere.

A power of attorney for a military member is a legal document that allows someone to act on behalf of the service member while they are away from home. This document is crucial for managing various tasks, including financial decisions and vehicle registrations. If you're looking to manage your automobile affairs while deployed, consider the Nevada Special Military Power of Attorney for Automobile Use and Registration for a streamlined solution.